Stock Data:

| Ticker | NSE: NDLVENTURE |

| Exchange | NSE |

Price Performance:

| Last 5 Days | -1.34 % |

| YTD | +17.48 % |

| Last 12 Months | +17.48 % |

Company Description:

NDL Ventures Ltd. (NDL) is a financial services company based in India, with a history rooted in the dynamic Hinduja Group. Formerly known as NXTDIGITAL Ltd., NDL underwent a strategic transformation in November 2022 when it demerged its digital media and communications business to Hinduja Global Solutions Ltd. and rebranded itself as NDL Ventures Ltd. Leveraging the formidable backing of the Hinduja Group, a diversified conglomerate renowned for its success across various industries, NDL is well-equipped to navigate the financial services landscape. Its core objective includes investing in and offering financial support to entities spanning diverse sectors such as media, entertainment, technology, telecom, and infrastructure.

Critical Success Factors:

1. Robust Parentage and Strong Backing: NDL Ventures Ltd. benefits significantly from its association with the Hinduja Group, a prominent conglomerate with a long history of success in various industries. This affiliation provides NDL with access to a vast pool of resources, including financial backing, industry expertise, strategic partnerships, and a well-established network. The Hinduja Group’s track record of creating value for its stakeholders instills confidence in NDL’s growth prospects and enhances its credibility in the market.

2. Diverse Portfolio of Strategic Investments: NDL Ventures has strategically diversified its portfolio of investments and financial assistance across a range of sectors. This diversified approach positions the company to capitalize on emerging growth opportunities in sectors such as media, entertainment, technology, telecom, and infrastructure. As these sectors continue to experience increased demand driven by digital services, content consumption, connectivity, and urbanization trends, NDL is well-positioned to benefit from its diversified interests.

3. Entry into the NBFC Sector: NDL’s strategic decision to enter the non-banking financial company (NBFC) sector through the proposed merger with Hinduja Leyland Finance Ltd. (HLFL) is a significant strength. HLFL, as a leading NBFC in India, specializes in vehicle finance and rural finance segments. This merger will create a formidable and diversified NBFC platform with amplified scale, extensive reach, an expanded product portfolio, and improved profitability. It allows NDL to venture into high-potential segments of the financial services industry.

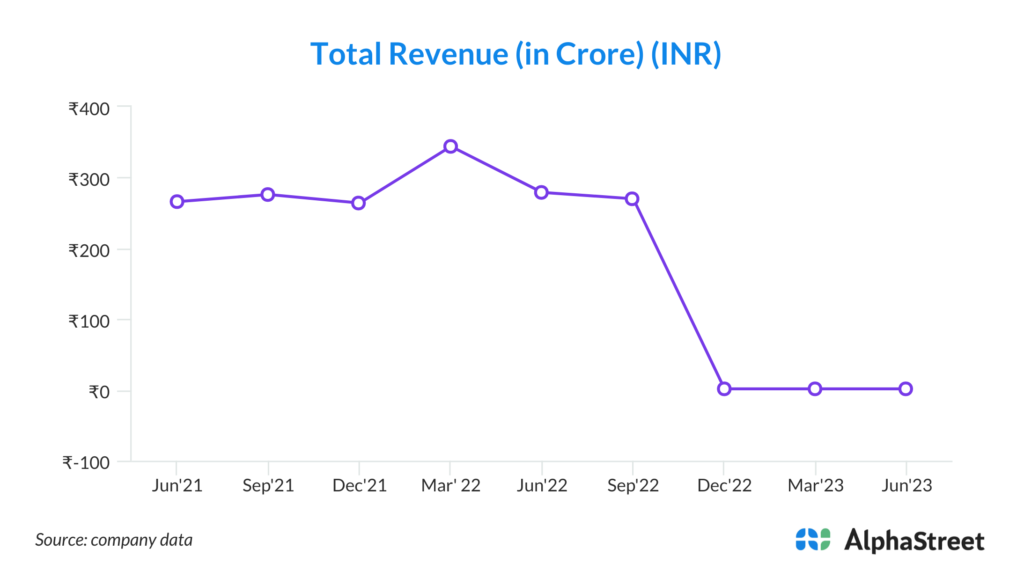

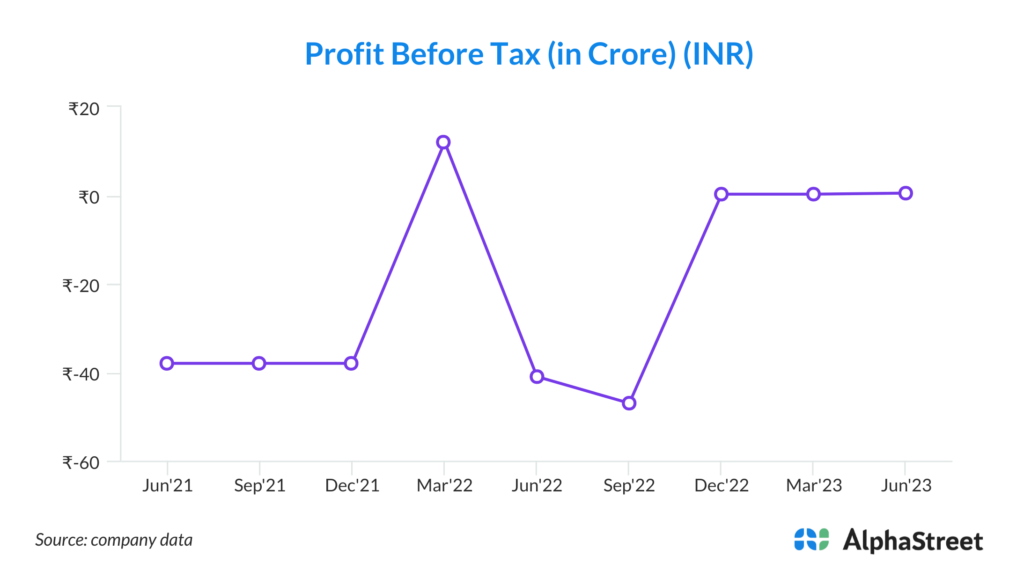

4. Resilient Financial Performance: Despite the disruptive impact of the COVID-19 pandemic, NDL demonstrated resilience and adaptability in its financial performance in FY23. Notably, the company achieved substantial revenue growth and exhibited improved profitability from its continuing operations. This resilience underscores NDL’s ability to navigate challenging market conditions and sustain its momentum.

5. Addressing Low Financial Inclusion: India’s financial services sector has historically exhibited lower penetration levels compared to developed economies. This presents an immense opportunity for NDL to contribute to financial inclusion by offering a comprehensive suite of financial products and services to underserved and unbanked segments of the population. NDL can play a vital role in bridging this gap and expanding its customer base.

6. Embracing Digital Transformation: NDL is well-prepared to leverage India’s ongoing digital transformation within the financial services sector. With the increasing penetration of the internet and smartphones, the widespread adoption of digital payment platforms, and the rise of fintech innovators, NDL can cater to the growing demand for digital channels to access financial services. This adaptability to evolving customer preferences is a strength that aligns with industry trends.

7. Strong Governance and Ethical Practices: NDL places a strong emphasis on corporate governance and ethical business practices. This commitment to transparency, accountability, and responsible business conduct enhances the company’s reputation and builds trust among investors and stakeholders. Strong governance principles are vital for maintaining the company’s long-term sustainability and credibility.

8. Access to Diverse Sources of Capital: Being part of the Hinduja Group grants NDL access to a wide range of capital sources. This access provides the company with financial stability and flexibility to pursue strategic investments and growth initiatives in a dynamic financial services landscape. The ability to secure capital from diverse avenues strengthens NDL’s ability to capture emerging opportunities.

9. Proactive Risk Management: NDL demonstrates a proactive approach to risk management. By closely monitoring factors such as regulatory changes, market dynamics, and competitive landscapes, the company can anticipate and mitigate potential risks and uncertainties. This risk-awareness is essential in safeguarding the company’s operations and maintaining investor confidence.

Key Challenges:

1. Regulatory and Compliance Risks: As a financial services company, NDL Ventures is subject to a complex regulatory environment in India. Changes in regulations, compliance requirements, or government policies can have a significant impact on its operations. Adherence to evolving regulatory standards is crucial, and non-compliance could result in penalties, legal issues, or restrictions on business activities.

2. Market and Economic Volatility: The financial services industry is sensitive to economic cycles and market fluctuations. NDL’s financial performance and asset quality may be negatively affected by economic downturns, interest rate movements, inflation, or changes in consumer behavior. Managing these external economic risks is essential to maintaining stability and profitability.

3. Credit Risk: As NDL ventures into the non-banking financial company (NBFC) sector through the proposed merger with Hinduja Leyland Finance Ltd. (HLFL), it will be exposed to credit risk associated with lending activities. Defaults on loans, non-performing assets (NPAs), and deteriorating credit quality within the loan portfolio could lead to financial losses and impact the company’s overall performance.

4. Integration Risk: The successful integration of HLFL into NDL following the merger is crucial for realizing the expected benefits. Integration challenges, such as cultural differences, operational issues, and technology transitions, can disrupt business operations and impact customer service. Failure to manage these integration risks effectively may result in suboptimal outcomes.

5. Competition: The financial services industry in India is highly competitive, with numerous established players and emerging fintech companies vying for market share. NDL will face intense competition in various segments, including vehicle finance, rural finance, and other NBFC services. Sustaining and expanding market share will require effective strategies and differentiation.

6. Market Risk: NDL’s portfolio of investments is subject to market risks, including equity market volatility and fluctuations in asset values. A downturn in the financial markets or adverse movements in specific asset classes could lead to asset devaluation, impacting the company’s financial health and profitability.

7. Liquidity Risk: Ensuring sufficient liquidity to meet financial obligations and fund growth initiatives is critical for NDL. Overextension or a shortage of liquid assets could hinder the company’s ability to seize opportunities, service debt, or address unforeseen financial challenges.

8. Operational Risks: Operational risks encompass a range of factors, including internal processes, technology infrastructure, cybersecurity threats, and human errors. Operational disruptions or security breaches can result in financial losses, reputational damage, and regulatory penalties. Implementing robust risk management and cybersecurity measures is imperative.

9. Asset Quality: Maintaining a healthy asset quality is paramount for a financial institution. The quality of loans and investments in NDL’s portfolio will be closely monitored by regulators and investors. A deterioration in asset quality, including a surge in NPAs, could lead to a loss of investor confidence and financial instability.