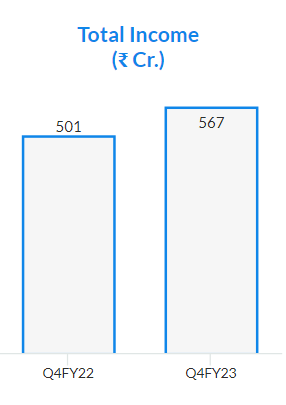

“FY ’23 has been an exciting year even after a lot of volatility for the business. The realizations for all the products were at peak at the starting of the year and have reached to a bottom level by the end of the year. Even after this, our top line for the year as a whole has increased by 41% to INR2,196 crores.

In FY ’23, we have commissioned various projects. We commissioned CPVC resin, epichlorohydrin, and additional capacity of caustic soda. This new and additional capacities have contributed marginally for the year as a whole and will contribute in a sizable way in FY ’24. The capex that we are already working on in FY ’24 towards additional capacity of CPVC resin and chlorotoluene and its value chain will bring volume growth in FY ’25.

Our transitions and the diversification towards derivatives and specialty chemical segments is now reflecting in numbers. Contribution from derivatives and specialty segments will keep on increasing as CPVC and ECH will contribute sizable way in FY ’24 and also because our all-future expansion plans are towards this segment for the business.”

– Mr. Maulik Patel, Chairman & Managing Director in Q4FY23 Concall

| Stock Data | |

| Ticker | MFL |

| Exchange | NSE |

| Industry | CHEMICALS |

| Price Performance | |

| Last 5 Days | +14.44% |

| YTD | -12.20% |

| Last 12 Months | -26.84% |

*As of 07.06.2023

Company Description:

Meghmani Finechem Ltd. is an Indian specialty chemicals company engaged in the manufacturing and marketing of pigments, agrochemicals, and intermediates. Established in 2007, the company has steadily grown its operations and has become a prominent player in the global chemical industry. This research report aims to provide an overview of Meghmani Finechem Ltd., including its business operations, financial performance, industry position, and future prospects.

Business Operations:

Meghmani Finechem Ltd. operates through multiple business segments, including Pigments, Agrochemicals, and Basic Chemicals. The Pigments segment manufactures a wide range of colorants and dyes used in various applications such as textiles, paints, inks, and plastics. The Agrochemicals segment produces crop protection chemicals, including insecticides, herbicides, fungicides, and plant growth regulators. The Basic Chemicals segment focuses on the production of intermediates used in the manufacturing of dyes, pigments, and other chemicals.

The company operates several manufacturing facilities in Gujarat, India, equipped with modern technologies and adhering to stringent quality standards. Meghmani Finechem Ltd. emphasizes research and development activities to enhance product quality, develop innovative solutions, and meet evolving market demands.

Industry Position:

Meghmani Finechem Ltd. operates in the specialty chemicals sector, which plays a crucial role in various industries such as textiles, paints and coatings, agrochemicals, and plastics. The Indian specialty chemicals industry has experienced robust growth due to rising domestic and international demand. Meghmani Finechem Ltd. has capitalized on this growth by leveraging its diverse product portfolio and expanding customer base. This is evident from the company’s increasing revenues.

The company has established a strong market presence in India and has expanded its global footprint through exports to over 75 countries. Meghmani Finechem Ltd. competes with both domestic and international players in the specialty chemicals market, and its ability to offer high-quality products, competitive pricing, and superior customer service has contributed to its success.

Future Prospects:

Meghmani Finechem Ltd. is well-positioned to capitalize on future opportunities in the specialty chemicals industry. The company’s strategic initiatives include:

- Capacity Expansion: Meghmani Finechem Ltd. plans to enhance its production capacity to meet growing demand. It has undertaken expansion projects to augment its existing manufacturing facilities and diversify its product offerings.

- Product Innovation: The company recognizes the importance of continuous innovation to maintain a competitive edge. Meghmani Finechem Ltd. invests in research and development activities to develop new products, improve existing formulations, and cater to emerging customer needs.

- Sustainability Focus: Meghmani Finechem Ltd. places emphasis on sustainable practices and responsible manufacturing. It aims to reduce its environmental impact through energy-efficient processes, waste reduction, and adoption of clean technologies.

- Market Diversification: The company intends to expand its market reach by targeting new geographies and sectors. It aims to leverage its existing customer relationships and distribution networks to explore untapped markets.

Key Challenges:

- Volatility in Raw Material Prices: Meghmani Finechem Ltd. relies on various raw materials, including petrochemicals and agricultural commodities, the prices of which can be subject to significant volatility. Fluctuations in raw material prices can impact the company’s profitability and margins, making it essential for Meghmani Finechem Ltd. to actively manage and mitigate these risks through strategic sourcing, hedging, and cost control measures.

- Regulatory and Compliance Factors: The chemical industry is subject to stringent regulations and compliance requirements related to safety, environmental impact, product labeling, and waste management.

- Intense Competition: Meghmani Finechem Ltd. operates in a highly competitive market, both domestically and internationally. The specialty chemicals industry witnesses significant competition from established players as well as new entrants. The company must continuously invest in research and development, product innovation, and operational efficiencies to differentiate itself and maintain a competitive edge in terms of quality, price, and customer service.