Stock Data:

| Ticker | NSE: MCDOWELL-N |

| Exchange | NSE |

| Industry | BREWERIES & DISTILLERIES |

Price Performance:

| Last 5 Days | +0.97% |

| YTD | +5.06% |

| Last 12 Months | +18.62% |

Company Description:

United Spirits Ltd is an Indian alcoholic beverages company. With a diverse portfolio of brands, it holds a dominant position in the Indian liquor market. The company is a subsidiary of British multinational Diageo Plc. United Spirits operates through various segments, including popular spirits, prestige and above, and the scotch whisky segment.

It offers a wide range of alcoholic beverages, including whisky, rum, vodka, gin, and more. The company has a strong distribution network, extensive manufacturing facilities, and a focus on innovation and brand building. Despite facing regulatory challenges and changing consumer preferences, United Spirits continues to be a key player in the Indian alcohol industry.

Strengths:

1. Portfolio Reshaping and Consumer Trends: United Spirits has strategically reshaped its portfolio to align with transformative consumer trends, focusing on breakout growth in the prestige and above segment. Their brands like Signature, Antiquity, and Royal Challenge American Pride have gained market share and delivered exceptional performance across key consumer metrics.

2. Brand Innovation and Expansion: The company has demonstrated brand innovation with offerings like Signature Rare and reimagined Antiquity Blue, expanding their variant footprint. They have successfully launched Johnnie Walker Blonde, positioned to recruit next-generation non-scotch consumers. Black & White and Black Dog have shown significant growth and improved brand metrics.

3. Sustainability Initiatives: United Spirits is committed to sustainability, associating its brands with eco-friendly festivals and implementing initiatives like the Signature Green Vibes Festival. They have reduced greenhouse gas emissions and achieved zero fossil fuel use across their distilleries, showcasing their commitment to reducing their carbon footprint.

4. Technological Advancements: The company utilizes technology across various aspects of its operations, including sales force automation, blockchain-based track and trace, artificial intelligence for image recognition, and predictive analysis. Their digital platforms like bar.com and the Diageo Bar Academy enhance market presence, reach, and bartender education.

5. Inclusion and Diversity: United Spirits promotes inclusion and diversity, with 50% of its India Executive Committee being women and 35% female employee representation. They have increased female hiring and strive to create a more inclusive work environment.

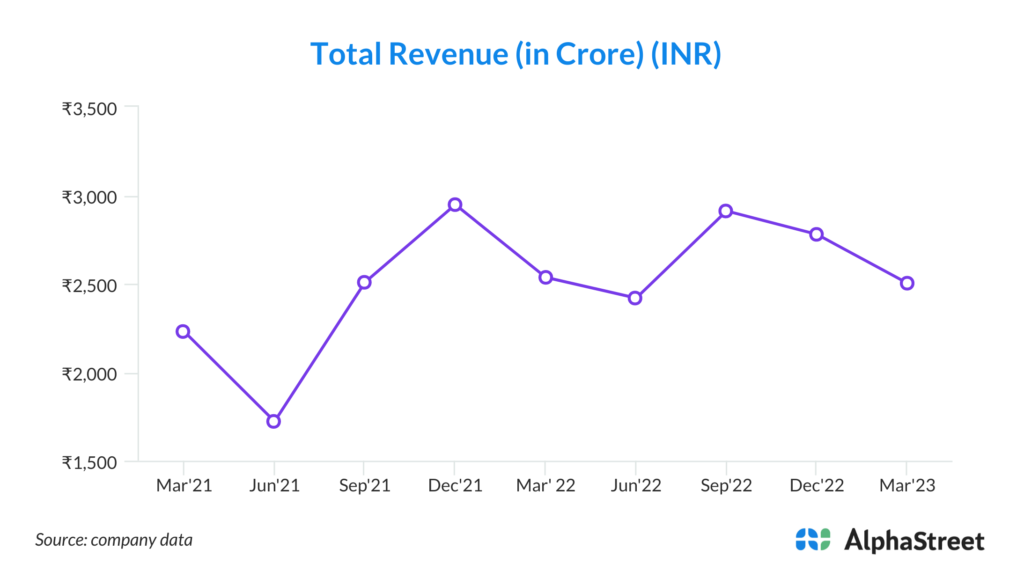

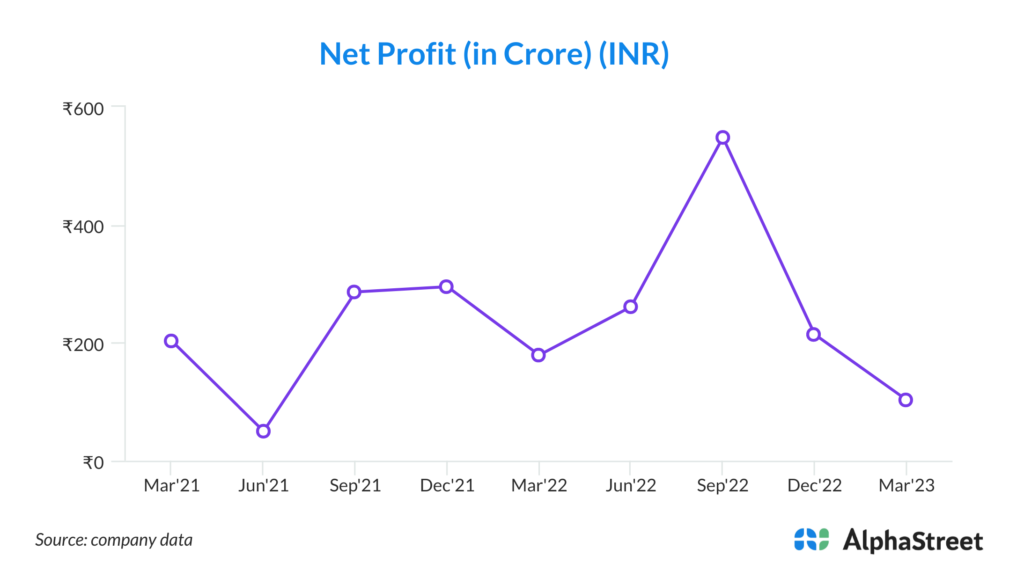

6. Resilient Margins and Financial Performance: Despite an inflationary environment, United Spirits has improved its performance through effective pricing, productivity, and mix management. They have made significant progress in reshaping their portfolio, closing transactions, launching supply chain programs, and reducing accumulated losses, positioning themselves to resume dividend distribution in the near future.

7. Strong Market Presence and Distribution Network: United Spirits has established a robust market presence in the Indian liquor industry. With a wide range of brands and a diverse portfolio, they have a strong distribution network that allows their products to reach a vast consumer base across the country. This extensive reach gives them a competitive advantage and enhances their ability to cater to different market segments effectively.

8. Focus on Corporate Social Responsibility (CSR): United Spirits demonstrates a commitment to corporate social responsibility. They have initiatives like the Godawan project, which involves building a water farm to generate water from the air, making them the first beverage alcohol brand to use SOURCE water. By prioritizing sustainability, reducing greenhouse gas emissions, and engaging in socially responsible practices, United Spirits contributes to environmental preservation and community welfare.

Key challenges:

1. Impact of Consumer Inflation: The Popular and lower Prestige segments are facing pressure due to consumer inflation, which can impact the purchasing power of the lower socioeconomic class consumers. This may lead to a decline in demand for certain products within these segments

2. Volatility in Market Conditions: The company expects continued volatility in the market, which can create challenges in terms of adapting to changing consumer preferences and market dynamics. This volatility may require United Spirits to seek alternative growth opportunities and adjust their strategies accordingly.

3. Route-to-Market Changes: United Spirits has experienced a significant number of route-to-market changes, which can disrupt business operations and require adjustments to distribution channels. Adapting to these changes and identifying new growth avenues may pose challenges for the company.

4. Increased Advertising and Promotion Costs: While advertising and promotion (A&P) investments are critical for sustaining profitable growth and building iconic brands, increased A&P expenses can impact the net sales value (NSV) realization per cases. Managing the balance between A&P spending and maintaining profitability is crucial.

5. Capital Deployment and Cash Surplus: The company acknowledges the presence of surplus cash on its balance sheet, which poses the challenge of effectively deploying this capital. Ensuring optimal utilization of funds and generating satisfactory returns on capital employed is important for maximizing shareholder value.

6. Competitive Pricing Environment: In the alcoholic beverages industry, headline pricing often trails inflation. While United Spirits feels confident in its strategy, intense competition and pricing pressures within the market could impact the company’s profitability and market position.

7. Market Performance of Lower Segments: The underperformance of the Popular and lower Prestige segments due to inflationary pressures raises concerns about sustaining growth and profitability within these segments. United Spirits needs to closely monitor and manage these segments to mitigate any negative impact on overall financial performance.