“In the coming years, we envision strengthening our Company’s leadership position in the maize processing segment. In this direction, we are set to diversify into new products, so far uncharted in the country. Our addition of a new value-added product line is set to emerge as a key extension to our maize processing vertical. Our Company’s robust infrastructure is poised to ensure a seamless integration of the new product line while leveraging our competitive advantage to the fullest.”

-Manish Gupta, Chairman & Managing Director

Stock Data

| Ticker | GAEL |

| Industry | Agro Processing |

| Exchange | NSE |

Share Price

| Last 5 Days | 0.7% |

| Last 1 Month | 29.9% |

| Last 6 Months | 32.6% |

Business Basics

Gujarat Ambuja Exports Limited, a well-established agri-processing company based in India, operates with a focus on agricultural and food processing, international trade, and sustainable growth. The company’s business fundamentals are deeply rooted in its diversified portfolio of agricultural products and value-added processing services.

Central to Gujarat Ambuja Exports’ business strategy is its core competency in agri-processing. The company engages in the processing and export of a wide range of agricultural commodities, including maize, soybean, rice, and other oilseeds and grains. These commodities are processed into derivatives such as starch, liquid glucose, and refined oil. Gujarat Ambuja Exports plays a pivotal role in India’s agricultural supply chain, from procurement to value addition and export. Innovation is a driving force behind the company’s operations. Gujarat Ambuja Exports actively invests in research and development to enhance its processing techniques and product quality. It continually seeks new methods to add value to its agricultural products and expand its product range, keeping pace with the evolving needs of global consumers.

Gujarat Ambuja Exports works with farmers to ensure sustainable sourcing, contributing to the well-being of rural communities and environmental conservation. Gujarat Ambuja Exports serves a diverse customer base, including international traders, food processors, and manufacturers in various countries. The company’s products, such as maize derivatives and refined oil, find application in the food, pharmaceutical, and industrial sectors, catering to the global demand for high-quality agricultural ingredients.

Q1 FY24 Financial Performance

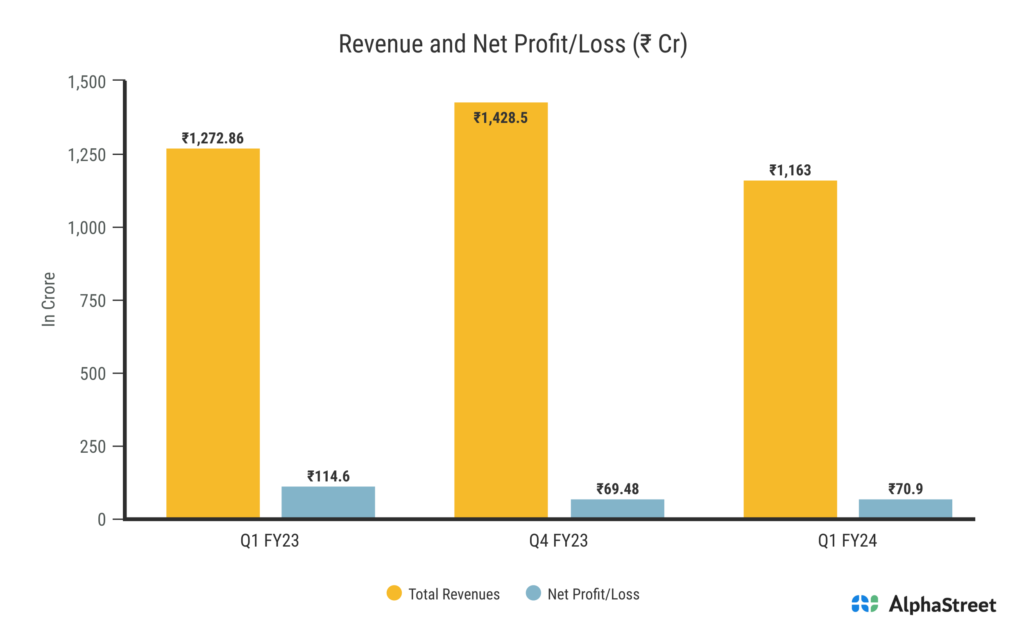

Gujarat Ambuja Exports reported Revenues for Q1FY24 of ₹1,163 Crores down from ₹1,272.86 Crore year on year, a fall of 8.64%. Consolidated Net Profit of ₹70.9 Crores down 38.26% from ₹114.6 Crores in the same quarter of the previous year. The Earnings per Share is ₹3.09, down 38.20% from ₹5 in the same quarter of the previous year.

To read more about Gujarat Ambuja’s Financials:

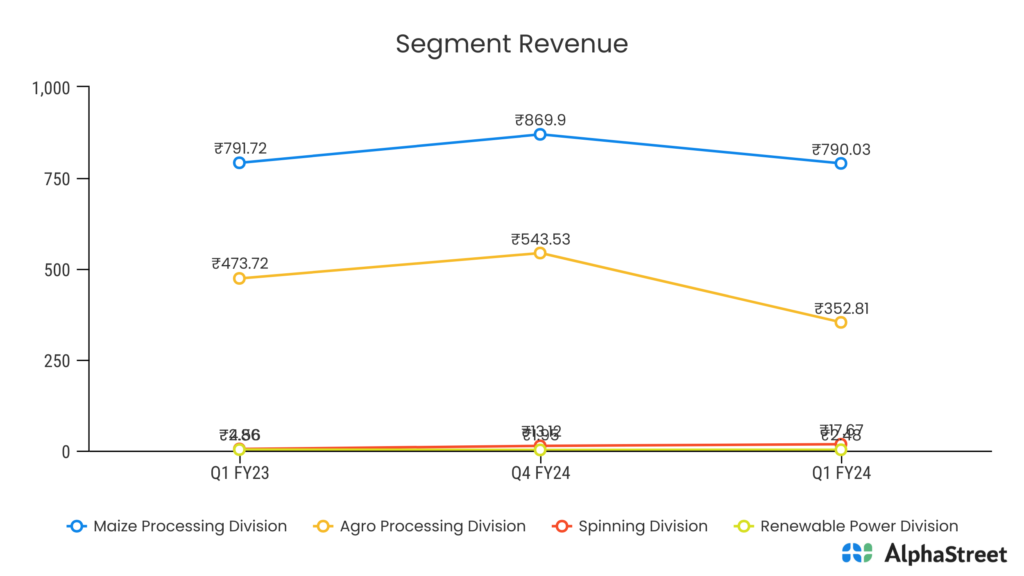

GAEL’s Segment Revenue

Maize Processing Division: The Maize Processing Division of Gujarat Ambuja Export Limited was a vital part of the company’s operations. Maize is a significant agricultural crop in India, and this division was involved in the processing of maize to produce a wide range of products. These products included maize starch, corn gluten meal, and corn gluten feed. The division catered to various industries such as food, pharmaceuticals, and animal feed. Revenue from this division was driven by both domestic and international demand for maize-based products.

Agro Processing Division: The Agro Processing Division was another essential component of Gujarat Ambuja Export’s revenue stream. This division was responsible for processing various agricultural commodities, including guar gum, guar meal, and castor oil. Guar gum, in particular, is widely used in industries such as food, pharmaceuticals, and oil drilling. The Agro Processing Division played a crucial role in the company’s overall revenue by exporting these processed agricultural products to global markets.

Spinning Division: The Spinning Division of Gujarat Ambuja Export Limited focused on the textile industry. India is known for its textile manufacturing capabilities, and this division was involved in the production of yarn from raw cotton. Gujarat Ambuja Export produced a variety of yarn types, including cotton and blended yarns, which were supplied to domestic and international textile manufacturers. The revenue from this division was influenced by factors such as global textile demand, cotton prices, and operational efficiency.

Renewable Power Division: The Renewable Power Division indicated the company’s commitment to sustainable and clean energy. Gujarat Ambuja Export Limited ventured into renewable energy by establishing power generation facilities using sources like wind and solar energy. The revenue from this division came from the sale of electricity to the grid and potentially through power purchase agreements with various industries and organizations. The success of this division depended on factors like energy tariffs, government incentives, and the efficient operation of renewable energy installations.

GAEL Adapts & Thrives Amidst Geopolitical Uncertainty

In the face of ongoing geopolitical tensions, Gujarat Ambuja Exports, a prominent player in the agro-processing industry, has revealed its strategic response to the challenges brought on by the Russia-Ukraine conflict and the subsequent global supply chain disruptions. As a result of these uncertainties, the agro-processing giant has seen a significant impact on global food trade, leading to soaring prices of essential food crops worldwide. Notably, these price hikes have even surpassed those experienced during the Covid-19 pandemic.

With three decades of experience in the agro-processing sector, Gujarat Ambuja Exports has established strong and trustworthy relationships with its suppliers. Leveraging these alliances, the company has managed to mitigate the repercussions of unpredictable price fluctuations, ensuring the smooth continuity of its operations. The steadfast partnerships have fortified their resilience during these challenging times. Recognizing the increasing importance of sustainability in today’s global landscape, Gujarat Ambuja Exports is committed to incorporating sustainable practices into every facet of its operations. This proactive approach not only aligns with their commitment to sustainability but also serves as a means to future-proof the business and enhance its overall resilience.

The Indian Government’s policies and support have played a pivotal role in shaping the country’s business ecosystem. Initiatives such as liberalization and privatization have unlocked substantial value across various sectors, leading to greater efficiency and higher revenues. Gujarat Ambuja Exports also acknowledges the continuous support of government policies, such as the Production-Linked Incentive (PLI) schemes, which have further fueled India’s growth momentum. Specifically for the agro-processing industry, the Agricultural and Processed Food Products Export Development Authority (APEDA), under the Ministry of Commerce & Industry, Government of India, has devised an outreach strategy to promote agro-exports. Under this scheme, APEDA has set an ambitious export target of USD 23.56 billion to be achieved in the fiscal year 2022-23.

Gujarat Ambuja Exports is poised to capitalize on the strategic support provided by APEDA, aiming to solidify its market leadership. Furthermore, with increased budgetary allocation towards the farm and food processing sectors, the company envisions a promising future for the agro-processing industry in the country. In the midst of geopolitical turmoil, Gujarat Ambuja Exports remains steadfast in its commitment to resilience and sustainability, providing a notable example of adapting and thriving amidst global uncertainties.

GAEL Management’s Outlook & Expansion Plans

In a recent announcement, Gujarat Ambuja Export Management (GAEL) outlined its optimistic outlook and ambitious expansion plans for various divisions of the company. The company anticipates significant growth and diversification in its maize processing vertical, further solidifying its position in the agro-ingredients supply chain.

GAEL has identified its maize processing division as a key contributor to the company’s future growth, with plans to expand its product portfolio in the corn-based sector. The company intends to explore new products within this domain that have not yet been introduced in the country. Leveraging government support for the fermentation sector, GAEL aims to extend its maize processing division. This expansion strategy involves both brownfield and greenfield projects, with the ultimate goal of achieving a capacity of 6,000 TPD by 2025. These efforts will strengthen GAEL’s leadership position in the agro-ingredients supply chain.

The agro-processing division remains a cornerstone of GAEL’s revenue generation, holding a significant share of the company’s revenue mix. GAEL is working to enhance its consumer brand and establish a stronger connection with consumers to bolster its position in the household consumer market. GAEL has diversified its agricultural offerings by introducing a solvent extraction division, which is expected to add a new dimension to the company’s portfolio.

The company’s global presence has received a boost from its Spinning division, which produces premium quality cotton yarn used in various applications in the garment industry. The cotton yarn segment is poised to play an increasingly prominent role in GAEL’s operations, contributing to the company’s revenue.