Financial Results:

Axis Bank Ltd‘s Net Interest Income for Q2 FY23 has increased by 31% YoY to ₹ 10,360 crores. Net Profit rose by 70% YoY to ₹ 5,330 crores. Operating Profit grew by 30% YoY for Q2 FY 2023. Return on Assets grew to 1.9%.

| ₹ Cr. | Q2FY23 | Q2FY22 | YoY% |

| Interest Income | 20,239 | 16,336 | 24% |

| Total Income | 24,180 | 20,134 | 20% |

| Interest Expended | 9,879 | 8,436 | 17% |

| Net Interest Income | 10,360 | 7,900 | 31% |

| Operating Revenue | 14,301 | 11,699 | 22% |

| Operating Profit | 7,716 | 5,928 | 30% |

| Provisions Other than Taxes | 550 | 1,735 | (68%) |

| Net Profit | 5,330 | 3,133 | 70% |

While going through the bank’s investor presentation, it becomes evident that part of the increase in profitability stems from the reduction of Provisions & Contingencies amount. That would explain as to why the YoY growth for Operating Profit is 30% whereas the YoY growth for Profit is 70%. So, it might be the case that the organic growth in profitability is better reflected by the operating profit.

Asset Quality:

The drastic increase in YoY growth in Net Profit comes indirectly from the improvement in Asset Quality that led to the reduction in Loan Loss provisions and other such provisions. There is a trend of reduction in Provisions from the highs of Fiscal Year 2022.

The improvement in Asset Quality can also be assessed by the reduction in the non performing assets in the bank’s loan book.

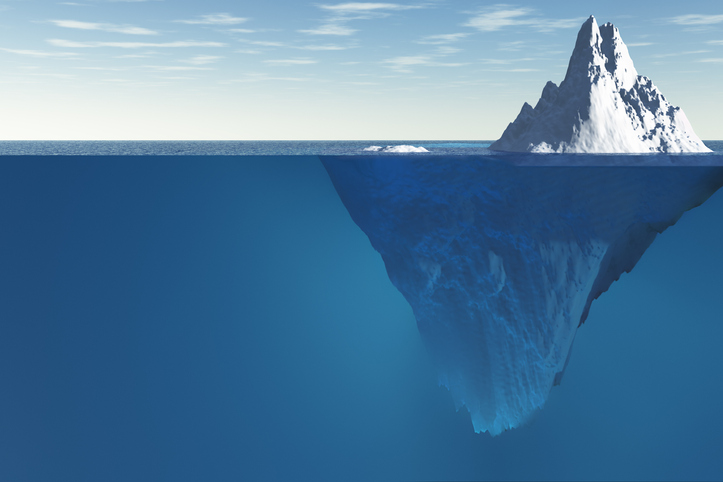

As can be observed from the diagram above, the amount of Gross Non Performing Assets (GNPA) as well as Net Non Performing Assets (NNPA) have been consistently falling over the quarters.

The reduction in the bank’s provisions stems from the improvement in asset quality rather than any other incentive. This could be proved by the fact that the bank’s Provision Coverage Ratio has been improving.

Since the PCR is increasing every quarter, it proves the fact that there is an improvement in the bank’s asset quality. As PCR indicates the percentage of funds that the bank sets aside for losses, its improvement states the fact that the bank is even more prepared to cover its estimated loan losses during the course of its operations.