“At Paisalo we believe that the purpose of any business transformation is that it should result in stronger growth momentum, better customer experience, additional cross sell, lower credit risk, lower ALM risk and improved liquidity. We are Pursuing our Business Transformation with these objectives.”

-Company’s Management

Stock Data

| Ticker | PAISALO |

| Exchange | BSE & NSE |

| Industry | NBFC |

Share Price

| Last 1 Month | -6.9% |

| Last 6 Months | -39.7% |

| Last 12 Months | -31.4% |

Business Basics

Paisalo Digital Limited is a non-banking financial company (NBFC) based in India that primarily focuses on providing financial solutions and services to the rural and semi-urban sectors. The company’s operations are centered around lending activities, primarily in the form of microfinance and retail loans, catering to the unique needs and challenges of the underserved segments of the population. Paisalo Digital operates through a wide network of branches and employs a technology-driven approach to deliver financial services efficiently and effectively. The company leverages its robust technological infrastructure and digital platforms to streamline loan processing, enhance customer experience, and ensure timely disbursal of funds.

One of the key business segments for Paisalo Digital is microfinance, wherein the company offers small-ticket loans to individuals and groups engaged in income-generating activities in rural and semi-urban areas. These microfinance loans play a crucial role in providing financial support to individuals who may not have access to traditional banking services. The company’s microfinance operations are backed by comprehensive credit assessment processes and customized loan products tailored to meet the unique requirements of its target customers.

In addition to microfinance, Paisalo Digital also provides retail loans to its customers. These loans cover various sectors such as agriculture, two-wheelers, small businesses, and consumer durables. By offering retail loans, the company aims to support the growth and development of businesses, enable the purchase of essential assets, and improve the overall quality of life for its customers. Paisalo Digital emphasizes responsible lending practices and ensures that its loan products are affordable and sustainable for borrowers. The company conducts thorough credit assessments to determine the repayment capacity of borrowers and maintains strict adherence to regulatory guidelines and risk management frameworks.

The company’s customer-centric approach extends beyond lending, as Paisalo Digital also provides value-added services such as financial literacy programs and skill development initiatives. These initiatives aim to empower individuals with the necessary knowledge and skills to effectively manage their finances and improve their livelihoods. Paisalo Digital’s success is attributed to its strong management team, extensive experience in the financial services industry, and deep understanding of the rural and semi-urban markets. The company’s focus on technology, data analytics, and process optimization enables it to operate with efficiency, scalability, and agility. Furthermore, Paisalo Digital places a strong emphasis on corporate governance, transparency, and compliance. The company maintains robust risk management practices to mitigate potential risks and ensure the stability and sustainability of its operations.

Q4 FY23 Financial Performance

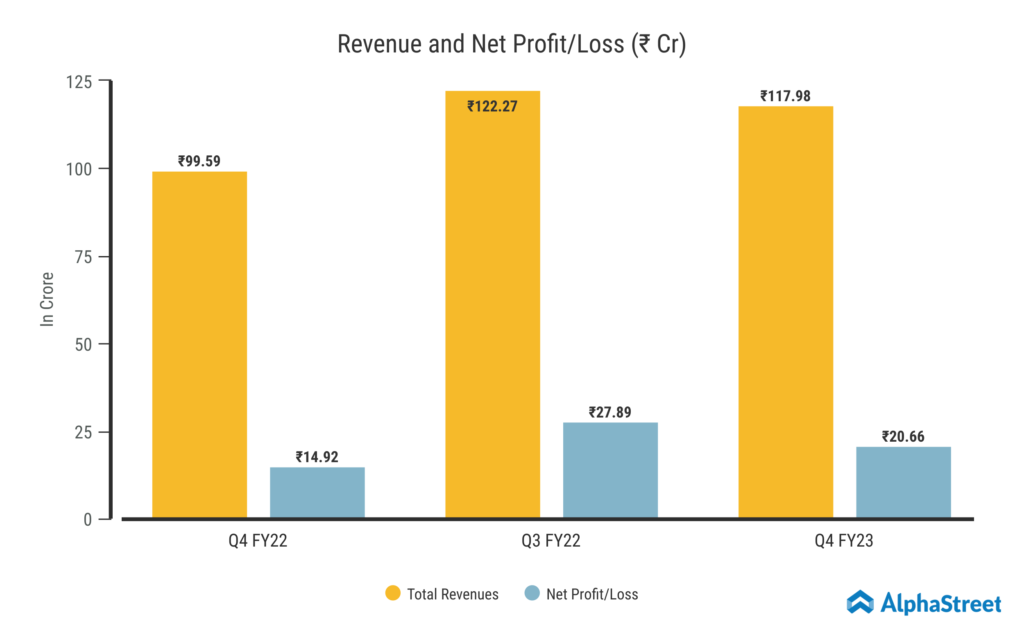

Paisalo Digital Limited reported Total Income for Q4 FY23 of ₹117.98 Crore up from ₹99.59 Crore year on year, a growth of 18.5%. The consolidated Net Profit of ₹20.66 Crore, up 38.5% from ₹14.92 Crore in the same quarter of the previous year. The Earnings per Share is ₹0.46 for this quarter. As of 31st March 2023, the company’s lending business touched an AUM of ₹3,492.80 Crore with a customer base of 1.5 million.

Paisalo’s Financial Product Porfolio

Paisalo Digital Limited offers a range of financial products designed to meet the diverse needs of its target customers in the rural and semi-urban sectors. These products are tailored to provide accessible and affordable financial solutions, empowering individuals and businesses to fulfill their aspirations and drive economic growth. Here are some key financial products offered by Paisalo Digital:

Microfinance Loans: Paisalo Digital provides microfinance loans to individuals and groups engaged in income-generating activities in rural and semi-urban areas. These loans typically have small-ticket sizes and are designed to support various micro-enterprises and self-employment ventures. The microfinance loans help individuals meet their working capital requirements, invest in income-generating assets, and expand their businesses.

MSME Loans: The company also offers business loans to small businesses and entrepreneurs, enabling them to expand their operations, invest in infrastructure, purchase machinery and equipment, and meet working capital needs. These loans support the growth and development of businesses in the rural and semi-urban areas, contributing to job creation and economic prosperity.

Vehicle Loans: Paisalo Digital provides loans for the purchase of vehicles, including motorcycles and cars. These loans enable individuals to own their own means of transportation, improving mobility and accessibility to work, education, and other essential services. The company offers competitive interest rates, flexible repayment options, and simplified loan application processes to make it easier for customers to avail the loans. The company is also betting on the rapid growth of EV markets.

Paisalo Digital & Karnataka Bank’s Co Lending Pact

Leading private sector bank Karnataka Bank (KBL) and Paisalo Digital Limited have formed a co-lending partnership to support the country’s micro and small businesses (MSEs) and people with low incomes financially. In order to assist in the sourcing, servicing, and recovery of small-ticket income-generating priority sector loans, the agreement will take advantage of Karnataka Bank’s low cost of funds and the end-to-end digital capabilities of KBL and Paisalo. The partnership between Karnataka Bank and Paisalo Digital Ltd will result in a dynamic synergy.

to improve the flow of credit to unserved and underserved segments, in accordance with the Reserve Bank of India’s guidelines on co-lending by banks and NBFCs to priority sectors. Shri Santanu Agarwal, Deputy Managing Director, Paisalo Digital Limited said that “Paisalo sees a huge opportunity and is well-positioned to capitalize on the huge ₹8.00 lakh crore market of small-ticket loans for our 365 million underbanked and under-serviced population. Karnataka Bank and Paisalo Co-Lending Product is a big step towards Paisalo’s goal of creating the most competitive and seamless banking solution for India’s Bottom of Pyramid Population.”