Patel Integrated Logistics Company Summary

Patel Integrated Logistics Limited (NSE: PATINTLOG), founded in 1962, is part of the House of Patels group. With presence across 500 stations across the nation, they offer prompt, dependable service while adhering strictly to delivery schedules. The company currently transports cargo worth more than ₹120 billion annually and has more than 75,000 clients mainly in B2B segment, ranging from small businesses to multinational corporations. The logistics service offering, combined with cutting-edge tracking systems, allows them to maintain a competitive advantage.

Investment Summary

India has been growing as the global centre for manufacturing. Once a product is created, it must be transported from the point of production to the consumer. So, as India’s production of goods rises, so does the need for logistics. The GOI has also taken up few initiatives which will streamline the sector and lower the cost of logistics. Patel Integrated Logistics Limited has the infrastructure to meet India’s logistic demand. In addition, the company is expanding its warehouse space in various locations across the country. The offerings from Warehousing and Distribution services will add a boost to the company’s growth. Moreover, the business’s profitability and revenue have begun to rise year over year. The company has also started reducing it’s external debt and investing in business expansion. It has also diversified its business by entering the health and fitness market through the acquisition of a GYM franchisee. However, the recent trend of the promoter’s shareholding decreasing is seen as a red flag.

National Logistics Policy & Other GOI Initiatives

In comparison to the U.S., where logistics costs have historically been around 8% of GDP, India’s logistics costs as a percentage of GDP are 14% on average. Despite the fact that there is no official estimate of the logistics cost for India, some private institutions have put it between 13% – 14% of GDP. The Government of India will soon take a proposal on the National Logistics Policy in order to lower the cost of logistics and achieve growth in this sector. The objective of the policy is to concentrate on the transportation of vital goods like coal, steel, iron ore, cement, food grains, fruits, and vegetables. To reduce losses during transport, NLP will suggest identifying the best mode of transportation for each of these commodities. According to some estimates, 16% of India’s agricultural output is lost at various points along the supply chain. The goal of the policy is to increase the effectiveness of the cold chain and warehouse facilities to keep losses during the transportation of perishable goods to under 5%.

The policy will also facilitate seamless distribution of goods across the nation and create a single point of contact for India’s highly defragmented logistics industry, thereby fostering the sector’s ease of doing business. In 2019, the government created a full-fledged department out of the logistics division of the commerce ministry.

Aside from this policy, the Gati Shakti, Sagarmala, PLI Scheme, and Asset Monetization program of the Indian government are all expected to support and advance the logistics sector. By constructing a solid infrastructure of 220 airports by 2025, the Aviation Ministry intends to expand the domestic aviation market in the nation. From 2022 to 2026, the market for transportation of perishable goods is expected to reach by US$6.43 billion. The Aviation Ministry plans to construct 33 new domestic cargo terminals to accommodate the 30% increase in perishable food cargo flights.

Patel Integrated Logistics Q1 Earnings

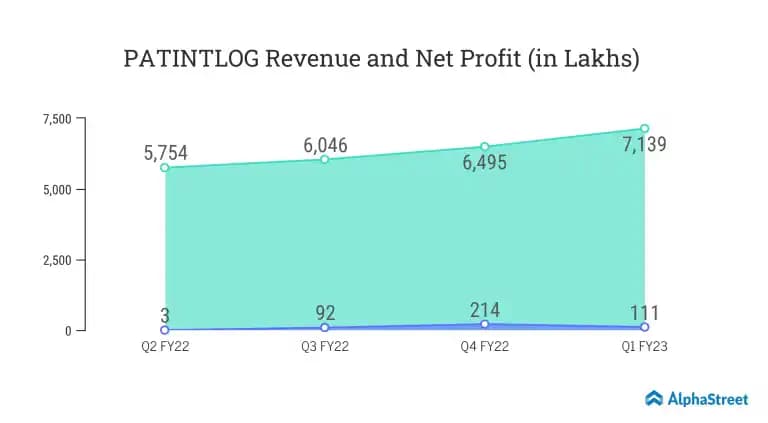

Patel Integrated Logistics Limited reported a Net Profit of ₹111.35 lakhs, a significant boost from the previous year’s loss of ₹80.81 lakhs. In comparison to negative margins during the same quarter last year, the Net Profit Margin is now at 1.6%. Operating revenue for the business increased by 40% year over year, to ₹7,139 lakhs from ₹5,106.92 lakhs.

Logistics & Air Freight Industry Outlook

The global air freight market was estimated to be worth $270.2 billion in 2019 and is expected to reach $376.8 billion by 2027, registering a CAGR of 5.6%, according to the “Air Freight Market” report from Allied Market Research. However, the market for air freight in India is projected to be worth $12.41 billion in 2022 and to grow slightly faster at a CAGR of 5.7% to reach $16.37 billion by 2027. Air cargo moved 15% of the volume of e-commerce, according to estimates from the IATA (International Air Transport Association). The players in the air cargo industry will directly benefit from India’s expanding e-commerce market.

The cost of air freight is typically 4–5 times higher than that of road freight and 12–16 times higher than that of sea freight. Air transport is used to transport goods with a high value or that must be delivered quickly, such as pharmaceuticals, clothing, production samples, and perishable goods like produce and seafood. Consolidated freight services, which are more affordable than standard air freight services, are another popular option provided by air cargo players.

The aviation industry is rapidly approaching the pre-pandemic level of growth cycle, creating a window for expansion in overall business. Following Air India’s privatisation, Vistara, Air Asia, and Air India will have a lot of synergy, which will help the air cargo industry as a whole. Additionally, the recent launch of Akasa Air, a new airline, and the restart of Jet Airways’ operations will boost business growth. Day by day, there are more passenger aircraft, increasing the amount of cargo space.

Improvement in Company’s Financial Statements

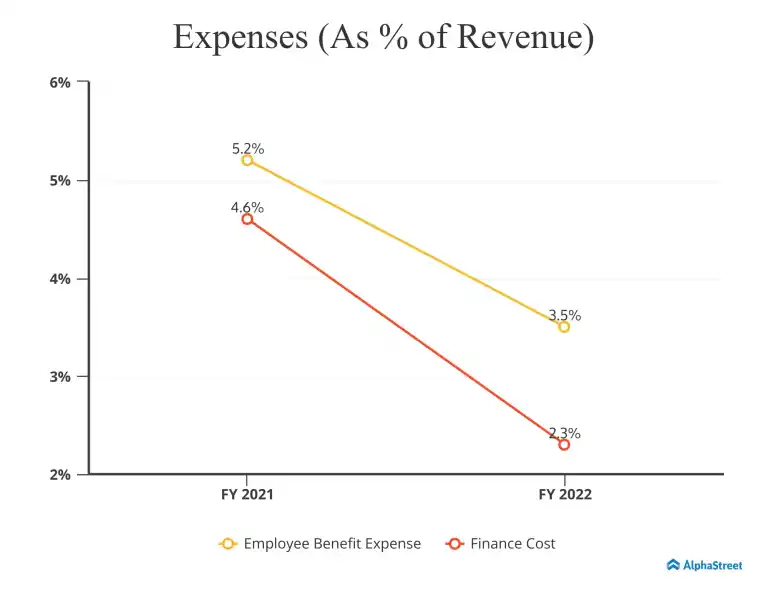

The management is concerned about lowering its Operational costs and receivables in accordance with industry standards. The Operating Revenue was decreased by more than 50% between FY17 and FY21. Also, between FY21 and FY22, operating revenue increased by 10.3%, going to ₹23,401 Lakhs from ₹21,225 Lakhs. In the same time frame, the Net profit multiplied year over year, rising from ₹5 Lakhs to ₹227 Lakhs. Reductions in Finance costs and Employee Benefit expenses were the main drivers of the Net Profit growth. Refer to the graph below:

Operating Revenue increased by almost 40% in Q1 2023, going to ₹7,139 Lakhs from ₹5,107 Lakhs. In comparison to last year’s loss of ₹81 lakhs, the net profit for this quarter is ₹111 Lakhs. High operational and employee benefit costs were the cause of the previous year’s same quarter’s negative earnings. In the most recent quarter, these costs saw a significant reduction.

The company’s profitability should have a positive if the trend toward cost optimization persists.

Patel Integrated Logistics’ Warehousing Services

In addition to providing services in cargo and vendor management, the company also offers services in warehousing and distribution, manufacturing logistics, and C&F management since 2017. They have storage space totalling over 200,000 square feet spread across several locations. The company has leased a warehouse in Bangalore for 99 years, and it has also bought land in Chennai to construct a storage facility on. The business rents out warehouses to different industries based on their needs, from short-term leases of 10 years to long-term leases of 40 to 99 years. The Indian warehouse market is experiencing tremendous demand as a result of the government’s emphasis on “Make in India.”

By adding more warehouse space to the existing infrastructure and riding the warehouse market demand, the company should be able to increase the contribution of warehousing service’s income to overall revenue.

Being Debt Free & Looking for growth

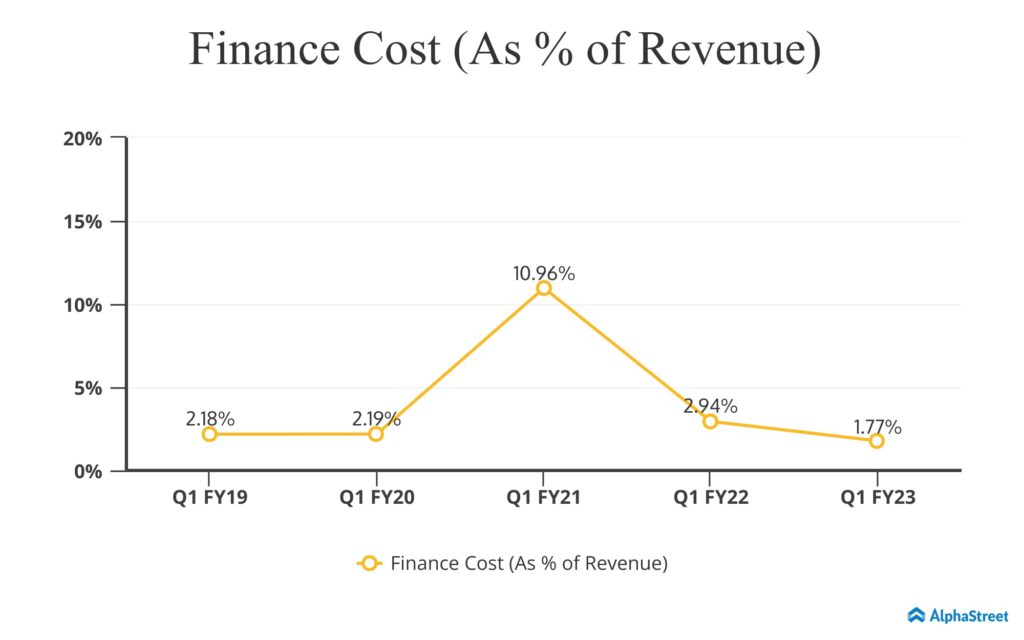

Patel Integrated Logistics issued 4,00,00,000 Crores Shares through a rights issue in November 2021 to raise ₹40 Crores in capital. The proceeds from the issue were used to minimise the company’s net external debt and strengthen its balance sheet in preparation for future expansion. As a result, the company’s debt-to-equity ratio significantly improved to 0.41, and as of march 2022, it had ₹63 crore in debt.

We can see from the graph above that the debt as a percentage of Revenue has significantly decreased. The increase in Q1 FY21 was brought on by the company’s revenue being dropped due to Covid. Currently, the financial burden on the P&L was lessened by partially paying off the external debt. The management intends to invest the money saved by reduced finance costs in the expansion of the business. According to the management, the company has 3M, which is necessary for growth. The first M stands for money and represents the company’s substantial cash reserves of ₹21 crore. The second M stands for skilled manpower, and the final M stands for a growing market.

Business Diversification & Investments

The Company is currently focused on and involved in the Air Cargo Consolidation business. This business has been carried out under the Patel Airfreight division. It offers domestic and international high-density cargo air and surface transportation. The expanding export of the nation will help the company’s international air cargo consolidation business. It also provides services for import consolidation.

The Company entered the health and fitness market last year by acquiring the franchisee of the GYM company, which prospered despite the pandemic. The management is confident that it will perform well in the upcoming year as well, increasing the revenue. This diversification will open up a new avenue for revenue growth.

The company has a low Price to Book value (0.47), compared to others in its sector. This is a result of the high book value brought on by real estate investments that appreciated in value over time. As of March 2022, Patel Integrated Logistics had ₹5.14 Crore worth of investment property. The business also has ₹2 Crore worth of mutual fund investments.

Patel Integrated Logistics Shareholding Pattern

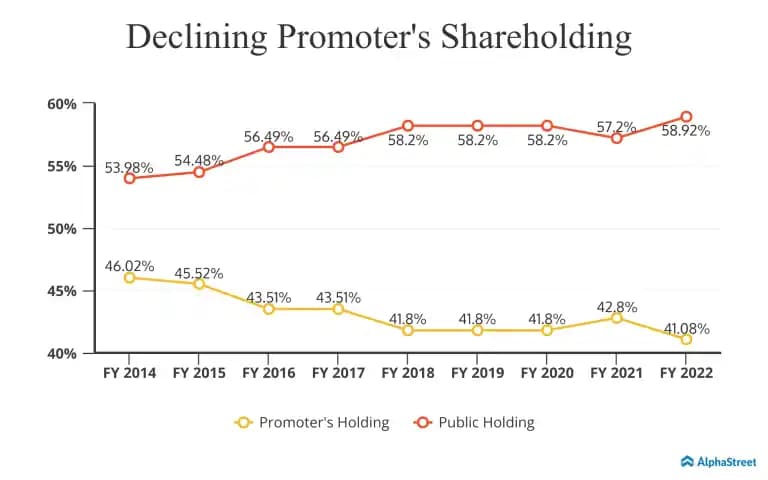

The company has 19,034 fully paid shareholders of which 79.67% are small retail shareholders and promoters who owns up to 500 shares. The promoters’ shareholdings decreased to 41.08% from 46.02% over the past nine years. Currently, individual shareholders make up the majority of the 58.92% public shareholding. The Institutional Investors, specifically mutual funds holding was only 0.06% by FY18. As of FY22, the mutual funds have not expressed interest in this stock and have no holdings in the company.

It is a good sign when the promoters have a sizable stake in their company’s shares because it demonstrates their confidence in it. Additionally, interest shown from institutional investors in a company, draws more demand from individual investors, which results in higher valuation and liquidity in the shares.