“As we have emphasized in the past, A&P investment will continue to be a key thrust for our growth as we believe that long-term brand building certainly is a much better choice over short-term profitability gains. Further, our focus on cost savings will continue and will be deployed to drive incremental growth. Owing to the above, we expect operating margins to move up by more than 100 bps year-on-year basis in FY24. We believe that we are moving in the right direction along the 4 strategic areas of diversification, distribution, digital and diversity, and we are confident of delivering improvement across all the 3 parameters of volume, revenue and earnings growth in FY24.”

-Saugata Gupta, CEO & Managing Director

Stock Data

| Ticker | MARICO |

| Industry | FMCG |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | -3.4% |

| Last 6 Months | 2.6% |

| Last 12 Months | 9.4% |

Business Basics

Marico Limited is a leading consumer goods company headquartered in India. With a strong presence in the beauty and wellness industry, Marico has built a portfolio of popular brands that cater to diverse consumer needs. The company operates in various segments and has established a strong market presence both in India and international markets. Marico’s core business lies in the manufacture and sale of hair care, skin care, and edible oil products.

Marico has successfully expanded its presence beyond India and operates in several international markets, including South Asia, the Middle East, and Africa. The company has a strong distribution network that enables it to reach consumers effectively across different geographies. In addition to its product portfolio, Marico focuses on innovation and product development to stay ahead in the market. The company continuously invests in research and development to introduce new and improved products that meet evolving consumer preferences and address emerging market trends.

Q4 FY23 Financial Performance

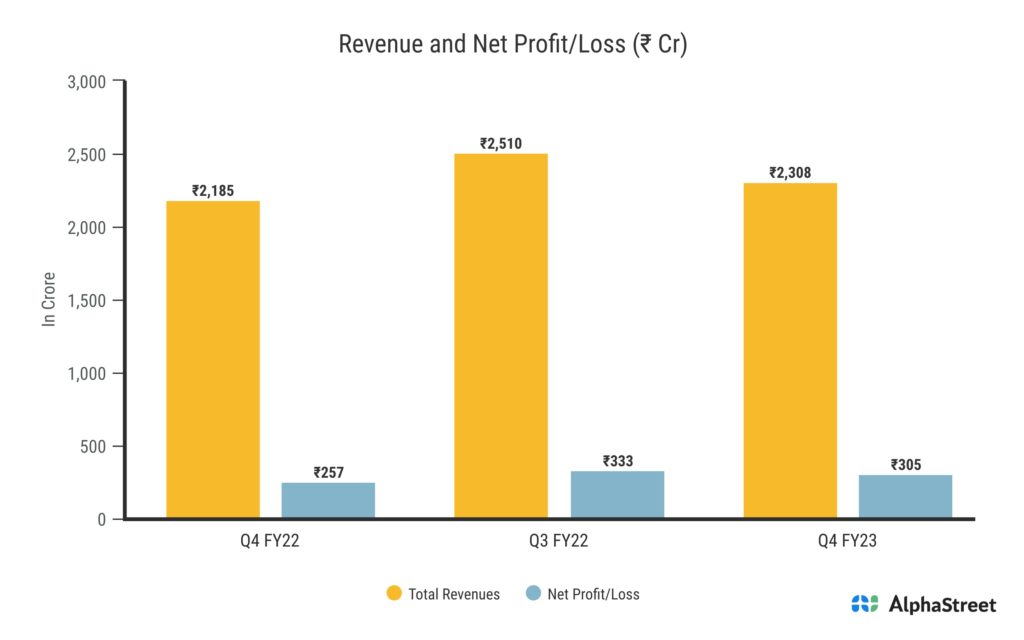

Marico Limited reported Total Income for Q4 FY23 of ₹2,308 Crore up from ₹2,185 Crore year on year, a growth of 5.6%. Consolidated Net Profit of ₹305 Crore, up 18.7% from ₹257 Crore in the same quarter of the previous year. The Earnings per Share is ₹2.34 for this quarter.

Marico’s Brand Portfolio

Marico Limited boasts a diverse and robust brand portfolio that caters to various consumer needs in the beauty and wellness industry. The company has strategically developed and nurtured several successful brands that have garnered a strong market presence and consumer loyalty. One of Marico’s flagship brands is Parachute, which has become synonymous with quality coconut hair oil in India. Parachute is widely trusted for its nourishing and strengthening properties, making it a household name for hair care.

Marico’s hair care portfolio extends beyond Parachute and includes other well-known brands such as Nihar, Hair & Care, and Livon. Nihar offers a range of hair oils that cater to different hair types and concerns, while Hair & Care specializes in hair oils enriched with natural ingredients. Livon, on the other hand, focuses on hair serums and leave-in conditioners that provide smoothness and manageability.

In addition to hair care, Marico has made a mark in the edible oil category with its Saffola brand. Saffola offers a range of cooking oils that promote heart health and wellness. The brand emphasizes the importance of making healthy choices in cooking and has gained a strong reputation for its quality and health-conscious offerings. Marico’s brand portfolio also includes other notable names such as Mediker, a leading anti-lice hair care brand, and Revive, a brand focused on personal hygiene and wellness products. These brands cater to specific needs within the personal care segment, showcasing Marico’s ability to address diverse consumer preferences.

Marico’s Domestic & International Brand Acquisitions

Marico Limited has made significant strides in the personal care segment through a series of strategic acquisitions. One of Marico Limited’s notable acquisition was the Indian hair oil company Nihar Naturals in 2007. Marico gained access to Nihar Naturals’ large consumer base and extensive distribution network through this acquisition. Marico’s existing portfolio was complemented by the brand’s herbal hair oil selections, which enabled the business to meet a wider range of customer preferences. In addition to Nihar Naturals, Marico also acquired Fiancee, a brand focused on the female grooming segment in the same period. By leveraging its marketing and distribution capabilities, Marico aimed to strengthen Fiancee’s position and capture a larger share of the female grooming market.

The acquisition of Caivil by Marico in 2007–2008 increased its presence in the hair care industry. Leading South African brand Caivil provided a selection of hair care items for various hair types and textures. Marico sought to enter the African market with this acquisition and capitalise on Caivil’s strong brand equity to promote regional growth. Another acquisition that strengthened Marico’s position in the African hair care market in 2007–2008 was Black Chic. These companies catered to customers with particular hair care requirements by specialising in hair relaxers and styling products. Furthermore, Haircode, a well-known hair dye in Bangladesh, was also purchased by Marico during that time.

Code IO, X-Men, and Set Wet were all acquisitions aimed at the men’s grooming market. The company acquired these brands in 2010, 2011, and 2012, respectively. To meet the grooming requirements of the modern man, they collectively offered a wide variety of products, including hair gels, deodorants, and fragrances. Marico’s presence in the hair care industry was further enhanced by the 2012 acquisition of Livon, a well-known hair serum company. A key Indian brand for men’s grooming, Beardo, was another significant acquisition by Marico. To meet the changing needs of men’s grooming, Beardo provided a variety of products, including beard care, hair care, and skincare items. Marico’s 2017 acquisition of Beardo gave the business a solid foundation in India’s expanding men’s grooming market.

Its position in the African market was bolstered by the acquisition of Isoplus, a leading South African brand in ethnic hair care products. For an undisclosed sum, Marico purchased a majority stake in Apcos Naturals, the company that owns “Just Herbs,” in 2021. In 2022, Marico also purchased a 54% stake in the direct-to-consumer company HW Wellness Solutions Private Limited. The True Elements brand is owned by HW Wellness Solutions. Purité de Prôvence and liv, two premium beauty brands, were also acquired by Marico.