Being one of the dominant players in the kitchen appliances industry, Stove Kraft Ltd (NSE: STOVEKRAFT) turned triumphant even in tumultuous times. Though the past year was cropped with multiple challenges, the company recorded robust revenue growth, strengthened in-house manufacturing units, and explored new business areas. June quarter was a mixed profile for the company with strong revenues and margins, offset by high costs and low profits. Nevertheless, to cater to the changing dynamics of the sector, Stove Kraft is on the path of expanding offerings in the form of branded modular kitchens and electrical switches & accessories through strategic acquisitions. Therefore, investors with buying the dips strategy can build a position in the stock.

Overview

Bangalore-based Stove Kraft Ltd is a Small Cap company that operates in the Domestic Appliances industry. Incorporated in 1999, the company is listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). With a market capitalization of about Rs 2,222 crore, Stove Kraft serves clients with a wide range of kitchen and home solutions.

Being a well-known manufacturer and retailer in the Indian kitchen appliances market, the company owns three large brands namely, Pigeon, Gilma, and BLACK+DECKER. The company is one of the dominant players in the pressure cooker, free-standing hob, non-stick cookware, and cooktop segments and has a foothold in 27 Indian states and 5 Union territories. Additionally, being an exporter to 12 countries worldwide, the company genertaes10% of sales through exports. It has also established OEM partnerships in the U.S. and Mexico.

Recent Share Price Insights

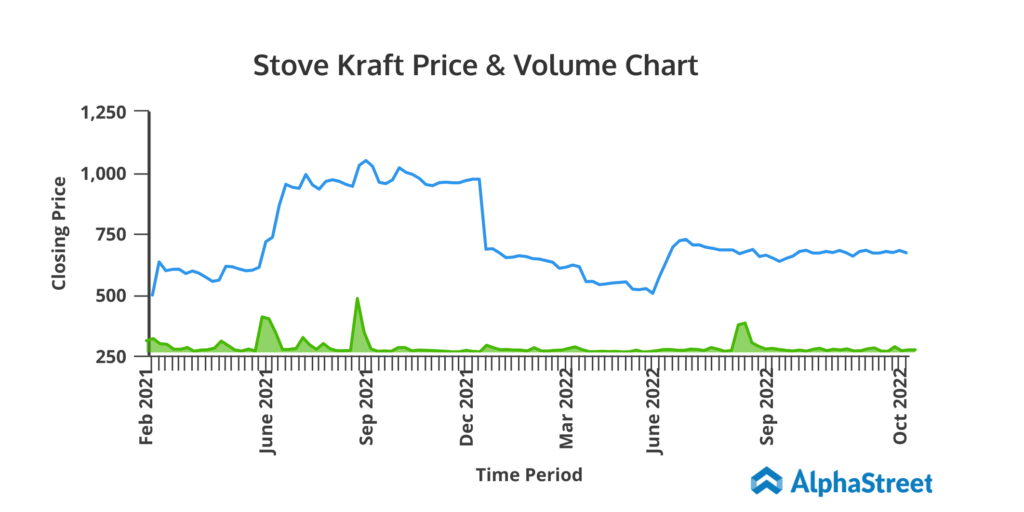

- With the current price of Rs 671.15, Stove Kraft is trading a bit above its 52-week low of Rs 475.

- The stock rose around 16.3% in the past three months, after recording a one-year negative return of around 37%.

Financial Snapshot

In August, Stove Kraft reported its financial results for the quarter ended June 30, 2022. For the quarter, the company recorded total revenue of operations of Rs 275.1 crore, up 28.4% YoY. Gross profit came in at Rs 90.5 crore, up 23.9% YoY.

Total expenses stood at Rs 263 crore, up 30.8% on a YoY basis. EBITDA declined marginally on a YoY basis to Rs 22.4 crore.

Net profit after tax decreased 40.3% on a YoY basis to Rs 8.1 crore on higher costs. Earnings per share came in at Rs 2.44 compared to Rs 4.09 in the prior-year quarter.

The total number of outlets added in the quarter was 10,568. Remarkably, volumes rose for all segments of appliances in the quarter.

Factors to Consider

- Stove Kraft is one of the big industry players, with over 79,000 retail outlets.

- Technology advancement, superior quality, a wide range of marketing and branding activities, and brand awareness is the key to success.

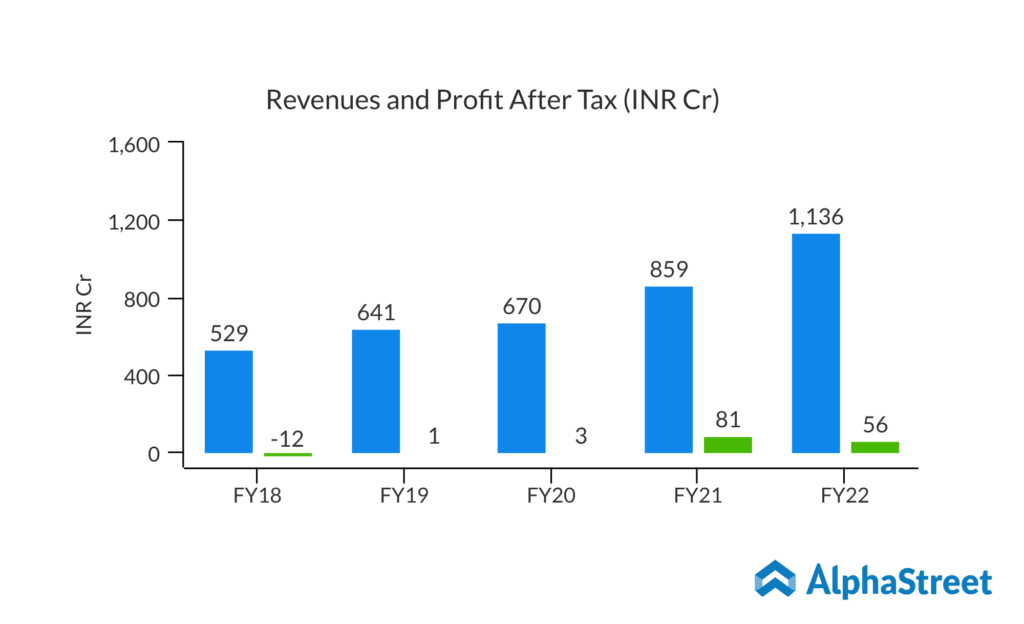

- Revenues recorded a five-year CAGR of 16.52% in FY22 riding on volume growth and a better product mix. The increasing trend continued in Q1 FY23 reflecting a 28.4% rise in revenue from operations. The continuation of such a trend depicts strong growth potential and rising market share.

- A consistent margin level reflects operational efficiency. Interestingly, gross margins have remained in the 30s over the last five years, with the trend continuing in the June quarter.

- Profits were impacted due to macroeconomic challenges leading to cost pressure in recent quarters. Nevertheless, Stove Kraft turned triumphant in recording profits consistently over the past four years, after posting losses in FY18. This depicts the company’s success in expanding into new markets and foraying into newer product categories, which is expected to continue on subsidizing global hues.

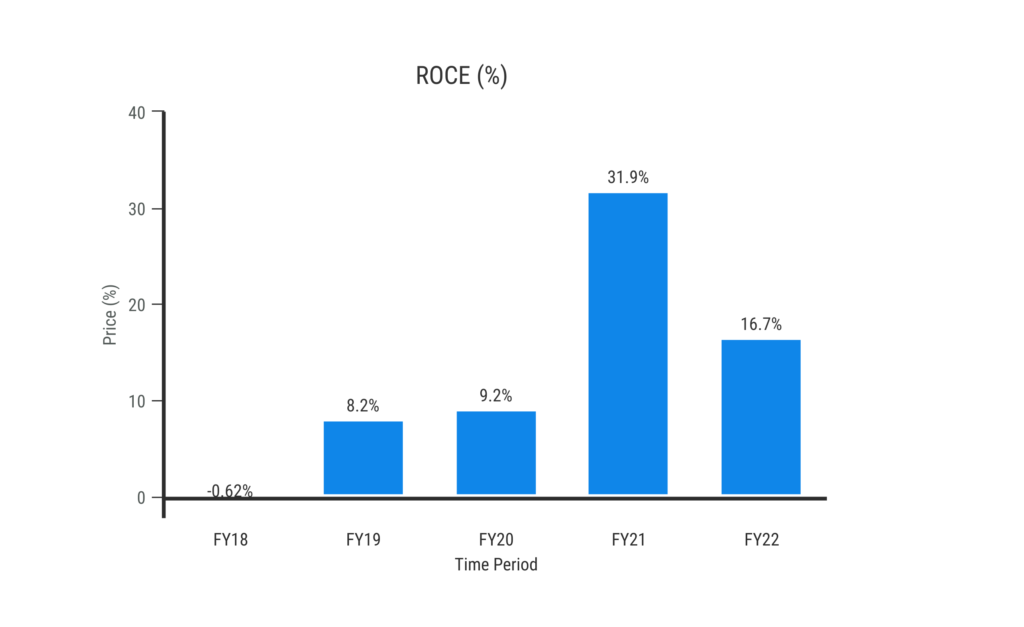

- Return on capital employed (ROCE) and operating cash flow were severely impacted in FY22 due to economic issues such as inflationary pressure, supply chain disruption, and geopolitical tensions. The continuation of such a trend remains a cause for concern.

- Rising costs due to supply chain issues and labor challenges remain a hindrance to profitability.

- Strong integration of the company’s supply chain and distribution network with its manufacturing facilities is an added advantage. It drives cost efficiencies, enhances customer outreach, and aids in faster delivery.

- Well-established brands ease competitive pressure.

Industry Analysis

Despite growing inflationary pressure and global supply-demand imbalances, rising income, growing urbanization, consumers’ changing behavioral patterns, and increasing usage of e-commerce are expected to be positive catalysts for the kitchen and home products market. Though the pandemic affected the market to some extent in 2020, it regained momentum due to the increased popularity of online sales and the rising need for cooking at home. The Indian household appliances market is worth $68.75 billion in 2022 and is expected to grow at 5.7% CAGR over 2022-2027.

Peer Comparison

In terms of market capitalization, Stove Kraft ranks after its peers. Nevertheless, the company provides strong returns than its peer companies. Additionally, from a valuation perspective, investors buying the dips can consider Stove Kraft an attractive investment based on its solid fundamentals and long-term growth prospects.