Yes Bank

Stock Data:

|

Ticker |

YESBANK |

|

Exchange |

NSE and BSE |

|

Industry |

Private Sector Bank |

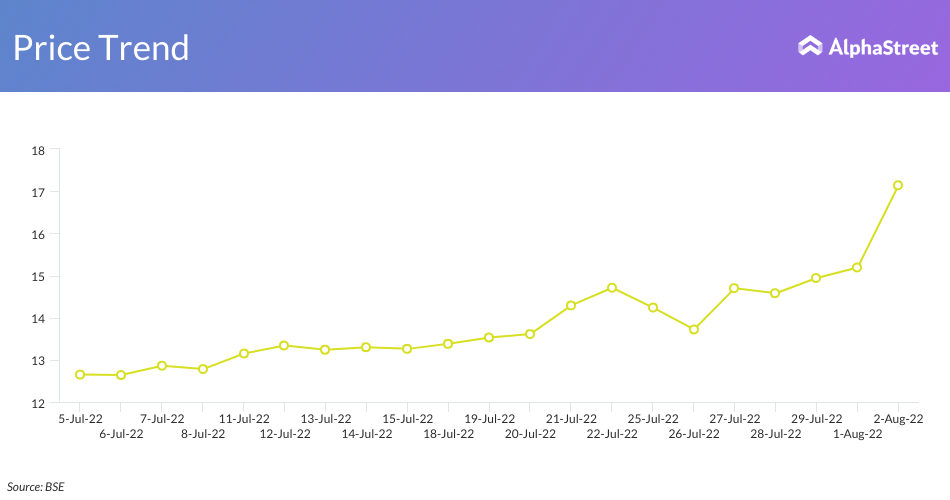

Price Performance:

|

Last 5 days |

21.6% |

|

Last 6 months |

27.5% |

|

Last 12 months |

34.5% |

As of Aug 2, 2022

What’s driving the stock?

The stock has been on a tear after the company announced its plans to sell up to a 10% stake each to U.S. private equity firms Carlyle Group and Advent International for INR8,900 crore ($1.1 billion). The capital raise will bolster the capital adequacy of Yes Bank and aid its medium to long term sustainable growth objectives. Once approved, this would be one of the largest private capital raises by an Indian Private Sector Bank.

The capital raise is subject to shareholders’ approval at the EGM, scheduled to be held on Aug. 24, 2022 and relevant regulatory and statutory approvals.

Buoyed by the news, the stock hit its highest since January 2021 on Aug 2, 2022.

Some analysts warned that the capital raise will suppress return on equity for the bank, however Prashant Kumar, Managing Director and Chief Executive Officer of Yes Bank, said that he doesn’t expect any such impact. He reasoned that the capital raise would take the company’s growth to a different trajectory. The capital raise can also be a re-rating, after which the lender may get a lot of business opportunities and cost of funding will also fall, he added.

Earnings Beat and Outlook:

Yes Bank reported solid set of numbers for the first quarter ended Jun. 30, 2022. Net profit rose nearly 50% on year to INR311 crore, while net interest income jumped 32% to INR1,850 crore. The private bank lender said that its advances grew 14% on year and its deposits rose 18%. Provisions for bad loans declined 62% benefitting from lower slippages.

Asset quality also improved during the quarter with gross non performing assets ratio at 13.4% compared with 15.6% year ago and 13.9% in the previous quarter. Net NPA ratio was 4.2% lower than 5.8% in Q1FY22 and 4.5% in Q4FY22.

![]()

The lender aims a 15% advances growth for the current year, led by retail and small enterprises growth of 25% and corporate growth of 10%. It expects NIM of 2.9% at the year-end, up from 2.4% reported in the first quarter.

Investment Thesis:

Since inception in 2004, Yes Bank has grown into a ‘Full Service Commercial Bank’ providing a complete range of products, services and technology driven digital offerings, catering to corporate, MSME & retail customers. Headquartered in Mumbai, it has a pan-India presence, with 1,140 branches, 101 business correspondent (BC) banking outlets and 1,273 ATMs (automated teller machine), CRMs (customer relationship managers) & BNAs (bank note accepting).

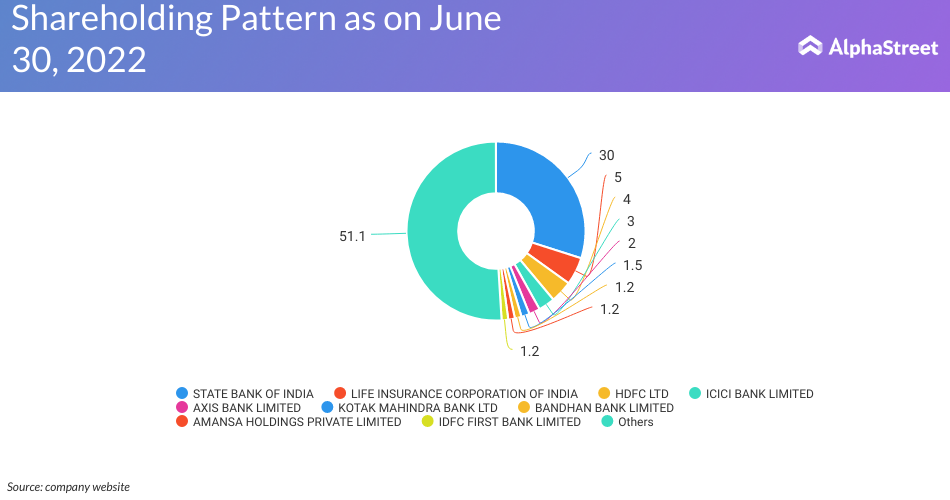

In 2020, in wake of Covid pandemic, Yes Bank entered troubled times post the IL&FS collapse. It was rescued by the government and the Reserve Bank of India (RBI), which brought in country’s biggest lender by assets, State Bank of India as an investor. LIC, SBI and top private banks infused INR11,000 crore into Yes Bank under a scheme, while private sector lenders Kotak, HDFC Bank, Axis Bank and ICICI Bank picked up stake.

Since then the lender undertook a number of steps to return to profitability as it revamped and strengthened governance standards. Laser focus on resolution of stressed assets also helped.

Carlyle Group and Advent International pact will provide confidence as well as growth capital to boost the return on assets. We expect to see a turnaround in key performance indicators and improved confidence in the stability of the lender.

We are also positive on its binding term sheet with partner JC Flowers to form an ARC with the objective of acquiring an identified pool of up to INR48,000 crore of stressed assets of the bank. JC Flowers has provided a bid of INR11,183 crore, i.e. 135% of carrying value in balance sheet as on Mar. 31, 2022. Pursuant to successful closure, transaction set to be the largest sale of stressed assets deal in domestic markets.

We are encouraged by the lenders effort to innovate and capture the market. The lender has launched a first of its kind floating rate fixed deposit linked to RBI repo rate –an Intelligent Fixed Deposit with Dynamic Returns. It has already acquired over 14,000 customers since launch.

However, Yes Bank will still need to improve cost metrics and advances growth to stay profitable in the medium-term.