“In general, the Indian real estate market is demonstrating robust growth and resurgence with the new facilities arising due to sustained market conditions. The Indian economy is displaying stability, robustness, and we have a positive outlook on it. Our attention on our new projects, we will persist in expanding our operations while preserving a sound financial position. Our focus is on implementing environmentally, socially and ‘ governance responsible practices and delivering value for our stakeholders through openness, creativity, the strong management and brand recognition. We are optimistic about our continued improvement in the long run and our capability to offer reliable cost-effective profitable and responsible growth.”

– Mr. Neeraj Gautam, Executive Vice President in Q3FY23 Concall

| Stock Data | |

| Ticker | PURVA |

| Exchange | NSE |

| Industry | REAL ESTATE |

| Price Performance | |

| Last 5 Days | +0.98% |

| YTD | -16.26% |

| Last 12 Months | -26.74% |

*As of 01.05.2023

Company Description:

Puravankara Limited is one of the leading real estate developers in India. The company was established in 1975 by Ravi Puravankara, and it has since become one of the most trusted names in the Indian real estate industry. The company is headquartered in Bengaluru, Karnataka, and has operations in various cities across India.

Puravankara Limited has a strong pipeline of projects in various stages of development, which bodes well for its future prospects. The company has millions of square feet of projects under development, including both residential and commercial properties. The company’s focus on affordable housing and sustainability is expected to drive demand for its projects in the coming years.

The company has also adopted a digital-first approach to marketing and sales, which is expected to help it reach a wider customer base and improve customer engagement. Puravankara Ltd has also partnered with several fintech companies to offer innovative financial solutions to its customers, which is expected to further enhance its competitive position in the market.

Key Strengths:

- Strong brand: Puravankara Ltd has a strong brand reputation, which has been built over the years through its focus on quality, timely delivery, and customer satisfaction. The company has won several awards and recognitions for its projects, which has helped it establish itself as a trusted name in the Indian real estate industry.

- Experienced management: The company has a highly experienced management team, led by its founder Ravi Puravankara, who has over four decades of experience in the real estate industry. The management team has a deep understanding of the industry and is focused on delivering value to its customers and shareholders.

- Diversified portfolio: Puravankara Ltd has a diversified portfolio of projects, including both residential and commercial properties. This helps the company mitigate risks and capitalize on opportunities across different segments of the real estate market.

- Strong pipeline of projects: The company has a strong pipeline of projects in various stages of development, which provides visibility into future revenue and cash flows. This pipeline includes several affordable housing projects, which are expected to drive demand in the coming years.

- Innovative approach: Puravankara Ltd has adopted a digital-first approach to marketing and sales, which has helped it reach a wider customer base and improve customer engagement. The company has also partnered with fintech companies to offer innovative financial solutions to its customers, which has helped it differentiate itself from its competitors.

- Commitment to sustainability: The company has a strong focus on sustainability and has implemented several initiatives to reduce its carbon footprint and promote eco-friendly practices. This commitment to sustainability is likely to resonate with environmentally conscious customers and investors.

Key Opportunities:

- Rising demand for affordable housing: With a growing population and increasing urbanization, there is a significant demand for affordable housing in India. Puravankara Ltd has already established itself as a leading player in the affordable housing segment and has several projects in the pipeline. The company can further leverage this opportunity by expanding its presence in Tier-2 and Tier-3 cities, where the demand for affordable housing is particularly high.

- Increasing focus on sustainability: With increasing awareness about climate change and environmental sustainability, there is a growing demand for eco-friendly and sustainable real estate projects. Puravankara Ltd has already implemented several sustainability initiatives and can further leverage this opportunity by incorporating more green features into its projects and promoting its eco-friendly practices.

- Growing use of technology: The Indian real estate industry is increasingly adopting technology to improve efficiencies and customer experience. Puravankara Ltd has already adopted a digital-first approach to marketing and sales, and can further leverage technology to improve its construction processes, project management, and customer engagement.

- Expansion into new geographies: While Puravankara Ltd has a strong presence in southern India, it can further expand its business by entering new geographies. The company has already entered the Mumbai and Pune markets, and can consider entering other high-growth markets such as Delhi-NCR and Kolkata.

- Partnerships with fintech companies: With increasing demand for innovative financing solutions, Puravankara Ltd can leverage partnerships with fintech companies to offer its customers a wider range of financing options. This can help the company differentiate itself from its competitors and improve customer engagement.

Financial Results:

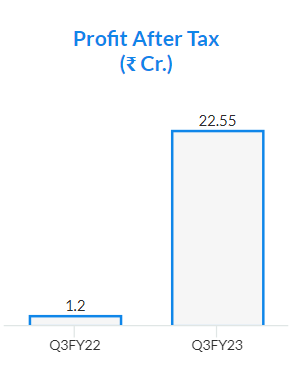

Puravankara Ltd.’s revenue in Q3FY23 rose 77% to ₹ 392 crores. Consolidated Profit After Tax came at ₹ 22.55 crores in Q3FY23 showcasing a 1,779% rise on an YoY basis. In this quarter’s results, the reports suggested that the firm has continued to deliver consistent performance in all key operational and financial indicators in Q3Y23.