“The demand outlook for the sector in 2023 remains robust on the back of sporting events such as world cup hockey and cricket, global events like the ongoing G20 and recovery of inbound and corporate travel. IHCL with its vast network of hotels spread across 125 cities is well positioned to cater to this rising demand.” – Puneet Chhatwal, Managing Director & CEO, IHCL

Stock Data:

| Ticker | NSE: INHOTEL | BSE: 500850 |

| Exchange | NSE & BSE |

| Industry | HOTELS, RESTAURANTS & TOURISM |

Price Performance:

| Last 5 Days | +1.84% |

| YTD | +7.47% |

| Last 12 Months | +38.02% |

Company Description:

The Indian Hotels Company Ltd. (IHCL) is a leading hospitality chain in India, founded by Jamsetji Tata in 1903. The company primarily owns, operates and manages hotels and resorts under various brands, including the flagship brand “Taj”. It has expanded its presence in key travel destinations in India and internationally, including operating hotels in former royal palaces, such as Rambagh Palace in Jaipur and Taj Lake Palace in Udaipur. The company also launched hotels under the brand “Ginger” to cater to the budget segment.

In addition to its hospitality business, IHCL operates restaurants and food and beverage businesses under various brands, including Golden Dragon and Thai Pavilion, as well as spas under the “Jiva” brand, shops under “Khazana”, and salons under “niu&nau”. The company has also launched a mobile application, “Qmin”, offering a repertoire of culinary offerings delivered to homes, and an exclusive business club, “The Chambers”, granting members exclusive benefits and privileges in eight cities. Through its joint venture, Taj SATS Air Catering Limited, the company also caters to airlines.

Critical Success Factors:

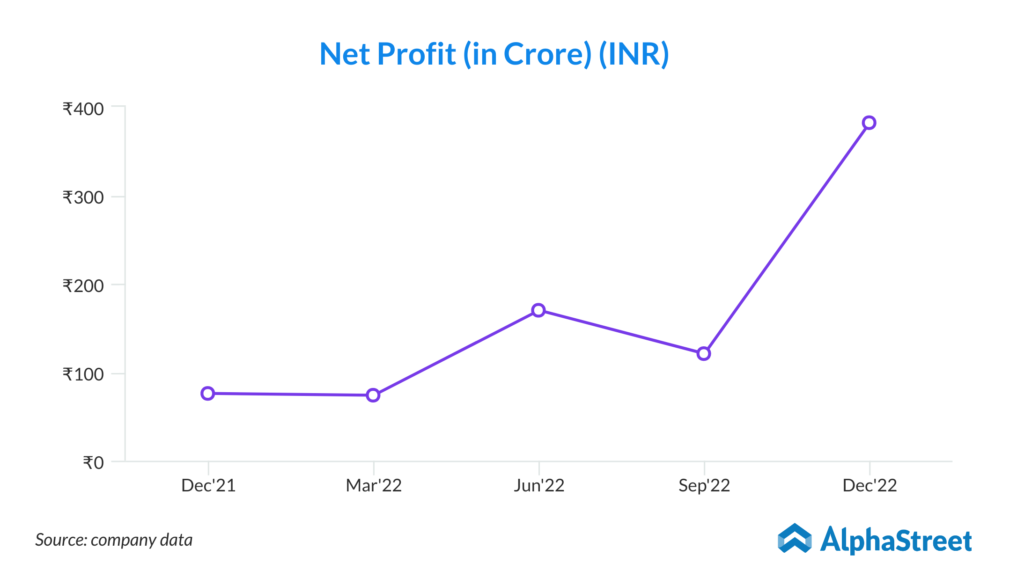

- Indian Hotels Company Ltd (IHCL) is focusing on new business ventures to reduce the impact of cyclicality on its hospitality ecosystem. With a range of new brands across different hotel segments, such as Qmin, ama stays and trails, 7Rivers, and niu&nau, IHCL is expected to complement the mainstream hotel revenue and become less vulnerable to the cyclicality of the hospitality industry. Furthermore, the company is enhancing the proportion of management contracts to its portfolio, which not only enhances the consolidated margin but also acts as a cushion during a down cycle. These asset-light high-margin business ventures are expected to contribute 25% to the overall revenue by FY26E, providing stable growth in earnings profitability.

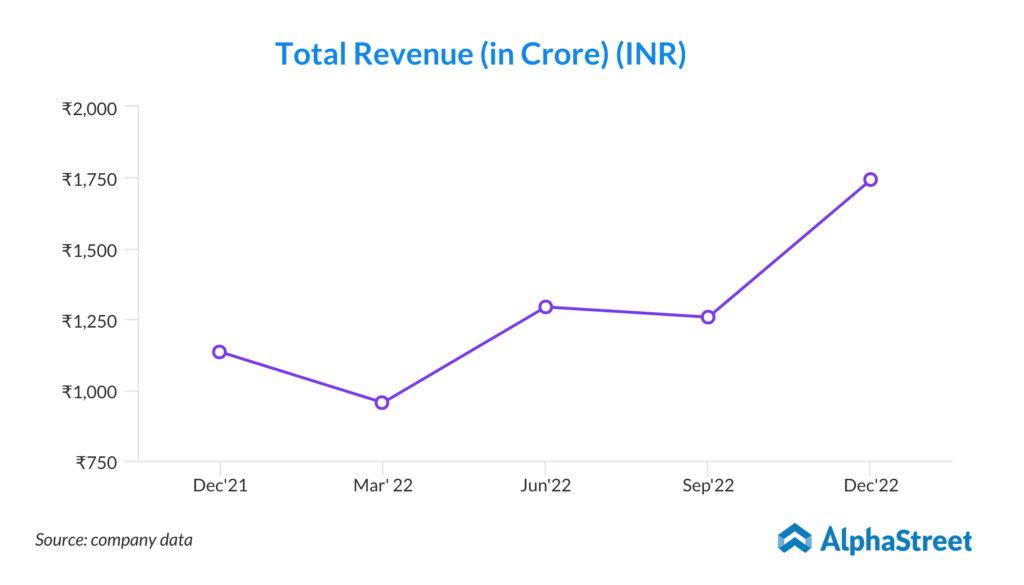

- Demand-supply gap is expected to drive ARR uptick for IHCL, which has emerged stronger post the COVID-led slump in business and has led the industry recovery in terms of RevPAR. With a pipeline of industry-leading hotel signups, IHCL will benefit from expansion in market share and rate premium, and growth in management fees income as it grows its portfolio of owned and management contracts. Improved ARR, better occupancy, and room additions are expected to lead to a CAGR of 28% in consolidated revenue over FY22-FY25E.

- Indian Hotels Company Ltd (IHCL) has shown remarkable strength in adapting to the changing market trends in the hospitality industry. One of the key strengths of the company is its shift from luxury to balanced supply. The decision to explore the midscale-economy segment has helped IHCL capture a huge market share and increase profitability. The company’s focus on this segment has paid off, as the midscale-economy segment has almost tripled its supply relevance between FY01 and 2021. This shift in focus has also led to a reduction in supply concentration in the luxury-upper upscale segment, from 56% in 2001 to 35.5% in December 2022, despite the addition of 44,000 new rooms in this segment. This trend is expected to continue for the next few years, with the luxury-upper scale supply share continuing to gradually decline while other segments gain.

- IHCL’s strength also lies in its ability to adapt to the demand-supply dynamics in key markets in India. The company has recognized the surge in domestic tourism and has shifted its focus towards budget and mid-market positioned hotels in Tier II and III cities to cater to the lower-paying domestic traveler and to capture previously untapped demand. New Delhi, Mumbai, and Bengaluru have the largest base of hotel rooms in absolute terms, but IHCL’s focus on Tier II and III cities has helped the company capture a significant share of the market in these cities. By catering to the demand in these cities, IHCL has been able to increase its market share and profitability. This flexibility and ability to adapt to the changing market dynamics have helped IHCL become one of the leading players in the Indian hospitality industry.

Key Challenges:

- Indian Hotels Company Ltd (IHCL) faces several risks and concerns that could impact its future growth and profitability. One of the key risks is the weak performance of its overseas subsidiaries, which has historically affected its consolidated margins and profitability. IHCL needs to improve the operating performance of its overseas properties and adequately sweat the Sea Rock asset to ensure its consolidated profitability going forward. It has cleared only half of the Sea-Rock Development so far, and completing the project on time would be crucial for IHCL’s future success.

- Another major risk that IHCL faces is the potential impact of a global recession. Although India’s current rising demand has brought some cheer to the sector, rising costs of materials, high manpower costs, and increasing borrowing costs due to rising interest rates could hurt hotel operations and margins. However, since the demand is outpacing supply in the current cycle, hoteliers like IHCL have the upper hand and can pass on some of these rising costs to customers in the form of higher ARR.

- The cyclical nature of the hospitality industry is another concern for IHCL. The company’s operating performance remains vulnerable to industry cyclicality, seasonality, macro-economic cycles, and exogenous factors. However, IHCL’s diverse portfolio presence has partially mitigated the risk, and the company will be able to withstand any demand vulnerability in a particular/micro segment. Nonetheless, IHCL needs to remain agile and adapt quickly to changing market conditions to stay competitive in a rapidly evolving industry.

- Finally, geopolitical risks such as terrorism and political instability in the regions where IHCL operates could also pose a significant threat to its business. The company needs to have robust risk management strategies in place to mitigate such risks and ensure the safety and security of its guests and employees. Overall, IHCL needs to remain vigilant and proactive in identifying and mitigating risks to ensure its long-term success in the hospitality industry.