Introduction

IndusInd Bank is one of India’s leading private sector banks with a strong presence in both retail and corporate banking. Established in 1994, the bank has consistently expanded its footprint and diversified its product offerings. As of the latest available data, it has a widespread network of branches and ATMs across the country, serving millions of customers.

Macroeconomic Analysis

- Economic Activity and High-Frequency Indicators: Economic activity in India gained momentum during the quarter, as indicated by various high-frequency indicators, including the Purchasing Managers’ Index (PMI). The PMI, which measures the health of the manufacturing and services sectors, showed an uptick, reflecting increased economic activity.

- Monetary Policy and Inflation: The central bank maintained a stable monetary policy during the quarter, extending a pause on policy rate changes. Consumer Price Index (CPI) inflation eased below the 5% level, providing room for monetary policy stability. This contributed to improved liquidity conditions in the banking system.

- Credit Growth and Deposit Trends: Bank credit growth stabilized at around 15%, with personal loans continuing to be the main contributor. Deposit growth picked up, helping bridge the gap with higher credit growth. Retail deposits, in particular, demonstrated strong growth, and the share of retail deposits improved.

- Demand Side: Private Consumption and Public Investments: Private consumption and public investments played pivotal roles in supporting economic activity. The services sector exhibited a strong ongoing pickup, bolstering urban demand. Additionally, signs of recovery in rural demand and improved conditions for capital formation bode well for sustained growth.

- Foreign Investor Interest: Foreign investor interest in India revived during the quarter, with net inflows in both debt and equity markets surpassing $10 billion. This renewed foreign interest can be attributed to the relatively bright growth prospects, easing inflation, and overall macroeconomic stability in the country.

Quarterly Performance Review

- Loan Growth Momentum: IndusInd Bank maintained a robust loan growth rate of 22% YoY and 4% QoQ. This growth was driven equally by consumer and corporate businesses, showcasing the bank’s diversified portfolio. Notably, the Vehicle Finance segment maintained 21% growth, while other retail segments exhibited strong growth at 27%.

- Maintaining Deposit Traction: The bank achieved significant deposit traction during the quarter. Retail deposit growth, as per the Liquidity Coverage Ratio (LCR), accelerated to 21% YoY, with the share of retail deposits improving. The Savings Account book also saw a reversal of attrition trends, growing by 6% QoQ.

- Continued Investment in New Initiatives: IndusInd Bank continued to invest in its franchise, expanding both its physical and digital distribution. Key initiatives included the growth of affluent deposits, NRI deposits, and the merchant acquiring business. The bank also soft-launched its digital platform, “Indie,” and hired a substantial number of employees to strengthen its distribution network.

- Improving Asset Quality: The bank exhibited improvements in asset quality during the quarter. Gross slippages reduced, and the restructured book decreased significantly. The bank’s Net Non-Performing Assets (NNPA) remained at 0.58%, with a provision coverage ratio of 71%.

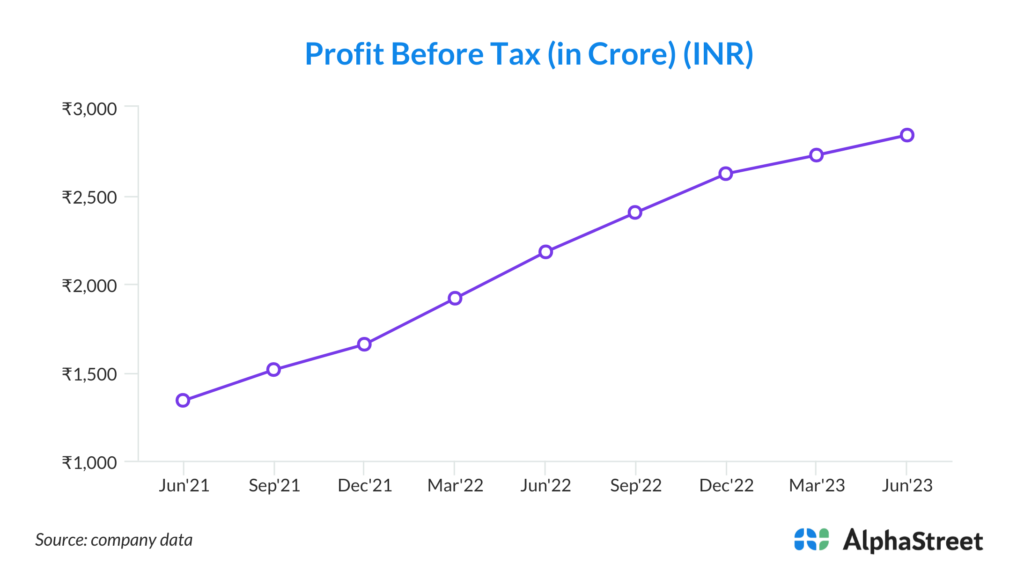

- Sustaining Profitability of the Franchise: IndusInd Bank maintained profitability, with Net Interest Margin (NIM) improving to 4.29%. Core client fee income, excluding trading income, grew by 19% YoY. Profit After Tax (PAT) for the quarter reached 2,124 crores, demonstrating a steady growth trajectory.

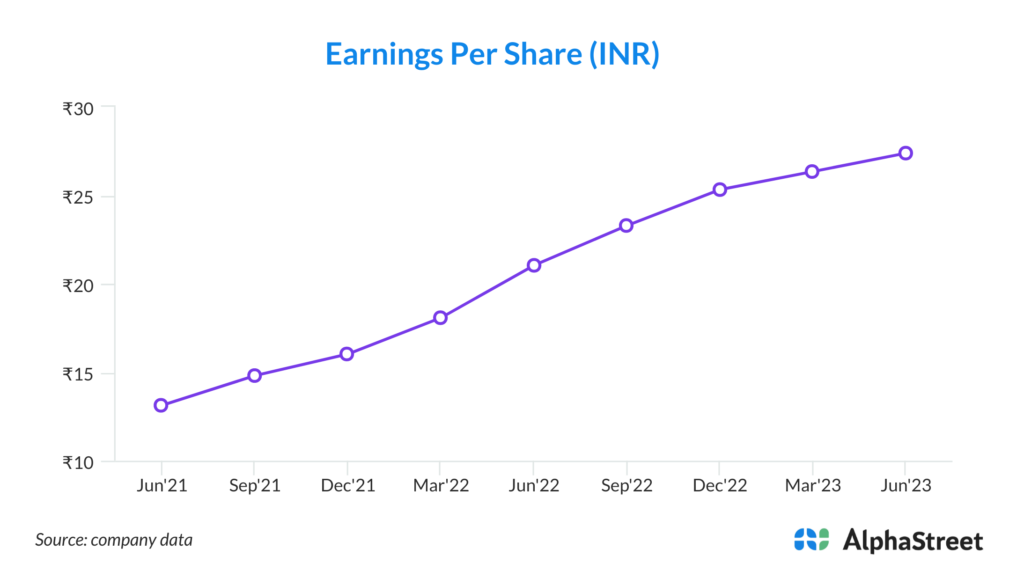

- Steady Improvement in Return Ratios: The bank’s Return on Assets (RoA) was at 1.90%, and Return on Equity (RoE) stood at 15.24% for the quarter. These return ratios reflect the bank’s efficiency and ability to generate returns for its shareholders.

- Capital Adequacy: IndusInd Bank’s Capital Adequacy Ratio (CAR) remained healthy, with Common Equity Tier 1 (CET1) capital at 16.44% and an overall CRAR at 18.40%. This positions the bank well to support its growth initiatives.

Business-Specific Developments

a) Vehicle Finance

Loan Growth: Vehicle Finance registered a healthy loan growth of 21% YoY, with strong disbursements in Commercial Vehicles, Utility Vehicles, and Cars. The bank maintained or improved its market share across all vehicle categories.

Efficiency Improvement: Implementation of the salesforce loan originating system for cars and two-wheelers is expected to enhance efficiency and reduce turnaround time.

Asset Quality: Gross slippages improved to 0.77% YoY, though they increased slightly QoQ due to seasonality. The restructured book in vehicle finance also reduced.

Outlook: With a strong two-year track record of disbursements in the vehicle portfolio, the bank expects asset quality to improve as the year progresses, with seasonality benefits in the rest of the year.

b) Bharat Financial Inclusion Limited (BFIL)

Loan Growth: The YoY loan growth in microfinance and merchant acquiring books accelerated to 14%.

Diversification: The bank focused on diversifying its microfinance business, aiming to become a micro-banker from a micro-financer. This diversification strategy is expected to contribute positively to the bank’s growth and risk mitigation.

Asset Quality: Gross slippages in the microfinance segment reduced, and the restructured book decreased significantly. The asset quality improvement is a testament to the bank’s prudent risk management practices.

Outlook: The bank sees significant growth potential in the microfinance and merchant acquiring business, particularly in rural and semi-urban areas.

c) Corporate Bank

Loan Growth: The corporate loan book showed a healthy growth trajectory, with small corporates and focused strategies on Corporates with < 500 crs turnover segment leading the way.

Risk Management: The bank has tightened policy norms, rationalized borrower limits, and strengthened post-disbursement checks to mitigate risks. This proactive risk management approach is crucial in maintaining asset quality.

Diversification: The focus is on diversifying across regions and acquiring more mid-corporate clients. This expansion strategy will help reduce concentration risk.

Outlook: The bank aims to continue growing its corporate book while maintaining a strong focus on risk management. The diversification strategy is expected to further enhance the bank’s resilience.

d) Global Diamond & Jewellery Business

Demand: The demand for diamonds remained muted due to sluggish growth in key consumer markets. The diamond book showed growth on a yearly basis but decreased QoQ.

Asset Quality: Despite the slowdown in the global diamond and jewelry market, asset quality remained stable. The bank’s ability to maintain asset quality in a challenging environment is commendable.

Outlook: The bank expects demand for diamonds to pick up as consumer markets recover. Its global presence and expertise in this segment position it well for future growth.

e) Other Retail Assets

Growth Momentum: Other Retail Loan book demonstrated growth momentum, with secured assets (like home loans) and unsecured assets (like personal loans and credit cards) both contributing positively.

Digital Initiatives: The bank is scaling up its home loan pilot and expanding its digital lending platform for small business banking. These initiatives align with the broader industry trend of digital transformation.

Outlook: The bank’s focus on retail assets and digital initiatives is expected to contribute significantly to its growth and profitability.

f) Liabilities

Deposit Growth: Deposits grew by 15% YoY, driven by granular acquisition with retail deposits as per LCR growing by 21%. This indicates a positive shift in the bank’s liability profile.

Savings Account: Savings Account deposits showed robust growth, reversing previous attrition trends. This growth in low-cost deposits is a positive development for the bank.

Branch Expansion: The bank is planning to add 250-300 branches during the year, which will enhance its physical presence and customer reach.

Outlook: The focus on expanding the retail deposit base and increasing the branch network is in line with the bank’s efforts to strengthen its liability side.

g) Digital Traction

User Base Growth: The bank registered strong growth in its monthly active user base on digital platforms, with mobile transaction volumes increasing significantly. This demonstrates the success of its digital initiatives in reaching and engaging customers.

Customer Acquisition Costs: Across products sold digitally, customer acquisition costs have substantially decreased YoY. This efficiency in customer acquisition is a testament to the bank’s digital strategy.

Digital Initiatives: The bank launched its CBDC app and soft-launched INDIE, its digital banking platform, with plans for a full-scale launch. These initiatives align with the evolving digital landscape.

Outlook: The bank’s digital initiatives position it well to compete in an increasingly digital banking environment and offer more convenient services to customers.

h) ESG (Environmental, Social, and Governance)

Environmental Commitment: The bank achieved LEED certification for pioneer branches, showcasing its commitment to environmental responsibility. Furthermore, it has set ambitious goals to become carbon neutral by 2032.

Recognition: IndusInd Bank was recognized as the ‘Best Bank in India for ESG’ by Asiamoney for FY-2023, reflecting its commitment to environmental and social responsibility. Such recognition can positively impact the bank’s reputation and stakeholder perception.

Outlook: As environmental and social responsibility become more critical for businesses, the bank’s commitment to ESG principles positions it well to attract socially conscious investors and customers.

Financial Performance Analysis

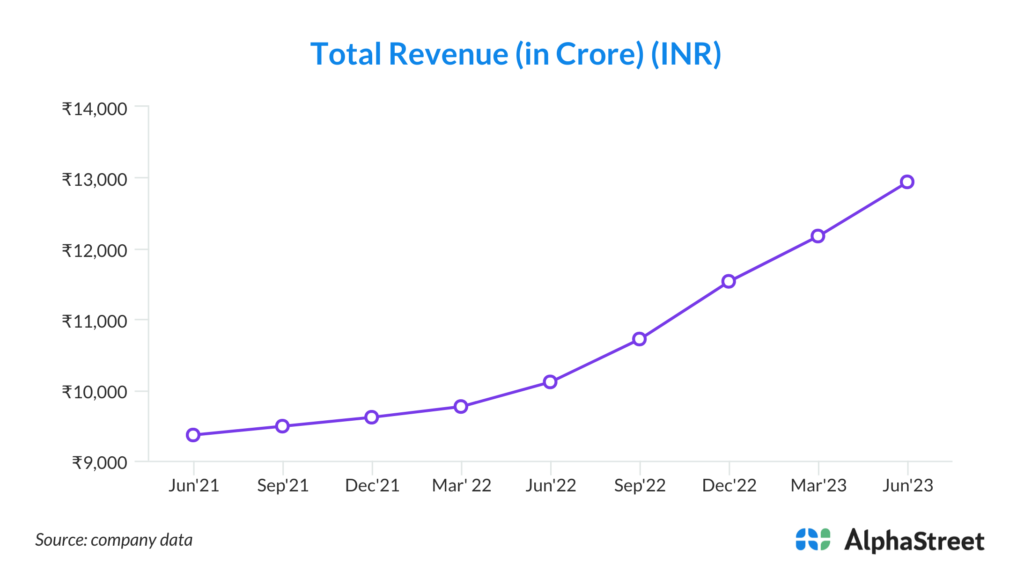

- Net Interest Income (NII) grew by 18% YoY and 4% QoQ. This growth can be attributed to the bank’s robust loan growth, improved deposit traction, and a favorable interest rate environment. The Net Interest Margin (NIM) improved to 4.29%, reflecting efficient management of interest rate spreads.

- Other income grew by 14% YoY and 3% QoQ. Core client fees, including fees from trade and remittance businesses, contributed significantly to this growth. The bank’s diversified income streams help reduce dependence on interest income.

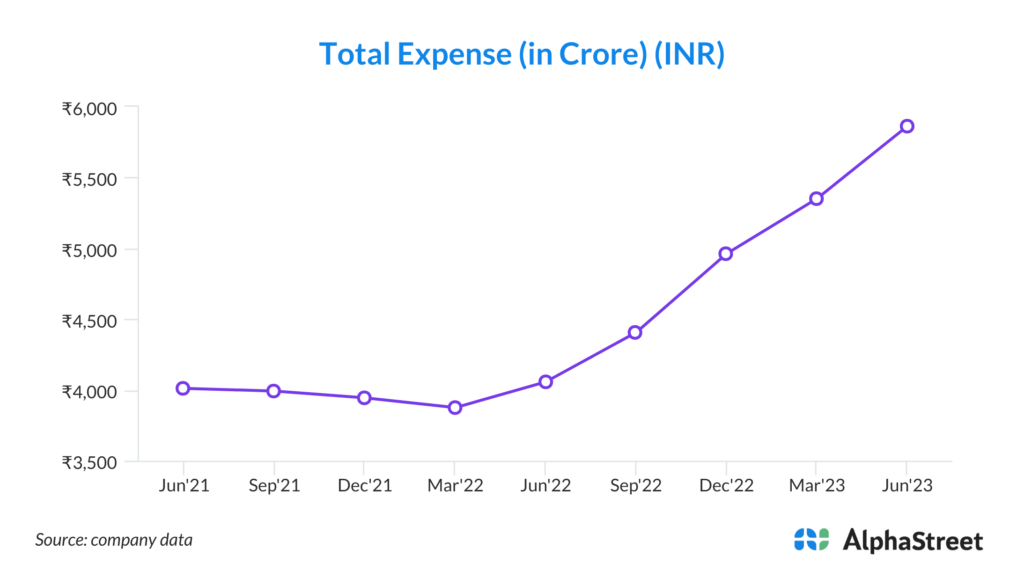

- Operating expenses grew by 6% QoQ, resulting in a Cost to Income ratio of 45.9%. This increase in operating expenses is partially attributable to investments in digital and branch expansion initiatives. However, it’s essential to monitor expense management closely to maintain cost efficiency.

- Asset Quality and Provisions: Provisions for the quarter reduced to 991 crores, with annualized provisions to loans down to 132 basis points (bps). The bank’s proactive measures to improve asset quality have contributed to a reduction in gross slippages. The Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) remained stable.

- Profit After Tax (PAT) for the quarter was at Rs 2,124 crores, growing 4% QoQ and 30% YoY. The bank’s profitability continues to be a strength, driven by a combination of factors such as improved asset quality, interest income, and fee income.

Strategic Outlook

- Future Growth Prospects: IndusInd Bank’s future growth prospects appear positive, given its diversified business segments, emphasis on digital transformation, and commitment to ESG principles. The bank’s focus on expanding its retail assets and liability franchise is expected to drive sustainable growth.

- Digital Transformation and Innovation: The bank’s digital initiatives, including the launch of its digital banking platform “INDIE,” are integral to its growth strategy. A successful digital transformation will not only enhance customer experience but also drive operational efficiency.

- ESG Commitment: IndusInd Bank’s commitment to environmental and social responsibility aligns with global trends, making it more attractive to responsible investors. Achieving carbon neutrality by 2032 and receiving recognition for ESG efforts are positive indicators of the bank’s long-term sustainability.

- Market Position and Competitiveness: The bank’s ability to maintain and improve its market position will depend on its ability to execute its growth strategies effectively, manage risk, and remain competitive in a rapidly evolving financial landscape.

Risks and Challenges

- Economic Uncertainty: Despite positive indicators, economic uncertainty persists, and external shocks can impact the banking sector’s performance. The bank must remain vigilant and adaptive to changing economic conditions.

- Regulatory Changes: Changes in banking regulations, such as capital adequacy requirements and lending norms, can affect the bank’s operations and profitability. Staying compliant with evolving regulations is crucial.

- Competition in the banking sector is fierce, with both traditional and digital players vying for market share. The bank must continuously innovate and differentiate itself to remain competitive.

- Asset Quality Risks: Maintaining asset quality, especially in challenging economic conditions, is essential. The bank must continue to manage and mitigate risks in its loan portfolio.

- Digital Transformation Challenges: While digital transformation presents opportunities, it also poses challenges, including cybersecurity threats and the need for ongoing investment. The bank must address these challenges effectively.