“The Company’s long-term vision is well supported by a growing workforce with a focus on upskilling and reskilling, higher international presence to increase proximity to customers and continued investments in customer-centric innovation through research & development initiatives.”

– Mr Dhruv Sawhney, Managing Director, Concall- Q3FY22

Stock Data:

| Ticker | TRITURBINE |

| Exchange | BSE and NSE |

| Industry | Capital goods – Electrical Equipment |

Price Performance:

| Last 5 days | -1.15% |

| YTD | 36.25% |

| Last 1 year | 70.13% |

Company Description:

Triveni Turbine Ltd is primarily engaged in the business of manufacturing and supply of power generating equipment and solutions. It was a division of Triveni Engineering & Industries Ltd since the 1970s and was demerged from Oct 2010 into a separate entity.

Product Portfolio:

The company’s product portfolio includes a wide range of turbines of different types ranging from 1-100 MW in capacities. It manufactures turbines for various industries such as sugar, cement, chemicals, textiles, palm oil, paper, steel, biomass power, distillery, waste-to-energy, carbon black, oil & gas, food, district heating and defense. Presently, the company owns and operates 2 manufacturing facilities in Bengaluru, Karnataka.

Aftermarket Business

The company’s aftermarket business provides timely service and spares support. It provides services not only for the Triveni branded turbines but also from other OEMs.

Market Position

The company is the market leader in steam turbines upto 30 MW in India and also the largest manufacturer of industrial steam turbines globally in 5-30 MW range. It has ~60% market share in the domestic steam turbines industry.

Past Track-Record:

Over the company’s existence, It has installed ~5,000 steam turbines globally in 70+ countries across 20+ industries with a cumulative capacity of 13 GW+.

IP Rights:

Over the last decade, the company has filed for protection of Intellectual property rights over 130 pioneering products/ solutions developed in-house. These include 60 patents filings and 180+ industrial design registrations. As per FY22, it has been awarded ~316 IP rights across various jurisdictions including India, European Union and USA.

GE Triveni Ltd:

It is a Joint-venture with affiliates of General Electric which is engaged in design, supply and service of advanced technology steam turbine generator sets, with generating capacity of 30.1-100 MW.

Petition and Arbitration Outcome:

In June 2019, the company had filed a petition before NCLT seeking specific reliefs to bring an end to matters of oppression and mismanagement in the Joint Venture company viz. GE Triveni Ltd By General Electric Co. (GE) and its affiliates.

In September 2021, the company and affiliates of GE had executed a settlement agreement wherein Triveni Turbines acquired whole stake in the Joint Venture for ~80 crores and it was paid a consideration of ~210 crores as a settlement consideration by the affiliates of GE

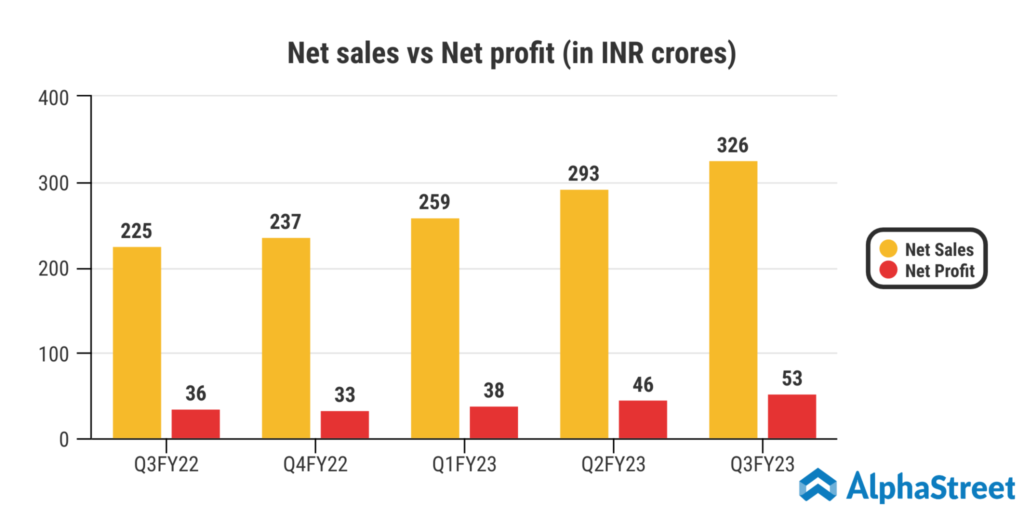

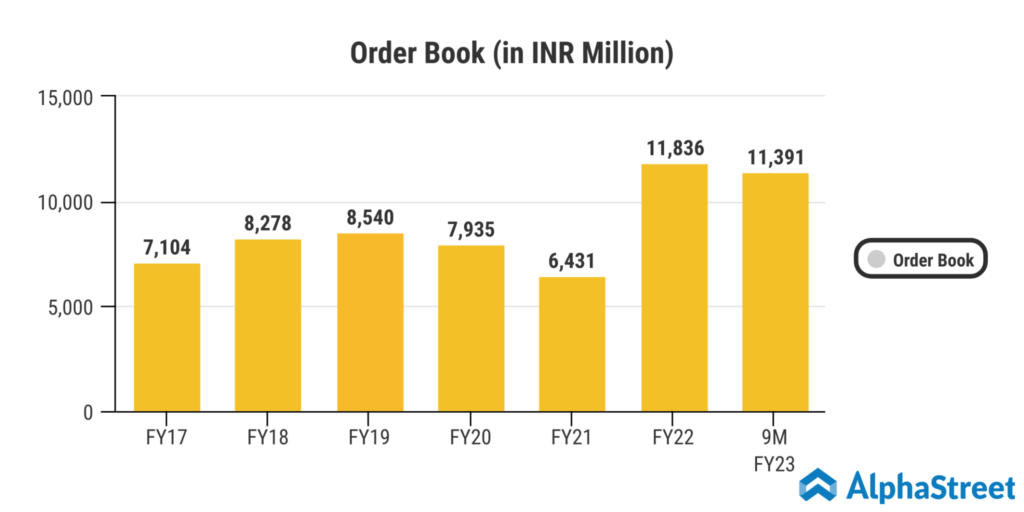

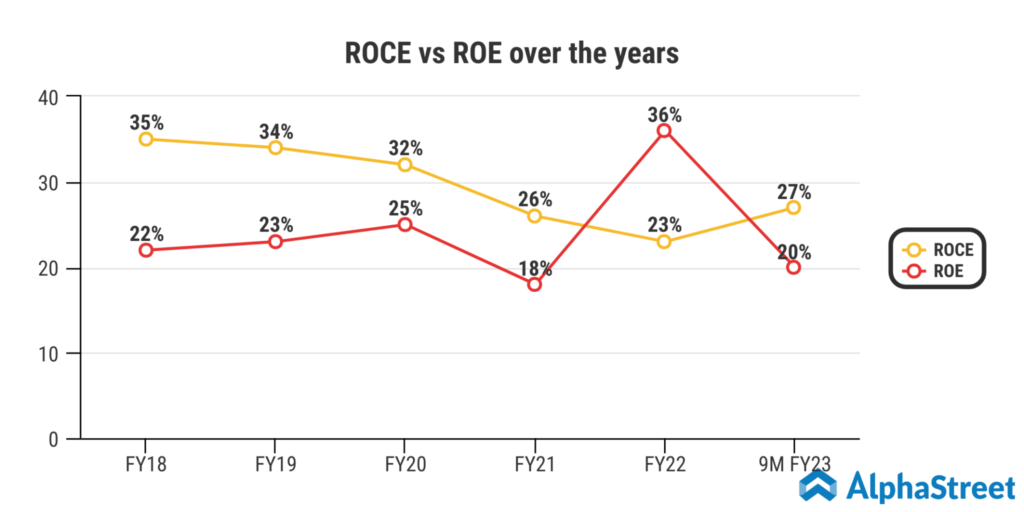

Financials:

What we like:

- Strong order book and healthy order pipeline:

In 9MFY23, the order book grew by 33.3% YoY to INR 1,232 Cr (which is 1.1x TTM revenue), supported by 26% YoY increase in order inflow. During the quarter, order inflow increased by 31% YoY to INR 420 Cr, supported by the aftermarket orders with a growth of 130%YoY, while product order inflow increased by 13% YoY to INR 306 Cr. The share of the export order book remained healthy at 44% in 9MFY23. The increasing share of the export order book would aid margin improvement in the coming quarters. The company remains positive on order pipeline going forward, aided by robust enquiry pipeline, incremental opportunity with foray into 30-100MW market and API turbines. Exports enquiry pipeline has been strong from regions such as South East Asia, South Africa, Central America and Europe, driven by process cogeneration, Biomass based IPP plants and thermal renewable power.

- Robust execution in Q3FY23:

Q3FY23 top-line registered a robust growth of 44.7% to Rs 326 Cr, supported by a 123% YoY increase in export business, while domestic business increased by 14.4% YoY. The management expects execution to pick up pace and generate 35% top-line growth in FY23 & FY24. Gross margin in Q3FY23 improved by 385 bps YoY to 48.6%, aided by a favorable product mix. While the EBITDA margin declined by 64 bps YoY to 19%, impacted by higher other expenses (106% YoY) and employee costs (30% YoY). Other expenses include sub-contracting expenses of INR 25.Cr related to the maintenance of large utility turbines in SADC. We expect that higher execution of export orders and increased aftermarket sales will improve margins going forward.

- Strong demand to aid in the growth of the company:

Strong demand from both the domestic and export markets is likely to aid medium-term order inflow visibility. Reduced operational costs, self-sufficiency, decarbonization and focus on earning carbon credits across segments such as waste-to-energy, biomass, steel, etc. are some of the key factors driving the demand for steam turbines. Domestic demand remains healthy from sectors such as distilleries, steel, cement, pharma, pulp, paper, food processing, etc., leading to revenue growth, which was largely driven by recovery in the end-user market and strong export growth ( year-on-year by 59%).

Factors to consider:

- The promoters are taking 8-10% salary of profit, which is higher from the industry norm.

- Low investments into Triveni Turbine’s customer oriented services: This can lead to competitors gaining advantage in the near future. Triveni Turbine needs to increase investment into research and development especially in customer services oriented applications.

Industry Analysis and Conclusion:

The past few years have seen India’s energy needs go up exponentially on account of rapid economic growth as well as overall industrialization and urbanization. As of March 2022, India has a total installed power generation capacity of 395 GW – a growth of 4% over March 2021. Of this, 38% share, i.e. 152 GW, is renewable power generation capacity as of March 2022*.

As per the Central Electricity Authority (CEA) strategy blueprint, the country is aiming for an even more ambitious target of 57% of the total power generation capacity from renewable sources by March 2027. According to the 2027 blueprint, India is striving for 275 – 350 GW of electricity from renewable energy by FY 27. This, in turn, will boost the demand for thermal renewable energy in the country, and concurrently trigger greater opportunity for installation of steam turbines in the future.

In 2021, the Indian Steam Turbine market for <30 MW range grew 137% (in MW) over 2020. The demand for heat and power from the industrial segment was the key factor contributing to the rebound in the Steam Turbine market to the 2019 levels. The market was primarily driven by thermal renewable based power plants (including biomass, waste heat recovery and WtE), followed by fossil fuel fired power plants. Majority of the steam turbines’ requirement in 2021 came from power generation applications (using MSW, Biomass, Waste Heat and Fossil as the fuel) and from energy-intensive segments like Steel, Cement, besides segments like Sugar, Distillery, Food Processing, Pulp and Paper, Chemicals and Oil & Gas for Combined Heat and Power applications.

With the manufacturing sector on a growth trajectory, and industries like Sugar, Distillery, Steel, Cement, Pulp and Paper and Chemicals expected to increase production, the demand for steam turbines is expected to remain robust in the future.