We are well poised to continue our healthy growth momentum in the 2nd half of the year, and we are confident of meeting our FY23 guidance of revenue growth of 12-15%, EBITDA growth of 15-18%, and reducing net debt by US$ 650 million.

–Jai Shroff, Chief Executive Officer

| Stock Data | |

| Ticker | UPL |

| Exchange | NSE & BSE |

| Industry | Pesticides & Agrochemicals |

| Price Performance | |

| Last 5 Days | 1.44% |

| YTD | 1.62% |

| Last 12 Months | -10.7% |

Business Basics

UPL Limited (NSE: UPL) is a global food systems leader with a presence in over 138 countries. The company has market access to 90% of the world’s food basket and is committed to bringing growth and progress to the entire agricultural value chain, including growers, distributors, suppliers, and innovation partners. For a variety of arable and specialty crops, UPL offers an integrated portfolio of patented and post-patent agricultural solutions. These include biological, crop protection, seed treatment, and post-harvest solutions, which cover the entire crop value chain.

Q2 Earnings

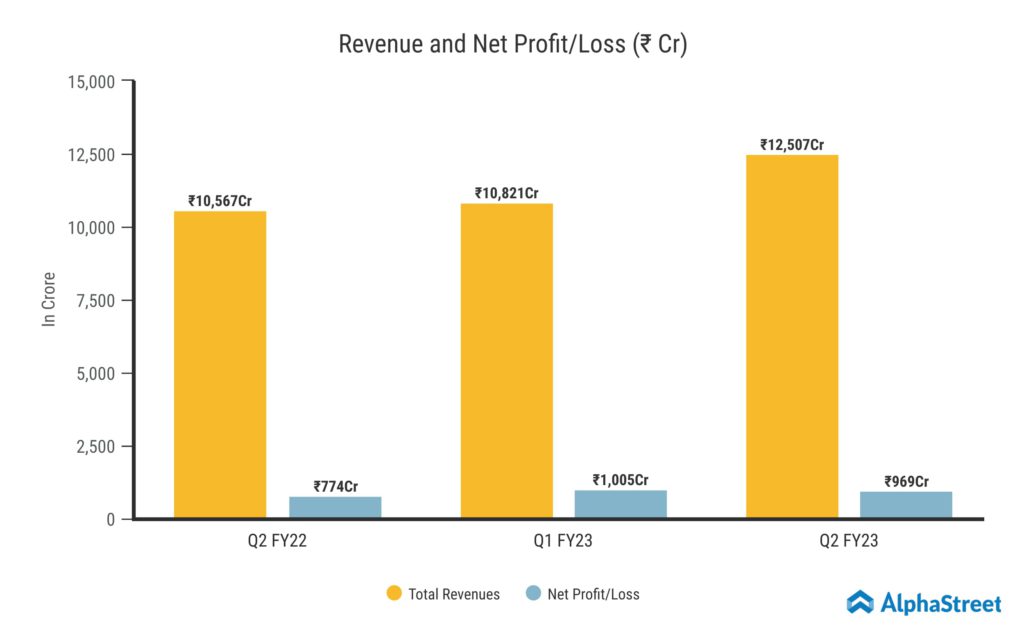

UPL Limited reported a Revenue from Operations of ₹12,507 Crores, a significant boost of 18.3% growth from the previous year. Despite the macroeconomic uncertainties and volatility, the company saw strong improvement from the previous year. The Consolidated Net Profit for the business increased by 25.1% year over year, to ₹969 Crore from ₹774 Crore. The Net Profit margin is at 7.7%, expanded by 40 basis points year on year. Earnings per Share is ₹10.83 for this quarter.

UPL’s Commitment For Debt Reduction

The company’s finance expenses increased by 80% to ₹644 crores, mostly as a result of the sharp rise in benchmark rates around the world. The interest costs, which is included in the interest expense, increased to ₹535 crores this quarter from ₹284 crores in Q2 of last year. As of March 2022, UPL had a net debt position of about $2.5 billion. Management has committed to reducing net debt by $500 million through cash generated from operations. Around $260 million will come from net cash generated by the company’s AgTech platform Advanta. At the end of the year, this would bring the total net debt down to $2 billion. By the end of the fiscal year, the net debt-to-EBITDA ratio should be below 1.4 times due to the anticipated reduction in net debt.

UPL’s Strong Performance in Latin America, North America & India

The growth in this quarter was driven by the important geographic areas of Latin America, North America, and India. Nearly 50% of the company’s Q2 revenue comes from Latin America, where it has significantly improved margins. Additionally, this area experienced a robust 20% growth driven by an expanded portfolio of herbicides and improved pricing. Brazil was the main area of growth, driven by strong price realisations and a strong demand for post-emergent herbicides. The new fungicide product from UPL, Evolution, provided additional support for this. The business experienced good growth in Argentina and the Andean nations this past quarter, which helped the region as a whole.

Despite dry weather in the Western United States, which had an impact on specialty crops and the rice market, revenue in North America increased by a healthy 24% on the quarter. Strong grower demand, channel support, price realisation in our herbicide segment, and other factors all contributed to this improvement.

India’s growth of 22% was fuelled by herbicides, particularly glufosinate-based products, new insecticide launches in cotton and paddy crops, and more affordable key products. The management anticipates favourable pricing of important crops like rice and wheat in this region, which will be supportive.

The management commented, “We are confident of our strong growth in the second half, driven by newly improved Flupyrimin in rice and a new three-way mixture herbicide for sugarcane along with NPP Biosolutions and seed treatment products in key rabi crops of wheat, potato, and cumin.”