Key highlights from Infosys Ltd (INFY) Q4 FY22 Earnings Concall

Management Update:

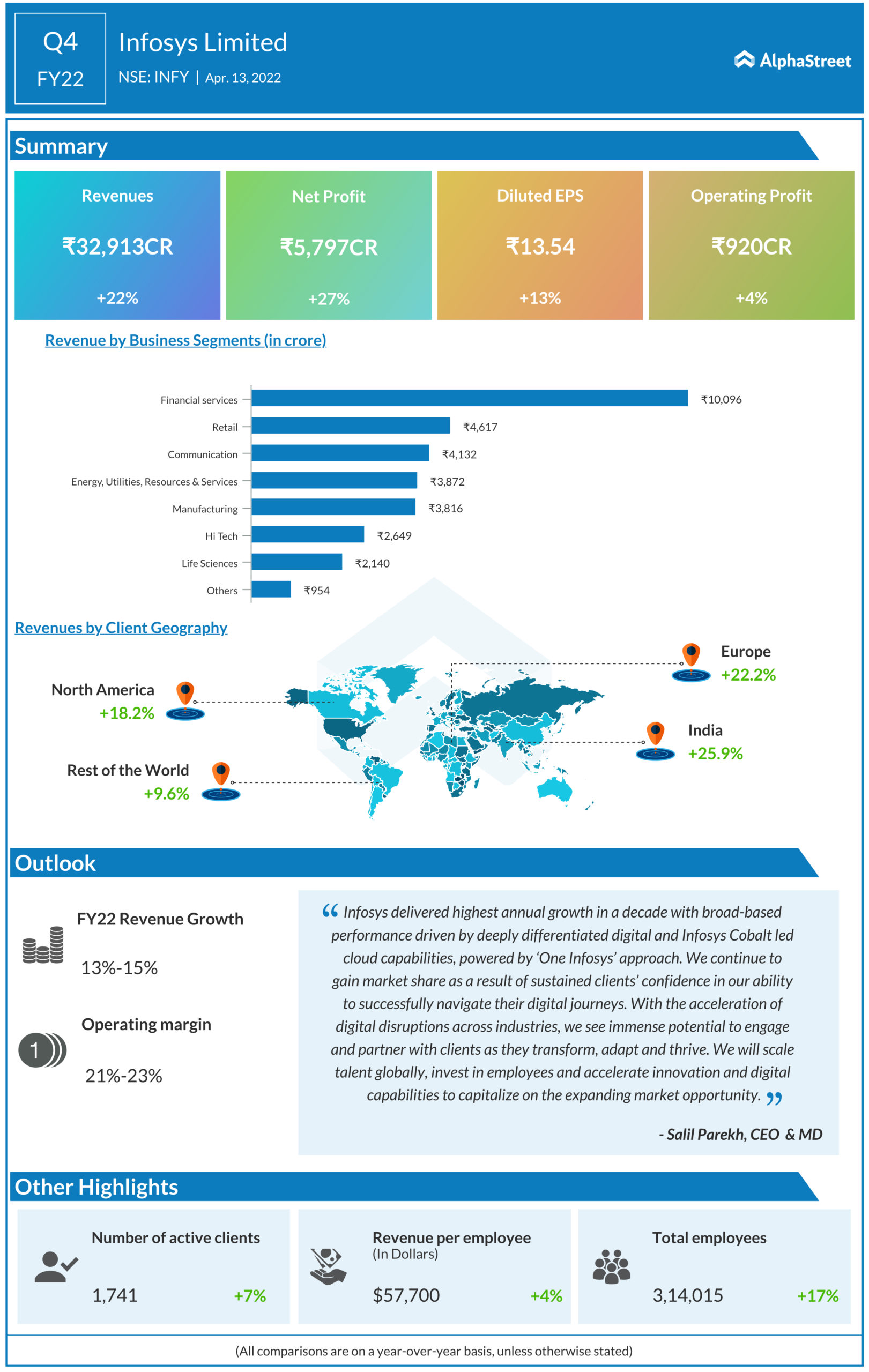

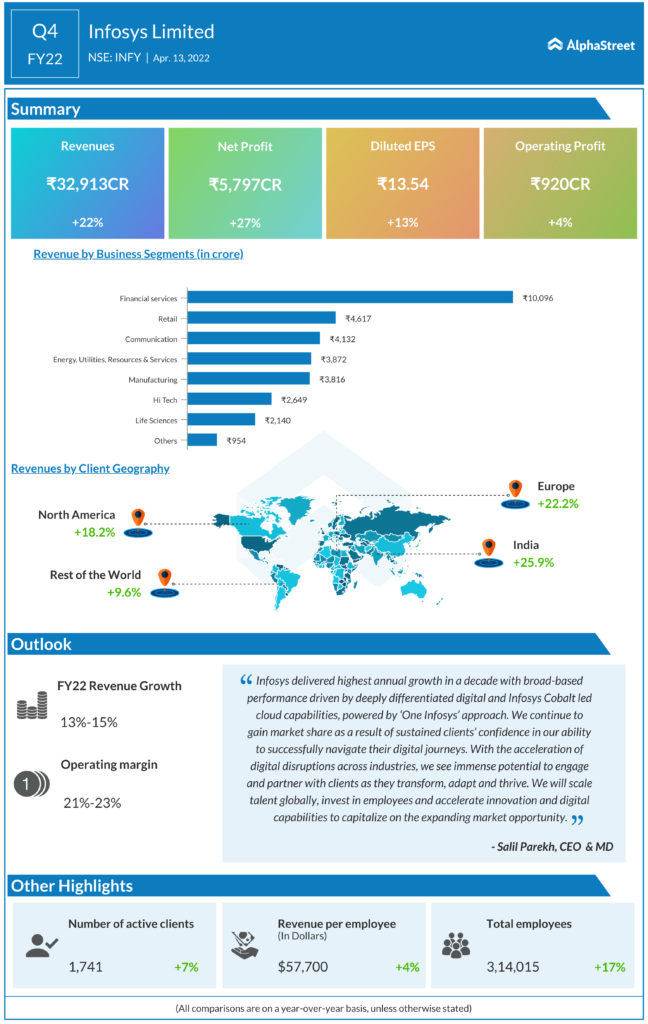

- INFY said it saw an annual growth of 19.7% in constant currency terms for FY22, its fastest growth in 11 years. INFY added that its digital revenues now account for 59.2% and grew at 41.2% for FY22.

- INFY recruited 85,000 college graduates in FY22. For 4Q22 net addition were of 22,000 employees, the highest ever in the company’s history.

- Voluntary LTM attrition increased to 27.7%, while quarterly annualized attrition saw a decline of approximately 5%, after a flattening in 3Q22.

Q&A Highlights:

- Ankur Rudra of J.P. Morgan asked why the revenue guidance for FY23 has improved YoY despite having a stronger order book in FY22. Salil Parekh CEO said that the confidence for giving FY23 revenue guidance of 13-15% was due to the demand environment for its client base being strong and for FY23 INFY has $9.5 billion in large deals, and for 4Q22 $2.3 billion with 48% net new. INFY said it’s also seeing expansion in dimensions relating to new client work.

- Ankur Rudra with J.P. Morgan also asked about margins and third-party costs going up sharply in 3Q22 and 4Q22. Salil Parekh CEO replied that the cost increase is due to bundling of services with the software and the allied services, which gives a multiplier effect in the client landscape.

- Moshe Katri from Wedbush Securities asked about margin guidance for FY23 and if it factors in acceleration in wage inflation. Nilanjan Roy CFO answered that in 1Q23, INFY will do a compensation hike, both offshore and onsite, which will be competitive. INFY will also differentiate it on talent side, which helped INFY last year, especially for people on the higher skills side.

- Nitin Padmanabhan of Investec asked about onsite wage inflation when compared to the prior year. Salil Parekh CEO answered that the wage inflation, outside India, is definitely higher than last year. And this will become part of how INFY factors in its overall compensation increase. INFY added that wage inflation numbers in most of western geographies are higher today than 12 months ago.

- Keith Bachman from BMO Capital Markets asked about INFY’s assumptions on both attrition and utilization. Nilanjan Roy CFO replied that on the utilization, INFY is still at the higher end at 87.5%, which it wants to bring down. This will happen through the influx of freshers. On attrition, INFY said it expects that this should come down in the following year.

- Pankaj Kapoor of CLSA asked about margins and the investments, if the investments are similar to the ones done in 2018-2019 of one-time investment or regular investments. Salil Parekh CEO said that INFY put in place that strategy a few years ago. The company built out deep capability across multiple areas. INFY is now seeing, over the last four years, a good impact of that approach.

- Pankaj Kapoor with CLSA asked about the guidance the company is building, if it’s building it on the macro concerns around Eastern Europe or on an as-is basis. Salil Parekh CEO answered that it’s built on the macro environment. However, on the demand environment, INFY is not seeing any impact.

- Vibhor Singhal from PhillipCapital asked if the situation in Ukraine is impacting any demand in European clients. Salil Parekh CEO replied that currently, INFY’s conversations and discussions with clients in Europe don’t see any impact on the demand environment for the company because of this situation.

- Ravi Menon from Macquarie asked about services revenue dropping in a surprisingly strong demand environment. Nilanjan Roy CFO said that it’s because the volume growth sequentially has been very strong; numbers for exits year-on-year were higher than the average for the year; and volume were sequentially higher, adding 22,000 people in 4Q for future demand.

- Ravi Menon from Macquarie also asked about a good level of utilization going forward. Nilanjan Roy CFO answered that roundabout 85% is the number. It may go up or down in the quarter, but that would be somewhere where the company would be more in the comfort range.

- Jamie Friedman of Susquehanna enquired why INFY stated that subcontractor costs are plateauing. Nilanjan Roy CFO said that subcon costs have plateaued at around 11.1%, 11.3% in the quarter as a percentage of revenue. However, from a headcount perspective, it has actually come down. The ramp-up of subcons was due to recruitment being behind. But now with fresher hiring ramping up, subcon costs should come down.

- Kumar Rakesh of BNP Paribas queried about any target of fresher hiring for FY23. Salil Parekh CEO said that next year’s campus recruiting, INFY will do more than 50,000 campus recruits. However, it added that as the company goes through the year, it will communicate more on that.