Company Overview:

Lumax Auto Technologies, founded in 1981, is a leading player in the automotive industry, part of the D.K Jain Group. Initially focused on two-wheeler lighting, the company has evolved into a comprehensive provider of automotive solutions. Lumax offers a diverse range of products, including integrated plastic modules, lighting, gear shifters, emission systems, and aftermarket solutions, catering to 2-wheelers, 3-wheelers, passenger and commercial vehicles, and the farm equipment sector. With strategic acquisitions, joint ventures, and technological partnerships, Lumax is positioned for sustained growth and profitability. Its strong financial performance, robust order book, and diversified client base underline its market leadership and resilience.

Financial performance Q3FY24:

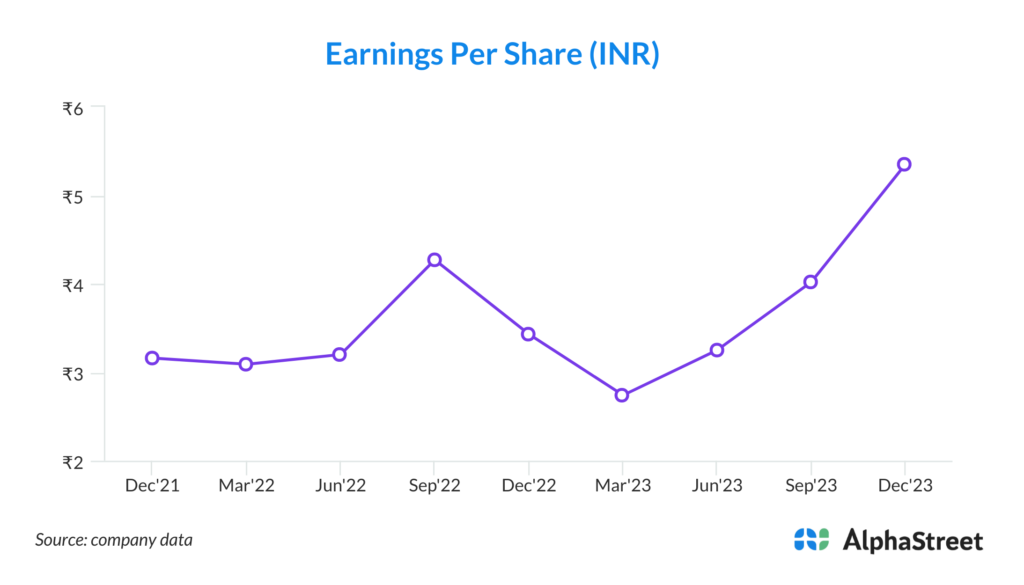

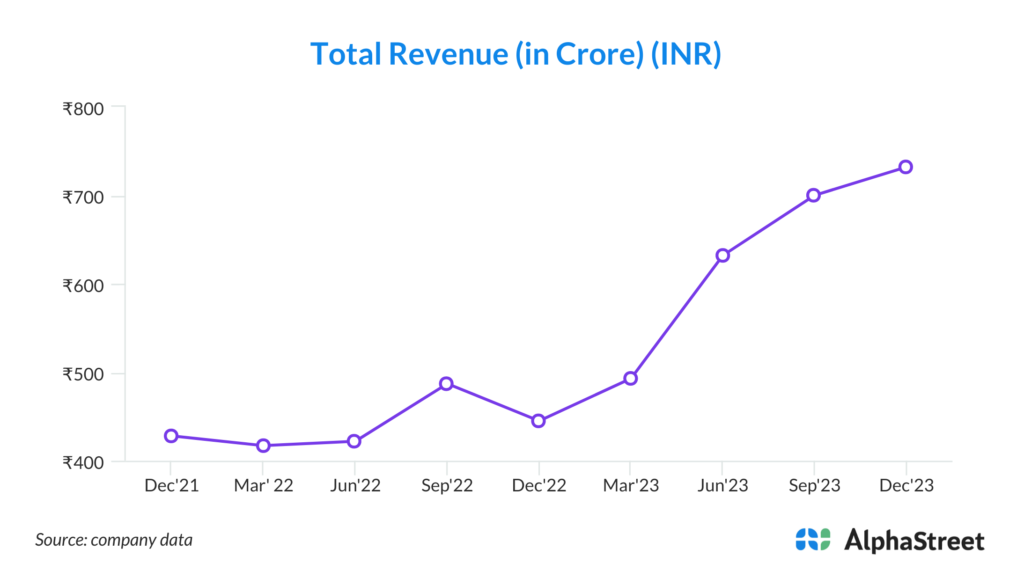

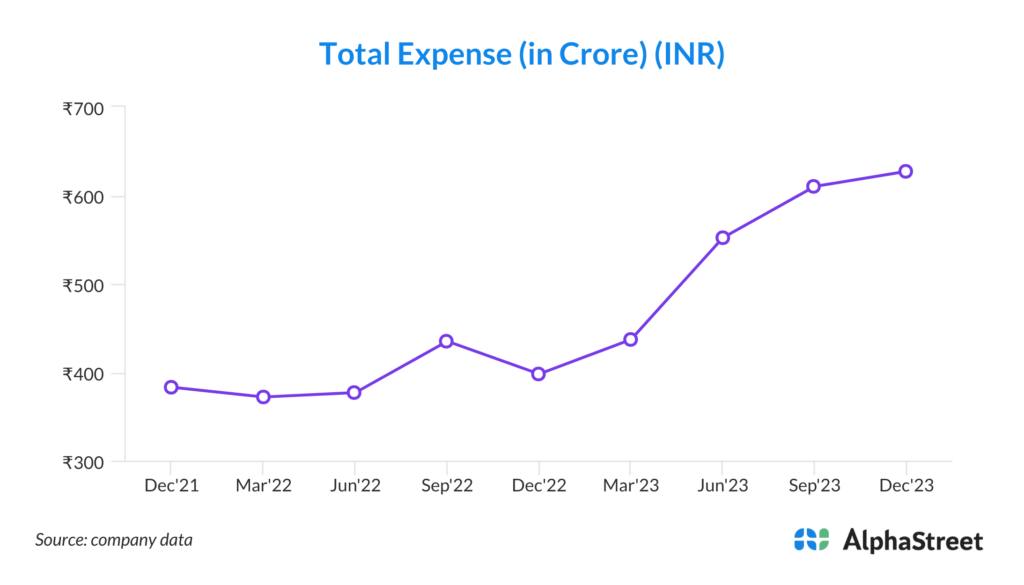

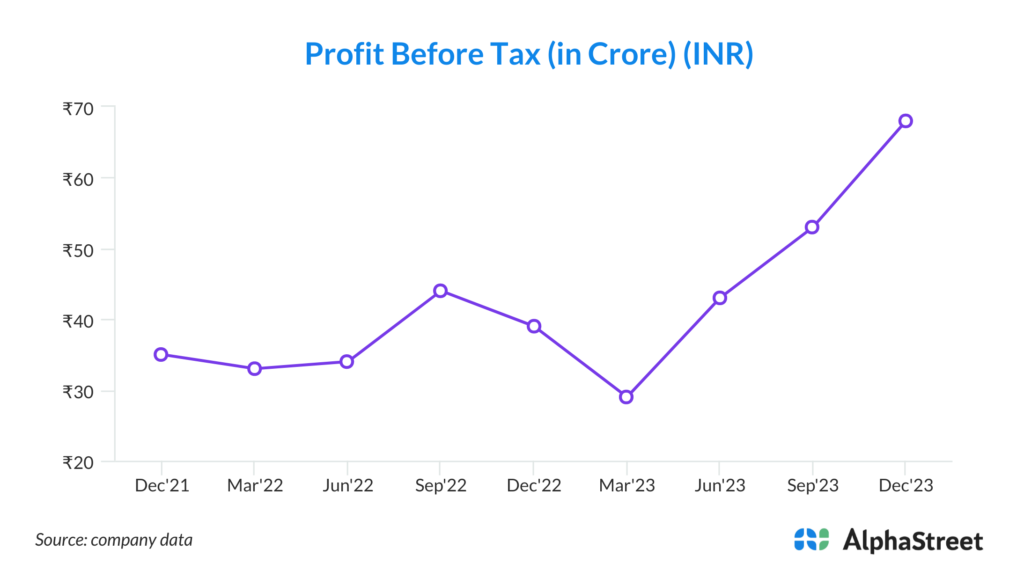

In Q3FY24, Lumax Auto Technologies reported robust financial performance, marked by significant growth across key financial metrics. The company’s profit after tax (PAT) surged by an impressive 56% year-on-year (YoY) to Rs 36 crore, driven by the successful acquisition of IAC International Automotive. Consolidated revenue soared by 65% YoY to Rs 732 crore, showcasing strong demand for its automotive products. Excluding the impact of the acquisition, the company’s topline still witnessed a commendable 9% increase. Moreover, earnings before interest, taxes, depreciation, and amortization (EBITDA) witnessed a substantial growth of 124% YoY to Rs 106 crore, with EBITDA margin expanding by 390 basis points to 14.5%. This margin improvement was primarily attributed to Lumax’s higher-margin business segments, particularly those associated with key customers like Bajaj Auto and Honda Motorcycle & Scooter India (HMSI), as well as increased aftermarket sales. The performance of segments such as gear shifters and aftermarket business reported notable growth, further bolstering the company’s financial position.

Key strengths of the Company:

1. Diversified Product Portfolio: Lumax boasts a wide array of automotive solutions ranging from integrated plastic modules to emission systems. This diverse product portfolio enables the company to cater to various segments within the automotive industry, including 2-wheelers, 3-wheelers, passenger vehicles, commercial vehicles, and the farm equipment sector. Such diversification not only mitigates the risk associated with dependence on a single product line but also positions Lumax as a one-stop solution provider for its clients, enhancing customer loyalty and market competitiveness.

2. Strategic Acquisitions and Partnerships: Through strategic acquisitions and partnerships, such as the acquisition of IAC International Automotive, Lumax has expanded its product offerings and market presence. These alliances have enabled the company to enhance its technological capabilities, enter new market segments, and access a broader customer base. By leveraging the expertise and resources of its partners, Lumax strengthens its competitive position and accelerates its growth trajectory in the automotive industry.

3. Strong Order Book and Revenue Visibility: With an outstanding order book of approximately Rs. 1100 crore, Lumax enjoys robust revenue visibility, providing stability and predictability to its financial performance. The company’s strong order pipeline, comprising orders from both domestic and international clients, underscores its market demand and customer confidence. This healthy order book not only ensures a steady stream of revenue but also reflects Lumax’s ability to secure new business and maintain long-term relationships with its customers.

4. Focus on Innovation and Technology: Lumax prioritizes innovation and technology advancement to stay ahead of industry trends and meet evolving customer needs. By investing in research and development, the company continuously develops cutting-edge solutions and enhances its product offerings. Moreover, strategic collaborations with global leaders and technology partners enable Lumax to access state-of-the-art technologies and integrate them into its products, ensuring competitiveness and relevance in the rapidly evolving automotive landscape.

5. Strong Financial Performance and Market Leadership: With its robust financial performance and market leadership position, Lumax demonstrates resilience and stability in the automotive sector. The company’s consistent revenue growth, profitability, and prudent financial management underscore its strong fundamentals and operational efficiency. Lumax’s market leadership in key product segments, coupled with its extensive distribution network and brand reputation, solidifies its position as a preferred supplier among OEMs and aftermarket customers, driving sustainable growth and value creation for its stakeholders.

Key risk and concern for the Company:

1. Dependency on Automotive Industry: Lumax’s business is closely tied to the automotive industry’s performance, exposing it to the cyclical nature of the sector. Any downturn in automobile sales or disruptions in the supply chain could adversely affect Lumax’s revenue and profitability. Economic downturns, changes in consumer preferences, or regulatory changes impacting the automotive sector could pose significant risks to the company’s financial stability and growth prospects.

2. Vulnerability to Raw Material Price Fluctuations: As a manufacturer of automotive components, Lumax is susceptible to fluctuations in raw material prices, particularly those of commodities like steel and plastics. Sharp increases in raw material costs without corresponding adjustments in selling prices could squeeze profit margins, impacting the company’s financial health. Additionally, supply chain disruptions or shortages of key raw materials could disrupt production schedules and hinder Lumax’s ability to meet customer demands.

3. Intense Competition in the Industry: The automotive components market is highly competitive, with numerous domestic and international players vying for market share. Intense competition may lead to pricing pressures, reduced margins, and the need for continuous investments in innovation and technology to stay ahead. Failure to effectively compete on factors such as quality, cost, and delivery schedules could erode Lumax’s market share and profitability over time.

4. Client Concentration Risk: Lumax’s revenue is significantly reliant on a few key customers, notably major automotive manufacturers like Mahindra & Mahindra and Bajaj Auto. Any adverse developments affecting these key clients, such as production cuts, loss of market share, or changes in procurement strategies, could have a material impact on Lumax’s business performance. Diversification of the customer base and reducing dependency on a few clients is essential to mitigate this risk effectively.

5. Technology Obsolescence: The automotive industry is witnessing rapid technological advancements, including the shift towards electric vehicles (EVs), autonomous driving technologies, and connectivity solutions. Lumax must continually invest in research and development to stay abreast of these technological trends and adapt its product portfolio accordingly. Failure to anticipate and respond to changing technology trends could render Lumax’s products obsolete, leading to reduced demand, loss of market share, and diminished competitiveness in the industry.