Prozone Intu Properties Limited is a leading Indian real estate developer with a focus on developing and managing large-scale integrated retail-led mixed-use developments across India. The company has a strong presence in major Indian cities, including Mumbai, Pune, Nagpur, and Coimbatore. Prozone Intu Properties has a diversified portfolio of assets that includes retail malls, office spaces, hotels, and residential developments.

| Stock Data | |

| Ticker | PROZONINTU |

| Exchange | NSE |

| Industry | REALESTATE |

| Price Performance | |

| Last 5 Days | -4.04% |

| YTD | -32.59% |

| Last 12 Months | -18.00% |

*As of 21.04.2023

Company Description:

Prozone Intu Properties primarily operates through three business segments, namely, Real Estate Development, Leasing and Management of properties, and Hospitality. The company’s primary focus is on developing large-scale retail-led mixed-use developments that cater to the growing demand for high-quality shopping and entertainment destinations in India.

The malls are located in Tier-I and Tier-II cities, including Mumbai, Pune, Nagpur, and Coimbatore. Prozone Intu Properties has also completed two commercial office projects with a total leasable area of approximately 0.7 million square feet.

Prozone Intu Properties has also diversified its business operations into the hospitality sector. The company currently operates a hotel under the Marriott brand in Nagpur, with a total of 150 rooms.

Future Prospects:

Prozone Intu Properties is well-positioned to benefit from the growing demand for high-quality retail and entertainment destinations in India. The company’s strong presence in Tier-I and Tier-II cities, combined with its diversified portfolio of assets, provides a solid foundation for future growth.

Prozone Intu Properties has several projects in the pipeline, including a retail mall in Aurangabad and a mixed-use development in Pune. The company is also planning to expand its hospitality portfolio by opening new hotels in major Indian cities.

Key Strengths:

- Diversified Portfolio: Prozone Intu Properties has a diversified portfolio of assets that includes retail malls, office spaces, hotels, and residential developments. This allows the company to mitigate risk and generate revenue from multiple sources.

- Strong Presence in Major Indian Cities: The company has a strong presence in major Indian cities such as Mumbai, Pune, Nagpur, and Coimbatore, which are key markets for retail and real estate development in India.

- Retail-Focused Approach: Prozone Intu Properties has a retail-focused approach to real estate development, with a primary focus on developing large-scale integrated retail-led mixed-use developments. This strategy has enabled the company to capitalize on the growing demand for high-quality shopping and entertainment destinations in India.

- Experienced Management Team: The company has an experienced management team with a proven track record in real estate development and management. This has enabled the company to successfully execute its growth strategy and deliver value to its stakeholders.

- Strong Partnerships: Prozone Intu Properties has strong partnerships with leading international and domestic brands, including Marriott, Hypercity, Reliance, and PVR Cinemas. These partnerships have helped the company to attract tenants and customers and enhance the value of its developments.

Key Opportunities:

Prozone Intu Properties has several key opportunities that it can capitalize on to further grow its business and enhance its value proposition. Some of these opportunities include:

- Growing Retail Market: India’s retail market is expected to continue to grow at a rapid pace, driven by factors such as increasing urbanization, rising disposable incomes, and a growing middle class. Prozone Intu Properties can leverage its retail-focused approach and strong partnerships with leading brands to capture a share of this growing market.

- Expansion into New Markets: Prozone Intu Properties can expand its presence into new markets in India to capitalize on the growing demand for high-quality retail and entertainment destinations. The company has already announced plans to develop a retail mall in Aurangabad and a mixed-use development in Pune, and can continue to explore opportunities in other Tier-I and Tier-II cities.

- Expansion of Hospitality Portfolio: The company can expand its hospitality portfolio by opening new hotels in major Indian cities. The success of its existing hotel in Nagpur, which is operated under the Marriott brand, provides a strong foundation for further expansion in this sector.

- Growing Demand for Commercial Office Spaces: The demand for commercial office spaces in India is expected to grow, driven by factors such as increasing foreign investment and the growth of the services sector. Prozone Intu Properties can leverage its experience in developing and managing commercial office spaces to capture a share of this growing market.

- E-Commerce Integration: With the growth of e-commerce in India, there is an opportunity for Prozone Intu Properties to integrate online and offline retail experiences to provide a seamless shopping experience for customers. The company can explore partnerships with e-commerce platforms or develop its own online retail platform to capture this opportunity.

Financial Results:

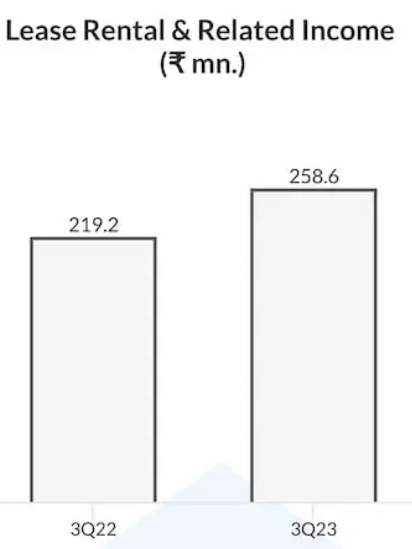

Prozone Intu Properties Ltd.’s revenue in Q3FY23 rose 135% to ₹ 622 millions. Consolidated Profit After Tax came at ₹ 128 millions in Q3FY23 showcasing a drastic rise in profitability. In this quarter’s results, the reports suggested that the firm has continued to deliver consistent performance in all key operational and financial indicators in Q3Y23.