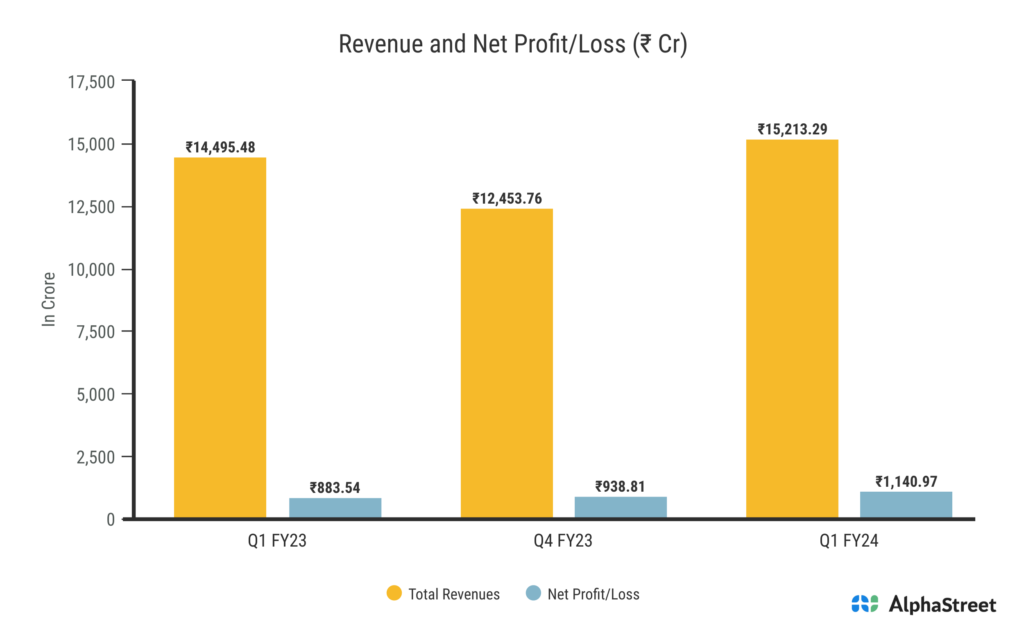

Tata Power Company Limited, a major player in India’s power sector, recorded a 4.95% increase in Q1FY24 revenues compared to the previous year, reaching ₹15,213.29 Crores. The consolidated net profit also surged by 29.07% to ₹1,140.97 Crores. The company’s commitment to sustainable energy generation and diversified portfolio, spanning conventional and renewable sources, contributed to its stable performance. Despite challenges in the coal business, investments in renewable energy, transmission, and distribution, along with a thriving electric vehicle charging infrastructure, are driving growth. Globally, falling coal and solar material prices are reshaping the power sector landscape, with expectations of more competitive solar prices in the future.

Stock Data

| Ticker | TATAPOWER |

| Industry | Power |

| Exchange | NSE |

Share Price

| Last 5 Days | -3.6% |

| Last 1 Month | 4.7% |

| Last 6 Months | 28.5% |

Business Basics

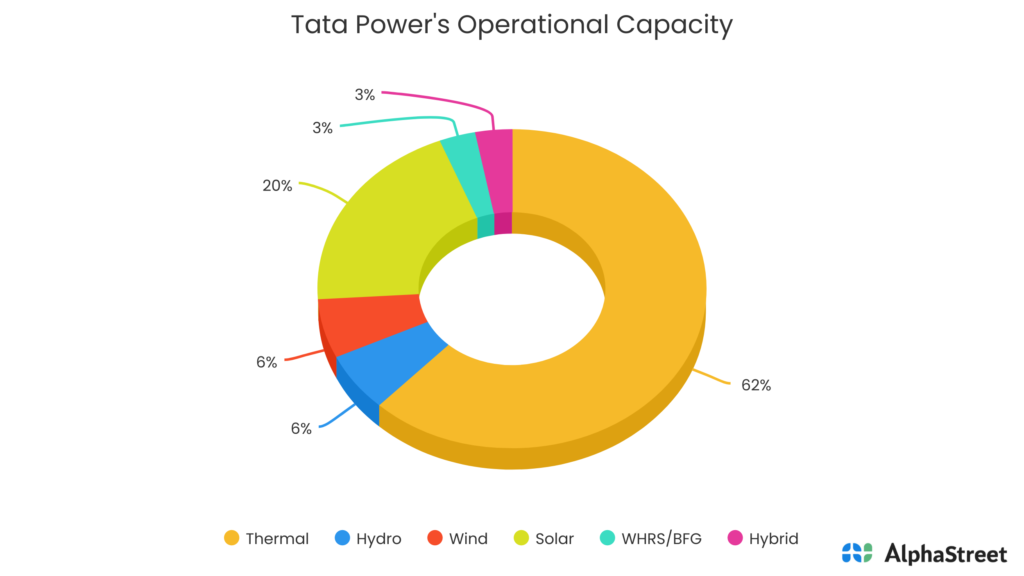

Tata Power Company Limited, a prominent player in India’s power sector, operates with a commitment to sustainable energy generation, innovation, and responsible growth. The company’s business fundamentals are grounded in its diversified portfolio of power generation assets, spanning conventional and renewable energy sources. Tata Power’s core business revolves around power generation and distribution. The company has a significant presence in conventional energy sources, including coal, gas, and hydroelectric power plants, which contribute to the stability of India’s power grid. Simultaneously, Tata Power is a frontrunner in the renewable energy sector, with a substantial portfolio of wind, solar, and geothermal power projects. This dual approach aligns with the global shift towards cleaner and more sustainable energy solutions.

Q1 FY24 Financial Performance

Tata Power Company reported Revenues for Q1FY24 of ₹15,213.29 Crores up from ₹14,495.48 Crore year on year, a rise of 4.95%. The consolidated Net Profit of ₹1,140.97 Crores up 29.07% from ₹883.54 Crores in the same quarter of the previous year. The Earnings per Share is ₹3.04, up 22.09% from ₹2.49 in the same quarter of the previous year.

Tata Power’s Business Update

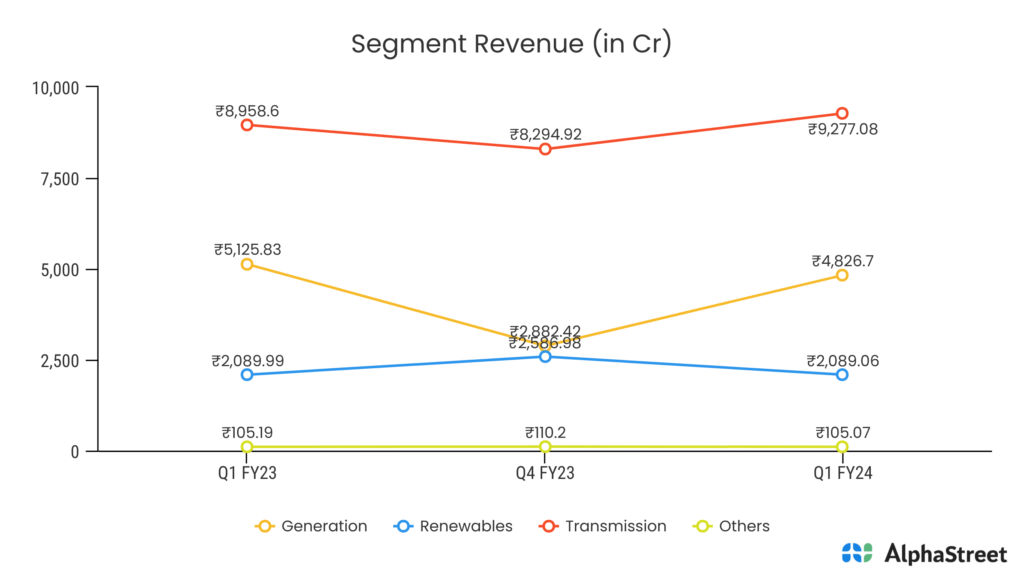

In our Generation business, we’ve maintained a stable performance despite a decrease in profits compared to the previous year due to falling prices. However, this dip in coal business profits has been more than offset by our strong presence in the Generation business, including the Mundra plant, as well as our investments in renewable energy and Transmission & Distribution (T&D) ventures. These sectors are becoming increasingly robust, and we anticipate this positive trend to continue in the coming quarters, laying the foundation for future improvements.

In our Transmission and Distribution segment, our operations in Odisha have largely stabilized, even after facing significant challenges during the past three months, which required extensive restoration and field activities due to adverse weather conditions. We foresee improved performance in the upcoming quarters from our Odisha business. Additionally, our Electric Vehicle (EV) business has been consistently thriving nationwide. We’ve installed approximately 4,400 public charging stations, 50,000 home charging points, and a substantial number of bus charging stations. In fact, we’re among the leaders in deploying bus charging infrastructure, with nearly 1,200 stations in various cities across the country.

Global and Domestic Power Sector Overview

To provide some context on the current state of the power sector, both globally and in our country, let’s delve into recent developments. During the first quarter of this year (April to June), the power sector faced unprecedented weather conditions. These months were characterized by heavy rains, and we also had to contend with a cyclone in Western India that impacted Gujarat. Additionally, extreme weather conditions in Odisha led to frequent occurrences of Kalbaisakhi, a type of lower-level cyclone, exacerbated by intense heat. As a result of these factors, power consumption in the last quarter only experienced a modest increase of 1.5%. This growth was lower than expected, especially considering the high temperatures observed in February, which had led us to anticipate more significant consumption growth.

On the global front, we’ve witnessed a notable reduction in coal prices, resulting in a substantial increase in the availability of imported coal at much lower prices compared to the previous year. Furthermore, the prices of solar materials, including solar cells, modules, and wafers, have seen a significant decline. We expect that as China and several Southeast Asian countries continue to expand their capacity in this sector, there will be an oversupply situation, leading to more restrained prices for solar cells and modules in the future.

To read more about Tata Power’s Financials: