Stock Data:

| Ticker | NSE: M&M |

| Exchange | NSE |

| Industry | Automobile |

Price Performance:

| Last 5 Days | +1.95% |

| YTD | +10.67% |

| Last 12 Months | +40.05% |

Company Description:

Mahindra and Mahindra Ltd. is the flagship company of the Mahindra Group, with core businesses in the automotive and tractor segments. M&M is a leading player in the Indian automotive industry, offering a diverse range of vehicles across all segments, including LCVs, UVs, 3Ws, medium and heavy commercial vehicles (MHCVs), and 2Ws. In addition to the automotive sector, M&M also holds controlling interests in various businesses under the Mahindra brand, including IT services, NBFC, logistics, hospitality, real estate, and auto ancillary businesses.

Critical Success Factors:

1. Diversified Product Portfolio: M&M has a strong presence across various segments of the automotive industry, offering a wide range of vehicles. This diversification provides stability and resilience to the company’s operations.

2. Market Leader in Tractor Segment: M&M holds a significant market share in the tractor segment, benefitting from its strong brand reputation, extensive distribution network, and customer trust. The company has been expanding its product portfolio and gaining market share through new product launches and expansion of the Swaraj brand.

3. Focus on Electric Vehicles (EVs): M&M has a well-defined roadmap for its EV segment and aims to achieve substantial growth in this sector. The company’s latest EV launch, the XUV400, has received a positive response in the market, and M&M plans to ramp up production volumes in the coming months.

4. Strong Order Book Position: M&M maintains a robust order book, indicating strong demand for its vehicles. The order book for the PV segment stands at 292,000 units, with significant bookings for key brands such as XUV300, XUV400, Bolero, Thar, and Scorpio.

5. International Market Expansion: M&M is actively pursuing expansion in international markets, particularly in the tractor and automotive segments. The company aims to penetrate individual markets through localized strategies and plans to introduce EVs in both right-hand drive and left-hand drive markets.

Key Challenges:

1. Dependence on Monsoon and Agricultural Sector: M&M’s tractor segment is closely tied to the performance of the agricultural sector, which is influenced by factors such as monsoon patterns, crop yields, and government policies. Any adverse developments in these areas could impact tractor demand.

2. Competitive Market Environment: The automotive industry in India is highly competitive, with numerous domestic and international players vying for market share. M&M faces intense competition, and its ability to sustain and grow market share is subject to various competitive factors.

3. Delayed or Unsuccessful Product Launches: M&M’s growth prospects are linked to its ability to introduce new products successfully. Any delays or failures in product launches could adversely impact the company’s market position and financial performance.

4. Commodity Price Volatility: M&M’s profitability is sensitive to fluctuations in commodity prices, particularly raw materials used in vehicle manufacturing. Price volatility could impact the company’s margins and profitability.

5. Regulatory and Policy Changes: The automotive industry is subject to various regulations and policy changes related to emissions, safety standards, and import/export regulations. Any significant regulatory changes could require M&M to make adjustments to its operations and product offerings, which may incur additional costs.

Financial Performance:

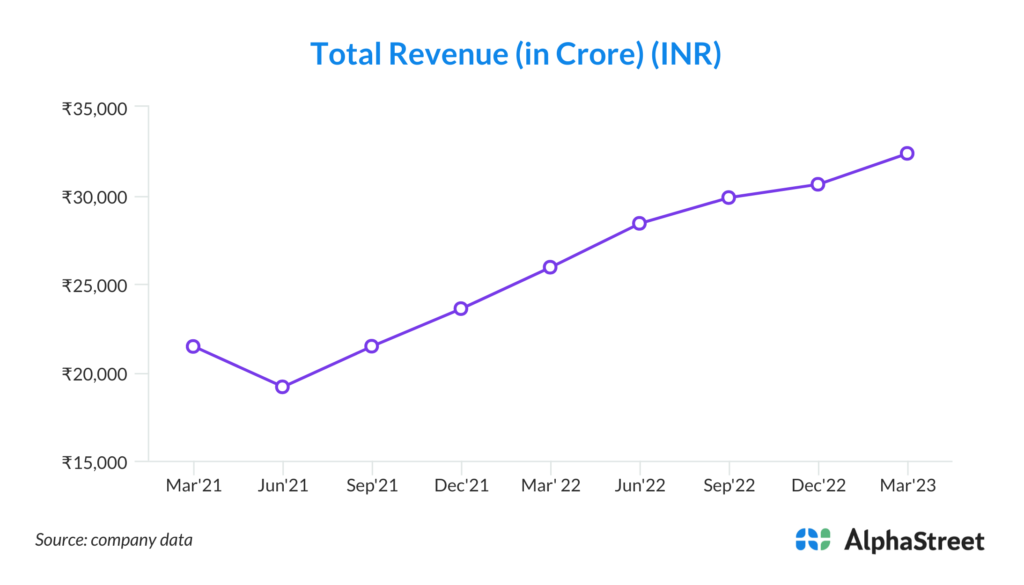

M&M reported a strong financial performance in Q4FY2023. The automotive segment registered a 10.8% q-o-q growth in revenue, driven by increased volumes and average selling prices. The tractor segment reported a decline in revenue due to lower volumes but maintained a healthy EBIT margin. The company’s profitability was supported by cost optimization measures and improved product mix. Overall, M&M’s consolidated revenue for the quarter stood at INR 28,650 crore, representing a growth of 8.6% compared to the previous quarter. The company’s operating profit (EBIT) increased by 12.4% to INR 3,187 crore, driven by higher volumes, favorable product mix, and cost control initiatives. The EBIT margin improved by 40 basis points to 11.1%.

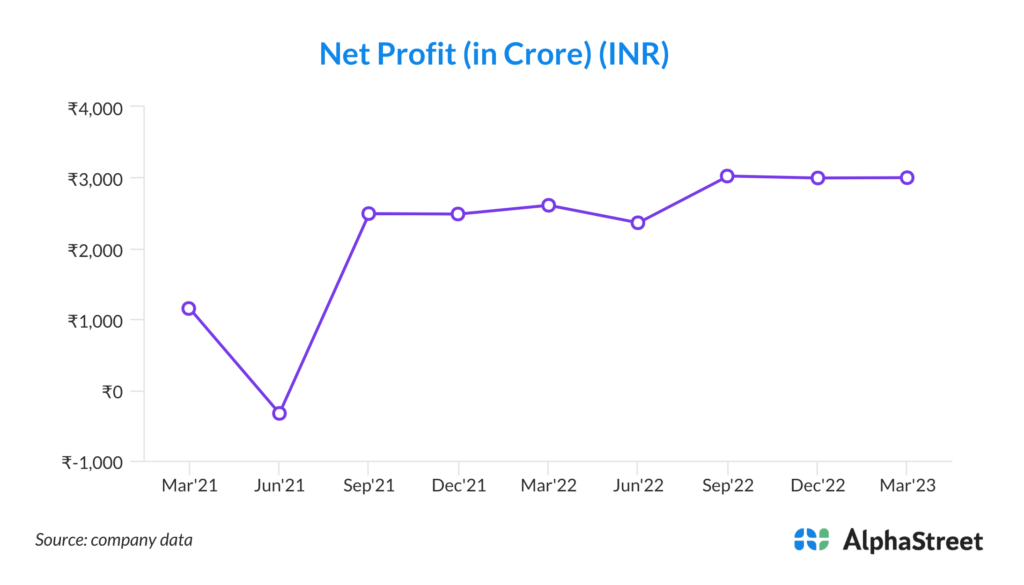

M&M’s net profit for the quarter was INR 1,856 crore, reflecting a growth of 15.9% compared to the previous quarter. The company’s strong financial performance can be attributed to the recovery in demand across its key segments and effective cost management. Cash flows remained robust, with M&M generating operating cash flow of INR 3,455 crore during the quarter. The company’s liquidity position remains strong, supported by healthy cash reserves and available lines of credit.