Company Overview:

Cyient, formerly known as Infotech Enterprises Ltd, stands as a global leader in Digital, Engineering, and Technology solutions, operating across eight strategic business units spanning various sectors such as Aerospace, Rail Transportation, Communications, Mining, Energy and Utilities, Medical, Semiconductor, and Hi-Tech & Automotive. With subsidiary Cyient DLM (formerly Rangsons) listed separately, Cyient boasts a clientele of 300+ customers across 14 countries. The company’s focus on niche products and process engineering services, coupled with its robust growth drivers, positions it as a formidable player in the Engineering, Research, and Development (ER&D) space.

Financial Performance:

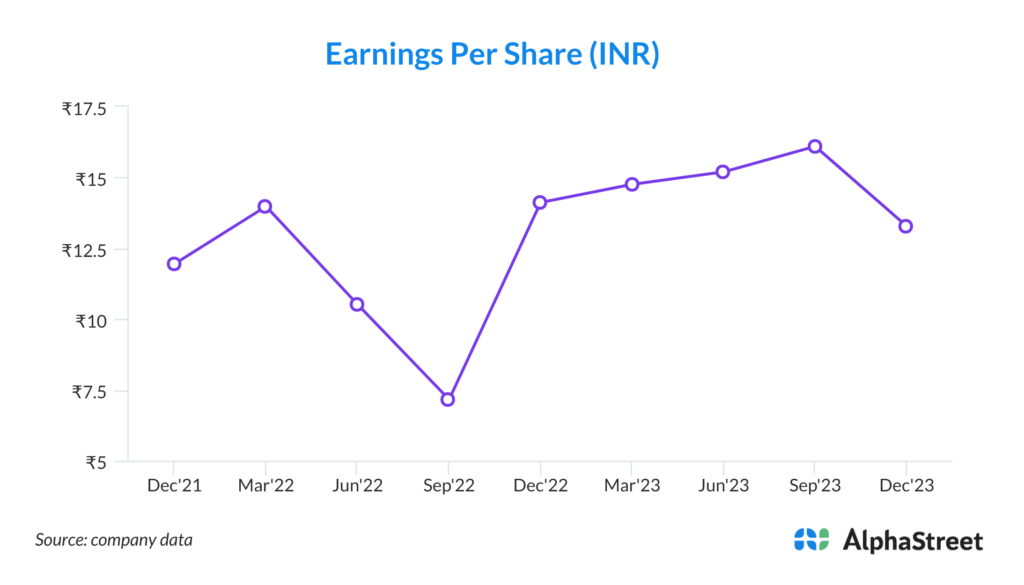

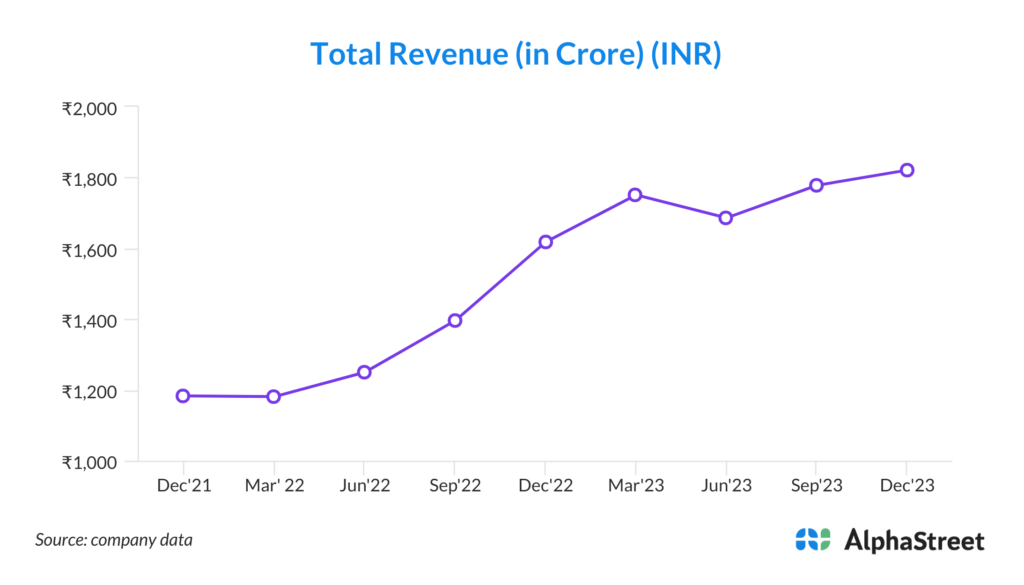

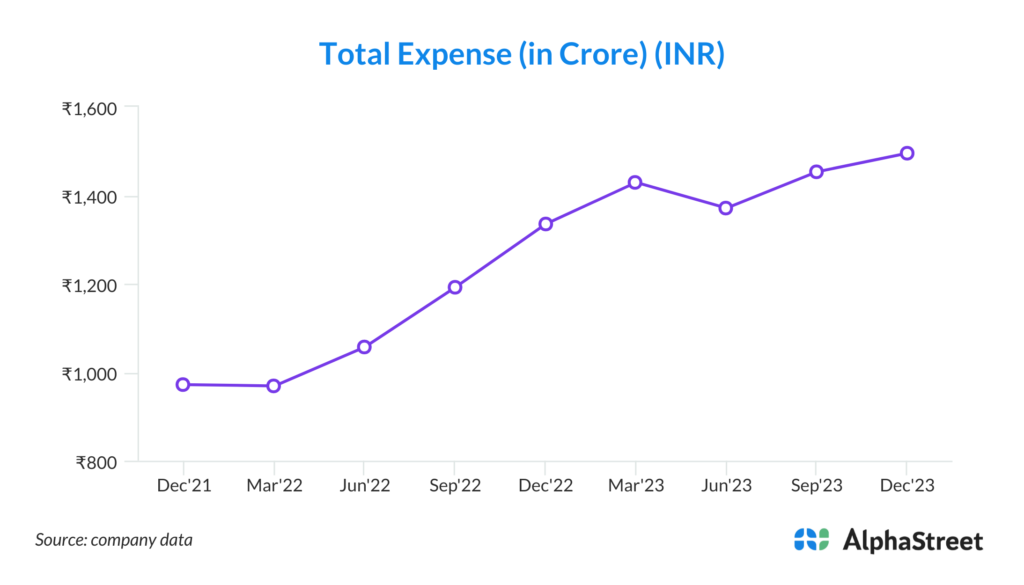

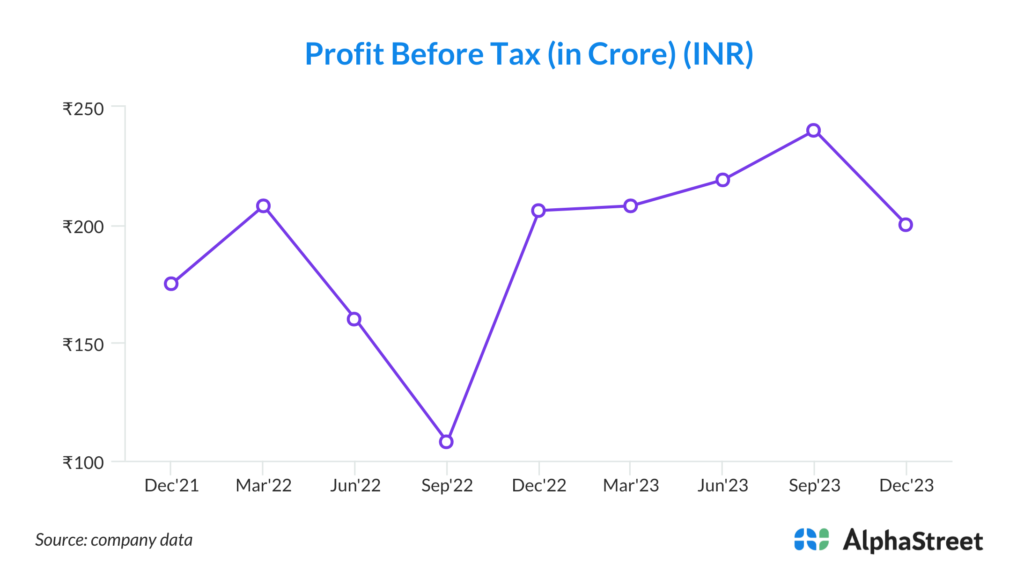

In Q3FY24, Cyient exhibited a mixed financial performance, with revenue meeting expectations but net profit falling below estimates. The company reported Digital, Engineering & Technology (DET) revenue of Rs 1,491 crore, representing a marginal 1% increase QoQ and a notable 8.1% rise YoY. In USD terms, DET revenue reached $179.2 million, growing by a slight 0.1% QoQ and a commendable 5.4% YoY. However, consolidated net profit declined to Rs 153.2 crore, marking a significant 16.6% decrease QoQ and a modest 1.8% dip YoY. This decline was primarily influenced by an exceptional item of Rs 50.3 crore related to the settlement of an antitrust lawsuit in the US District Court. Despite the profit setback, Cyient’s revenue growth trajectory remains intact, reflecting its resilience amidst market challenges.

Key strengths of the Company:

1. Diverse Business Verticals: Cyient’s presence across eight strategic business units, including Aerospace, Rail Transportation, Communications, and Semiconductor, provides diversification and resilience against sector-specific fluctuations. This diverse portfolio enables Cyient to capture opportunities across multiple industries and navigate through varying market conditions, thereby reducing dependency on any single sector.

2. Niche Offerings: Cyient offers niche products and process engineering services in domains such as Transportation, Communication, Utilities, and Semiconductor. By specializing in these areas, Cyient addresses specific client needs with tailored solutions, fostering strong client relationships and positioning itself as a preferred partner for complex engineering projects.

3. Strong Client Base: With over 300 customers across 14 countries, Cyient boasts a robust client base comprising leading organizations in various industries. This extensive client network not only provides revenue stability but also offers opportunities for cross-selling and up-selling additional services, further enhancing revenue growth and profitability.

4. Strategic Partnerships: Cyient’s strategic partnerships with industry leaders such as Airbus and SkyDrive Inc. bolster its market positioning and technological capabilities. These collaborations enable Cyient to access new markets, expand its service offerings, and leverage cutting-edge technologies, thereby enhancing its competitiveness and driving long-term growth.

5. Focus on Large Deals and Innovation: Cyient’s focus on securing large deals, coupled with its emphasis on innovation and digital transformation, strengthens its competitive edge in the ER&D space. By investing in digital solutions and intelligent engineering, Cyient stays ahead of industry trends, meets evolving customer demands, and drives value creation for its stakeholders.

Key risks and concerns for the Company:

1. Currency Fluctuations: Cyient is exposed to risks associated with currency fluctuations, particularly the depreciation of the Indian rupee against the USD. As a global company with significant operations and revenue streams in foreign currencies, adverse movements in exchange rates can impact its financial performance and profitability, leading to potential earnings volatility and hedging challenges.

2. Talent Retention: High attrition rates within the industry, coupled with intense competition for skilled professionals, pose a significant challenge for Cyient. Retaining and attracting top talent is crucial for sustaining innovation, maintaining service quality, and executing projects effectively. Failure to address talent retention issues could result in increased recruitment costs, project delays, and hindered business growth.

3. Sector-specific Slowdowns: Cyient operates in sectors such as Aerospace, Rail Transportation, and Semiconductor, which are susceptible to cyclical downturns and market disruptions. Any slowdown in these sectors, whether due to economic downturns, geopolitical tensions, or regulatory changes, could adversely affect Cyient’s order intake, revenue growth, and profitability, leading to decreased investor confidence and share price volatility.

4. Client Concentration: Cyient’s revenue is dependent on a few key clients, with its top 5 and top 10 clients contributing a significant portion of its total revenue. Dependency on a limited number of clients increases the company’s vulnerability to client-specific risks, such as contract non-renewals, project cancellations, or changes in spending priorities. Diversification of the client base is essential to mitigate this risk and ensure revenue stability and growth.

5. Debt-funded Capex or Acquisitions: Any significant debt-funded capital expenditures or acquisitions undertaken by Cyient could strain its balance sheet, increase leverage, and impact its financial flexibility. Excessive debt levels could lead to higher interest expenses, reduced cash flows, and credit rating downgrades, negatively affecting investor sentiment and the company’s ability to pursue growth opportunities. Prudent capital allocation and disciplined financial management are essential to mitigate this risk and maintain long-term sustainability.