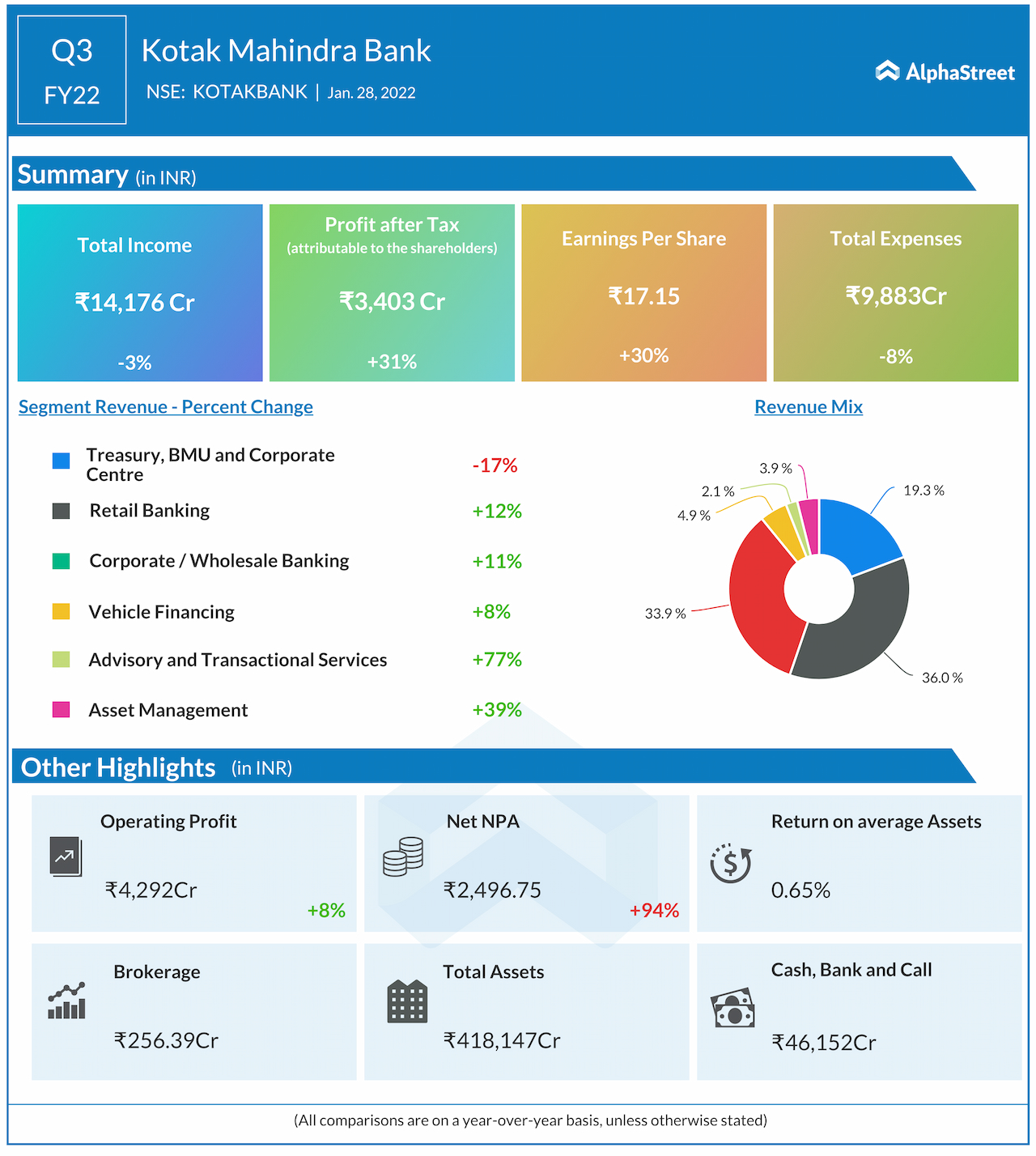

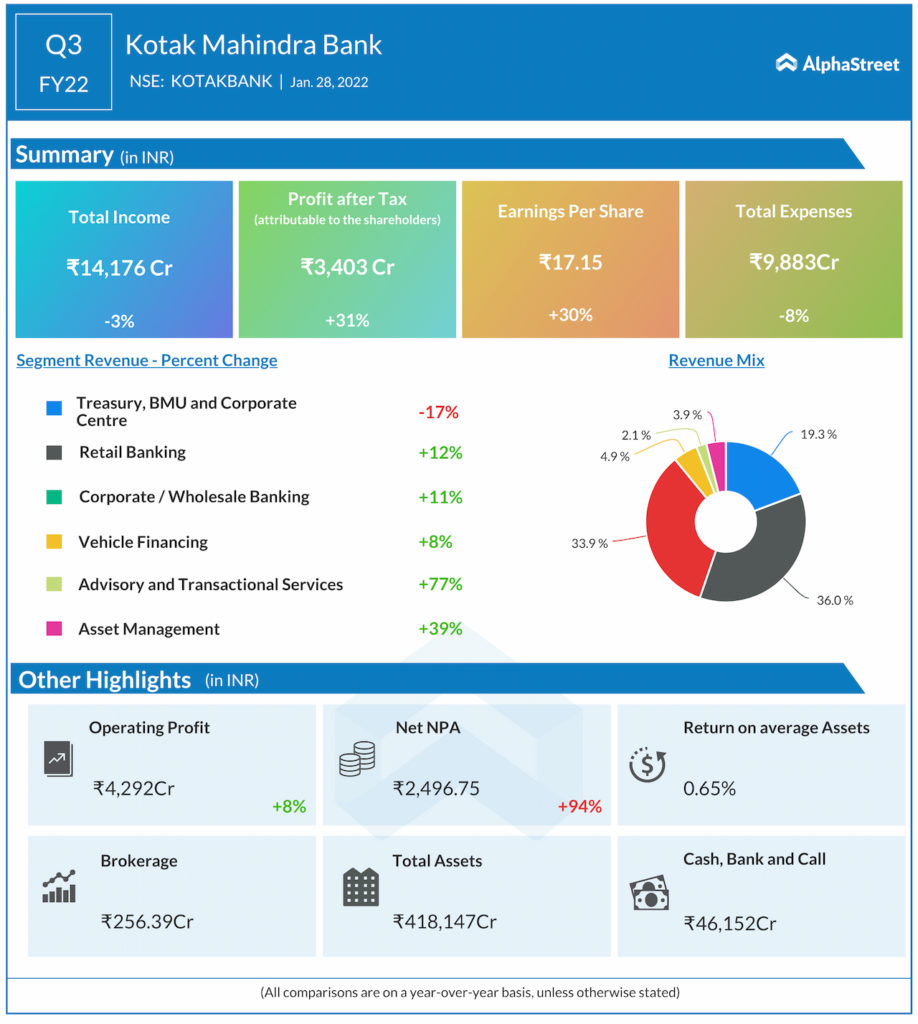

Key highlights from Kotak Mahindra Bank Ltd (KOTAKBANK) Q3 FY22 Earnings Concall

Management Update:

- On the mix of company’s consolidated profits, the bank contributed 63% of Q3 FY22 consolidated profits, and the bank is looking forward to a broad continuing performance of its overall consolidated profits.

- KOTAKBANK added 21 lakh customers in Q322, versus 8 lakh in the same quarter last year, about 3 times growth in new customer acquisitions.

- Kotak Mahindra Capital, for the first time clocked profit after tax of over INR100 crores.

Q&A Highlights:

-

Rahul Jain from Goldman Sachs asked that on the provisioning policy and the reversal, if it was led by recoveries in upgradation or it’s the feeling of worst is behind the company. Jaimin Bhatt CFO said that the realizations continued to improve and the gross accretion of NPA slowed down and QoQ realizations, upgradations continued to increase.

-

Rahul Jain from Goldman Sachs asked about some light on the unsecured businesses, if couple of years down the book start to become more meaningful, would the bank take provision as and when it happen. Uday Kotak CEO said that while the company is growing the unsecured book, which today is still about 5% of the advances book, though it is growing on a lower base. The company added that the provision requirement as a policy on unsecured is more aggressive than the regulatory requirements.

-

Rahul Jain from Goldman Sachs enquired that on the franchise side, what’s the customer profile that’s on-boarded. Shanti Ekambaram answered that on customer acquisition, the company continue to attract a lot of millennials and people in the age group of 25-40, though no customer is restricted. Therefore across channels, the bank looks for customers across segments.

-

Rahul Jain from Goldman Sachs asked that on the home loan business is it all organic customer acquisition or there has been some balance transfer. Shanti Ekambaram said that balance transfer is also acquisition to the company. And balance transfer has been about 30% of the business historically and added that the primary market business flow is strong. Therefore, the bank is having a combination strategy of primary market, customers buying readymade property, secondary market sale and balance transfer.

-

Adarsh Parasrampuria from CLSA asked that on opex, there has been a pickup in opex for large banks and over the next 2, 3 years where does the bank expect cost income to be at. Uday Kotak CEO said that ultimately the cost to income will get corrected. The company added that first, front-end cost it is ready to take. Second, the bank is growing its customer base at a very high speed, keeping in mind unique economics versus front-end costs. Finally, digitization will ultimately lead to significantly lower operating costs; and fourth, cost to income for the company is an outcome, not a target.

-

Kunal Shah of ICICI Securities asked which one would be giving a better return looking at home loans and corporate banking. Uday Kotak CEO answered that looking at returns, the bank looks at customer returns. A home loan customer with a engaging bank account gives the bank a deeper engaging relationship with the customer. Therefore, the bank is focusing on customer engagement and customer return in addition to making sure the product makes economic sense.

-

On a queston asked by Abhishek Murarka from HSBC on the SA rates, Uday Kotak CEO answered that the rate the company has is a uniform 3.5%. The company added that some larger banks are at 2.75% and 3% at less than INR50 lakhs deposit. The company believes that as interest rate starts moving up the bank doesn’t need to increase its SA deposit rate since its lowest is 3.5%.

-

Nilanjan Karfa from Nomura asked about IPO financing, how the bank is trying to mitigate that impact if any, and does it have an impact on the overall or average deposits. KVS Manian answered that RBI had asked bank owned subsidiaries to not do loan against shares and IPO financing, therefore there is no IPO financing built into these quarterly results. The bank added that its associate company Infina does IPO financing and it comes into consolidation as part of the Infina profit.