Company Overview:

Mahanagar Gas Limited (MGL) is one of India’s leading Natural Gas Distribution Companies, primarily operating in the Greater Mumbai area (GA1), its expansion areas (GA2), and Raigad (GA3). Established with a dominant position in Compressed Natural Gas (CNG) and Piped Natural Gas (PNG) distribution, MGL benefits from strong parentage with GAIL India Ltd holding a 32.5% stake.

Financial Performance:

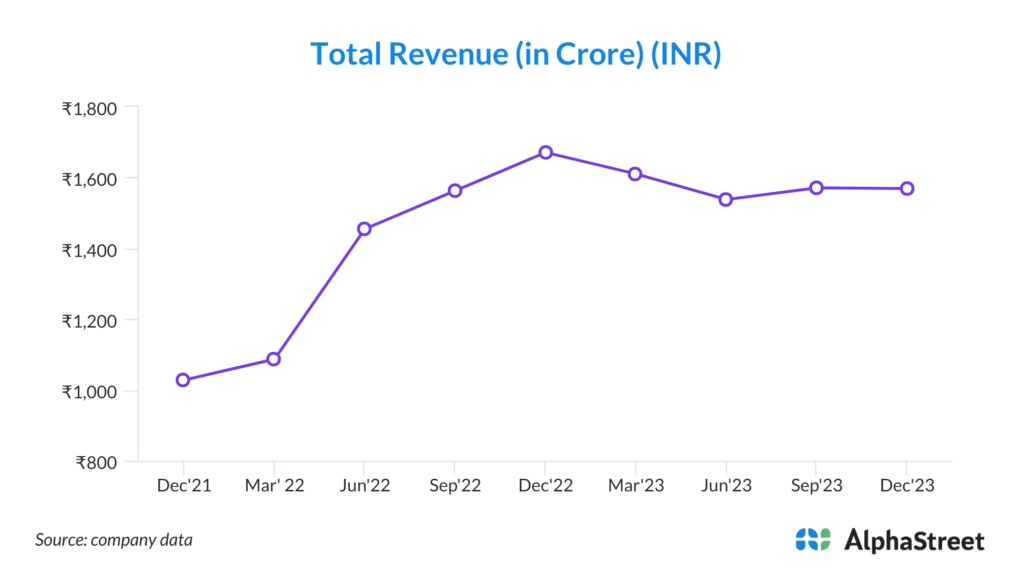

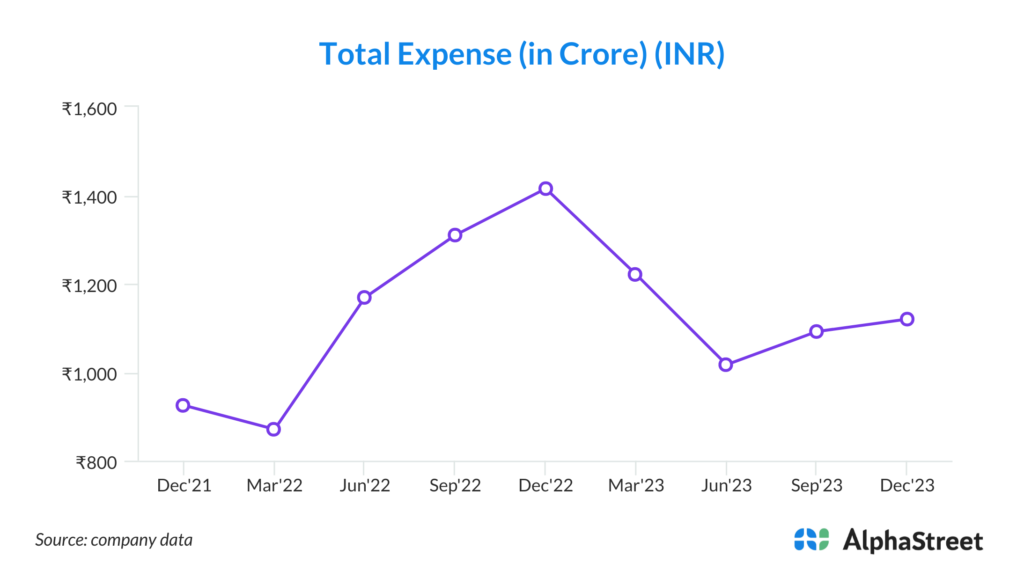

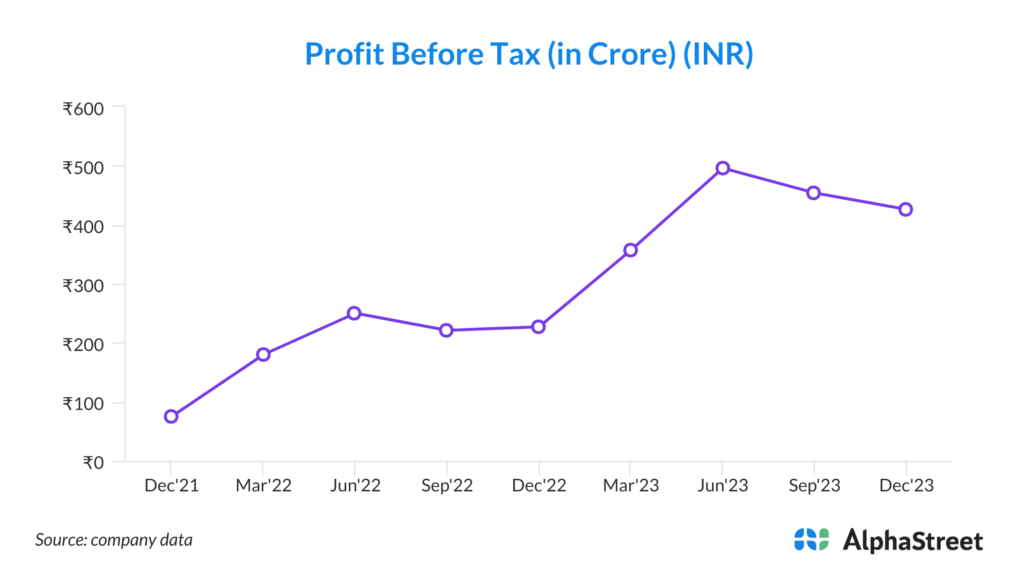

In Q3FY24, Mahanagar Gas Limited (MGL) demonstrated a resilient financial performance in line with expectations. Despite a marginal decline in net revenue, which stood at Rs 1,569 crore, down by 6.1% QoQ and almost flat YoY, the company exhibited notable strength in its operational metrics. EBITDA witnessed a remarkable surge, growing by 75.2% QoQ to reach Rs 449 crore, albeit experiencing a slight dip of 6.3% YoY. Notably, the EBITDA margin improved significantly, standing at 28.6% in Q3FY24 compared to 15.2% in Q3FY23 and 30.5% in the preceding quarter, showcasing the company’s enhanced operational efficiency. Furthermore, despite facing challenges, net profit for the quarter reached Rs 317 crore, exhibiting stability in comparison to the previous year’s corresponding period. The PAT margin stood at 20.2% in Q3FY24, slightly lower than the same period last year (21.5%), yet significantly higher than Q2FY24 (10.3%). These financial indicators reflect MGL’s ability to navigate through market dynamics and maintain profitability amidst evolving industry landscapes.Key Strengths of the Company:

Key Strengths of the Company

1. Dominant Market Position: MGL holds a dominant position in the Greater Mumbai area (GA1) and its expansion areas (GA2) and Raigad (GA3) in the natural gas distribution sector. With a vast network of Compressed Natural Gas (CNG) stations and Piped Natural Gas (PNG) distribution infrastructure, MGL enjoys exclusivity and significant market share, bolstering its revenue streams and competitive advantage. This entrenched position not only ensures stable revenues but also acts as a barrier to entry for potential competitors, enhancing MGL’s market resilience and long-term sustainability.

2. Strategic Parentage and Partnerships: Backed by GAIL India Ltd as its sole promoter, MGL benefits from strong parentage, which provides technical, managerial, and operational support. This affiliation enables MGL to leverage GAIL’s expertise and resources for sourcing natural gas and managing operations efficiently. Moreover, strategic partnerships with innovative startups and joint ventures, such as Mahanagar LNG Private Ltd and Nawgati, reflect MGL’s proactive approach towards fostering collaboration and exploring new business avenues, enhancing its market agility and growth prospects.

3. Robust Expansion Plans and Infrastructure: MGL’s commitment to expanding its network and infrastructure underscores its growth-oriented strategy. With a focus on adding new CNG stations, expanding pipeline networks, and penetrating untapped geographies, MGL aims to capitalize on growing demand for natural gas. High capital expenditure in FY23 and planned investments for future expansion signify MGL’s confidence in its growth trajectory. This proactive approach not only strengthens MGL’s market presence but also positions it to cater to evolving consumer needs and emerging market opportunities effectively.

4. Government Support and Favorable Policy Environment: MGL stands to benefit from the Indian government’s emphasis on increasing the share of natural gas in the country’s energy mix. With initiatives aimed at reducing carbon emissions and promoting cleaner energy sources, the government’s push for natural gas adoption presents a conducive environment for MGL’s growth. Moreover, policies facilitating city gas projects, renewable energy integration, and infrastructure development align with MGL’s objectives, providing regulatory support and revenue visibility. This favorable policy landscape enhances MGL’s market outlook and facilitates sustainable growth.

5. Focus on Innovation and Diversification: MGL’s proactive stance towards innovation and diversification strengthens its competitive edge and resilience. Initiatives like establishing Mahanagar LNG Private Ltd, collaborating with startups for enhanced customer services, and venturing into non-gas portfolios demonstrate MGL’s adaptability and forward-thinking approach. By embracing technological advancements and exploring new business verticals, MGL not only enhances its value proposition but also mitigates risks associated with industry disruptions and evolving consumer preferences. This strategic focus on innovation and diversification reinforces MGL’s position as a market leader and fosters long-term shareholder value.

Key Risks and Concerns for the Company:

1. Regulatory Uncertainties and Policy Changes: MGL faces risks associated with regulatory uncertainties and potential policy changes in the oil and gas industry. Shifts in government policies regarding pricing mechanisms, allocation of natural gas, and marketing exclusivity could impact MGL’s operations and profitability. Moreover, changes in regulatory frameworks by bodies like PNGRB may introduce new challenges, such as third-party access to infrastructure, affecting MGL’s market position and revenue streams. These regulatory risks require MGL to maintain flexibility and adaptability to navigate evolving industry dynamics and regulatory landscapes effectively.

2. Competitive Pressures and Market Saturation: As the natural gas distribution market becomes increasingly competitive, MGL faces challenges from existing competitors and potential new entrants. Rival CGD players, such as BPCL, IOC, and Adani Total Gas Ltd, are ramping up investments and expanding their footprints, intensifying competitive pressures. Moreover, market saturation in MGL’s primary operating areas, particularly Mumbai and its adjoining regions, limits growth opportunities and exposes MGL to pricing pressures and margin erosion. To mitigate these risks, MGL must focus on differentiation, operational efficiency, and market penetration strategies.

3. Economic Volatility and Oil Price Fluctuations: MGL’s business performance is susceptible to economic volatility and fluctuations in oil and gas prices. Economic downturns, currency fluctuations, and geopolitical tensions can impact consumer spending patterns, affecting MGL’s demand and revenue. Additionally, sharp fluctuations in oil prices may lead to fluctuations in natural gas prices, impacting MGL’s profitability and margins. To mitigate these risks, MGL must adopt robust risk management practices, including hedging strategies, cost optimization measures, and diversification of revenue streams to cushion against economic uncertainties and commodity price risks.

4. Infrastructure Limitations and Project Execution Risks: MGL’s expansion plans and infrastructure development initiatives are subject to risks associated with project execution, including delays, cost overruns, and operational challenges. Factors such as regulatory approvals, land acquisition, environmental clearances, and labor shortages can impede project timelines and increase project costs. Moreover, logistical constraints and infrastructure bottlenecks may limit the scalability of MGL’s operations, hindering its ability to meet growing demand efficiently. To mitigate these risks, MGL must enhance project management capabilities, streamline approval processes, and invest in technology and innovation to optimize infrastructure utilization and enhance operational efficiency.

5. Technological Disruptions and Emerging Threats: MGL faces risks from technological disruptions and emerging threats, such as the rapid adoption of electric vehicles (EVs) and advancements in alternative energy sources. The widespread adoption of EVs could reduce demand for CNG, impacting MGL’s revenue from the transportation segment. Additionally, advancements in renewable energy technologies and decentralized energy solutions may pose challenges to MGL’s traditional business model. To address these risks, MGL must stay abreast of technological trends, diversify its product portfolio, and invest in sustainable energy solutions to remain competitive and resilient in a rapidly evolving energy landscape.