Stock Data:

| Ticker | NSE: GMRINFRA |

| Exchange | NSE |

| Industry | INFRASTRUTURE |

Price Performance:

| Last 5 Days | +1.80 % |

| YTD | +45.64 % |

| Last 12 Months | +66.48 % |

Company Description:

GMR Group is a leading Indian conglomerate with diverse interests spanning infrastructure, aviation, energy, and urban development. With a legacy of over four decades, GMR has earned a reputation for excellence and innovation in transforming the infrastructure landscape of India and beyond. The group operates and manages world-class airports, power plants, highways, and urban infrastructure projects, contributing significantly to the country’s economic growth.

Critical Success Factors:

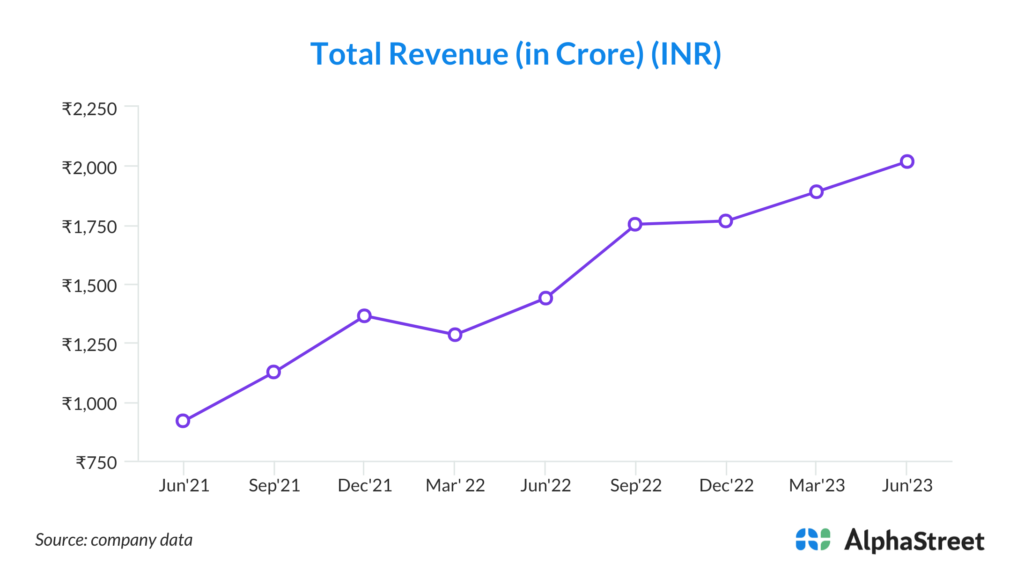

1. Strong Revenue Growth: GMR Airports Infrastructure Limited demonstrated impressive revenue growth in Q1 fiscal year 24, with gross revenue increasing by a substantial 40% year-on-year to INR 2,018 crores. This growth is a testament to the company’s ability to attract and serve a growing number of passengers and businesses, indicating a strong market presence.

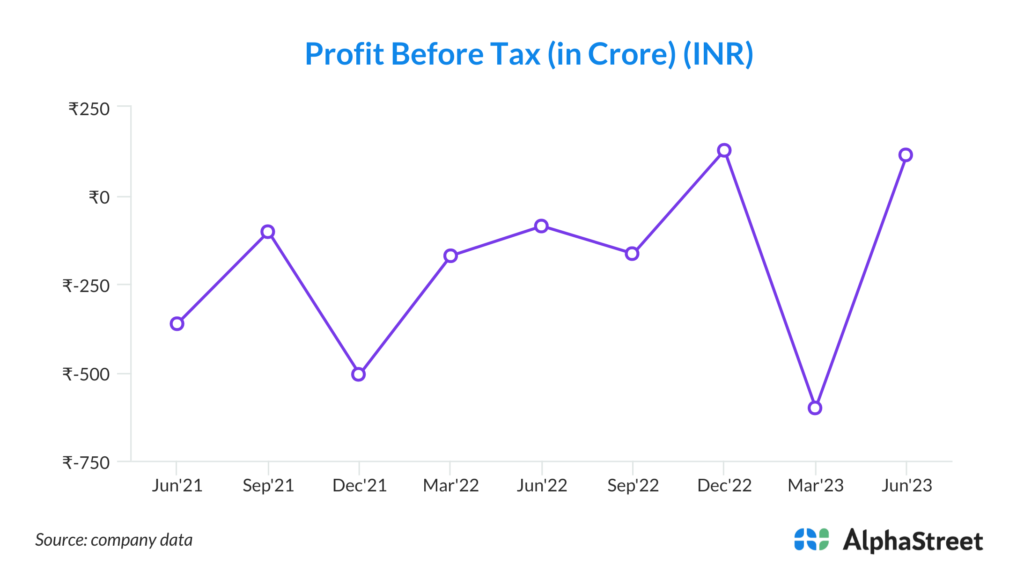

2. Profitability and Margin Expansion: Notably, the company also showcased a remarkable improvement in profitability. EBITDA increased by an impressive 77% to INR 753 crores in the same quarter. This substantial increase in EBITDA reflects the company’s operational efficiency, cost management, and its ability to capitalize on the growth opportunities in the aviation sector. Additionally, EBITDA margins expanded to 51%, up 10% year-on-year, which indicates that the business is generating higher profits from its operations.

3. Resilient Recovery Post-Pandemic: The earnings call highlights India’s resilient economic recovery post-pandemic. GMR’s strong performance is a reflection of this recovery, indicating that the company is well-positioned to benefit from the resurgence of economic activities.

4. Traffic Growth: GMR airports experienced significant growth in passenger traffic. Overall, total traffic increased by 26% year-on-year to 27 million passengers, surpassing pre-COVID levels. This demonstrates the company’s ability to attract travelers and suggests that its airports are well-connected and desirable hubs.

5. International Expansion: The company reported substantial growth in international traffic, with Delhi and Hyderabad airports experiencing a 35% and 33% increase, respectively. This expansion in international operations reflects GMR’s ability to tap into global markets and diversify its revenue streams.

6. Strategic Initiatives: GMR highlighted various strategic initiatives, including the merger of GMR Airports with GMR Airports Infrastructure Limited. Such strategic moves can enhance shareholder value and streamline operations, positioning the company for long-term success.

7. Infrastructure Development: GMR is actively involved in infrastructure development, with capacity expansion projects underway at Delhi, Hyderabad, and Crete airports. The progress achieved in these projects underscores the company’s commitment to enhancing its infrastructure and operational capabilities.

8. Sustainability Commitment: GMR’s commitment to sustainability is evident through its efforts to become a net-zero carbon emission airport by 2030. Initiatives like the inauguration of a fourth runway and Eastern Cross Taxiway at Delhi Airport reflect its dedication to reducing environmental impact while enhancing operational efficiency.

9. Diverse Revenue Streams: GMR’s involvement in various projects, including real estate development, hotel monetization, and the establishment of MRO facilities, diversifies its revenue streams and reduces dependency on a single sector, making it more resilient to economic fluctuations.

10. Operational Excellence: Delhi and Hyderabad airports maintained an ASQ (Airport Service Quality) score of 5 during the quarter, indicating a high level of customer satisfaction and operational excellence.

Key Challenges:

1. Economic Dependence: GMR’s performance is intricately linked to the overall economic health and growth of India. While there have been signs of a resilient recovery post-pandemic, the company’s financial results are subject to the economic trajectory. Any unexpected economic downturn or recession could lead to reduced passenger traffic and aviation-related activities, which, in turn, could impact GMR’s revenue and profitability.

2. Regulatory Uncertainty: The earnings call mentioned that GMR has navigated various regulatory changes and challenges. The aviation industry is highly regulated, and changes in regulations can have a significant impact on operations, pricing, and profitability. Any adverse regulatory developments, such as changes in tariffs or airport fees, could affect GMR’s financial performance.

3. Operational Risks: Operating airports involves complex logistics, security concerns, and potential disruptions. Natural disasters, security threats, labor strikes, or technical issues can disrupt airport operations. These operational risks could lead to financial losses and damage the company’s reputation.

4. Debt and Financial Leverage: GMR’s expansion and infrastructure development projects often require substantial capital investment, leading to increased debt levels. High levels of debt can pose financial risks, especially if the company struggles to meet its debt obligations or if interest rates rise significantly.

5. Competition and Market Saturation: The aviation industry in India is competitive, with several players vying for passengers and contracts. Increased competition could affect pricing power and profit margins. Additionally, if the market becomes saturated or experiences overcapacity, it may lead to challenges in maintaining growth rates.

6. Project Execution Risks: GMR has embarked on infrastructure expansion projects at various airports. Delays or cost overruns in these projects could strain financial resources and potentially impact the company’s ability to meet its commitments.

7. Environmental and Sustainability Challenges: While GMR has committed to sustainability initiatives, achieving net-zero carbon emissions by 2030 is a challenging goal. Meeting environmental targets may require significant investments and could be subject to regulatory scrutiny.

8. Global Economic Factors: GMR’s international operations expose it to global economic factors. Economic downturns or geopolitical events in other countries can affect international travel demand and the profitability of its overseas operations.

9. Exchange Rate Fluctuations: GMR’s international operations are subject to exchange rate fluctuations. Currency devaluation or adverse movements in exchange rates could impact the company’s financial results.