Patel Integrated Logistics Limited, founded in 1962, is part of the House of Patels group. With presence across 500 stations across the nation, they offer prompt, dependable service while adhering strictly to delivery schedules. The company currently transports cargo worth more than ₹120 billion annually and has more than 75,000 clients mainly in the B2B segment, ranging from small businesses to multinational corporations. The logistics service offering, combined with cutting-edge tracking systems, allows them to maintain a competitive advantage.

| Stock Data | |

| Ticker | PATINTLOG |

| Exchange | NSE |

| Industry | LOGISTICS |

| Price Performance | |

| Last 5 Days | -0.42% |

| YTD | -18.71% |

| Last 12 Months | -23.15% |

*As of 18.04.2023

Brief Summary:

India has been growing as the global centre for manufacturing. Once a product is created, it must be transported from the point of production to the consumer. So, as India’s production of goods rises, so does the need for logistics. The GOI has also taken up a few initiatives which will streamline the sector and lower the cost of logistics. Patel Integrated Logistics Limited has the infrastructure to meet India’s logistic demand. In addition, the company is expanding its warehouse space in various locations across the country. The offerings from Warehousing and Distribution services will add a boost to the company’s growth. Moreover, the business’s profitability and revenue have begun to rise year over year. The company has also started reducing its external debt and investing in business expansion. It has also diversified its business by entering the health and fitness market through the acquisition of a GYM franchise.

Key Strengths:

- National Logistics Policy & Other GOI Initiatives: The goal of the policy is to increase the effectiveness of the cold chain and warehouse facilities to keep losses during the transportation of perishable goods to under 5%. The policy will also facilitate seamless distribution of goods across the nation and create a single point of contact for India’s highly defragmented logistics industry, thereby fostering the sector’s ease of doing business. In 2019, the government created a full-fledged department out of the logistics division of the commerce ministry. Aside from this policy, the Gati Shakti, Sagarmala, PLI Scheme, and Asset Monetization program of the Indian government are all expected to support and advance the logistics sector.

- Patel Integrated Logistics’ Warehousing Services: In addition to providing services in cargo and vendor management, the company also offers services in warehousing and distribution, manufacturing logistics, and C&F management since 2017. They have storage space totalling over 200,000 square feet spread across several locations. The company has leased a warehouse in Bangalore for 99 years, and it has also bought land in Chennai to construct a storage facility on. The business rents out warehouses to different industries based on their needs, from short-term leases of 10 years to long-term leases of 40 to 99 years. The Indian warehouse market is experiencing tremendous demand as a result of the government’s emphasis on “Make in India.” By adding more warehouse space to the existing infrastructure and riding the warehouse market demand, the company should be able to increase the contribution of warehousing service’s income to overall revenue.

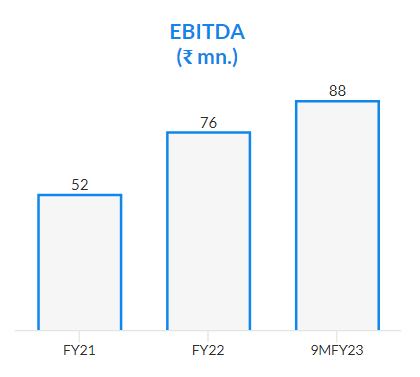

- Being Debt Free & Looking for growth: Patel Integrated Logistics issued 4,00,00,000 Crores Shares through a rights issue in November 2021 to raise ₹40 Crores in capital. The proceeds from the issue were used to minimise the company’s net external debt and strengthen its balance sheet in preparation for future expansion. As a result, the company’s debt-to-equity ratio significantly improved to 0.41, and as of march 2022, it had ₹63 crore in debt. Currently, the financial burden on the P&L was lessened by partially paying off the external debt. The management intends to invest the money saved by reduced finance costs in the expansion of the business. According to the management, the company has 3M, which is necessary for growth. The first M stands for money and represents the company’s substantial cash reserves of ₹21 crore. The second M stands for skilled manpower, and the final M stands for a growing market. The healthy state of EBITDA shows that the company is headed in the right direction.

- Business Diversification & Investments: The Company is currently focused on and involved in the Air Cargo Consolidation business. This business has been carried out under the Patel Airfreight division. It offers domestic and international high-density cargo air and surface transportation. The expanding export of the nation will help the company’s international air cargo consolidation business. It also provides services for import consolidation. The Company entered the health and fitness market last year by acquiring the franchisee of the GYM company, which prospered despite the pandemic. The management is confident that it will perform well in the upcoming year as well, increasing the revenue. This diversification will open up a new avenue for revenue growth.