Stock Data:

| Ticker | NSE: MOTHERSON |

| Exchange | NSE |

| Industry | AUTOMOTIVE |

Price Performance:

| Last 5 Days | +1.82 % |

| YTD | +25.89 % |

| Last 12 Months | +29.57 % |

Company Description:

Samvardhana Motherson International Limited (Motherson) is a globally renowned automotive manufacturing and engineering conglomerate.

Critical Success Factors:

1.Strong Financial Performance: Motherson has consistently demonstrated its ability to navigate challenging economic conditions. Despite facing inflationary headwinds related to interest rates and wage bills across various geographies, the company has maintained a strong financial performance. This resilience is a testament to its robust financial management practices and strategic decision-making.

2. Diverse Business Divisions: One of Motherson’s key strengths lies in the diversity of its business divisions. These divisions have consistently performed well, indicating the company’s ability to excel across various segments of the automotive industry. This diversified portfolio helps Motherson mitigate risks associated with fluctuations in specific sectors, providing stability and growth opportunities.

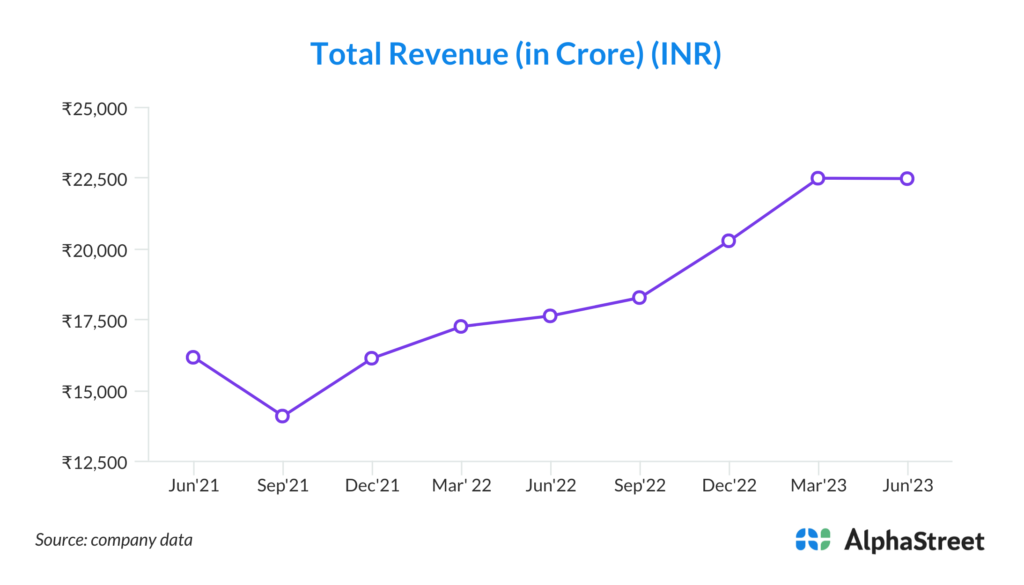

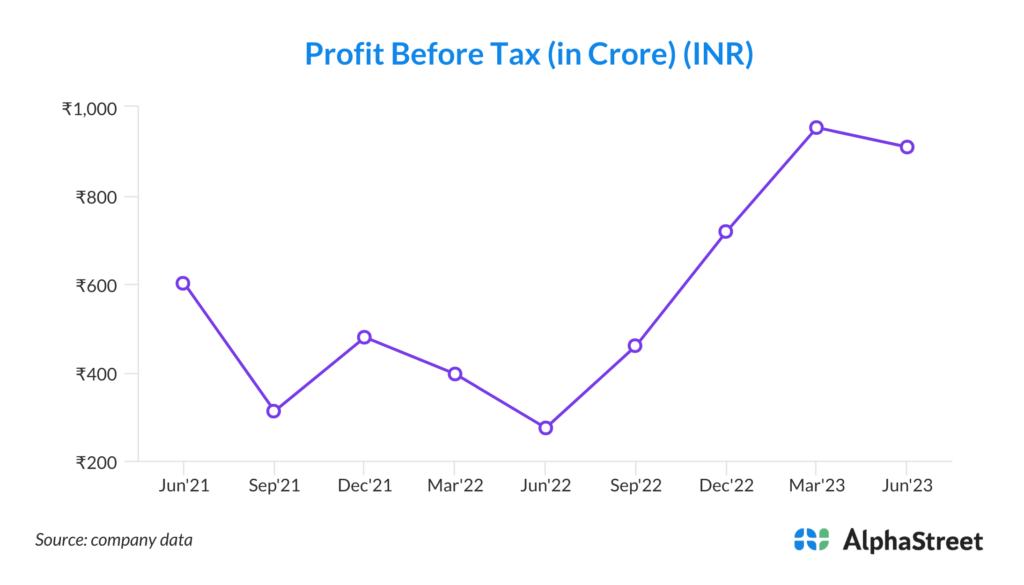

3. Impressive Revenue and EBITDA Growth: Motherson’s year-on-year revenue growth of 27% and EBITDA growth of 64% are exceptional figures. These metrics reflect the company’s capacity to not only weather economic challenges but also to thrive and expand its operations. Such impressive growth indicates that Motherson has a strong market presence and is well-positioned to capture opportunities in the automotive sector.

4. Healthy Leverage Ratio: Maintaining a leverage ratio of 1.4, well below its target of 2.5x, underscores Motherson’s prudent financial management. This low leverage ratio signifies that the company manages its debt efficiently, reducing financial risk and ensuring its financial stability.

5. Organic Growth: Motherson’s significant growth is primarily organic, with acquisitions contributing only a small fraction to its top-line figure. This demonstrates the inherent strength of Motherson’s core operations, which are capable of driving substantial revenue and profit growth independently.

6. Profitability Improvement: Despite facing challenges like rising interest rates and wage bills, Motherson has managed to sustain and even improve its profitability. This indicates the company’s ability to adapt to changing economic conditions and its commitment to delivering value to shareholders.

7. Strategic Acquisitions: Motherson’s strategic focus on acquisitions is another notable strength. The company has closed seven acquisitions since April 2023, with more to come in the near future. These acquisitions are expected to add substantial value to Motherson’s offerings and open up new growth avenues. Additionally, Motherson’s ability to integrate these acquisitions efficiently enhances its competitiveness in the market.

8. Customer Trust and Collaboration: Motherson acknowledges the support of its customers during challenging times. The company maintains close collaborations with its customers, working together to find innovative solutions to operational issues. This strong customer trust and collaboration are essential for long-term success in the automotive industry.

9. Strategic Outlook: Motherson believes that the macroeconomic environment is stabilizing, and disruptions are normalizing. The company anticipates strong growth from the organic side, driven by stabilizing automotive production and emerging trends such as zero-emission vehicles and premiumization. This forward-looking approach positions Motherson for sustained growth.

10. Future Growth Opportunities: Motherson’s focus on new order wins and investments in emerging markets, including setting up Greenfield facilities in India and China, indicates its commitment to exploring new growth opportunities. As the automotive industry evolves with changing technologies, Motherson is well-positioned to capture these opportunities and maintain its leadership position.

Key Challenges:

1. Inflationary Pressure: Motherson faces the risk of rising inflation, including increasing interest rates and wage bills across various geographical regions. Such inflationary pressures can erode profit margins and affect overall financial performance.

2. Interest Rate Volatility: Fluctuations in interest rates can impact Motherson’s borrowing costs and financial stability. High or unpredictable interest rates could lead to increased debt-servicing expenses, potentially affecting the company’s leverage ratios and financial health.

3. Labor Cost Challenges: Labor-related issues, such as strikes or wage negotiations, can disrupt Motherson’s operations. Protracted labor disputes can lead to production delays, increased costs, and strained relationships with employees.

4. Supply Chain Disruptions: Ongoing vulnerabilities in global supply chains pose a significant risk to Motherson. Disruptions in the supply chain, such as shortages of critical components or transportation disruptions, can impact production schedules and result in revenue losses.

5. Plant Sub-Optimization: Some of Motherson’s manufacturing plants may operate below their optimal capacity due to various factors, including inflated cost structures, labor-related challenges, or pricing issues. This sub-optimization can affect overall operational efficiency and profitability.

6. Integration Challenges: Motherson’s growth strategy relies on acquisitions. Integrating newly acquired companies can be complex and time-consuming. Delays or difficulties in integration may prevent Motherson from realizing the expected benefits of these acquisitions within anticipated timelines.

7. Market Volatility: The automotive industry experiences cyclical market trends. Economic downturns or shifts in consumer preferences can lead to fluctuations in demand for automotive products and components, affecting Motherson’s revenue and profitability.

8. Customer Relationships: Operational issues, delays in delivery, or quality problems can strain relationships with key customers. Maintaining strong customer relationships is crucial, as Motherson relies on long-term partnerships with major automotive manufacturers.

9. Global Economic Conditions: Motherson’s business is sensitive to global economic conditions. Economic downturns or uncertainties can lead to reduced consumer spending on automobiles, negatively impacting the demand for Motherson’s products.

10. Regulatory Changes: The automotive industry is subject to evolving regulations related to safety, emissions, and other standards. Complying with these regulations can be costly and complex. Changes in regulatory requirements may necessitate costly modifications to products or processes.