Company Overview:

Muthoot Microfin Limited is a leading non-banking financial institution (NBFC) in India, specializing in microfinance services with a strong focus on financial inclusion and digital empowerment. As part of the renowned Muthoot Pappachan Group, a 137-year-old conglomerate with extensive experience in financial services, Muthoot Microfin is committed to providing tailored financial solutions to the underserved segments of society. The company’s core operations involve offering joint liability group loans to groups of women at the grassroots level, thereby enabling them to access credit and formal financial services.

Muthoot Microfin’s services extend beyond microfinance, catering to the evolving financial needs of its customers throughout their lifecycle. This includes providing home improvement loans, gold-backed loans, and two-wheeler finance as customers progress on their financial journey. Backed by a strong governance structure, a diversified distribution network, and a seasoned management team, Muthoot Microfin has demonstrated impressive growth in its loan portfolio, branch network, and customer base. With a solid capital base post-IPO and healthy liquidity, the company is well-positioned to further expand its operations and continue contributing to financial inclusion across India’s diverse regions.

Recent Financials (Q3FY24):

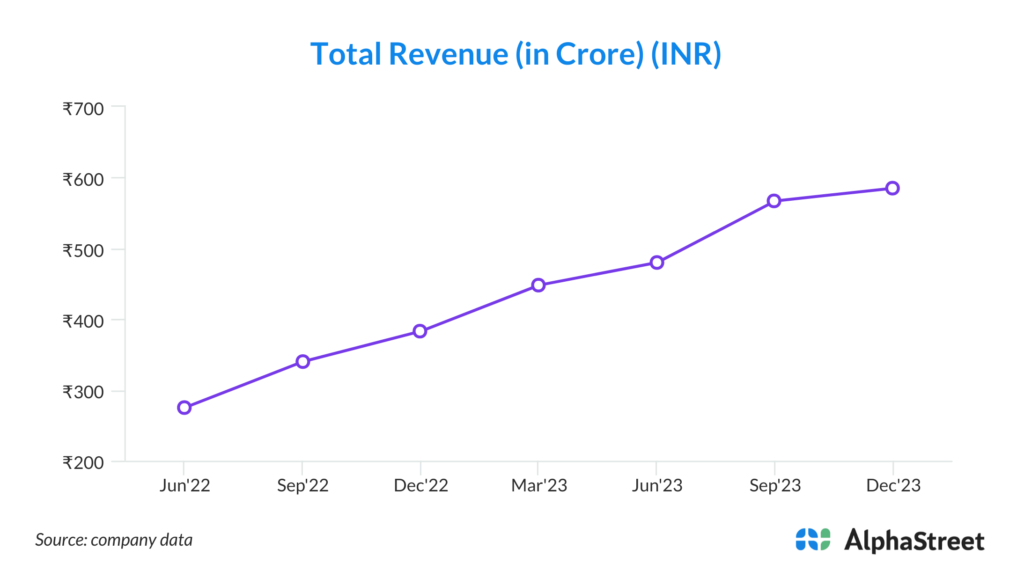

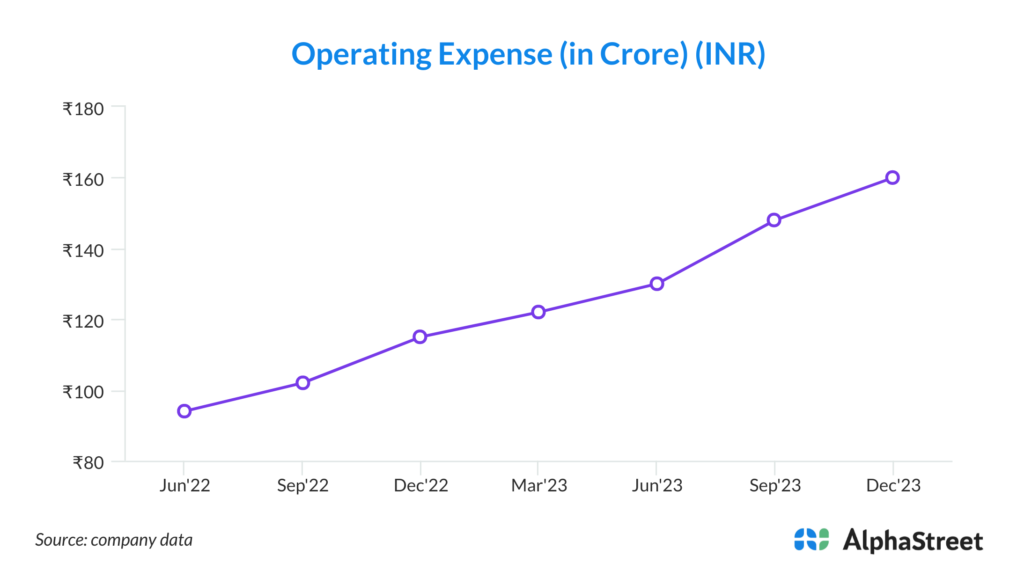

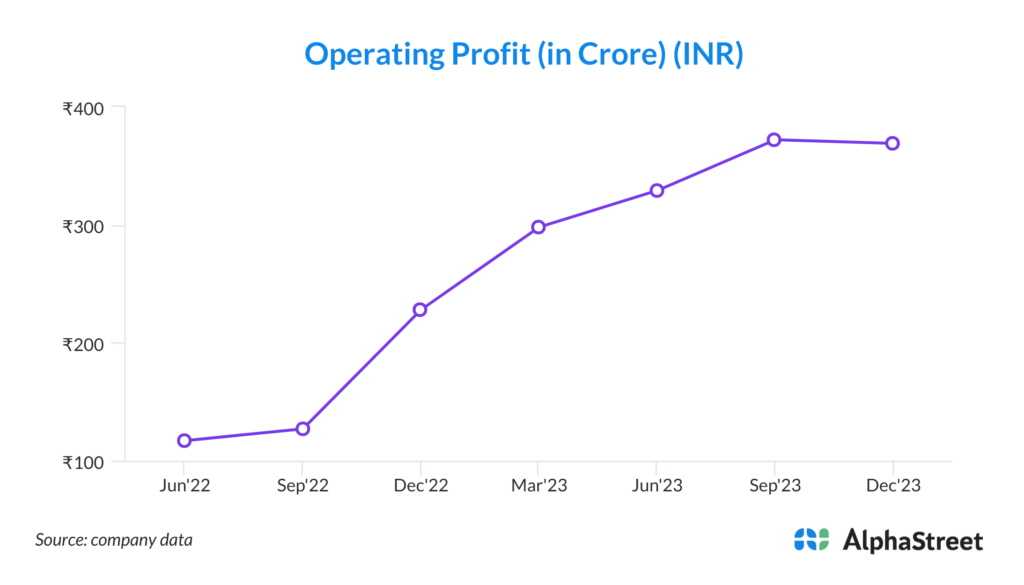

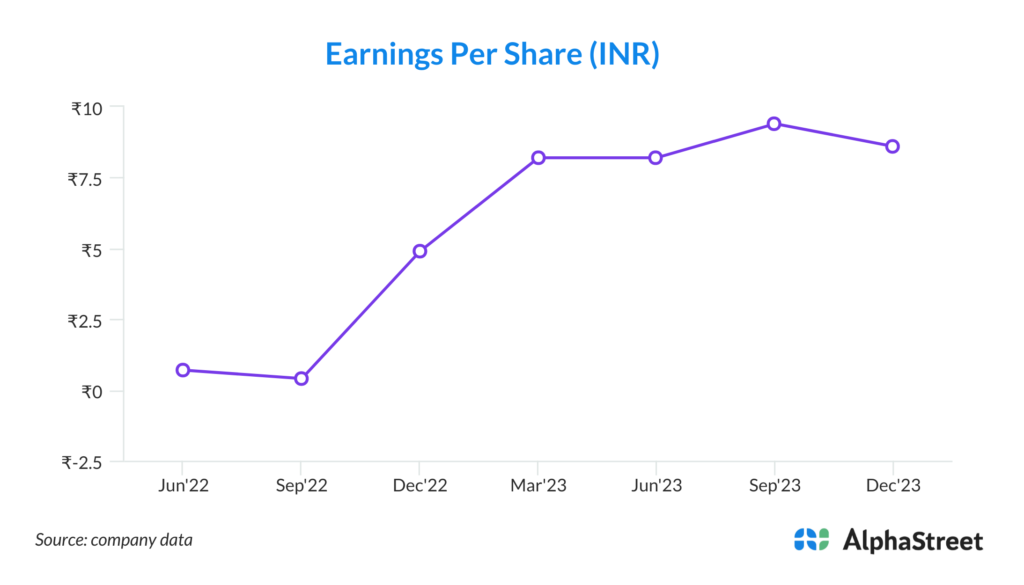

Muthoot Microfin Limited has reported robust financial performance in its latest quarterly results, highlighting significant growth across key metrics. Total Income for the quarter surged by an impressive 52.61% year-over-year (YoY), reaching Rs 584.83 crore compared to Rs 383.21 crore in the corresponding period last year. This substantial increase in Total Income was complemented by a noteworthy 53.07% YoY rise in Net Interest Income (NII), climbing from Rs 224.13 crore to Rs 343.07 crore. The company’s Gross Loan Portfolio (GLP) expanded by 38.64% YoY to Rs 11,458.14 crore, reflecting robust demand for its microfinance offerings. Moreover, Profit After Tax (PAT) saw a substantial surge of 119.06% YoY, reaching Rs 124.57 crore compared to Rs 56.86 crore in the same period last year.

Muthoot Microfin’s impressive financial performance is underpinned by its strong asset quality metrics. The Gross Non-Performing Assets (NPA) ratio improved significantly to 2.29% from 3.49% YoY, showcasing effective risk management and collection strategies. Similarly, the Net NPA ratio declined to 0.33% from 0.97% YoY, highlighting the company’s focus on maintaining a healthy loan portfolio. These improvements in asset quality metrics, coupled with robust growth in operational metrics such as borrower base and branch network expansion, position Muthoot Microfin as a key player in India’s microfinance sector. With a solid foundation and prudent financial management, the company is well-poised for continued growth and success in serving the financial needs of underserved communities across the country.

Key strengths of the company:

1. Established Promoter Group: The company is part of the esteemed Muthoot Pappachan Group, a conglomerate with over 137 years of experience in financial services. This legacy brings strong brand credibility, extensive industry knowledge, and access to diverse resources, enabling Muthoot Microfin to leverage its deep-rooted foundation for sustainable growth.

2. Focus on Financial Inclusion: Muthoot Microfin specializes in providing microfinance services aimed at empowering the underserved segments of society. By offering joint liability group loans to women at the grassroots level, the company plays a pivotal role in promoting financial inclusion and economic empowerment among marginalized communities.

3. Robust Risk Management Framework: The institution emphasizes prudent risk management practices, evidenced by its improving asset quality metrics. Muthoot Microfin’s rigorous credit assessment processes and proactive collection strategies contribute to maintaining a healthy loan portfolio and minimizing credit risk.

4. Technology Adoption: The company leverages technology extensively to enhance operational efficiency and customer experience. With a significant portion of transactions conducted digitally, including digital collections and disbursements, Muthoot Microfin achieves cost optimization and scalability while ensuring accessibility and convenience for its customers.

5. Diversified Distribution Network: Muthoot Microfin has expanded its branch network strategically across different regions in India, enabling wider reach and market penetration. This diversified distribution network strengthens customer outreach and supports the company’s growth trajectory.

6. Strong Governance Structure: The company boasts a robust governance framework with a well-balanced board comprising experienced professionals and independent directors. This governance model ensures transparency, accountability, and adherence to regulatory standards, fostering investor confidence and credibility in the market.

7. Solid Financial Performance: Muthoot Microfin’s consistent financial growth, as evidenced by rising Total Income, Net Interest Income, and Profit After Tax, underscores its operational excellence and sound business fundamentals. The company’s strong financial position post-IPO, coupled with healthy liquidity and capital adequacy, positions it for sustained growth and resilience in the dynamic financial landscape.

Key risks and concerns for the company:

1. Credit Risk Exposure: The company’s focus on lending to underserved segments poses inherent credit risks due to the vulnerability of these borrowers to economic fluctuations and unforeseen events. Economic downturns or localized disruptions can impact borrowers’ ability to repay, potentially leading to increased non-performing assets (NPAs) and credit losses.

2. Regulatory Environment: Changes in regulatory policies and compliance requirements could pose challenges for Muthoot Microfin. Shifts in regulations governing microfinance institutions (MFIs) or interest rate caps may impact the company’s operations and profitability, requiring adaptation to evolving legal frameworks.

3. Dependency on External Funding: Microfinance institutions heavily rely on external funding sources for liquidity. Any disruptions in capital markets, changes in borrowing costs, or constraints in accessing funding could affect Muthoot Microfin’s ability to sustain lending operations and growth.

4. Market Competition: Intensifying competition in the microfinance sector from existing players or new entrants may lead to pricing pressures, impacting margins and market share. Maintaining competitive positioning amidst evolving market dynamics requires continuous innovation and strategic differentiation.

5. Operational Risks: Operational challenges such as technology disruptions, cybersecurity threats, or internal process inefficiencies can impact service delivery and customer experience. Muthoot Microfin must prioritize operational resilience and invest in robust systems and controls to mitigate operational risks.

6. Concentration Risks: Over-reliance on specific regions or borrower segments exposes the company to concentration risks. Adverse developments in key markets or borrower segments could disproportionately impact Muthoot Microfin’s portfolio quality and financial performance.

7. Macroeconomic Factors: External macroeconomic factors such as interest rate fluctuations, inflationary pressures, or geopolitical uncertainties can influence the overall operating environment. Changes in macroeconomic conditions may affect borrowers’ repayment capacity and asset quality, necessitating proactive risk management strategies.

Navigating these risks requires Muthoot Microfin to maintain a proactive risk management framework, diversify its portfolio, and continuously monitor market dynamics to adapt swiftly to evolving challenges while capitalizing on growth opportunities.