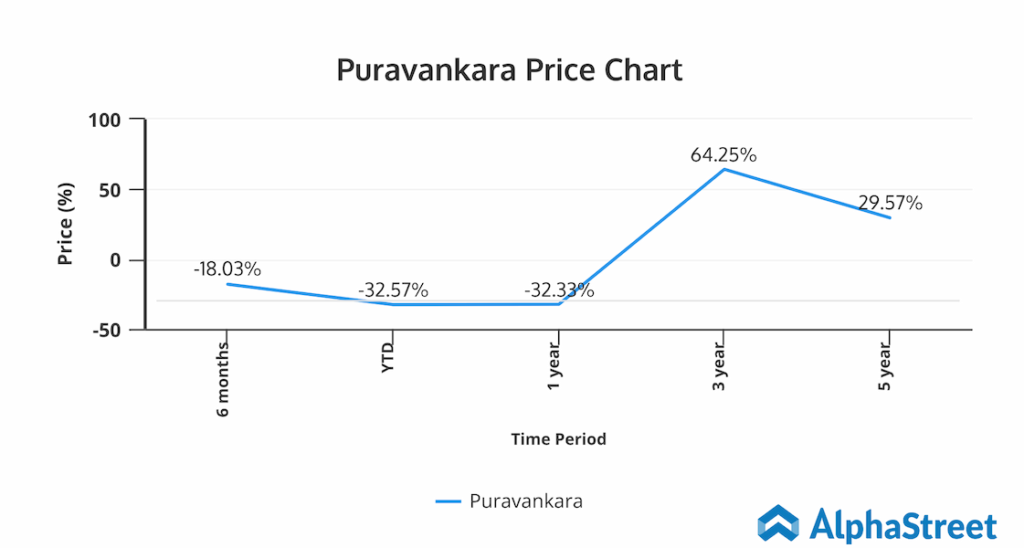

Puravankara Ltd (NSE: PURVA), an Indian real estate company, has turned triumphant and provided a five-year return of more than 30%. Though post-pandemic and due to global hues, the stock has suffered reflecting a 25.43% fall in price over the past year, recent business momentum in the real estate market is expected to come to the rescue.

Interestingly, the stock gave a 3-year return of 57.06% as compared to the Nifty Smallcap 100 return of 71.9%.

As on May 31, 2022, the Indian economy has completely recovered to the pre-pandemic real GDP level of 2019-20. In FY 2021-22, real GDP growth stands at 8.7%, up 1.5% higher than the real GDP in FY 2019-20. As a result, with a revamp in the real estate business, demand for residential properties has jumped on rising urbanization and increasing household income.

According to the Indian Brand Equity Foundation (IBEF), by 2040, the real estate market is likely to rise to Rs 65,000 crore from Rs 12,000 crore in 2019. Additionally, the Indian real estate sector is expected to contribute 13% to the country’s GDP by 2025. Interestingly, retail, hospitality, and commercial real estate have also reflected strong growth, which in turn, provides infrastructure for India’s increasing needs. As a result, Puravankara is poised to grow with the recovery in the market and provide strong returns to investors.

Fundamental Factors to Consider

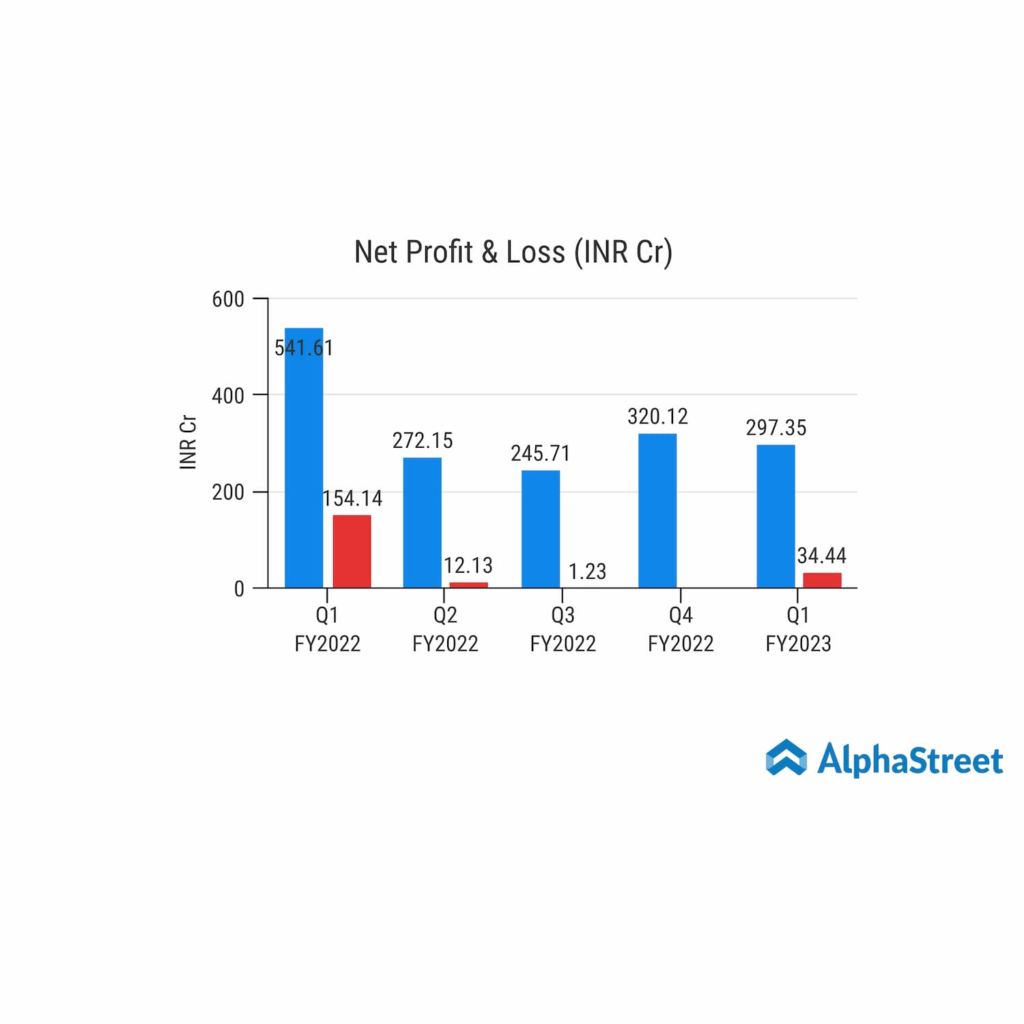

With a strong sustainable business model and robust project pipeline across its brands, Puravankara returned to profits in FY 2021-22 from a loss recorded in the prior year. Remarkably, it recorded the highest ever sales value for the company of Rs 2,407 crores in the year.

From a cost perspective, the company has depicted prudent expense management resulting in superior operational efficiency. Total expenses increased marginally or remained stable over the past few quarters.

The company’s positive net cash flow and strong cash levels reflect a robust liquidity profile. Also, the return on capital employed (ROCE) has remained consistent over the last five years in the range of 8-13%.

For income-oriented investors, Puravankara is an attractive bet. It offers an annual dividend yield of 5.37%.

Our View

In the urbanizing world, the company reflects strong business momentum with long-term prospects. The move towards a robust pipeline, operational efficiency, dividend policy, and financial stability of the company depicts strength. As a result, long-term investors might consider the stock as an attractive investment opportunity.