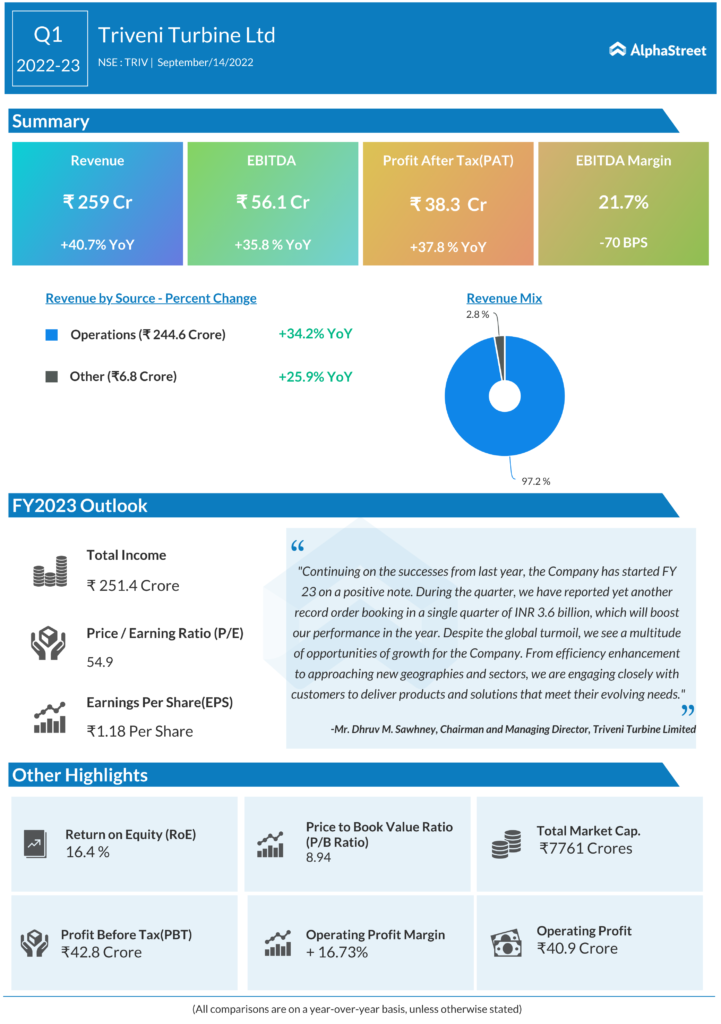

Triveni Turbine (NSE:TRITURBINE) delivered a robust performance with healthy revenues (up 40.7% YoY) led by strong export growth (up 59% YoY) while domestic sales rose 32% YoY. Order inflow of Rs 3.6 billion (up 30.9% year-on-year) was driven by higher international product orders and a large aftermarket order in the Southern African Development Community region.

Strong demand from both the domestic and export markets is likely to aid medium-term order inflow visibility. The short-term outlook remains positive as there is strong export demand, continued domestic demand from sectors such as distilleries, steel, cement, pharma, pulp, paper, food processing, etc., and a better addressable market for energy efficient API turbines for oil and gas industry and 30-100 MW turbines and capacity expansion at the Sompura plant to meet growing demand over the next few years.

Management has indicated that with an improving product mix, an increasing share of exports, PBT margins are expected to remain close to 20% in the medium term.

A strong order book of Rs 10.7 billion, robust demand, an incremental opportunity with foray into the 30-100 MW and API turbine market and a favorable product mix likely to help margins and drive growth over the medium term.

The company is adding a new plant at Sompura which will increase capacity from 150-180 machines to 200-250 machines/year and is expected to be completed by Q2FY23. No additional capacity will be needed to meet growing demand over the next few years.

Management said PBT margins will remain close to 20% over the next few years on the back of better product mix, contribution from exports and growth in the aftermarket segment.

The company expects 35% revenue growth over the next few years, given a strong order book and promising demand with a higher conversion rate. Higher export order fulfillment and increased aftermarket sales would improve margins in FY23E.

The company is expanding capacity, preparing its export sales team and enhancing its supply chain capabilities to move on a high growth trajectory in the coming years.

The company sees strong growth opportunities in industries such as cement, pharmaceuticals, steel and distillery domestically and internationally in industries such as steel, waste to energy, distillery, food processing and cement.