“As you know, Cyient DLM Limited listed on 10, July 2023. I want to take this opportunity to thank you for the overwhelming response to our IPO. Over the past several years, we have demonstrated Cyient DLM’s credibility and capability in a wide range of design-led manufacturing solutions. And we are now with your support well positioned to leverage the tailwinds in this space. I’d also like to take a moment to thank the Cyient team that made the IPO possible and for doing this in a very short and compressed time frame.”

-Krishna Bodanapu, Executive Vice Chairman & MD

Stock Data

| Ticker | CYIENT |

| Industry | IT |

| Exchange | NSE & BSE |

Share Price

| Last 5 Days | -6.6% |

| Last 1 Month | 11.5% |

| Last 6 Months | 86.4% |

Business Basics

Cyient Limited, a prominent player in the global engineering and digital technology solutions industry, operates with a focus on innovation, collaboration, and sustainable growth. The company’s business fundamentals are deeply rooted in its diversified portfolio of services, spanning engineering, data analytics, digital solutions, and technology-driven industries. One of the central pillars of Cyient’s business strategy is its expertise in providing engineering and manufacturing solutions. The company serves clients across industries such as aerospace, defense, automotive, telecommunications, and utilities. Cyient’s services encompass product design, testing, manufacturing support, and maintenance, enabling clients to bring innovative products to market efficiently.

Cyient’s digital solutions and data analytics services are key drivers of its business. The company leverages technologies like IoT, artificial intelligence, and machine learning to help clients transform their operations, optimize processes, and harness the power of data for informed decision-making. These digital solutions cater to industries including utilities, transportation, and telecom, enhancing efficiency and sustainability. The company’s focus on collaboration is evident in its partnerships with leading global organizations and academia. Cyient collaborates on cutting-edge research and development projects, allowing it to stay at the forefront of technological advancements and deliver innovative solutions to its clients.

Q1 FY24 Financial Performance

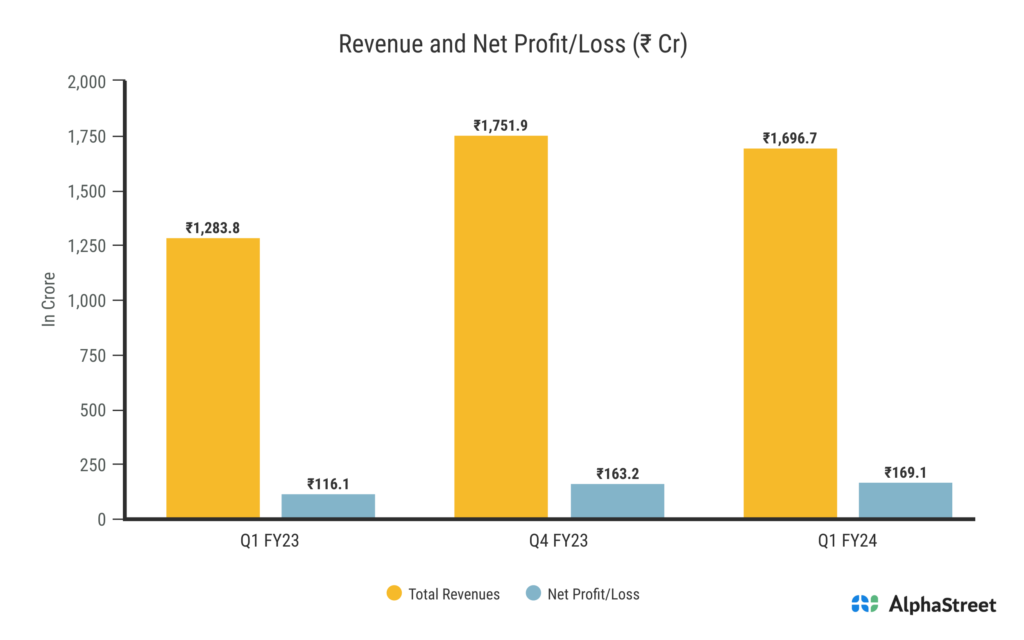

Cyient Ltd reported Revenues for Q1FY24 of ₹1,686.00 Crores up from ₹1,250.00 Crore year on year, a rise of 34.88%. Consolidated Net Profit of ₹169.00 Crores up 45.69% from ₹116.00 Crores in the same quarter of the previous year. The Earnings per Share is ₹15.20, up 44.49% from ₹10.52 in the same quarter of the previous year.

Cyient’s Restructured Business Segments

Cyient, a leading global engineering and technology solutions provider, has unveiled a revamped structure for its business segments and a new financial reporting model. The changes are aimed at reflecting the company’s evolving focus on digital transformation and advanced technology adoption.

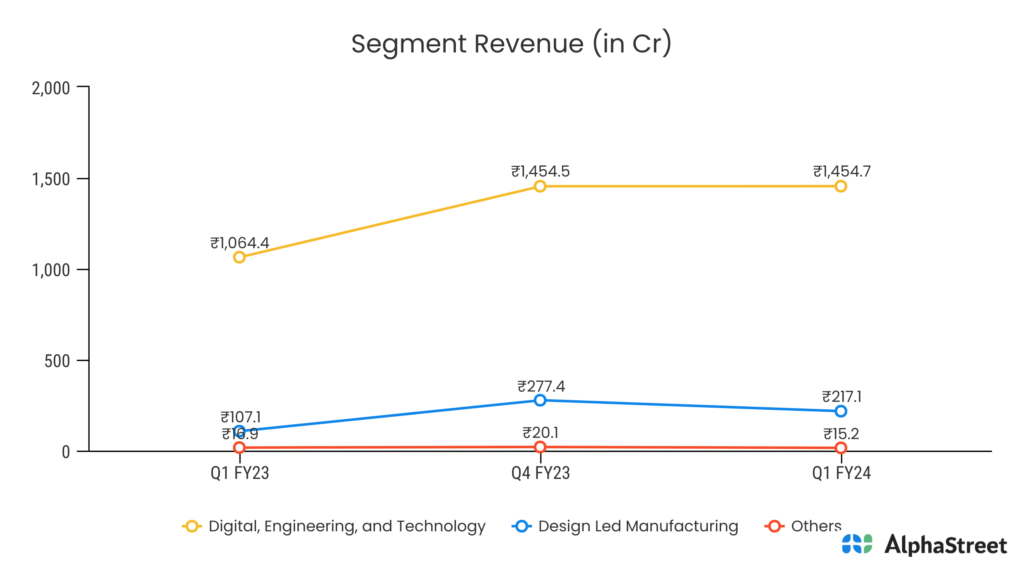

In a recent update, Cyient introduced three distinct business segments within the Cyient Group:

Cyient DET (Digital, Engineering, and Technology): This segment signifies the convergence of traditional engineering and engineering services with the digital transformation and the adoption of advanced technologies such as generative AI. Cyient DET encompasses the company’s core services and acquisitions, along with a portion of its engineering parts business previously classified under DLM. Notably, this reclassification of the engineering parts business has a minimal impact on Cyient DET’s revenue, accounting for approximately $0.9 million per quarter, or 0.5% of Cyient DET’s total revenue.

Cyient DLM (Design Led Manufacturing): This segment includes the business that was divested after the reclassification of the engineering parts business. This revenue segment is dedicated to providing end-to-end engineering and manufacturing solutions. Cyient assists clients in designing and manufacturing complex products and components, often for industries with stringent quality and precision requirements. Services within this segment encompass product design, manufacturing support, supply chain optimization, and lifecycle management. Cyient collaborates with clients in sectors like aerospace, defense, and automotive, helping them turn innovative design concepts into reality while ensuring cost-effectiveness and compliance with industry standards.

Others: This category now includes Cyient’s Aerospace tooling business, which was previously categorized under DLM and was reclassified prior to the divestiture.

Company’s Simplified Dashboard for Financial Reporting

To align with the evolving business landscape and to address feedback from stakeholders, Cyient is adopting a simplified dashboard-model for financial reporting. This model will provide insights into six key metrics, including revenue in US dollar terms, revenue in INR terms, Earnings Before Interest and Taxes (EBIT) in percentage terms, Profit After Tax (PAT) in INR terms, Earnings Per Share (EPS) in INR terms, and Free Cash Flow (FCF) in INR terms. Additionally, Cyient will present performance trends on a quarterly (Q-o-Q) and yearly (Y-o-Y) basis for each of these metrics.

Cyient DLM IPO & It’s Performance

Cyient DLM is a well-positioned company in the growing electronics manufacturing services (EMS) market. The company has a strong order book and a diversified customer base. It is also investing in new technologies and capabilities to stay ahead of the competition. The IPO was a Book Built Issue with a total issue size of Rs 592.00 Cr. The price per share was set between ₹250 to ₹265. The IPO was listed on both BSE and NSE.

The IPO was subscribed over 67 times during the bidding period. Upon listing, Cyient DLM had a strong performance, with its share price rocketing over 50%. Cyient DLM’s share price has shown a strong performance since its listing. As of September 8, 2023, the share price was at ₹699.20. The share price has seen a significant increase over time, with returns of 45.52% in 1 month, 68.75% in 3 months. On September 4, 2023, Cyient DLM’s share price zoomed to ₹739.85, which was its highest level since its market debut on July 17, 2023. This represents a remarkable increase of 179% from its issue price of ₹265 per share.