Stock Data:

| Ticker | NSE: RAYMOND |

| Exchange | NSE |

| Industry | TEXTILE |

Price Performance:

| Last 5 Days | -1.58 % |

| YTD | +19.23 % |

| Last 12 Months | +59.62 % |

Company Description:

Raymond Ltd. is a renowned Indian conglomerate with a rich legacy in textiles, apparel, and lifestyle products. Established in 1925, the company has evolved into a diversified entity, operating in segments including branded textiles, apparel, high-value cotton shirting, garmenting, and real estate. Raymond is celebrated for its high-quality fabrics, suiting, and branded apparel under iconic labels like Color Plus, Park Avenue, and Raymond Ready To Wear.

Critical Success Factors:

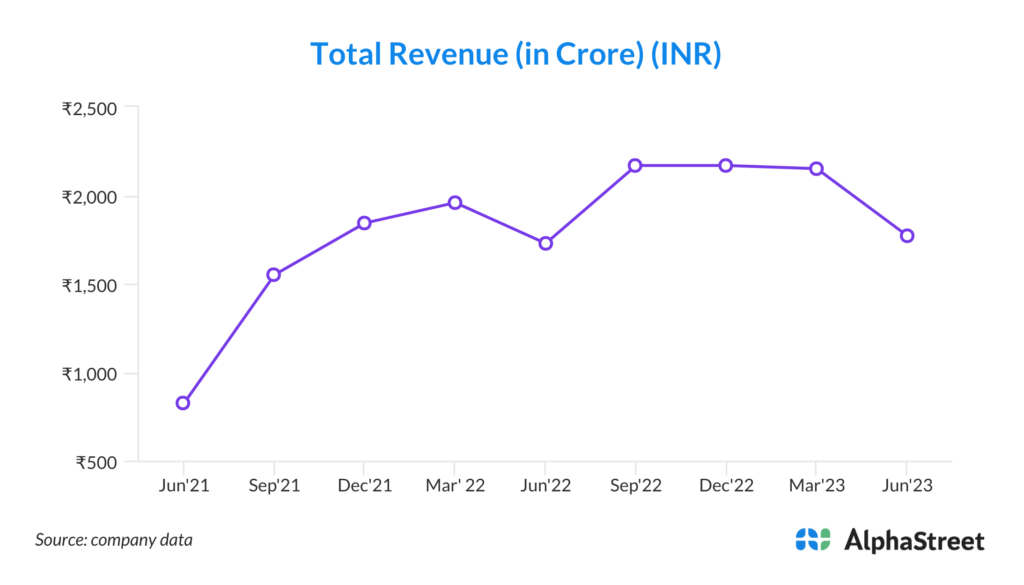

1. Consistent Performance in Seasonally Weak Quarter: Raymond’s ability to maintain a strong performance in a seasonally weak quarter is a testament to its effective business strategies and adaptability. Despite low consumer demand and subdued sentiment, the company not only sustained its operations but also achieved record-breaking revenue of ₹1,826 crores. This indicates its resilience in challenging market conditions.

2. Diversified Revenue Streams: Raymond operates in a variety of business segments, including branded textiles, branded apparel, high-value cotton shirting, garmenting, and engineering. The company’s diversified revenue streams mitigate risks associated with dependency on a single market or product category. It allows Raymond to tap into various market segments and maintain growth even when specific sectors face challenges.

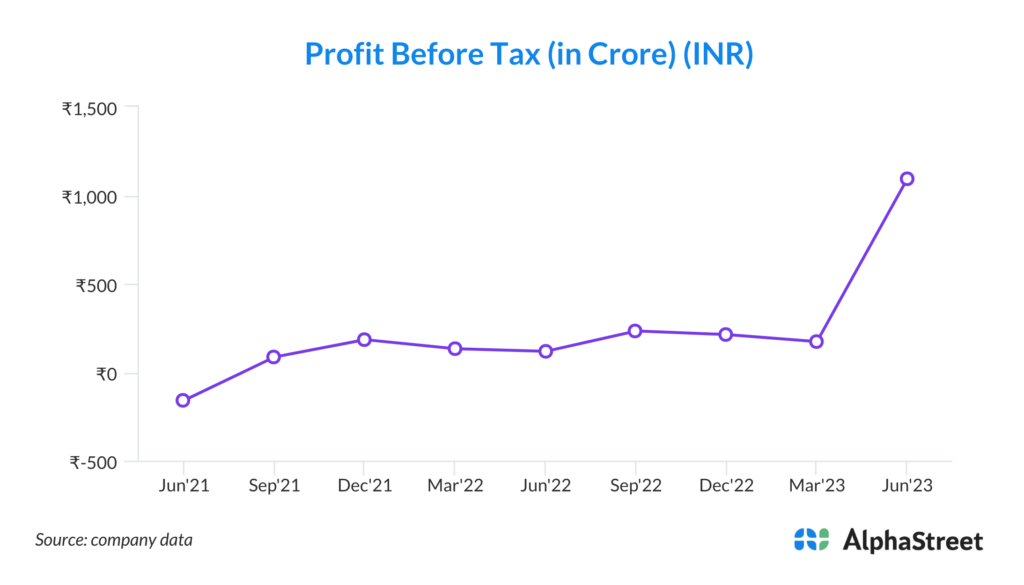

3. Healthy EBITDA Margins: Raymond reported an EBITDA of ₹252 crores with a robust EBITDA margin of 13.8%. This signifies efficient cost management and operational excellence within the company. Maintaining healthy margins in a competitive market is essential for long-term sustainability.

4. Employee Engagement: The decision to grant stock options to eligible employees under the Raymond Employee Stock Option Plan 2023 demonstrates the company’s commitment to employee engagement and retention. Engaged employees often contribute more effectively to the company’s success.

5. Strategic Divestment: Raymond’s successful sale of its FMCG business for ₹2,825 crores with a net realization of ₹2,200 crores is a strategic move to streamline its focus on core businesses. By eliminating debt and generating surplus cash, the company is better positioned for future investments and growth opportunities.

6. Retail Network Expansion: Raymond’s expansion of its retail network by opening 37 new stores during the quarter is indicative of its commitment to reaching a broader customer base. The focus on different market segments and geographic locations reflects a comprehensive growth strategy.

7. Robust Growth in Garment Segment: The garment segment’s impressive 7% growth, driven by demand from both existing and new global customers, underscores Raymond’s ability to attract and retain clients in a competitive market. This segment’s performance is a testament to the company’s competitiveness and product quality.

8. Real Estate Success: Raymond’s strong booking momentum in its real estate projects, despite challenges in the sector, highlights its ability to deliver attractive properties that resonate with customers. The success of brands like Tex X and Address by GS in the real estate market adds another dimension to the company’s overall growth potential.

9. Strong Liquidity Position: The company’s surplus cash position of over ₹1,500 crores, following the FMCG business divestment, strengthens its financial stability. This liquidity provides Raymond with ample resources for future growth, strategic investments, and debt reduction.

10. Working Capital Management: Raymond’s commitment to efficient working capital management is evident through strong cash collections and reduced receivables. This financial discipline ensures that the company can navigate through periods of increased working capital requirements, such as during the festive season.

11. Capacity Expansion: The ongoing capacity expansion projects in garmenting and engineering businesses indicate Raymond’s readiness to meet growing demand. It positions the company to take advantage of emerging opportunities in these sectors.

12. Adaptability to Market Conditions: Raymond’s ability to adapt to changing market conditions, such as price fluctuations in raw materials, demonstrates its proactive approach to mitigating risks and optimizing its operations.

Key Challenges:

1. Seasonal Weakness and Market Sentiment: Raymond Ltd. operates in a market where demand is highly seasonal and influenced by market sentiment. The company’s reliance on strong performance during seasonally weak quarters, as well as its susceptibility to changes in consumer sentiment, poses a significant risk. Extended periods of economic downturn or reduced consumer confidence can lead to decreased sales and profitability.

2. Weather-Dependent Factors: Raymond’s performance is also influenced by weather conditions, including heatwaves and heavy rains. These factors can disrupt consumer patterns, particularly in retail outlets, and lead to lower foot traffic. Raymond’s sensitivity to weather patterns makes it vulnerable to unexpected climate events that can impact sales and operations.

3. Competition and Discounting: The retail landscape, especially in the branded apparel segment, is highly competitive. The impact of competition and aggressive discounting by large e-commerce players can erode Raymond’s store sales and profit margins. Sustained price wars can undermine the company’s profitability and market position.

4. Dependence on Real Estate: The real estate segment is a significant part of Raymond’s business portfolio. However, it is susceptible to various risks, including changes in regulations, market sentiment, construction delays, and competition. Any adverse developments in the real estate sector could affect the company’s revenue and profitability.

5. Global Economic Trends: Raymond’s global operations in the garment and engineering segments expose it to global economic trends. Currency devaluation, inflation, and economic instability in key export markets can impact demand and profitability. Fluctuations in exchange rates can affect the competitiveness of its exports.

6. Raw Material Price Fluctuations: Raymond’s businesses, particularly in textiles and apparel, are sensitive to fluctuations in raw material prices. While certain raw material prices remained stable during the reporting period, the volatility of materials like linen and flax seeds can impact production costs and pricing strategies. The ability to pass on these cost increases to customers is subject to market conditions.

7. Delayed Festive Sales: Raymond mentioned that the delay in festivals and weddings due to calendar-related factors may delay primary sales to channel partners. This could impact revenue recognition and cash flows in subsequent quarters.