Federal Bank Limited a stalwart in the Indian banking sector, reported robust Q1 FY24 financial performance marked by significant revenue growth. The bank’s diversified revenue segments, including treasury, corporate banking, and retail banking, showed impressive gains. Additionally, the withdrawal of ₹2,000 notes spurred deposit growth and signaled a resurgence in remittance and non-resident deposits. Federal Bank’s strategic collaboration with neo banks is opening new avenues for customer acquisition and personalized banking experiences. The bank’s management remains optimistic about the future, emphasizing a balanced approach to credit distribution and anticipating substantial credit growth in fiscal year 2024. Read this article to find more details.

Stock Data

| Ticker | FEDERALBNK |

| Industry | Banking |

| Exchange | NSE |

Share Price

| Last 5 Days | 0% |

| Last 1 Month | 11.9% |

| Last 5 Months | 16.2% |

Business Basics

Federal Bank Limited, established in 1931, is a prominent Indian commercial bank with a rich legacy spanning over nine decades. The bank has solidified its presence in India with an extensive branch and ATM network, ensuring convenient access for customers across the country. Notably, Federal Bank has proactively embraced digital transformation, enhancing the overall customer experience and operational efficiency. Offering a comprehensive suite of financial products, including savings accounts, loans, credit cards, and wealth management services, it caters to a diverse customer base comprising individuals, businesses, and Non-Resident Indians (NRIs). Federal Bank’s strong presence in crucial sectors like agriculture, Small and Medium-sized Enterprises (SMEs), and retail banking further highlights its potential for investors seeking opportunities in the financial sector.

Q1 FY24 Financial Performance

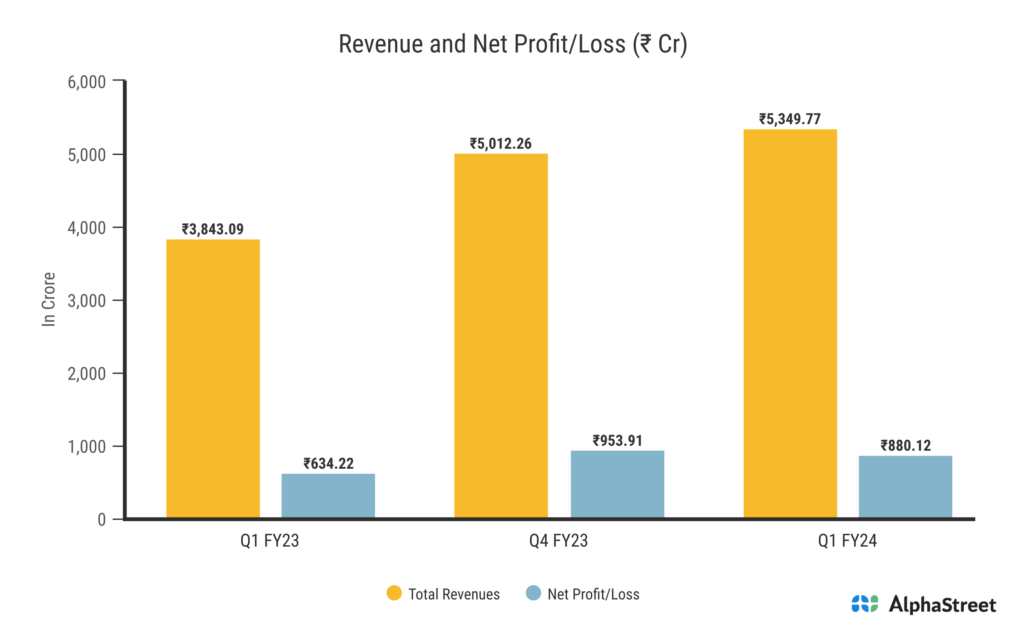

Federal Bank Limited reported Revenue from Interest for Q1FY24 of ₹5,349.77 Crores up from ₹3,843.09 Crore year on year, a rise of 39.21%. The Revenue was increased despite being a slow quarter. Moreover, all of its businesses showed approximately 5% sequential growth. The consolidated Net Profit of ₹880.12 Crores up 38.6% from ₹634.22 Crores in the same quarter of the previous year. The Earnings per Share is ₹4.16, up 37.75% from ₹3.02 in the same quarter of the previous year.

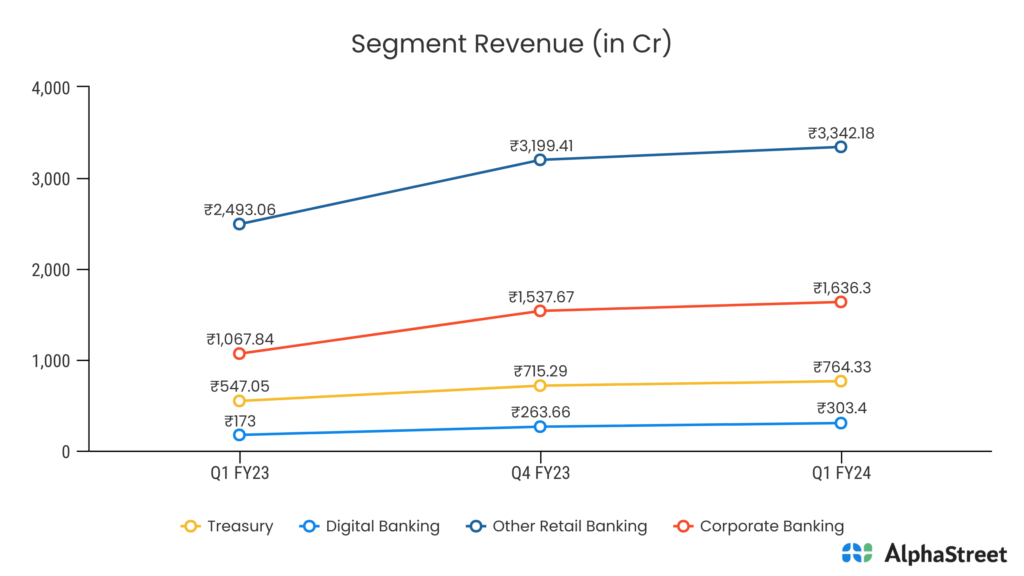

Federal Bank’s Revenue Segment

Treasury: Treasury operations are a significant source of revenue for Federal Banks. These departments are responsible for managing the bank’s own investments, including bonds, securities, and other financial instruments. By strategically investing in these assets, banks aim to generate income through interest and capital gains. The Treasury segment experienced substantial growth, with revenue increasing by approximately 39.75% up to ₹764.33 Crore.

Corporate Banking: Corporate banking is another substantial revenue segment for Federal Banks. This segment focuses on serving the financial needs of businesses and corporations. This segment saw remarkable growth with revenue surging by around 53.18% year on year. Services include providing loans, credit facilities, cash management solutions, foreign exchange services, and investment banking advisory services. Revenue is generated through interest income on loans, fees for various services, and commissions on investment banking transactions.

Retail Banking: Retail banking serves individual consumers and households. It encompasses a wide range of financial products and services, including savings accounts, checking accounts, personal loans, mortgages, and credit cards. Two significant sub-segments of retail banking are:

Digital Banking: Digital banking includes online and mobile banking platforms, which enable customers to perform various transactions, check balances, pay bills, and access a suite of financial services from the convenience of their devices. Revenue in this segment is often generated through fees, such as ATM fees, overdraft charges, and interchange fees on debit card transactions.

Other Retail Banking: This sub-segment encompasses the more traditional aspects of retail banking, such as branch-based services. It includes services like in-person customer support, safe deposit boxes, and personalized financial advice from bank representatives. Revenue here comes from fees related to account maintenance, safety deposit box rentals, and other branch-specific services.

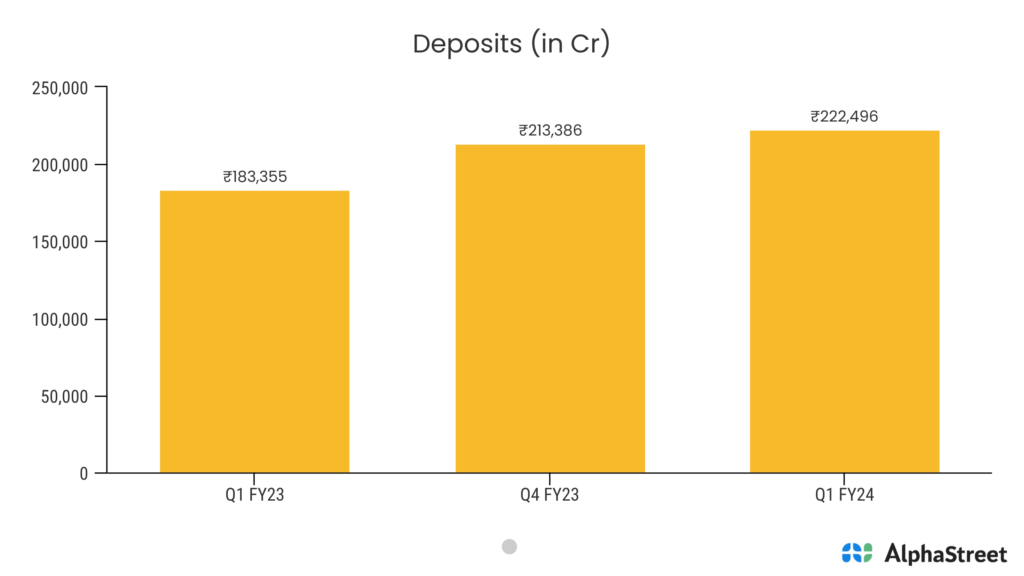

Increased Deposit Post ₹2000 Note Withdrawal

The withdrawal of ₹2,000 had provided an opportunity for additional deposit growth and offered some much-needed relief for the bank. Particularly encouraging for Federal Bank was the resurgence in the remittance business and the non-resident (NR) deposit business, which had been somewhat subdued in most of FY23 but started picking up towards the latter part of the fiscal year. The bank also highlighted that their market share, which had previously declined, had now rebounded. Furthermore, their Rupee deposit share was on the rise, indicating a positive momentum in this aspect. The management attributed these developments to changing post-COVID behavioral patterns, suggesting that the growth trajectory in these areas was showing signs of recovery.

Customer Acquisition Through Neo Banks

Traditional banks in India are teaming up with neo banks to revolutionize the country’s financial sector. A Redseer Strategy Consultants report indicates that neo banks have substantial room to grow by offering personalized experiences, data-driven insights, improved interfaces, and value-added services. India’s fintech market, valued at $31 billion in 2021, ranks as the third-largest globally, making it ripe for neo bank disruption. Collaboration benefits both sides, with neo banks gaining a foothold and traditional banks reaching tech-savvy customers.

To scale, neo banks aim to acquire primary bank accounts, especially white-collar salary accounts. However, regulations prevent them from becoming fully digital banks, requiring reliance on bank partnerships. Notable collaborations include Jupiter, Fi, Niyo, and RazorpayX partnering with established banks. Federal Bank, for instance, opened over 300,000 accounts through such collaborations.

Federal Bank’s CEO, Shyam Srinivasan, highlights the potential for user behavior analysis and cross-selling opportunities, with plans to customize solutions through analytics. Taking cues from their successful personal loan portfolio strategy, they intend to offer credit based on debit card profiles. Federal Bank also shifted to Visa and RuPay platforms for credit card issuance, overcoming regulatory challenges. This collaboration between traditional and neo banks sets the stage for an exciting transformation in India’s financial sector, promising more personalized and technologically advanced banking experiences for customers.

Credit Opportunity in India’s Banking Sector

There has been continued growth of credit opportunities within the banking sector. The management emphasized that these opportunities remain robust and sustainable, with demand persisting into the early part of July and throughout the second quarter. Federal Bank’s strategy is to maintain a balanced approach to credit distribution, avoiding over-concentration in any single business sector. This approach encompasses a mix of retail and wholesale lending, ensuring flexibility to capitalize on opportunities within these segments. The bank’s management remains optimistic about the outlook for fiscal year 2024, with an anticipated credit growth of 80%-20% considered attainable.