“Our focus remains on creating a strong foundation, sustainable and profitable growth, while maintaining a robust balance between short term profitability as well as long term value creation. Our commitment lies in extensive expertise, abundant resources, strategic partnerships to fuel culture of innovation, increase operational efficiency and secure superior outcomes on behalf of all our investors and stakeholders. I am pleased to report that our ongoing projects are progressing well. Milestones are being achieved within the scheduled timelines. Our technical teams have demonstrated exceptional dedication, expertise and a commitment to overall corporate governance and safety matters, and it has allowed us to overcome all the challenges that we had and deliver excellent outstanding execution results.”

-Ragini Advani, Director Finance

Stock Data

| Ticker | IRCON |

| Industry | Infrastructure |

| Exchange | NSE |

Share Price

| Last 5 Days | -9.6% |

| Last 1 Month | 28.7% |

| Last 5 Months | 156.8% |

Business Basics

Ircon International Limited, a government-owned engineering and construction company, is a key player in India’s infrastructure development landscape. The company’s business fundamentals are grounded in its expertise in the construction of major infrastructure projects, both in India and abroad, across various sectors. Ircon’s core competency lies in its ability to execute large-scale infrastructure projects. The company specializes in sectors such as railways, highways, bridges, tunnels, and urban development. Its diverse portfolio includes the construction of railway tracks, electrification, signaling, and telecommunication systems, making it a crucial contributor to India’s railway network expansion.

One of the defining aspects of Ircon’s business strategy is its international presence. The company actively seeks and executes projects in foreign countries, leveraging its engineering prowess to contribute to the infrastructure development of nations beyond India’s borders. This global approach has enabled Ircon to establish a strong reputation as a reliable and proficient infrastructure partner. Ircon’s commitment to innovation is evident in its adoption of advanced construction technologies and best practices. The company continuously invests in research and development to enhance project efficiency, quality, and safety. This focus on innovation aligns with the evolving needs of modern infrastructure projects.

Q1 FY24 Financial Performance

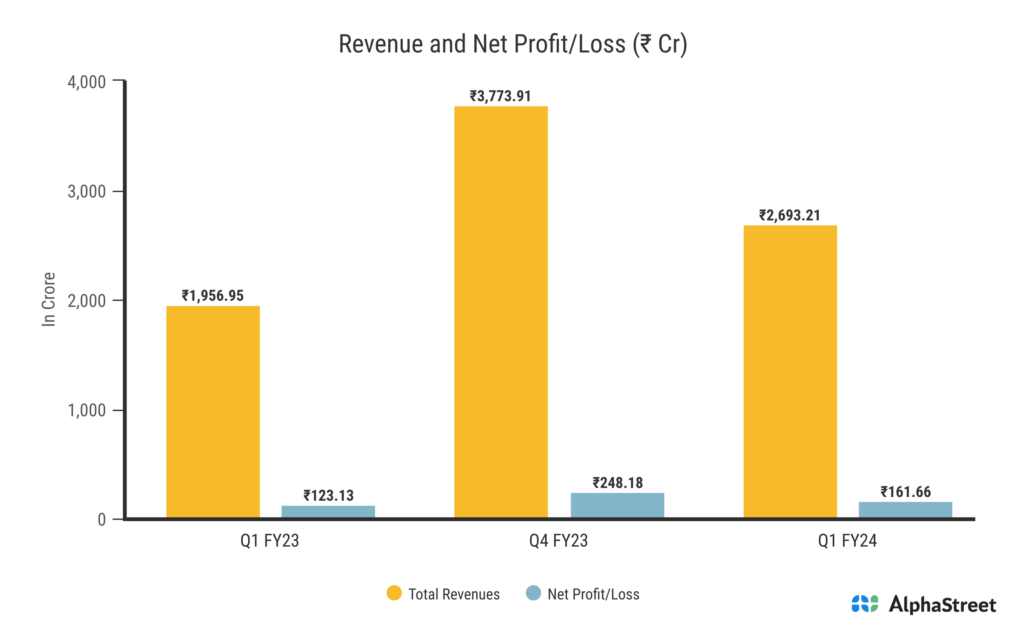

Ircon International reported Revenues for Q1FY24 of ₹2,717.00 Crores up from ₹2,002.00 Crore year on year, a rise of 35.71%. Consolidated Net Profit of ₹187.00 Crores up 28.97% from ₹145.00 Crores in the same quarter of the previous year. The Earnings per Share is ₹1.99, up 29.22% from ₹1.54 in the same quarter of the previous year.

Ircon’s Customer Segment

International: Ircon has a significant presence in the international market, offering its expertise in engineering and construction services to various countries. This customer segment primarily includes foreign governments, international organizations, and private entities seeking infrastructure development and construction expertise. Ircon’s extensive experience in executing complex projects, especially in the railway sector, makes it an attractive partner for international clients looking to enhance their transportation infrastructure.

Domestic: In its domestic market, Ircon caters to a range of clients, including government agencies, public-sector organizations, and private enterprises. The company is actively involved in infrastructure development projects across India, particularly in the railway and transportation sectors. Ircon’s domestic customers rely on its engineering and construction capabilities to execute critical infrastructure projects that contribute to the country’s economic growth and connectivity.

Ircon’s Order Book and Diversified Operations

As of June 30, 2023, the company’s order book amounted to Rs. 32,486 crores. This order book is divided into two categories: approximately 45% of the orders are on a nomination basis, while the remaining 55% are competitive orders. In terms of the geographical distribution of our orders, the split between domestic and international orders stands at 91% for domestic orders and 9% for international orders. It’s important to note that IRCON, the company, has diversified its operations by having 11 subsidiaries and being involved in 7 joint ventures. Collectively, including IRCON itself, our activities primarily revolve around projects related to roads, railways, highways, and renewable power projects.

Infrastructure Industry in India

India’s infrastructure sector is poised for significant growth, expected to play a pivotal role in boosting the country’s economic development. This growth is set to create an environment conducive to increased investment and business expansion. Key infrastructure elements such as roads, railways, airports, and ports are undergoing substantial development, which will enhance logistics and trade facilitation, bolstering India’s global competitiveness.

The government’s dedication to infrastructure development is clearly evident in the recent budget announcement for the fiscal year 2023-24. Notably, there is a paramount focus on increasing infrastructure spending, with a substantial budget allocation of nearly ₹10,00,000 crores dedicated to capital expenditures.

This allocation represents a remarkable 33% surge compared to the previous year’s budget and constitutes a significant 22% of the total budget.

Of this substantial allocation, roads and railroads receive special attention, accounting for nearly half of the total infrastructure budget with an allocation of ₹4,98,000 crores. This allocation underscores the government’s commitment to improving road connectivity and expanding the national railway network.