“As per RBI’s estimate, the next year inflation is expected to further moderate to around 5.3%, combined with a fairly strong robust GDP growth expected of around 6.4%. The strong growth in system credit has intensified the competition for deposits, which has led to an increase in deposit rates for all commercial banks in the third quarter. As systemic liquidity continues to reduce, interest rates remain a key variable and our ability to optimize cost of funds remains a key priority.”

-P.N. Vasudevan, Managing Director & Chief Executive Officer

Stock Data

| Ticker | EQUITASBNK |

| Exchange | NSE & BSE |

| Industry | Banking – Microfinance |

Share Price

| Last 1 Month | -7.6% |

| Last 6 Months | 37.2% |

| Last 12 Months | 27.9% |

Business Basics

Equitas Small Finance Bank is focused on promoting financial inclusion and reaching out to underserved segments of society. The bank primarily serves the unbanked and underbanked population in India, including low-income individuals, small businesses, and MSMEs. Equitas Small Finance Bank has a strong presence in the southern and western regions of India and aims to expand its reach to other parts of the country. It offers loans for housing, education, micro enterprises, agriculture, and other purposes. The bank’s lending approach is based on a thorough assessment of the borrower’s creditworthiness and ability to repay the loan. The bank has a strong focus on digital banking and has also partnered with fintech companies to offer innovative digital products and services to its customers. The bank’s focus on financial inclusion, innovative digital solutions, and customer-centric approach is expected to drive its growth in the coming years.

Q3 FY23 Financial Performance

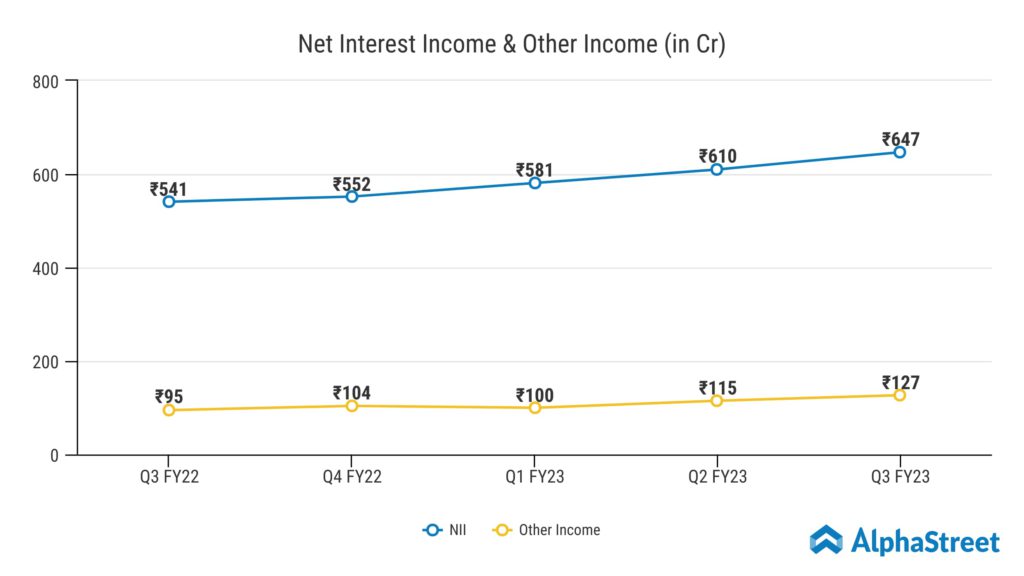

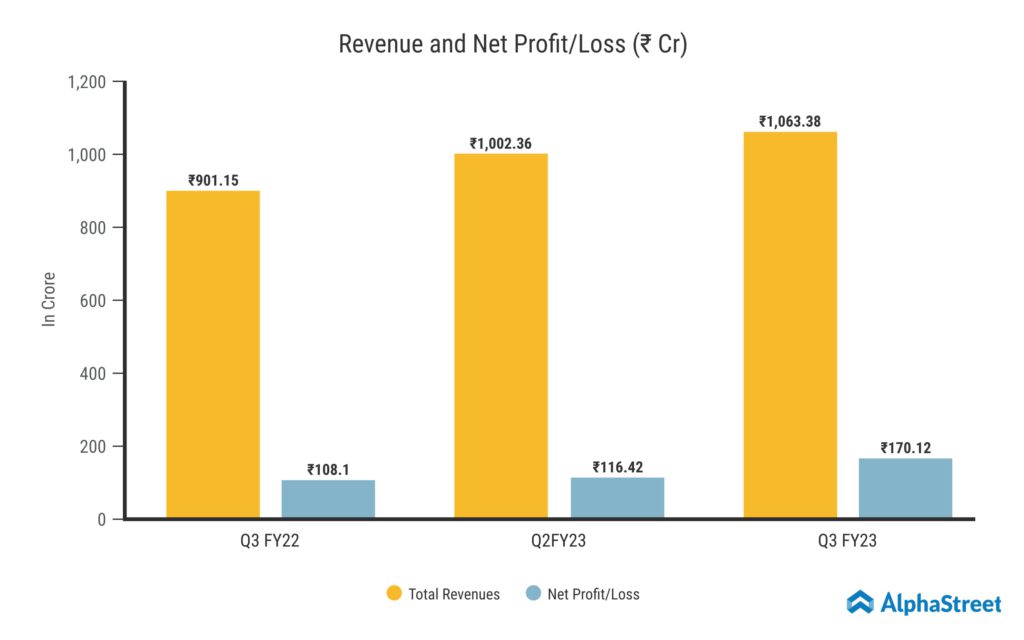

Equitas Small Finance Bank’s Revenue from Interest for Q3 FY23 was ₹1063.38 crore, a 18% increase from ₹901.15 crore in the same period last year. The Retail Banking segment generated ₹1,065.9 Crores in revenue, accounting for 87% of the total. The Other Banking Operations segment decreased by 9% year on year to ₹15.21 crore.

The Treasury segment contributed 9% of revenue in the third quarter of FY23, totaling ₹111.75 crore. The remaining percentage of revenue was accounted for by the Wholesale Banking segment, which reported revenue of ₹23.14 Crore. The Consolidated Net Profit was ₹170.12 crore, a 57% decrease from the same quarter last year’s figure of 108.1 crore. Earnings per share for the quarter was ₹1.34.

Equitas’ Performance In Residential Property Backed Loans

It is estimated that there is a ₹22 lakh crore addressable market for small business loans backed by residential properties. Despite the fact that the Equitas is one of the few banks that operate in this market, this segment is still significantly underserved by the other banks. The bank launched this enterprise in 2013 as an upsell to its eligible microfinance clients with a product with a ticket size of ₹50,000 to ₹5 lakh. As of December 2022, the bank offers loans to this market up to ₹25 lakh. With more than 5 lakh customers and a book size of over ₹9,300 crores, Equitas Bank’s business expanded at a CAGR of 48% from FY15 to FY22. The bank has been able to keep the Gross NPAs below 4% due to the institutional knowledge in credit assessment it has built over the years.

Equitas Bank’s Overdraft Facilities

Along with term loans, Equitas Bank recently started offering overdraft facilities to businesses as a means of working capital. According to the management, the response has been very positive, and the book size has already surpassed INR 150 crores. Additionally, the information the bank has been gathering about merchant’s cash flow through the current accounts will be extremely helpful in profiling and presenting them with additional goods and services.

Equitas Bank is creating a tech-driven merchant ecosystem that will link merchants, distributors, payment solutions, customers, and other players in the bank in order to strengthen its position among merchants. This will be possible with the merchant app, which will launch soon. The launch of the end-to-end digital current account opening process is scheduled for this quarter and will add to the ecosystem’s seamlessness. The management of the bank is confident that they will be able to carve out a niche in the merchant space with continued investment.

Microfinance Industry Analysis

The Indian microfinance market is expected to grow at a CAGR of more than 40% through 2025, owing primarily to increased demand for microfinance loans from the MSME sector. The primary goal of microfinance organizations is to provide low-income borrowers with the opportunity to become self-sufficient. Through the provision of credit to borrowers who fall under the BPL (Below Poverty Line) category, this sector contributes significantly to the promotion of inclusive growth. This industry also assists rural women in obtaining small loans at reasonable interest rates to support their livelihood.

A report by MFIN India states that as of September 30, 2022, banks held the largest percentage of the microcredit portfolio, accounting for 37.7% of the total microcredit universe with a total loan outstanding of ₹1.13 lakh Crore. With ₹1.10 lakh Crore in outstanding loans, NBFC-MFIs are the second-largest microcredit provider, making up 36.7% of the industry’s total portfolio. At the end of December 2022, the microfinance sector had grown by 26% annually to ₹3.24 lakh crore, supported by growth of about 43.4% recorded by NBFC-MFIs.

However, the microfinance sector in India faces a wide range of challenges. Over-indebtedness is a common and significant challenge in this sector because it primarily serves the poorer parts of the nation. Other challenges include high interest rates, an excessive reliance on the banking system, illiteracy, and a lack of knowledge about the products.