Business Outlook

“We have delivered strong broad based credit growth while overall costs have been well managed, resulting in the highest ever profits,” said Shyam Srinivasan, MD&CEO, Federal Bank in a statement alongside April-June quarter results.

Kochi-based private sector lender Federal Bank witnessed loan book growth of 16% on year, while deposits rose 8% in the three months ended June 30.

The lender continues to expect credit growth in the range of 15%-18% for this year. We see a five to 10 basis points improvement in the net interest margin in the near-term as about 75% to 80% of the bank’s loan portfolio is linked to variable rates, and will benefit in the rising rate scenario.

Earlier this year Federal Bank’s 74%-owned subsidiary Fedbank Financial Services (FedFina) initiated the process for an initial public offer (IPO). FedFina plans to raise INR900 crore via fresh issue of shares and an offer for sale (OFS) of up to 45.71 million shares by its existing shareholders and promoters. Federal Bank will continue to own over 51% of the outstanding share capital after the completion of this offering.

With the new NBFC norms and ongoing market consolidation led by HDFC Bank, which is set to acquire HDFC Ltd. we could see a scale back in the IPO. Also recession-fear led market turmoil could lead the lender to shelve the plan entirely.

The lender is focused on customer acquisition. To strengthen brand positioning it appointed M V S Murthy as its first Chief Marketing Officer at the beginning of this month. He plans to leverage marketing to help build scale.

Financial Snapshot

In the first quarter, the lender’s net profit rose 63.5% on year to record INR601 crores. Lower provisions and stronger net interest income pushed the bottom line, resulting in best-ever quarterly showing. Net interest income, a measure of the gap between interest earned and expended, jumped 13.1% to INR1,605 crore in the reported quarter. Net interest margin improved to 3.22%, up seven basis points on year and six basis points sequentially.

However, in contrast, other income fell 30.2% to INR453 crore. Even as provisions and contingencies fell by 74% on year to INR167 crore, while on quarter it more than doubled from INR75 crore.

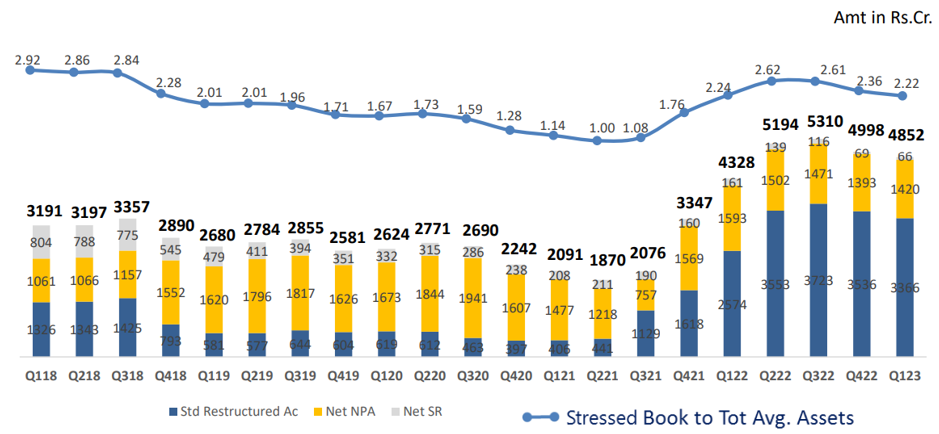

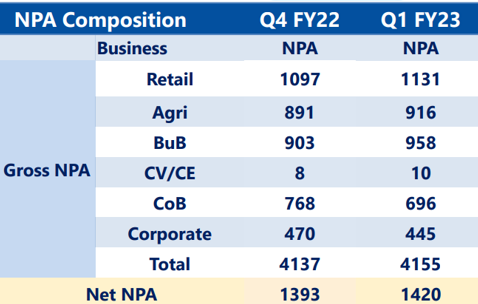

Asset quality improved as gross non-performing assets (NPAs) stood at 2.69% during the first quarter as compared with 2.80% in the previous quarter. Net NPAs dropped two basis points sequentially to 0.94%.

Source: company statement

Source: company statement

Price Performance

Shares of the bank rose nearly 1.5% after the Q1 earnings at INR98.80. Stock jumped nearly 14% in the last one month. The midsize lender that was off-radar for quite some time before that was buoyed by encouraging comments from Shyam Srinivasan and slew of brokerages adopting a more bullish view including Axis Securities.

Source: BSE

Investment Thesis

Incorporated in 1931, Federal Bank is a banking company with market cap of INR20,770 crore. Its competitors City Union and Equitas Bank, both have P/E of over 15, while Federal Bank is relatively still cheaper with a P/E of around 10. We believe the share price has a lot of room to grow.

Federal Bank has a wide network of 1291 branches, 1860 ATMs/ Recyclers as on June-end. It opened 10 new branches in a day during Q1, which is encouraging.

Federal Bank plans a horizontal play across the existing portfolio of customers and pans vertically to strengthen the bank’s organic acquisition as well as inorganic growth, which is powered by its strategic partnerships within the fintech and start-up ecosystem.

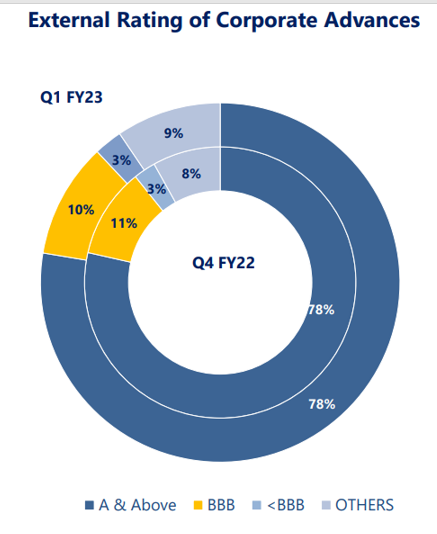

The lender’s credit standards have been way better than other midsize peers.

Federal Bank has witnessed steady growth in market share for the first quarter with market share at an all-time high of 21.06% for Individual Inward Remittance. Market share in advances was at 1.21%, while market share in deposits was at 1.08%.

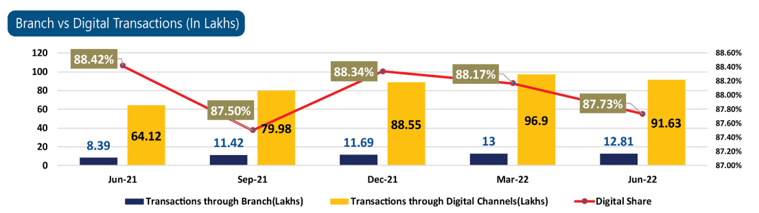

We are positive on the lender’s focus on expanding its digital business by leveraging several partnerships. Share of digital transactions currently account for almost 90%. The bank has tied up with FPL Technologies, also known as ‘One Card’ for issuing co-branded credit cards. The pact concentrates on the new to bank but digitally savvy segment. Additionally more than 4.5 lakh accounts are being opened with the help of its two fintech partners – Fi and Jupiter.

Source: company statement