Stock Data:

| Ticker | NSE: GLAND |

| Exchange | NSE |

| Industry | PHARMACEUTICALS |

Price Performance:

| Last 5 Days | +0.38 % |

| YTD | +8.19 % |

| Last 12 Months | -25.66% |

Company Description:

Gland Pharma is a leading global pharmaceutical company dedicated to delivering high-quality and innovative healthcare solutions. With a strong commitment to excellence, gland pharma specialize in the development, manufacturing, and marketing of a wide range of sterile injectables, complex injectables, and niche oral products.

Critical Success Factors:

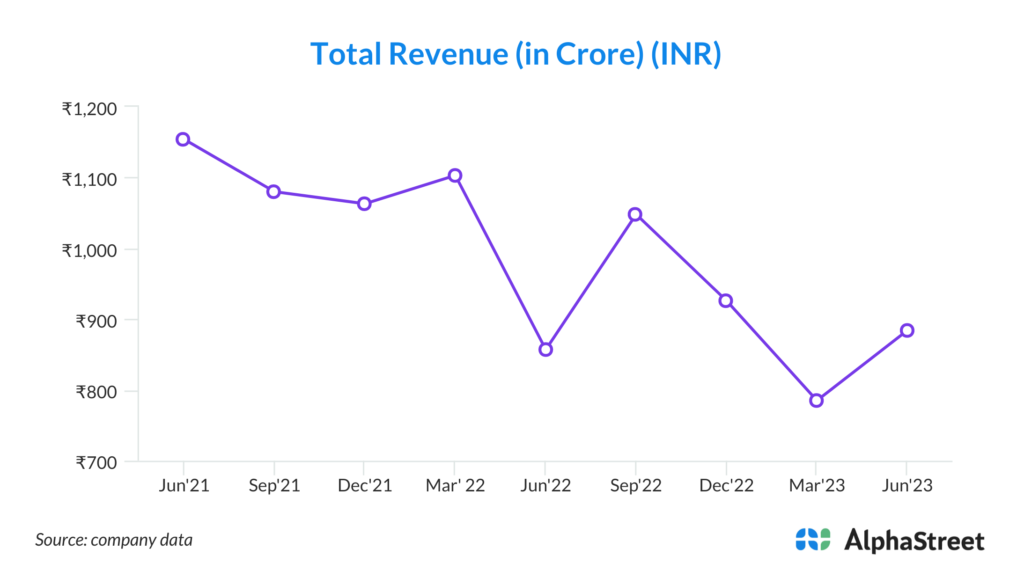

1. Impressive Revenue Growth: Gland Pharma’s achievement of INR 12,087 million in total revenue during the first quarter of the current financial year is a testament to its strong market presence and revenue-generating capabilities. This level of revenue growth indicates that the company is successfully tapping into demand for its products and services.

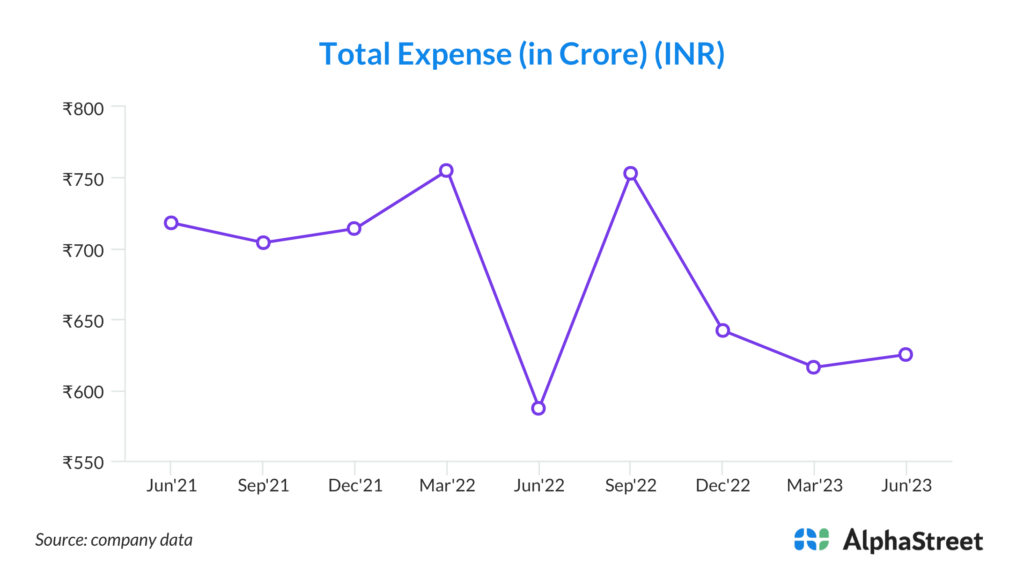

2. Strong EBITDA and Profitability: The company’s EBITDA of INR 2,982 million and net profit of INR 1,941 million in the same quarter highlight its robust profitability. These figures suggest effective cost management and operational efficiency, which contribute to maintaining healthy margins.

3. Quality and Regulatory Excellence: The successful inspection of three sterile plants by the U.S. FDA underscores Gland Pharma’s unwavering commitment to quality and regulatory compliance. Being a quality-focused and compliant company is essential for building trust with customers, partners, and regulatory authorities, which can lead to expanded business opportunities and collaborations.

4. Investment in Research and Development: Allocating INR 457 million (5% of revenue from operations) to research and development in Q1FY’24 demonstrates Gland Pharma’s dedication to innovation. The company’s ongoing R&D efforts can result in the development of new pharmaceutical products, enhancing its competitiveness in the market.

5. Strategic Acquisition of Cenexi: Gland Pharma’s acquisition of Cenexi has significantly contributed to its revenue growth. Cenexi generated INR 3,214 million in revenue in the first two months of consolidation. This strategic move diversifies Gland Pharma’s offerings and strengthens its position in the pharmaceutical industry.

6. Geographical Expansion: The company’s increased revenue from Europe and the Rest of the World, driven by Cenexi’s consolidation, indicates successful geographical expansion. This diversification reduces reliance on specific regions and broadens the company’s global footprint, opening doors to new market opportunities.

7. Market Expansion and Product Launches: Gland Pharma’s ability to launch 23 new molecules in the U.S. market, as well as experiencing higher volumes in existing products, showcases its agility in expanding its product portfolio and capturing market share. This adaptability and innovation are essential for sustained growth.

Key Challenges:

1. Regulatory Compliance and Quality Control: Gland Pharma’s dependence on stringent regulatory approvals, especially from agencies like the U.S. FDA, exposes the company to risks related to compliance issues, product recalls, or regulatory changes that could impact production and sales.

2. Market Competition: The pharmaceutical industry is highly competitive, with numerous established players and new entrants. Increased competition can put pressure on pricing and market share, potentially affecting profitability.

3. Dependence on Key Markets: Although the company is expanding into new markets, its dependence on core markets such as the U.S., Europe, and Canada means that any adverse changes or economic downturns in these regions could impact revenue and growth.

4. Integration Challenges: The successful integration of Cenexi is crucial for realizing the full potential of the acquisition. Integration challenges, such as cultural differences or operational issues, could disrupt business operations and synergies.

5. Currency Exchange Rate Risks: Fluctuations in currency exchange rates can impact revenue and profitability, especially when dealing with international markets. Unfavorable exchange rate movements may lead to financial losses.

6. Supply Chain Disruptions: The pharmaceutical industry relies on complex supply chains. Disruptions in the supply chain, whether due to natural disasters, geopolitical factors, or other disruptions, could affect production and delivery schedules.

7. Intellectual Property and Patent Risks: The pharmaceutical industry is highly dependent on patents and intellectual property rights. Challenges to patents or legal disputes related to intellectual property can impact the exclusivity and market presence of the company’s products.