Stock Data:

| Ticker | NSE: INDIGOPNTS |

| Exchange | NSE |

| Industry | PAINTS |

Price Performance:

| Last 5 Days | +0.74% |

| YTD | +12.44% |

| Last 12 Months | -3.27% |

Company Description:

Founded in 2000, Indigo Paints Ltd is a leading paint company in India. The company started its operations by manufacturing lower-end cement products and gradually expanded its product range to cover various segments of water-based paints, including exterior emulsions, interior emulsions, distempers, and primers. Indigo Paints has gained recognition for its innovative paint solutions, introducing India’s first metallic paint, first-floor coat paint, unique ceiling coat paint, and paint for roofs. The company has established itself as a strong player in the paint industry, with a growing dealership base of over 16,500 dealers covering 27 states.

Critical Success Factors:

1. Differentiated Products: Indigo Paints has successfully developed and marketed differentiated products, contributing approximately 30% to its overall revenue. The company’s focus on innovation and unique painting solutions has helped it carve a niche for itself in the competitive paint industry.

2. Strong Gross Margins: Indigo Paints boasts one of the highest gross margins in the industry, standing at approximately 45%. This demonstrates the company’s ability to maintain healthy profitability and effectively manage its cost structure.

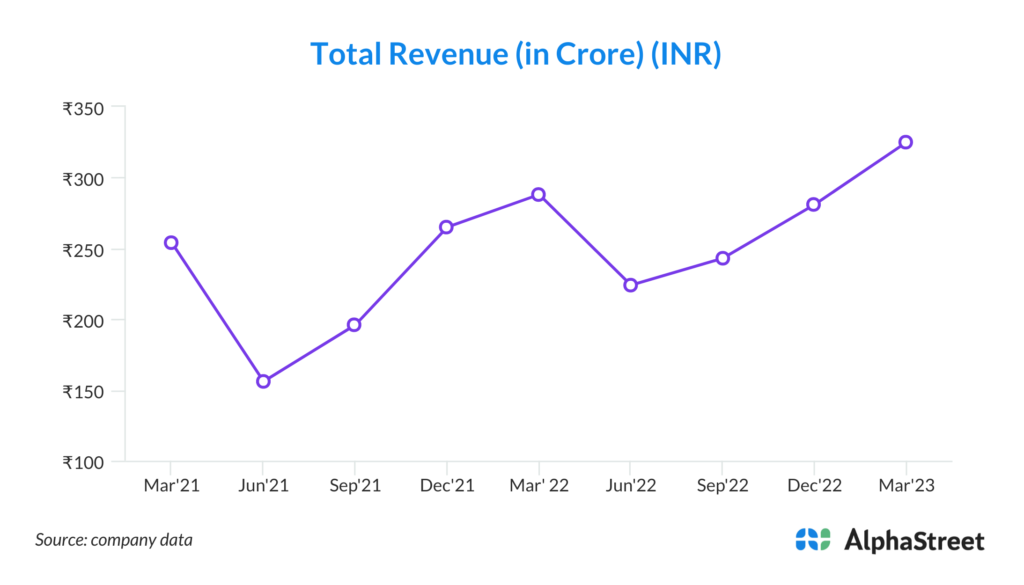

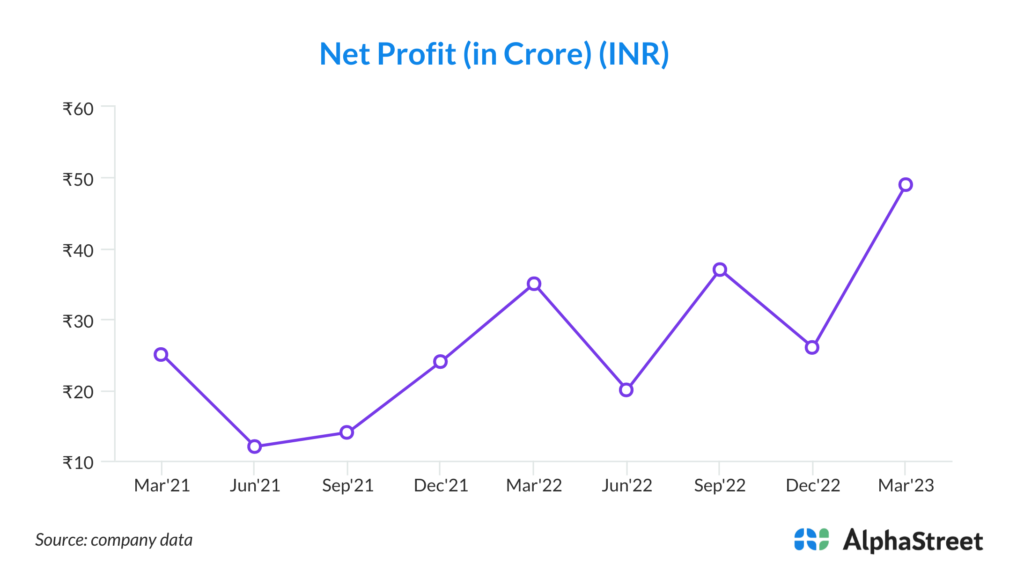

3. Rapid Growth: Indigo Paints has experienced rapid growth in recent years. With a compounded annual revenue growth rate of 15% and earnings growth rate of 37% over FY2019-FY2023, the company has demonstrated its ability to outperform its peers and capitalize on market opportunities.

4. Market Share Gains: Through its differentiated products and effective marketing strategies, Indigo Paints has been able to gain market share in the highly competitive paint industry. The company’s focus on Tier-1 and Tier-2 towns, along with its growing dealership network, has contributed to its market penetration.

5. Expansion Plans: Indigo Paints has been actively expanding its production capacity to meet the growing demand for its products. The company has a new plant in Tamil Nadu, which is in the trial phase and expected to commence commercial production shortly. Additionally, Indigo Paints plans to set up a new water-based paint plant in Jodhpur, further strengthening its production capabilities.

Key Challenges:

1. Raw Material Price Volatility: Indigo Paints is exposed to the risk of raw material price fluctuations, particularly in the prices of crude oil and other key inputs. Any significant increase in raw material costs could impact the company’s profitability.

2. Competitive Landscape: The paint industry in India is highly competitive, with several established players vying for market share. Indigo Paints faces competition from both domestic and international paint companies, which could affect its pricing power and market positioning.

3. Economic Factors: Indigo Paints’ performance is influenced by macroeconomic factors such as GDP growth, inflation, and consumer sentiment. Economic downturns or unfavorable market conditions may affect consumer spending on home improvement, impacting the demand for paint products.

4. Regulatory and Environmental Compliance: The paint industry is subject to various regulations and environmental standards. Indigo Paints must ensure compliance with these regulations, which could entail additional costs and operational challenges.

5. Supply Chain Disruptions: Any disruptions in the company’s supply chain, such as delays in the procurement of raw materials or transportation issues, could impact production and affect customer satisfaction.

Financial Results:

Indigo Paints reported strong financial performance in FY2023. In Q4 FY2023, the company recorded revenues of Rs. 325.5 crore, representing a year-on-year growth of 12.9%. Gross margin improved to 46.8%, driven by a correction in raw material prices, while the operating profit margin increased to 22%. The operating profit grew by 33.4% to Rs. 71.7 crore, and the net profit increased by 40.7% to Rs. 48.7 crore. For the full fiscal year, Indigo Paints achieved revenue growth of 18.5% year-on-year, an expansion in operating profit margin to 16.9%, and a significant growth in net profit of 57% to Rs. 209 crore.

Conclusion:

Indigo Paints Ltd has established itself as a prominent player in the Indian paint industry, driven by its focus on differentiated products, strong gross margins, and rapid growth. The company’s innovative solutions, expanding dealership network, and capacity expansion plans position it well for future growth. However, risks such as raw material price volatility, intense competition, and economic factors need to be closely monitored. Overall, with its strong financial performance and market positioning, Indigo Paints is well-positioned to capitalize on the growing demand for paints in India.