Company Overview

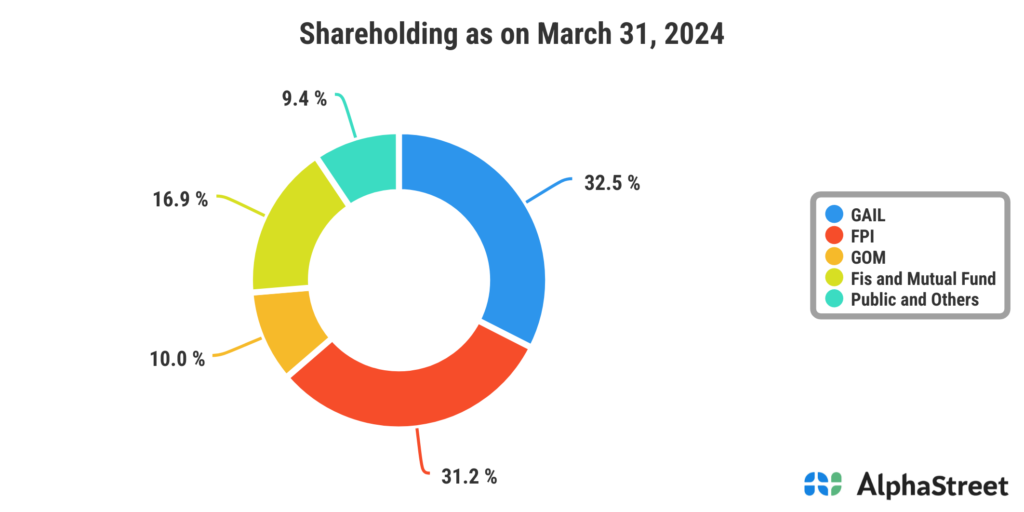

Mahanagar Gas Ltd. (MGL) is one of India’s leading natural gas distribution companies. Established in 1995, MGL operates primarily in Mumbai and its surrounding regions, providing piped natural gas (PNG) to domestic, commercial, and industrial customers, as well as compressed natural gas (CNG) for the automotive sector. The company is a joint venture between GAIL (India) Ltd. and the BG Group, now part of Royal Dutch Shell.

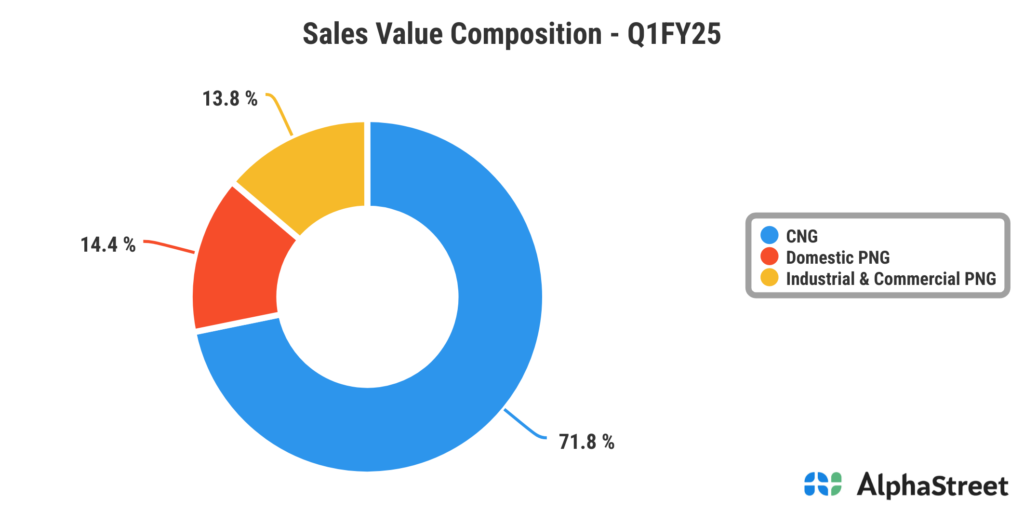

PNG Segment

The company supplies Piped natural gas (PNG) for domestic, industrial and commercial uses. It has a wide network of 6,500+ kms of carbon steel and polyethylene pipeline. Presently, it has ~24.9 lakh domestic customers with a capacity to connect ~30 lakh customers in the domestic segment. It also serves to ~4,500 commercial and industrial customers.

CNG Segment

As of March 2024, the company has a well-established network of ~347 CNG stations and 1,909 dispensing points spread across Mumbai and its adjoining areas. Presently, it serves to ~9.96 lakh CNG customers in its Geographical areas.

Geographical Areas

Presently, the company operates in 3 Geographical areas (GA) namely Mumbai & Greater Mumbai (GA1), Adjoining areas of Mumbai (GA2) and Raigad District (GA3). It has established a firm presence with a dominating market share in the Greater Mumbai (GA1) distribution business which contributes ~70% of revenues as per 2024.

Infrastructure Exclusivity

The company has infrastructure exclusivity for Extension areas of Mumbai (GA2) and Raigad (GA3) till 2030 and 2040 respectively.

Raigad District (GA3) – It was won by the company in 2015 with an infrastructure exclusivity period of 25 years.

Market Position

Presently, the company has a dominant position in all its 3 operating GAs primarily due to infrastructure exclusivity and/or first-mover advantage

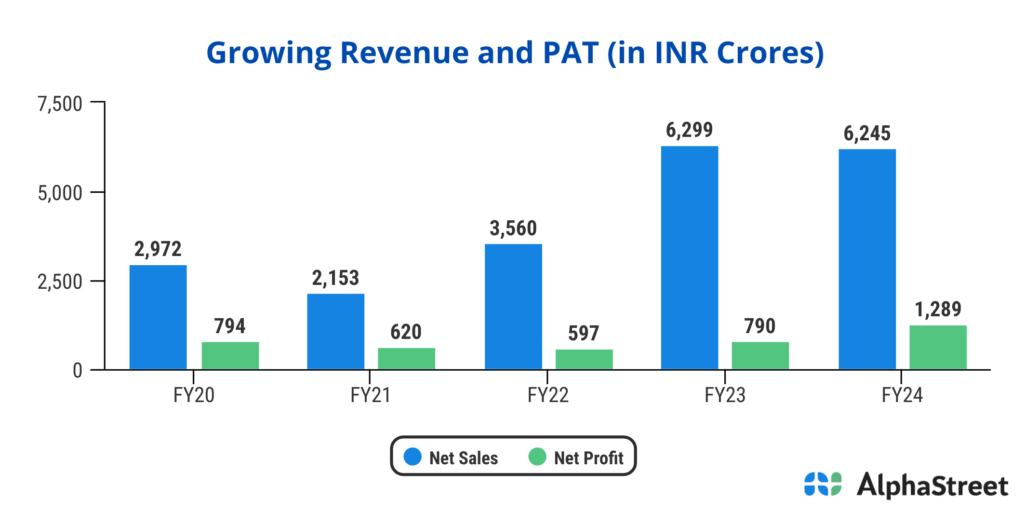

Recent Financial Performance

In the financial year 2023-2024, Mahanagar Gas reported a net profit of INR 1,289 crore, marking a 63% increase from the previous year’s INR 790 crore. The company’s operating profit stood at INR 1,843 crore, up from INR 1,184 crore, reflecting a 56% increase in profitability.

- Quarterly Revenue (Q4 FY2024): INR 1,567 crore (-3% YoY)

- Quarterly Operating Profit (Q4 FY2024): INR 394 crore (+1% YoY)

- Quarterly Net Profit (Q4 FY2024): INR 265 crore (-1.4% YoY)

Shareholding:

Moat and Key Strengths

- Extensive Distribution Network: MGL operates an extensive natural gas distribution network, with over 5,000 km of pipeline infrastructure serving more than 1.2 million domestic consumers, 4,000 commercial establishments, and 400 industrial customers. This extensive network provides a significant competitive edge and ensures stable revenue streams.

- Regulated Market Position: As a regulated utility, MGL benefits from a monopolistic market position in its operating regions. The regulatory framework ensures a steady return on investments, minimizing competitive pressures and providing long-term revenue visibility.

- Strong Growth in CNG Segment: The rising adoption of CNG as a cleaner and more economical alternative to petrol and diesel has driven robust growth in MGL’s CNG segment. In FY2024, CNG sales volume increased by 18%, contributing significantly to the company’s revenue growth. MGL operates over 300 CNG stations, with plans to expand to 350 stations by FY2025.

- Environmental Sustainability: MGL’s focus on natural gas aligns with global and national priorities for cleaner energy solutions. Natural gas is a cleaner fuel compared to traditional fossil fuels, reducing carbon emissions and improving air quality. This positions MGL favorably in the context of increasing environmental regulations and societal shifts towards sustainability.

Key Risks or Concerns

- Regulatory Risks: MGL operates in a highly regulated industry. Changes in regulatory policies, tariff structures, or government subsidies could impact the company’s financial performance. For example, any adverse changes in the allocation of domestic natural gas could increase input costs, affecting profitability.

- Supply Chain Dependency: The company’s operations depend significantly on the supply of natural gas from GAIL and other sources. Any disruption in supply due to geopolitical tensions, pipeline issues, or other factors could adversely affect MGL’s ability to meet consumer demand. In FY2024, about 75% of MGL’s natural gas supply was sourced from GAIL.

- Economic Sensitivity: MGL’s revenue is sensitive to economic conditions. A slowdown in economic activities can reduce industrial and commercial consumption of natural gas. Additionally, high inflation or economic downturns can affect consumer spending power, impacting CNG sales.

Industrial Overview

The natural gas distribution industry in India is poised for significant growth, driven by the government’s initiatives to increase the share of natural gas in the country’s energy mix from the current 6% to 15% by 2030. The government is promoting the expansion of city gas distribution (CGD) networks, aiming to cover more cities and towns.

City Gas Distribution (CGD) Sector: The CGD sector is expected to grow at a CAGR of 10-12% over the next five years, driven by increasing urbanization, rising environmental awareness, and supportive government policies. The demand for PNG and CNG is projected to rise steadily, with the latter benefiting from the growing adoption of CNG vehicles.

Future Outlook

- The Company has capex plan of Rs 1,000 Crores for FY 2024-25 . Out of this composition the company plans to spends Rs 800 on MGL and Rs 200 Crore on UEPL. They plan on creating pipeline infrastructure steel of 25 kms, PE of 200 kms and around 60 CNG station in MGL and 30 in UEPL, PNG Domestic Connection of more than 3 Lakhs and 60 Industrial connection and 300 Commercial Connections.

- The company expects a volume growth in the range of 6 to 7%.

Analysis

Mahanagar Gas Ltd. is well-positioned to capitalize on the growth opportunities in the natural gas distribution sector, supported by its extensive infrastructure, strong market position, and focus on environmental sustainability. The company’s robust financial performance, driven by increasing CNG adoption and expanding customer base, underscores its growth potential.

However, potential regulatory changes and supply chain dependencies pose significant risks. MGL must navigate these challenges carefully to sustain its growth trajectory. The company’s strategic initiatives, including the expansion of CNG stations and continuous improvement of its distribution network, are crucial for maintaining its competitive edge.

Valuation Perspective: Given MGL’s stable revenue growth, strong EBITDA margins, and strategic initiatives to expand its distribution network, the company presents a solid investment opportunity.

Conclusion

Mahanagar Gas Ltd. presents a compelling investment opportunity in the natural gas distribution sector, supported by its extensive distribution network, regulated market position, and strong growth in the CNG segment. However, potential investors should remain cautious of regulatory risks and supply chain dependencies. Overall, MGL’s strategic initiatives and solid financial performance provide a positive outlook for future growth.