Summary

Welspun India Ltd (WIL) is a leading global home textile major with a positive growth outlook. This equity research delves into the company’s strengths, market positioning, and potential catalysts for future growth. WIL has witnessed a demand recovery in its primary market, the US, following de-stocking by retailers. Additionally, factors such as Pakistan’s financial woes, the China+1 strategy, and robust B2C strategies in India are expected to drive growth. WIL’s foray into flooring and advanced textiles is showing promise, and the company’s aim to be net debt-free by FY26 portends strong earnings growth.

Company Overview

Welspun India Ltd is a global leader in the home textile industry, exporting its products worldwide. The company’s commitment to quality, innovation, and sustainability has established it as a trusted brand in the sector.

Business Segments

WIL operates in various business segments:

–B2B Home Textiles: WIL exports home textile products, primarily to North America.

–B2B Flooring: The company has entered the flooring business, which is gaining traction both domestically and in the export market.

– Advanced Textiles: WIL focuses on high-performance textiles used in healthcare, transportation, and personal protection.

Market Analysis

North American Market

– WIL is a major player in the North American market, which is showing signs of recovery following de-stocking.

– The company’s exports to the US are expected to normalize, contributing to growth.

– Forecasted 21.5% CAGR growth in B2B textile revenues to INR 9,100 cr over FY23-26E.

European Market

– Political instability and economic challenges in Pakistan are making India a more favorable competitor in Europe.

– The potential India-UK FTA and China+1 strategy in Europe present growth opportunities.

– Higher sales in the UK market and the Disney deal open new geographies and age groups.

Domestic Market

– WIL is targeting the unorganized domestic towel and bed linen market in India, worth INR 50,000 crore.

– The company’s strong presence in 500+ cities and a growing retail outlet network position it as a leader in the domestic market.

– Post-GST, the organized segment is gaining market share.

Overseas Brand Acquisitions

– WIL’s acquisition of brands like Martha Stewart and Christy in the US and the UK has strengthened its global presence.

– Normalization of the supply chain is driving demand for these brands, contributing to overseas B2C initiatives.

Diversification into Advanced Textiles and Flooring

– Advanced textiles business is displaying promising growth trends with a revenue target of INR 1,000 crore by FY26 (42.3% CAGR).

– The flooring business is set to gain momentum due to anti-dumping duties on Chinese imports.

– WIL is reducing business cyclicality through diversification.

Financial Performance

Historical Performance (FY17-22)

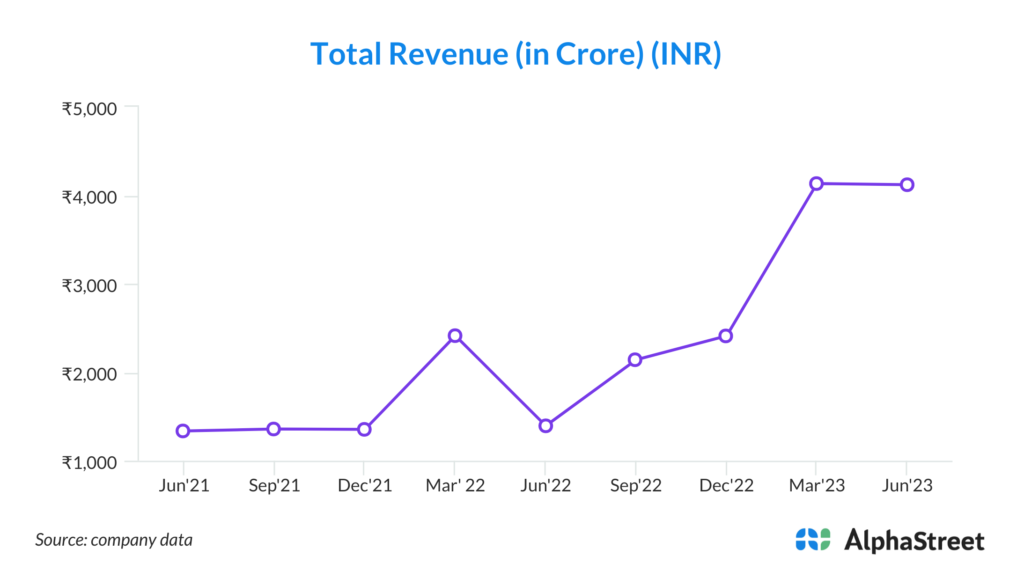

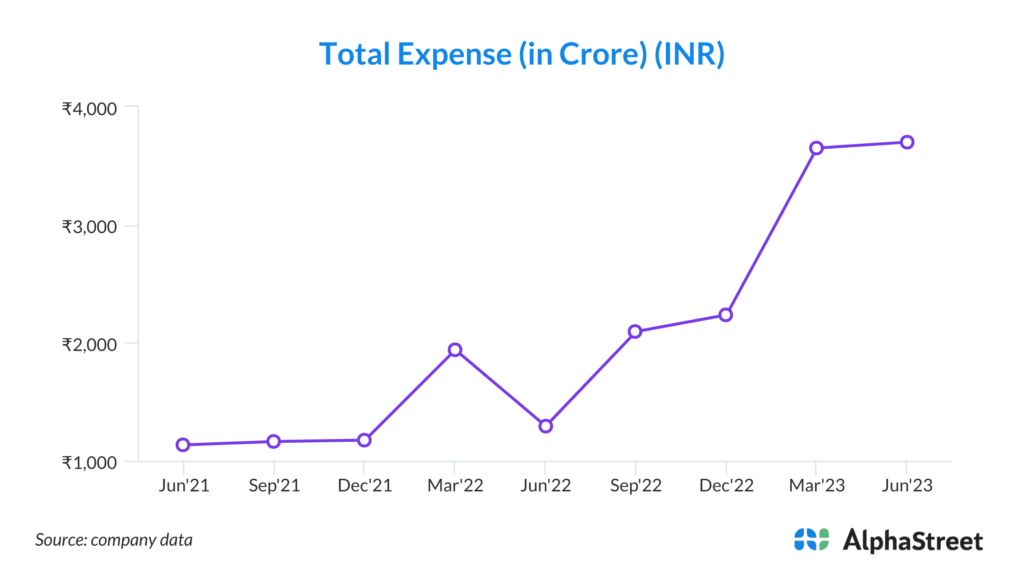

– Over FY17-20, WIL experienced stagnant revenue and declining profitability.

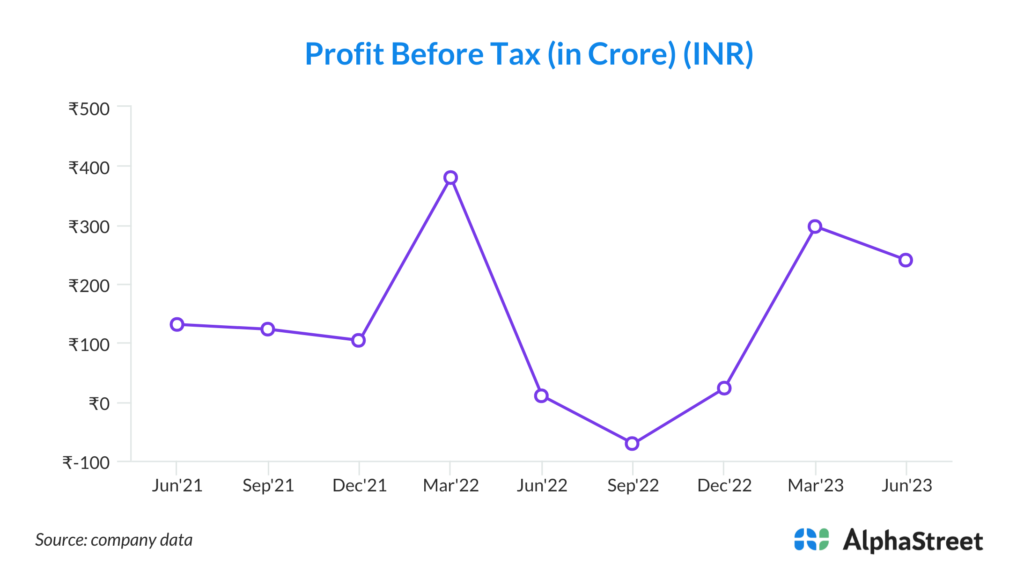

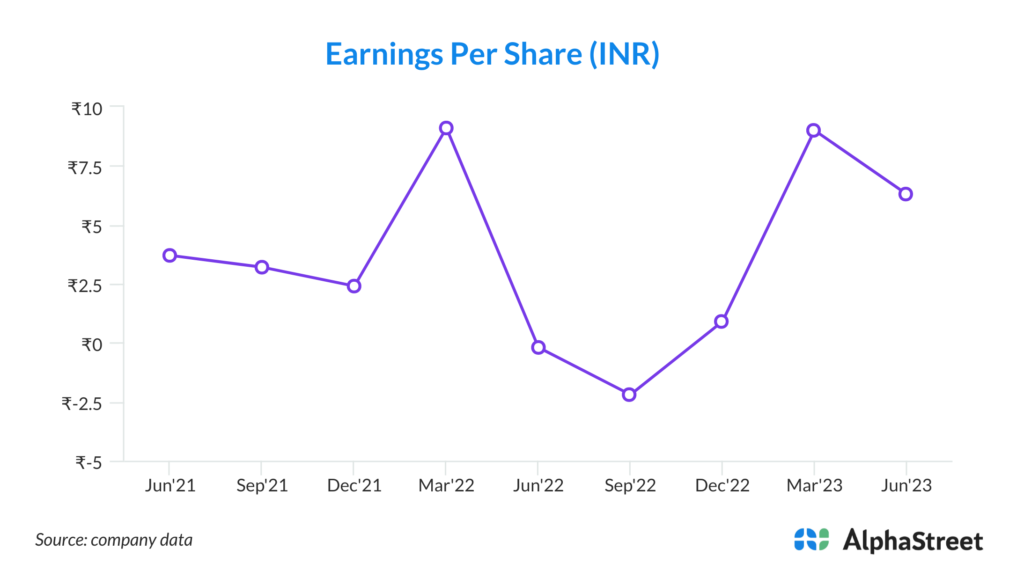

– EBITDA and adjusted net profit declined, impacting return ratios.

Recent Performance (FY23)

– A 14.1% YoY revenue decline in FY23, primarily due to de-stocking by global retail chains.

– Branded business sustained momentum with a YoY growth of 16.1%.

Future Projections (FY23-26)

– Revenue is expected to grow at a CAGR of 19.5% to INR 13,800 crore by FY26, driven by B2B, branded, and advanced textiles.

– EBITDA and net profit are projected to grow significantly, with improved margins.

– Aspirations to be net debt-free by FY26.

Investment Thesis

– Demand recovery in North America and Europe, strong growth prospects in the domestic market, overseas brand acquisitions, and diversification into advanced textiles and flooring are key growth drivers.

– Optimum utilization of capacities and debt reduction enhance future FCF.

– WIL’s focus on branding and e-commerce supports brand equity and retail growth.

Key strengths:

1. Global Market Presence: WIL is a leading player in the global home textile market, exporting its products to major markets such as North America and Europe. Its strong international presence and established relationships with global retailers contribute to its competitive advantage.

2. Diversified Product Portfolio: The company operates in multiple segments, including B2B home textiles, B2B flooring, and advanced textiles. This diversified product portfolio allows WIL to capture a wide range of market opportunities and adapt to changing consumer preferences.

3. Strong Brand Acquisitions: WIL has strategically acquired well-known brands like Martha Stewart and Christy, enhancing its brand equity in the developed markets. These brand acquisitions have contributed to overseas growth and increased market reach.

4. Robust Domestic Market Presence: WIL has a significant presence in the unorganized domestic towel and bed linen market in India. With an extensive retail network and a focus on brand building, the company is well-positioned to tap into the growing demand in the domestic market.

5. Focus on Innovation: WIL’s commitment to innovation and sustainability is evident in its product offerings. The company continuously develops high-performance products, particularly in the advanced textiles segment, catering to various applications such as healthcare and personal protection.

6. Deleveraging Strategy: The company has set ambitious goals to become net debt-free by FY26. This deleveraging strategy will not only reduce the interest burden but also enhance cash flows, allowing WIL to reinvest in its business and drive future growth.

Risks and challenges:

1. Global Economic Uncertainty: The company’s international operations make it vulnerable to global economic fluctuations. Economic downturns in major export markets, such as the US and Europe, can adversely impact demand for home textiles, affecting WIL’s revenue and profitability.

2. Commodity Price Volatility: WIL’s business is sensitive to fluctuations in raw material prices, especially cotton and polyester. Rapid price increases in these commodities can squeeze profit margins unless the company can pass on the increased costs to customers.

3. Competition and Market Saturation: The home textile industry is highly competitive, with numerous domestic and international players. Intense competition and market saturation can lead to pricing pressures and limit the company’s ability to maintain or expand its market share.

4. Supply Chain Disruptions: Disruptions in the supply chain, such as delays in the sourcing of raw materials or transportation bottlenecks, can impact production schedules and lead to missed sales opportunities. The COVID-19 pandemic highlighted the vulnerability of supply chains in the textile industry.

5. Exchange Rate Risk: WIL’s export-oriented business exposes it to currency exchange rate fluctuations. Adverse movements in exchange rates can impact the company’s revenues and profitability when translating foreign currency-denominated earnings into Indian Rupees.

6. Regulatory and Environmental Compliance: The textile industry is subject to various regulatory and environmental compliance requirements. Non-compliance with these regulations can result in fines, legal disputes, and damage to the company’s reputation, particularly in international markets with stricter environmental standards.