Stock Data:

| Ticker | NSE: RADICO |

| Exchange | NSE |

| Industry | BREWERIES & DISTILLERIES |

Price Performance:

| Last 5 Days | +10.79% |

| YTD | +32.88% |

| Last 12 Months | +52.86% |

Company Description:

Radico Khaitan is a prominent Indian company that has carved a niche in the alcoholic beverage industry. With a rich legacy dating back to 1943, Radico Khaitan has become a leading player in the production and distribution of spirits and alcoholic beverages. Known for its commitment to quality, innovation, and customer satisfaction, the company offers a diverse portfolio that includes premium brands like 8PM Whisky, Magic Moments Vodka, and Morpheus Brandy, among others. Radico Khaitan’s state-of-the-art manufacturing facilities and rigorous quality control measures ensure that each product meets the highest industry standards. With a strong presence in both domestic and international markets, Radico Khaitan continues to be a trusted name in the spirits industry.

Critical Success Factors:

1. Strong Growth in Prestige & Above Category: Radico Khaitan has experienced double-digit growth in its Prestige & Above (P&A) category, which includes luxury brands like Rampur Indian Single Malt and Jaisalmer Indian Craft Gin. The company’s strategic decision to focus on the P&A segment has resulted in a significant increase in its market share and volume.

2. Diversified Product Portfolio: Radico Khaitan has a diverse product portfolio that includes both Indian-made foreign liquor (IMFL) and non-IMFL categories. This diversification allows the company to cater to different consumer preferences and capture market opportunities in various segments.

3. Successful International Expansion: The company’s luxury brands, such as Rampur and Jaisalmer, have received positive responses both domestically and internationally. Radico Khaitan has been able to leverage its high-quality products to penetrate global markets and establish a strong presence, indicating its ability to compete with renowned international brands.

4. Effective Cost Management: Radico Khaitan has demonstrated its ability to manage input cost pressures by rationalizing volume in the regular category and strategically increasing prices in certain key states. The company’s focus on profitability improvement and margin enhancement has helped mitigate the impact of commodity inflation and maintain a competitive position in the market.

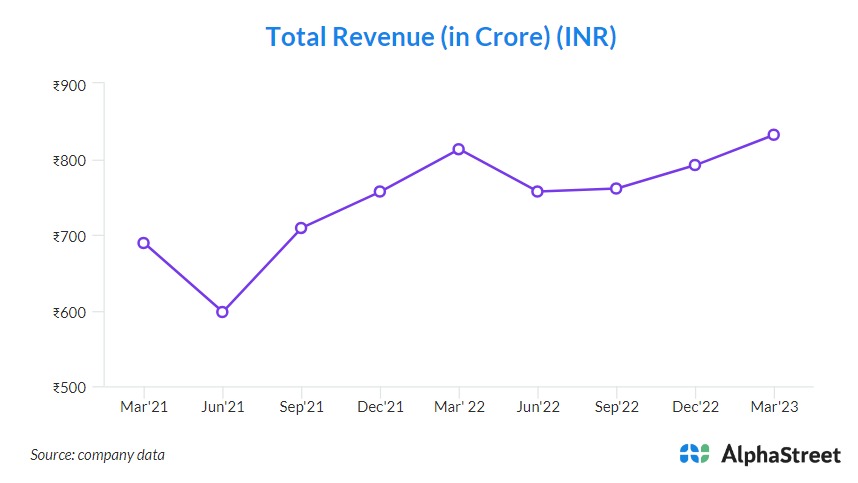

5. Robust Financial Position: Radico Khaitan has a strong financial position and comfortable liquidity, which provides stability and resilience during challenging times. The company’s financial strength enables it to sustain its operations, invest in growth initiatives, and navigate potential market fluctuations effectively.

6. Expansion and Capacity Enhancement: Radico Khaitan has made strategic investments in expanding its production capacity, such as the operational Rampur dual feed plant and the upcoming Sitapur Greenfield plant. These initiatives not only support the company’s growth ambitions but also provide additional leverage for profitability improvement and margin expansion in the future.

Key Challenges:

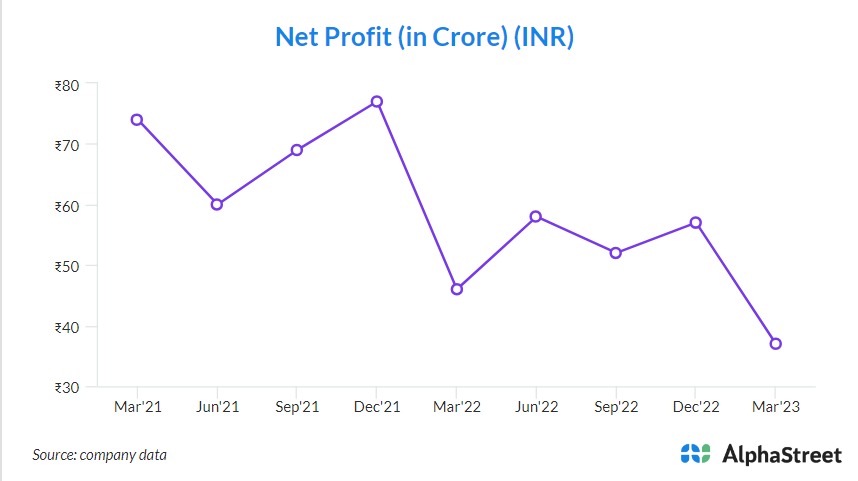

1. Commodity Inflation and Input Cost Pressure: Radico Khaitan faces the risk of commodity inflation, particularly in non-IMFL business segments. Fluctuations in raw material prices, such as ENA and glass, can put pressure on the company’s gross margin and overall profitability.

2. Volatile Raw Material Pricing: The company expects the raw material pricing situation to remain volatile in the near term. Uncertainty in commodity markets can pose challenges in managing input costs and may impact Radico Khaitan’s profitability.

3. Dependency on Price Increases: While the company has implemented price increases in certain key states to mitigate input cost pressures, there is a risk that these price increases may not be sustainable or sufficient to fully offset the impact of inflation. Failure to effectively manage pricing dynamics could impact the company’s margin and financial performance.

4. Revenue Concentration in Prestige & Above Category: While the growth in the Prestige & Above (P&A) category has been strong, Radico Khaitan’s revenue is becoming increasingly dependent on this segment. Any adverse market conditions or shifts in consumer preferences that negatively impact the P&A category could have a significant impact on the company’s financial performance.

5. Debt Levels and Financial Stability: Radico Khaitan has incurred significant debt, and its debt level reached around INR 600 crores. While the company expects its debt to decline through free cash flow, any challenges in generating sufficient cash flow or disruptions to the business could impact its financial stability and ability to service its debt obligations.

6. Competitive Landscape and Market Risks: Radico Khaitan operates in a highly competitive market, both domestically and internationally. Intense competition from established players and emerging brands poses risks to the company’s market share, pricing power, and growth prospects. Additionally, changes in consumer preferences, regulatory environment, and geopolitical factors can impact the company’s operations and market position.