“The company initiated various measures to increase growth in decorative. The measures include an increase in feet on the street, digital interventions, network expansion, new product launches and brand strengthening. Judicious management of costs and overheads continued. Looking forward it is expected that demand would remain healthy in the short to medium term”. – Mr. Anuj Jain, Managing Director

| Stock Data | |

| Ticker | NSE: KANSAINER & BSE: 500165 |

| Exchange | NSE & BSE |

| Industry | Paints |

| Price Performance | |

| Last 5 Days | -1.09% |

| YTD | -12.91% |

| Last 12 Months | -15.45% |

Company Description:

Kansai Nerolac Paints Limited is a subsidiary of Kansai Paint of Japan and is the largest industrial paint and third largest decorative paint company in India. The company is headquartered in Mumbai and is involved in the industrial, automotive, and powder coating businesses. Kansai Nerolac Paints Limited specializes in developing and supplying paint systems used in various industries such as electrical components, cycle, material handling equipment, bus bodies, containers, and furniture.

Critical Success Factors:

- Kansai Nerolac Paints Ltd reported that its topline growth was led by the Industrial paints segment, driven by strong demand in the auto industry. The company has been consistently focusing on extending technologically superior products and has started selling seam sealant and underwater sealant, which is a new market for them. They have also started selling higher-margin technology products in coil coatings, and have exited some basic categories of coil coatings where profitability was low. The management expects robust demand in the industrial paints segment for the coming few quarters, led by the auto sector. On the non-auto side, the company is witnessing good demand from the infrastructure segment, and has received approvals for its performance coatings for bullet trains, Vande Bharat trains, and Mumbai Coastal project. Additionally, on the construction chemicals front, the company has received approvals for construction equipment and air conditioner segment.

- Kansai Nerolac Paints Ltd has implemented a 3% price hike in decorative paints and an 8-9% hike in industrial paints during 9MFY23. The company is holding some high-cost inventory which is expected to be liquidated in the next two to three quarters, leading to a recovery in margins. Despite the company’s plan to improve margins in the industrial segment using high-technology products, industrial paint margins are unlikely to reach the level of decorative paint margins. The management expects better gross margin and EBITDA margin from Q4FY23 onwards due to the falling raw material prices. However, in Q4, the product mix is expected to be tilted towards the industrial paints segment which commands lower margins compared to decorative paints.

- Kansai Nerolac Paints Ltd (KNL) is planning to expand its water-based manufacturing capacity by 42% YoY through a capex of INR 290 crore. The company’s total paint manufacturing capacity is 50,000 kL/month. The dealer count is increasing as KNL is focusing on increasing its influencer network. To achieve same-store growth and increase counter share, the company has started initiatives like next-generation shopping, which provides customers with a touch and feel experience. Currently, KNL’s dealer count ranges between 28,000 to 30,000, and the company is focusing on expanding its distribution network at a faster pace.

Key Challenges:

- Kansai Nerolac’s Q3FY23 decorative paints volume de-growth was approximately 9% YoY due to early festival season and prolonged monsoon, which is the lowest compared to Berger Paints and Asian Paints. Dealers made high stockings in Q3 as the company had taken significant price hikes in Q3FY23. The revenue CAGR of KNL over a three-year basis was 11%, which is much lower than the 17% CAGR of Asian Paints and Berger Paints. The company seems to have lost market share in the decorative paints business due to the aggressive product launches and dealer addition by its competitors. Kansai is increasingly focusing on the premiumisation of products and new product launches in the decorative segment. The company is making efforts to improve its brand strength through several marketing activities and influencer network expansion. KNL’s management has indicated that the company is making efforts to regain its lost market share through new product launches in the premium product segments and addition of dealers and influencers in new geographies. The management expects an uptick in demand from both urban and rural areas from Q4FY23 onwards. Kansai is lowering its focus on selling puttys as it is a low-margin business.

- The company’s gross margin is expected to improve from Q4FY23 onwards, but in Q4, the product mix is expected to be higher towards the industrial paints segment, which commands lower margins than decorative paints. Additionally, the company is holding some high-cost inventory, which is expected to get liquidated in the next two to three quarters. While this is expected to result in a recovery in margins, it could also impact the company’s financial performance in the short term.

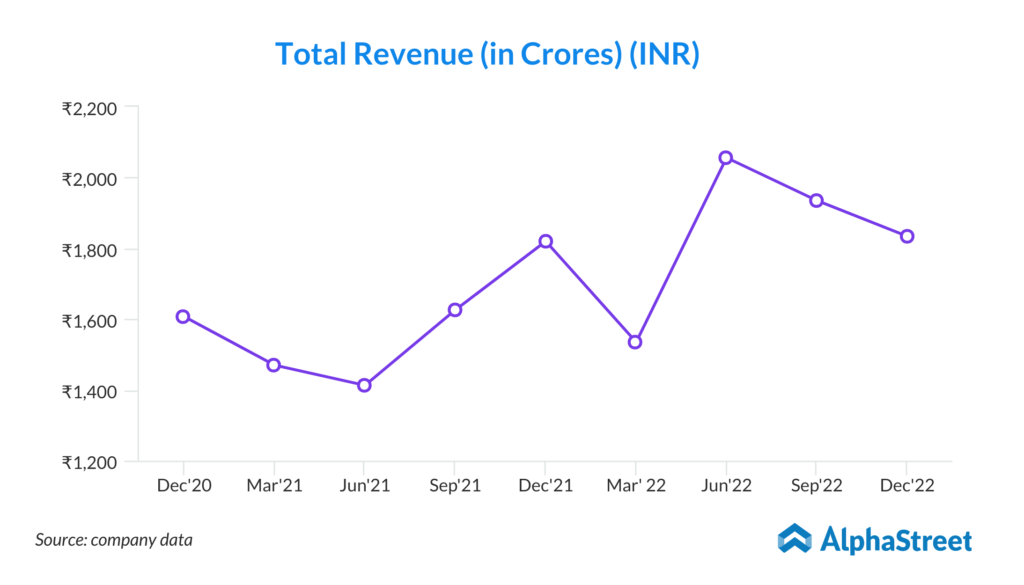

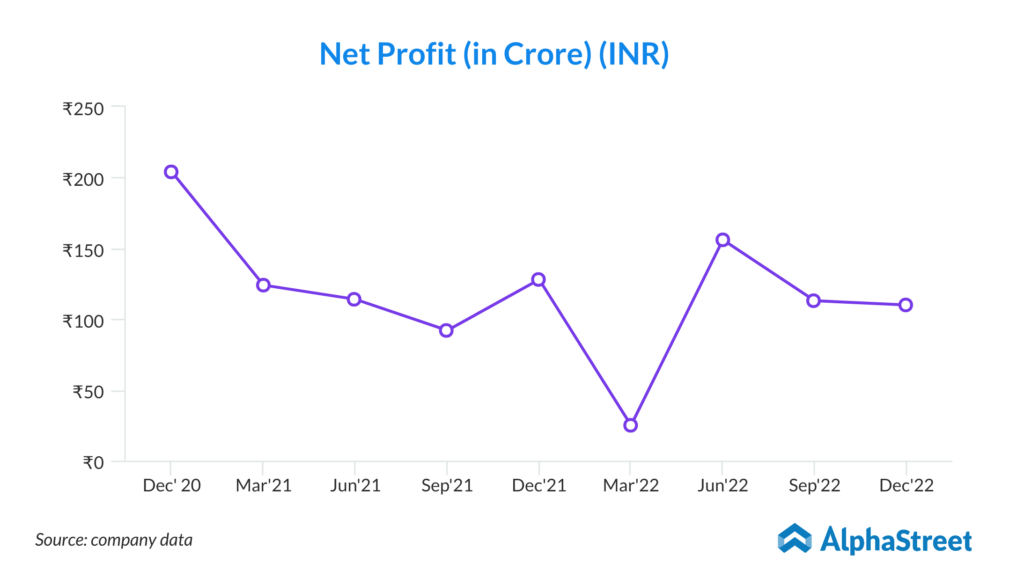

- Kansai Nerolac Paints Ltd has announced its Q3FY23 results, reporting a net revenue of Rs 1,717.1 crore, which is a growth of 1.4% compared to the same quarter of the previous year. The company’s EBIDTA was Rs 188.5 crore, which is a de-growth of 10.2% over Q3FY22, and its PAT was Rs 112.3 crore, a de-growth of 15.2 % over Q3FY22. However, if we exclude the exceptional income of Rs 44.8 crore from the previous year’s Q3, the net revenue is up by 4.1%, EBITDA is up by 14.1%, and PAT is up by 13.5%. For the nine months period, the company earned a net revenue of Rs 5,475.9 crore, which is a growth of 20.7% over the same period of the previous year, with EBITDA at Rs 641.4 crore, a growth of 13.7%, and PAT at Rs 392.4 crore, a growth of 12.2%.