Can you guess the name of the company that was listed during the IPO frenzy in 2020 and is the second largest player in the Indian municipal waste management industry?

Well, here is a small hint for you – The company handles ~60% of total waste generated in Mumbai.

What? Still didn’t get it?

Well, let me drop the curtains for you. The name of the company is Antony Waste Handling Cell.

Established in 2001, the company’s expertise in waste management can be traced back since its inception. Initially it commenced its operation with simple collection and transportation of waste. Today, the company is engaged in the business of mechanical power sweeping of roads and collection and transportation of waste. It also handles waste to energy projects and undertakes the designing, construction, operation and maintenance of the integrated waste management facility in Kanjurmarg, Mumbai.

While adopting the latest technologies and innovations, the company has developed in-house expertise in landfill construction and management in a scientific manner. Antony Waste is also focusing on the emerging waste management areas like waste-to-energy as well as bio-mining of legacy wastes.

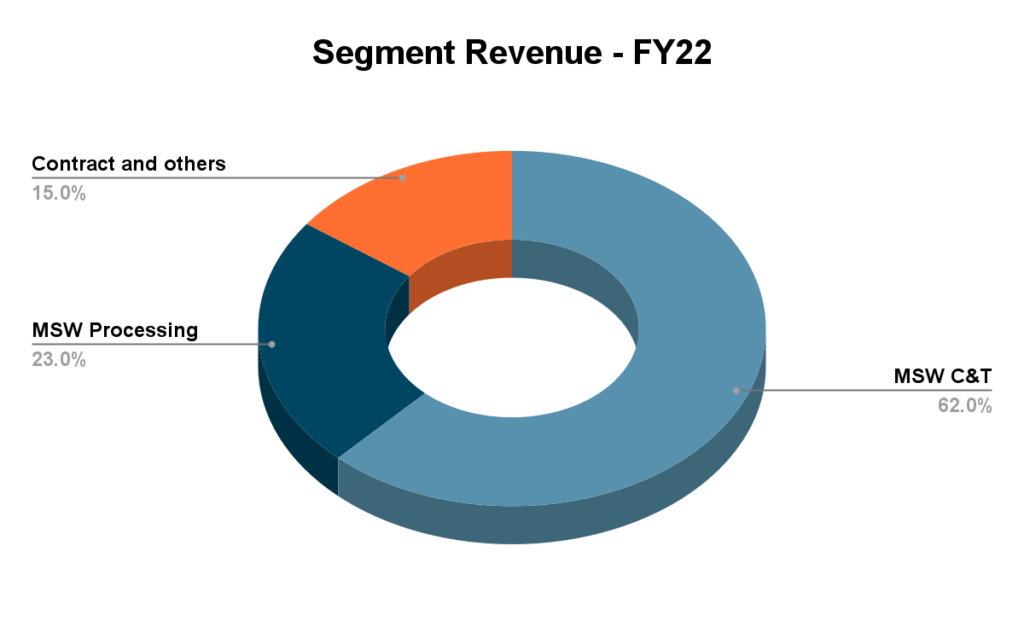

Let’s talk about the company’s business verticals:

Currently, the company has presence across three broad business areas and lets understand it chronologically:

First, business vertical is: Municipal Solid Waste Collection and Transportation Projects:

Here Antony Waste is involved in door-to-door collection of municipal solid waste from households, commercial establishments and other bulk waste generators through a primary collection vehicle. Currently the company has 14 ongoing projects in this service alone. They are typically multi-year contracts and average on-going contract duration is 7.7 years.

In second business vertical, the company is involved in Municipal Solid Waste Processing Projects:

Now, this vertical involves sorting and segregating the waste received from municipal solid waste through collection and transportation. Here the company generates compost, recycles the waste, segregates and converts inorganic waste into refuse derived fuel as required.

Currently, the company has three large ongoing waste processing projects; these have a tenure of 23 years. It is to be noted that collection and transportation and municipal processing are normally exclusive contracts and are not pretty easily available to anyone. One is at Kanjurmarg, Mumbai, which has a concession agreement till 2036. The second one is in the Pimpri-Chinchwad area and this one has an agreement till 2040.

The third business of the company is Contract and other services:

In this vertical, the company is involved in mechanized sweeping, which utilizes power sweeping machines, manpower, comprehensive maintenance, consumables, etc. The company also generates revenue from the sale of scrap collected.

Till now the company has undertaken overall more than 25 projects, of which 16 are ongoing projects.Today It has geographical presence in more than 9 states in India through ongoing and completed projects.

So, what’s the traction like?

With project tenure of more than 26 years and order balance of ~15 years, the company is the owner of one of the largest single-location waste processing plants in Asia. The Kanjurmarg site in Mumbai handles ~5,300 TPD of Solid waste with a total capacity of handling ~7,500 TPD waste.

Antony Waste currently handles ~5900 Tonnes of waste everyday and surprisingly it plans to sell surplus electricity to BMC in future at Rs 3 per unit and Rs 5 per unit to PCMC. The company also has a bioreactor landfill with a capacity of ~6,500 TPD, Sanitary landfill of 250 TPD and Material recovery and Composting facility with a capacity of 1,000 TPD.

Currently, the company has 1121 vehicles in its fleets of which 1092 are fitted with GPS tracking devices. So, GPS allows in movement tracking and optimize route thereby achieving higher vehicle utilization.

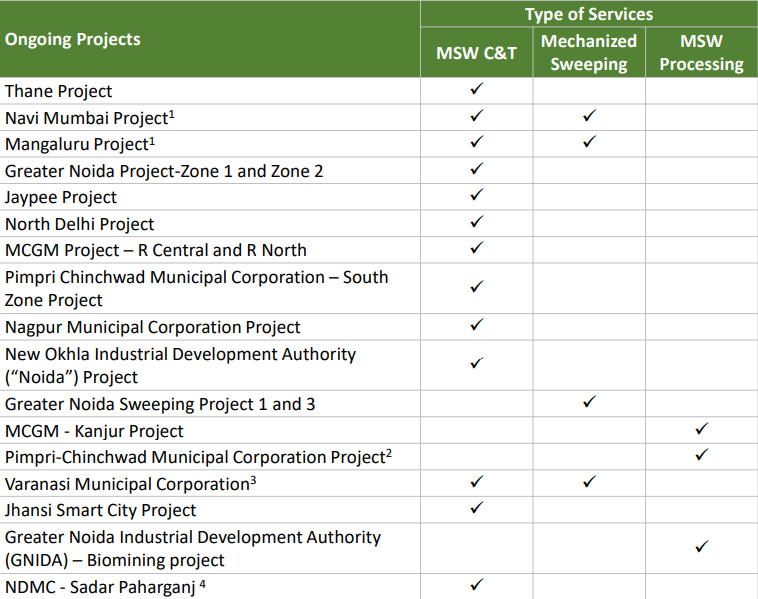

Let’s take a look at the Company’s projects:

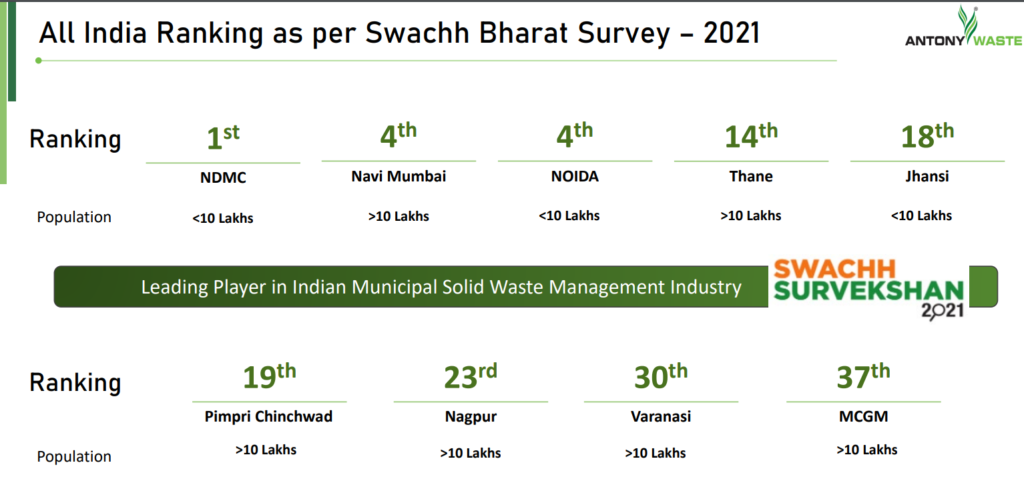

The company has undertaken more than 28 projects till date of which 20 are ongoing. With more than two decades of experience and professional management the company has demonstrated a track-record as a comprehensive service provider equipped with the resources to handle large-scale projects for municipalities as well as private players.

The company’s portfolio of 20 ongoing projects comprised 13 MSW C&T projects, 3 MSW processing (including WTE) projects and four mechanized sweeping projects.

Also in FY21, the company bagged two new projects of which one was meant for collection and transportation project in Jhansi Smart City and another is a bio-mining project in Greater Noida. The bio-mining project in Greater Noida, is the first of its kind that the Company has bagged.

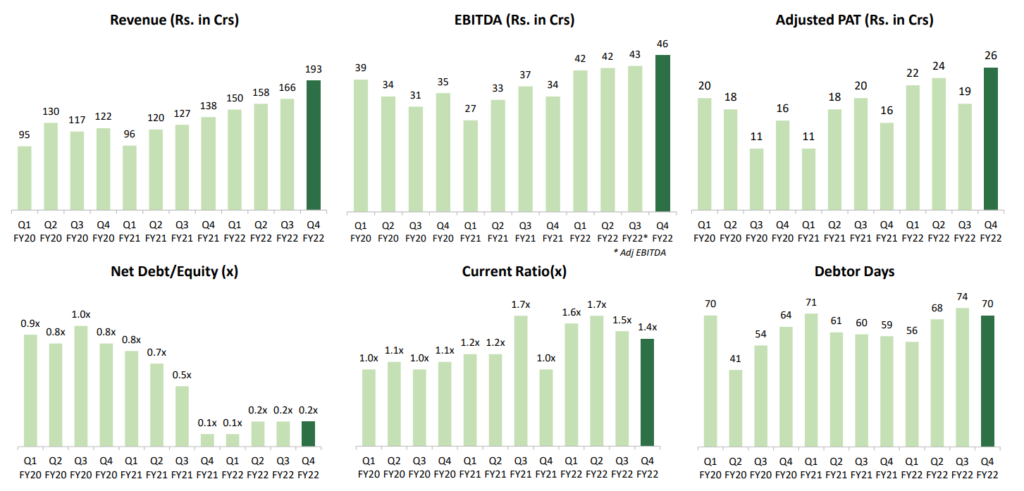

What about the Financials?

Conclusion:

Antony Solid Waste Management is among the very few companies which are engaged in Solid Waste management to be listed on the stock exchange and this trait makes it a bit tedious for peer group comparison. However based on the pure fundamentals, the company does show good value based on the sales as well as net profit numbers.

Sales has grown consistently at 22% CAGR over 5 year period while net profit has grown at 19% CAGR over the same period. Though one has to be weary about the accounts receivables of the company which has substantially increased over last year.

Additionally the company has very low/ sufficient levels of debt with a Debt to Equity ratio of 0.41x which depending upon the CAPEX to be taken by the company may increase further. Company currently trades at a PE of 15 based on the TTM. Thus this makes the company worth exploring for the long term and could be added to the portfolio for diversification purposes with a very small chunk.

To check the latest earnings and company’s vision about the future, please click the video below.