“Hey, how is the market doing today?”

“Oh!, its falling tremendously since morning”

I am sure news like these might be a common topic of discussion for you nowadays. Interestingly, unlike the past, today, we don’t fear much of the falling market, in fact we tend to add more stocks to our portfolio in such a scenario. And quite honestly, you were just thinking of adding a few of them in your portfolio, right? So what are you buying, huh?

EV stocks?? Renewable energy stocks?? Or some IT??

But do you know what all these stocks have in common? Nah! We are not talking about innovation or technology but we are talking about Lead, Copper, Zinc, etc. In fact, have you ever wondered, what happens to the Lead cells of your inverter battery or the Copper wires of any electronic gadget, once they decay?

Before answering that question, let us discuss how harmful Lead is:

Lead is among the limited class of elements that can be described as purely toxic. Though, it is a relatively corrosion resistant, dense and malleable metal that has been used by humans for at least 5000 years. During this time, Lead pollution has increased from an estimated 10 tons per year to 1,000,000 tons per year, accompanying population and economic growth and it has now become a global health issue which often leads to Lead poisoning. And thus streamlining collection, disposal and recycling of Lead are the need of the hour and this will also help in Lead recovery in an eco-friendly manner.

And this is where Pondy Oxides and Chemicals Limited comes into play.

Let’s talk about the company:

Incorporated in the year 1995 and headquartered in Chennai, Pondy Oxides and Chemicals Limited (“POCL” | BSE: 53262) is India’s leading non-ferrous recycling company and the largest secondary Lead metal manufacturing company of India. The company recycles Lead, Copper, Zinc and Plastic in various forms. It is India’s first and only 3N7 Lead Brand to be registered on the London Metal Exchange (LME) which basically makes the Lead metal manufactured by the Company completely liquid and easy to be delivered to LME warehouses globally and MCX warehouses in India as well.

What are the products offered?

POCL has broad-based operations which includes manufacturing of Lead, Litharge Red lead, Zinc oxide, Lead sub Oxide, and solid and liquid stabilizers of PVC. The Automobile batteries industry (Lead, Lead-Antimony & Lead-calcium alloys) is the major customer segment. Tires & Ceramics (Zinc Oxide), Cable sheathing (Lead oxides), Galvanizing units (Zinc), and Plastics (PVC stabilizers) are the other customer industries Pondy caters to. Currently, pure Lead and Lead alloys are the speciality of the company’s manufacturing process and and quite astonishingly, POCL is the major exporter of these elements.

Quite surprisingly, Lead and Lead alloy’s export turnover amounts to about 50% of the total turnover of the company.

So, what’s the traction like?

The Company has a large clientele which includes big names like Amara Raja Batteries, J K Tyres, Kisan, Exide Industries, Shriram EPC, Supreme Industries, Chemplast, MRF Ltd, Tata Yuasa to name a few. It has entered into a global partnership with 150+ clients and has its operations up and running in more than 15 countries. Also, POCL is

the only Company exporting Lead alloys to Japan, which itself bears testimony to the quality of the product.

With more than 500+ employees, the company has 3 industrial plants mainly located in Andhra Pradesh and Tamil Nadu. Currently, the company’s capacities for Lead division stands at 120,000 Metric Ton per annum, for Copper at 30,000 Metric Ton per annum and for Zinc at 12,600 Metric Ton per annum respectively.

Sounds cool, huh! Now, having known about the company let’s see how the industry structure looks like:

Industry structure:

Lead is majorly used in storage batteries and dubbed Lead acid batteries. India is most likely to witness a substantial growth for Lead batteries on the verge of expansion of several sectors including, telecommunication, automobile, railways and defense. Also, Lead is increasingly used in UPS, inverters and similar other energy storage devices.

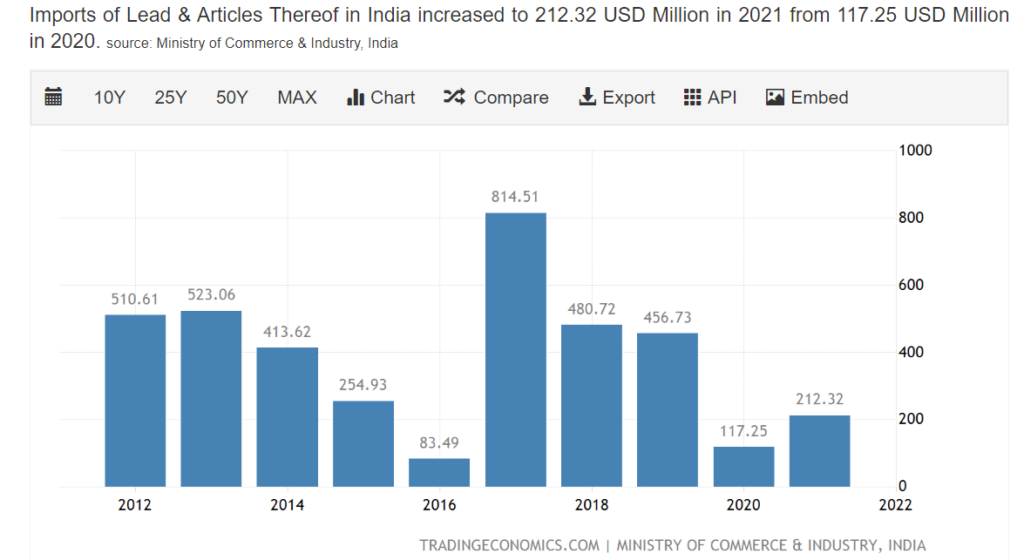

Driven by the automotive industry which consumes 60% of the total Lead capacity, the Indian market for Lead acid batteries is currently estimated at US$ 7 billion. This market is projected to grow at a CAGR of 6.5% during 2021-2027 while to meet this demand, we have been consistently importing Lead from various countries over the past few years.

But what about the Indian Lead industry?

The Indian Lead industry is expected to reach USD 8.57 billion by FY2027, registering a CAGR of about 6.5% during the forecast period of 2022-2027. The COVID-19 pandemic reflected a minor impact on the Lead-acid battery market in India, as the demand from the end-user industries recovered in the later half of 2020. Now, this was mainly due to the deficit covered by the industrial and other applications segment, which was created by decreased demand in the SLI (start, light and ignition) segment due to decreased sales of vehicles during the pandemic.

Factors, such as the growing demand from the telecommunication and data centres, coupled with the increasing applications in industries, such as railways, are expected to drive the market during the forecast period. However, the alternate technologies, such as – Lithium-ion, are expected to disrupt the market growth, primarily owing to their decreasing costs and technical advantages.

Any competitive advantage?

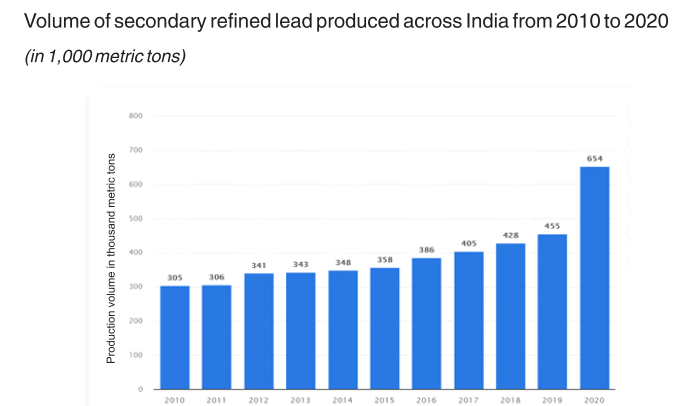

Sourcing of scrap is one of the major challenges of the non ferrous industry and POCL has a competitive edge on the same. The company has a strong procurement strategy to fulfill their production capacities. It has over 200 plus suppliers and has a unique, engrained and extensive scrap collection network in over 30 countries to collect scrap at the most competitive price. Also, with the Indian Government putting more emphasis on recycling through EPR Guidelines and Waste Management Rules, the scrap battery collection is becoming more organized in the domestic part of the country as well. The procurement trend from domestic has improved from 10% earlier to 20% of total primary raw material sourcing which will subsequently reduce logistics cost and improve working capital cycle of the company.

To combat the fluctuating commodity market, the company has a back-to-back hedging mechanism in place supported by their in-house software because of which the margins of the company remain integral. They hedge their open positions with two of the most globally prominent service providers of the industry. Adding to this, the three decades of experience with a very strong and competitive management team adds to the added advantage of the company.

Future outlook:

The future outlook of the company remains very positive since Lead business will continue to grow at a CAGR of 20-25% plus and now they even have added copper to their portfolio. Hence the company intends to grow the same portfolio and other non-ferrous metals in FY 22-23.

Since, lead business remains the primary forte, the company intends to put special focus on it by improving operational processes and adding new manufacturing processes for a sustainable and green environment. Also, the company has an inherent advantage to procure other non-ferrous metal scrap as well since they have access to a wide supplier base and scrap yards in various countries.

POCL has invested and revamped its smelting division where maximum profitability and cost of conversion is gained. This was a mindful and calculated effort to scale up capacities in smelting, foreseeing the need to process higher quantities of batteries and other smelting-related raw materials from the domestic and international market as well, in order to realize the maximum value addition.

The R & D team also sees potential in lithium ion batteries and also its substitutes and therefore, Pondy is also planning to expand in this niche as well. POCL is continuously endeavoring to emphasize on the importance of a circular economy and to support & focus on the environmental responsibility by adopting better processes in its manufacturing plant. The company expects to achieve operational revenue of Rs 1400 Crores in the year 2022-23 with margins of over 6%, an increase of 39% YoY. And hence, the company is targeting to increase the financial metrics with 25% CAGR, about 15% return on capital employed, and 7% plus on our EBITDA margins.

Where is the quarter?

| Particulars (in crores) | Q3 FY 2022 | Q3 FY 2021 |

| Revenue from Operation | 41,365.62 | 29,256.14 |

| Total Income | 41492.57 | 29.279.09 |

| Total expense | 39,503.33 | 28,844.79 |

| Profit | 1,989.24 | 434.3 |

| Diluted EPS | 25.85 | 1.85 |

The production has grown by 18% on a year-on-year basis. In the second Quarter of FY22, it had increased by 2%, and on a Quarter-on-Quarter it had grown by 13%. Meanwhile, the revenue from Operations for the third quarter of FY 22 was INR 413.65 Crores which was an increase by 50% on a year-on-year basis and 41% on quarter-on-quarter basis.

Pondy reported an EBITDA of INR 25.09 Crores in the third quarter of FY22 with INR 64.78 Crores, year to date. The Earnings before Tax for quarter 3 of FY 2022 is INR 19.89 Crores and Year to Date is INR 51.78 Crores.

To know more about the Q3 results please click on the link here

Click here to never miss any update of POCL.