Stock Data:

| Ticker | NSE: JSL |

| Exchange | NSE |

| Industry | METALS |

Price Performance:

| Last 5 Days | +4.17 % |

| YTD | +96.21 % |

| Last 12 Months | +272.28 % |

Company Description:

Jindal Stainless is a leading global player in the stainless steel industry, renowned for its high-quality stainless steel products. With a strong commitment to sustainability, the company leverages advanced manufacturing processes, including electric arc furnace technology, to promote a circular economy and reduce carbon emissions. Jindal Stainless serves diverse sectors, including infrastructure, renewables, process industries, and more, offering tailored solutions to meet customer needs.

Critical Success Factors:

1. Robust Sales Volume Growth: In Q1 FY ’24, Jindal Stainless demonstrated remarkable strength with an 8% quarter-on-quarter growth in sales volumes. This impressive performance was primarily attributed to sustained growth in the domestic market, government initiatives for infrastructure development, and increased demand from various sectors.

2. Diverse Product Mix: Jindal Stainless benefits from a diverse product portfolio, allowing it to cater to a wide range of customer needs. This diversification strategy has proven effective in capturing opportunities in emerging markets and product segments.

3. Export Expansion: The company’s commitment to expanding its export markets has yielded positive results, as export sales increased by a substantial 45% quarter-on-quarter. This growth showcases the company’s adaptability and determination to overcome market challenges, particularly in Europe.

4. Strategic Acquisition: Jindal Stainless successfully acquired the remaining 74% equity stake of Jindal United Steel Ltd. (JUSL) for INR 958 crores. This move has consolidated critical stainless steel manufacturing facilities, enhancing synergies between the two entities and ultimately creating greater value for stakeholders.

5. Digital Transformation: The company’s partnership with Dassault Systems to strengthen production planning, scheduling, and execution processes through digitization and automation demonstrates its commitment to modernizing operations and improving efficiency. This forward-looking approach aligns with the company’s goal of providing top-notch customer service.

6. Recognition for Customer-Centric Approach: Jindal Stainless received the Expand Global Markets Award from U.S.-based Dana Incorporated, recognizing its outstanding contributions as a stainless steel solutions provider for over 15 years. This accolade highlights the company’s dedication to delivering tailored solutions to its customers.

7. Environmental Responsibility: Jindal Stainless is committed to environmental responsibility, with a focus on sustainability. Its use of the electric arc furnace for manufacturing enables 100% recyclability, contributing to a circular economy. The company has also set ambitious targets, aiming to reduce carbon emission intensity by 50% by FY 2035 and achieve Net Zero emissions by 2050.

8. Strategic Partnerships: Jindal Stainless has established itself as a key supplier in the defense and space sectors, partnering with organizations like ISRO and contributing to prestigious programs like Chandrayaan-3. This reflects the company’s technological prowess and importance in India’s critical industries.

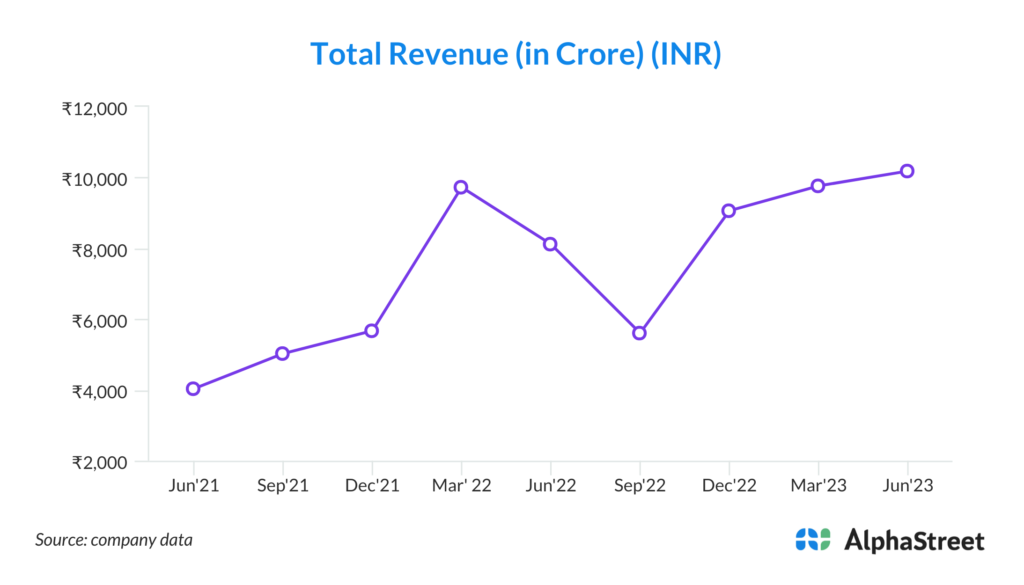

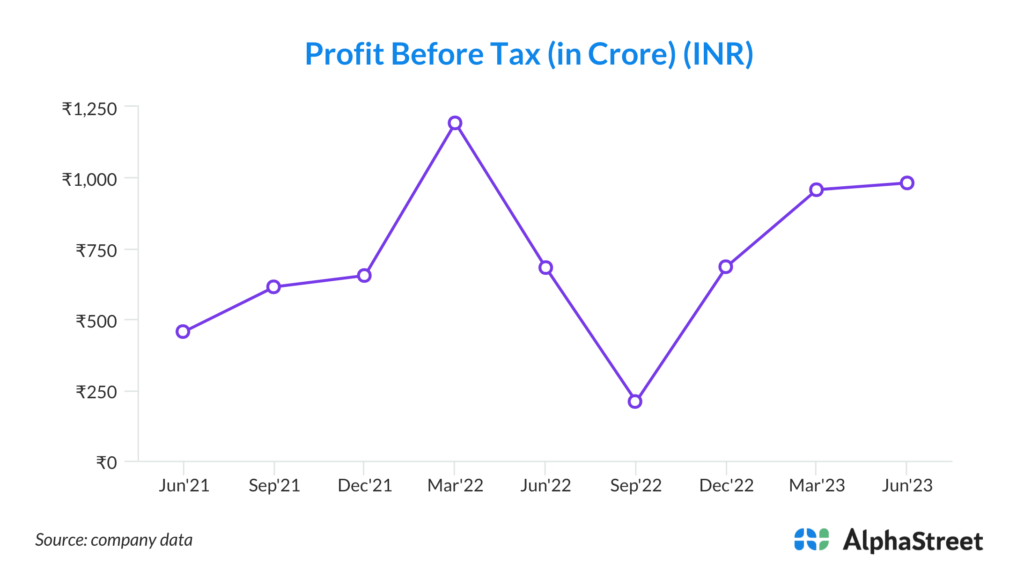

9. Strong Financial Position: Despite capex investments, the company maintains a healthy financial position, with a debt/equity ratio of 0.2x and net debt to EBITDA at 0.8x as of June 30. This financial stability provides a solid foundation for future growth and investment.

10. Positive Demand Outlook: The company is optimistic about domestic demand due to government initiatives, such as the PM Gati Shakti project, which is expected to boost infrastructure spending and generate additional demand for various projects.

Key Challenges:

1. Global Economic Uncertainty: Jindal Stainless operates in a global market, and economic downturns or uncertainties in key markets, especially Europe and the United States, can impact demand for stainless steel products. Reduced economic activity in these regions can lead to decreased orders and lower prices for stainless steel, affecting the company’s revenue and profitability.

2. Commodity Price Volatility: The company is exposed to fluctuations in the prices of raw materials such as nickel and chromium, which are essential components of stainless steel production. Sudden price spikes in these commodities can significantly increase the company’s production costs, potentially squeezing profit margins.

3. Import Competition: The Indian stainless steel industry faces challenges from subsidized and substandard imports, particularly from China. These imports can flood the market with low-priced stainless steel, putting pressure on domestic producers to reduce prices to remain competitive. Such competition can erode profit margins and market share for Jindal Stainless.

4. Government Policies: Changes in government policies, including trade policies, import duties, and environmental regulations, can have a profound impact on the company’s operations and profitability. Adverse policy changes, such as increased import tariffs or stricter environmental compliance requirements, can increase production costs and hinder market access.

5. Supply Chain Disruptions: Disruptions in the supply chain, including delays in the availability of raw materials or transportation bottlenecks, can impact production schedules and customer deliveries. Supply chain interruptions can lead to increased lead times, increased operational costs, and potential customer dissatisfaction.

6. Currency Exchange Rates: As Jindal Stainless engages in international trade, fluctuations in currency exchange rates can affect the competitiveness of its exports. A strengthening Indian Rupee can make the company’s products relatively more expensive in international markets, potentially reducing export volumes and revenues.

7. Debt Levels: While the company maintains a healthy debt/equity ratio, any significant increase in debt levels to fund expansion projects could increase financial risk, especially if market conditions worsen. High debt levels can lead to increased interest costs and financial instability during economic downturns.

8. Environmental Regulations: Compliance with environmental regulations and the company’s commitment to reducing carbon emissions may require substantial investments in technology and infrastructure. These investments can impact operational costs and capital expenditure requirements.

9. Geopolitical Risks: Political and geopolitical factors can impact international trade and business operations. Trade disputes, sanctions, or political instability in key markets can disrupt the company’s supply chain or access to critical markets.

10. Market Demand: While domestic demand is expected to grow due to government infrastructure projects, any slowdown or delays in these projects could impact the company’s sales and revenue growth. Jindal Stainless relies on a robust domestic market, and any adverse changes in demand dynamics can affect its financial performance.