Jubilant Foodworks Limited (NSE: JUBLFOOD) is a leading Indian food service company that operates the Domino’s Pizza franchise in India, Nepal, Sri Lanka, and Bangladesh. The company has a strong brand reputation and customer loyalty. The Domino’s Pizza brand is well-known and well-loved in India, with a strong presence in both urban and rural areas. The company has invested in technology to enhance its delivery capabilities and customer experience, making it a preferred choice for customers. The company has introduced several new products and menu offerings under the Domino’s Pizza brand, catering to evolving customer preferences. Jubilant Foodworks’ multi-brand and multi-nation expansion strategy has enabled the company to tap into new market segments and drive growth. The company’s successful track record in launching and scaling new brands, coupled with its existing infrastructure and operational expertise, make it well-positioned to continue expanding its portfolio beyond the Domino’s Pizza brand.

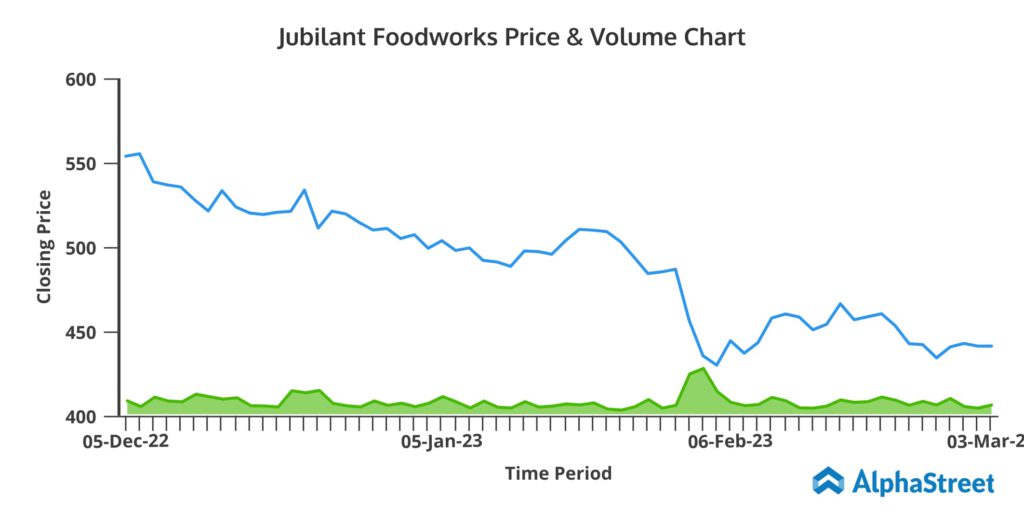

Share Price Performance Of Jubilant Foodworks

Jubilant Foodworks has delivered strong share price performance over the years, reflecting the company’s growth and profitability. The company’s share price has been on an upward trajectory, with several peaks and troughs along the way.However, in past 12 months, the share price has delivered a return of over -21%. Over the past 6 months, the share price was fallen by 26% and it has been consolidating between the range of ₹400 – ₹450 for past 1 month.

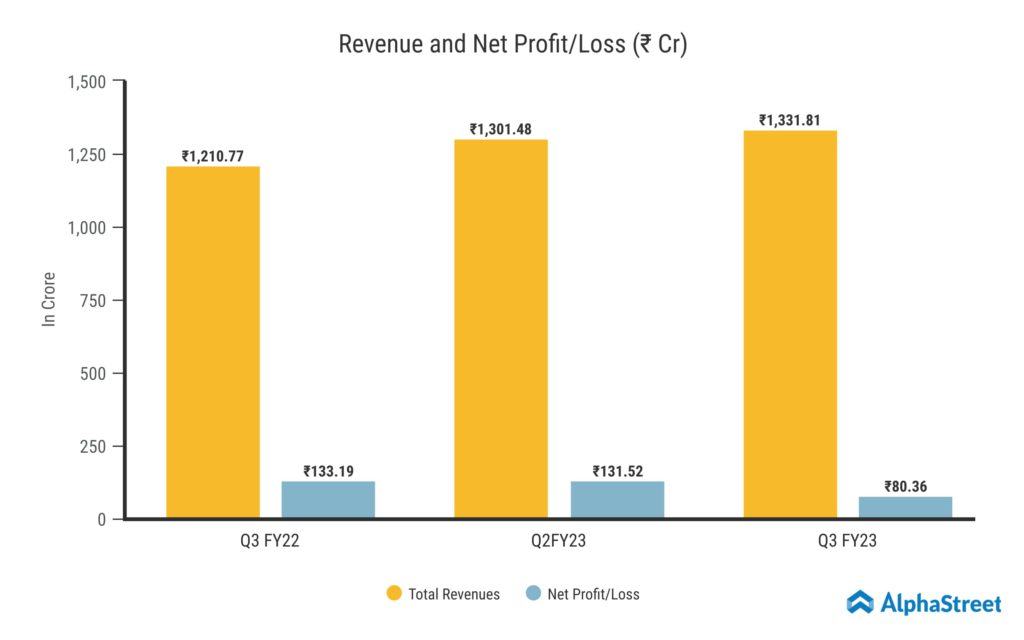

Q3 FY23 Financial Performance

Jubilant Foodworks Limited reported Revenue from Operations for Q3 FY23 of ₹1,331.81 Crore up from ₹1,210.77 Crore year on year, a growth of 10%. The Revenue growth was driven due to higher number of orders. Consolidated Net Profit of ₹80.36 Crore, down 40% from ₹133.19 Crore in the same quarter of the previous year. The decline in Net Profit is caused by rising dairy prices, particularly cheese prices, as well as high wheat flour due to inflation and increase in minimum wages in many states. The Earnings per Share was ₹1.22 for this quarter.

Brand Network Expansion

The company has been expanding its brand network by adding stores at a rapid pace in India. In this quarter, 60 new stores of Domino’s were added, which brings up to a total of 1,760 Domino’s stores across 387 cities in India. The company will open a new state-of-the-art food factory in Bengaluru by Q1FY24 for its US based fried chicken brand Popeyes. This food factor will serve as a hub for Popeyes’ network expansion strategy in South India. India is Popeyes’ first global market and the only Chicken-QSR player in India to move chicken marination to a centralised facility, ensuring consistent quality and high store fill rates. This significantly improves taste consistency, which results in increased brand repeat rates.

Hong’s Kitchen has made remarkable progress, with further enhancements in taste, surged repeat orders, and a record high NPS. During the quarter, the company closed two stores in order to relocate them to nearby locations that offer both dine-in and take-out services. This reduces the total number of stores to 18. During the quarter, Jubilant Foodworks unveiled a new Dunkin’ restaurant design as a part of the brand’s global coffee-forward evolution.

Jubilant Foodworks’ Digital Push

The company’s effort in its digital agenda has resulted in all-time high app installs and monthly active users of 9.4 million and 11.3 million, respectively. Furthermore, app ratings on the Play Store and iOS jumped by 22%, reaching 4.5 and 4.7, respectively. Meanwhile, Domino’s Cheesy Rewards program received a tremendous early response, surpassing the 10.6 million cumulative enrolment mark in December. The members’ order contribution reached 39%.

As per the management, “Loyalty should pan out in a full year to understand its results fully but what we have learned in six months is actually very, very encouraging. Loyalty is targeted towards repeat customer so it is not targeted towards new customer we have other programs that target new customers, our high frequency and medium customer frequency base is at an all-time high and growing very rapidly in fact it is working quite well like I said the delivery as a channel, own-app ordering that continues to be very robust so that is something working well in the engine and our technology investments are therefore paying off.”

The improvement in digital push and surge in loyalty program enrolment should up the customer’s repeat rate.

International Expansion

Domino’s management intends to deploy the emerging market playbook, which includes four pillars: cuisine localization, best value to customers, unrivalled delivery credentials, and digital channels. The company experienced growth in both Sri Lanka and Bangladesh. In Sri Lanka, the company opened a record-breaking seven new stores this quarter, bringing the total network strength to 47. Dine-in and takeaway channel growth drove system sales growth by 24.9%. In Bangladesh, system sales surged by 44.7%, owing to the Dine-in and Delivery channels. In addition, two new stores were added, bringing the total number of stores to 13.

Finally, to meet the growing demand for quick and convenient food options, Jubilant FoodWorks has been expanding its brand portfolio and opening new stores across India. Jubilant FoodWorks is well-positioned to capitalise on the fast-growing food service market in India as well as internationally, with a strong focus on growth and expansion.

The management comments, “Overall, I remain confident of getting growth back into the business by looking at how our company is focusing on providing best tasting food to our customers, innovating on price points, rapidly building out digital assets and investing in long term health of the business.”