Stock Data:

| Ticker | NSE: DIVISLABS |

| Exchange | NSE |

| Industry | Pharmaceutical |

Price Performance:

| Last 5 Days | +0.43 % |

| YTD | +12.23 % |

| Last 12 Months | +5.91 % |

Company Description:

Divi’s Laboratories is a leading pharmaceutical company headquartered in India, recognized for its excellence in research, development, and manufacturing of Active Pharmaceutical Ingredients (APIs) and custom synthesis solutions. With a commitment to innovation and sustainability, Divi’s has diversified its product portfolio to include Contrast Media, Sartans, and nutraceutical APIs, positioning itself as a key player in the global pharmaceutical industry. The company’s strong focus on R&D, state-of-the-art technologies, and robust supply chain management ensures high-quality products and reliable customer service. Divi’s Laboratories also actively engages in corporate social responsibility initiatives, fostering positive community relationships.

Critical Success Factors:

1. Diverse Growth Prospects: Divi’s Laboratories recognizes the evolving landscape of the pharmaceutical industry, both in India and globally. They acknowledge the potential challenges such as price pressures in the US and European markets. However, they remain optimistic about the broader trajectory of the industry. Their focus on Contrast Media, Sartans, and soon-to-expire patented products indicates a forward-thinking approach. This diversification mitigates risks associated with overreliance on a single product or market segment, positioning the company for long-term growth.

2. Strong Custom Synthesis Business: The Custom Synthesis segment is a cornerstone of Divi’s success. The fact that they are doing well, particularly in phase 2 and 3 projects, signifies a robust demand for their services. Enhanced production capacity and reduced lead times indicate operational efficiency and the ability to meet customer demands promptly. This strength contributes to revenue stability and customer loyalty.

3. R&D and Development: Divi’s Laboratories’ commitment to the development of MRI contrast media is noteworthy. This demonstrates their ability to adapt to emerging market trends and capitalize on growth opportunities. The substantial potential in contrast media, coupled with their cost-effective capacity and strong customer relationships, positions them as a leader in this sector. Additionally, their focus on iodine recovery further underscores their dedication to sustainable and cost-efficient practices.

4. CAPEX Investments: The ongoing Unit-3 construction project reflects Divi’s commitment to expanding its manufacturing capabilities. With a significant initial investment and the potential for further expansion in the future, this project allows them to diversify their product offerings. The planned manufacturing of starting materials, nutraceutical APIs, advanced intermediates, and complex chemistry APIs frees up existing facilities for custom synthesis and generic products. This strategic move enhances their competitiveness and strengthens their market position.

5. Technological Advancements: Divi’s Laboratories’ investments in new technologies and expanded production capacity are critical for staying competitive in the pharmaceutical industry. Their ability to adopt and leverage advanced technologies positions them at the forefront of innovation. This strength ensures that they can meet evolving market demands efficiently and effectively.

6. Corporate Social Responsibility (CSR): Divi’s Laboratories’ active engagement in CSR initiatives reflects a commitment to responsible and sustainable operations. Their initiatives, such as providing safe drinking water, infrastructure development, and empowerment projects, not only contribute to the well-being of surrounding communities but also enhance their corporate reputation. This strength not only aligns with ethical values but also fosters positive relationships with stakeholders.

7. Supply Chain and Inventory Optimization: Divi’s Laboratories’ focus on optimizing inventory levels and supply chain management is crucial for cost control and operational efficiency. In a global market with fluctuating dynamics, their vigilance in monitoring and mitigating supply chain risks is a significant strength. Efficient inventory management allows them to respond to market changes while maintaining financial stability.

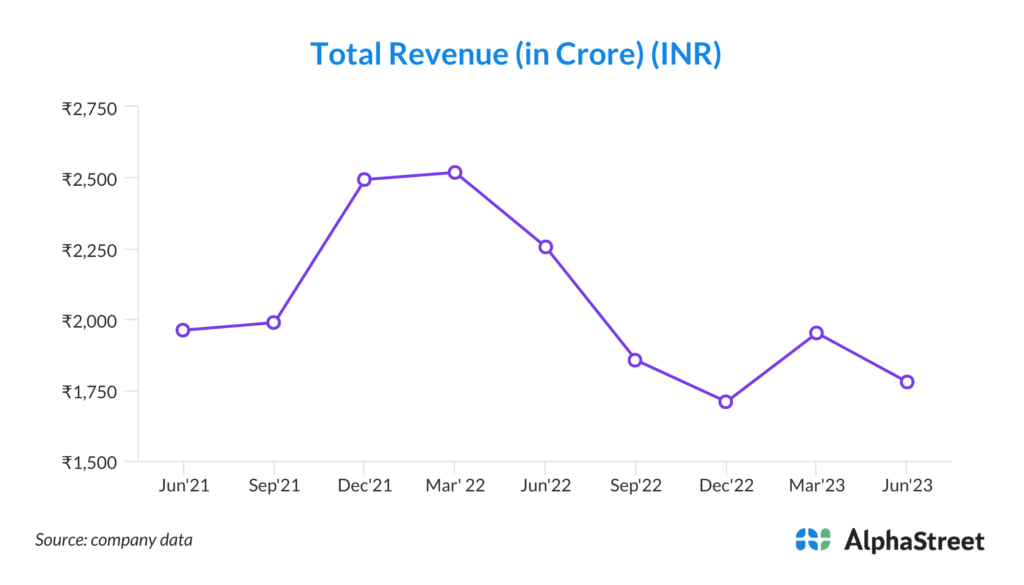

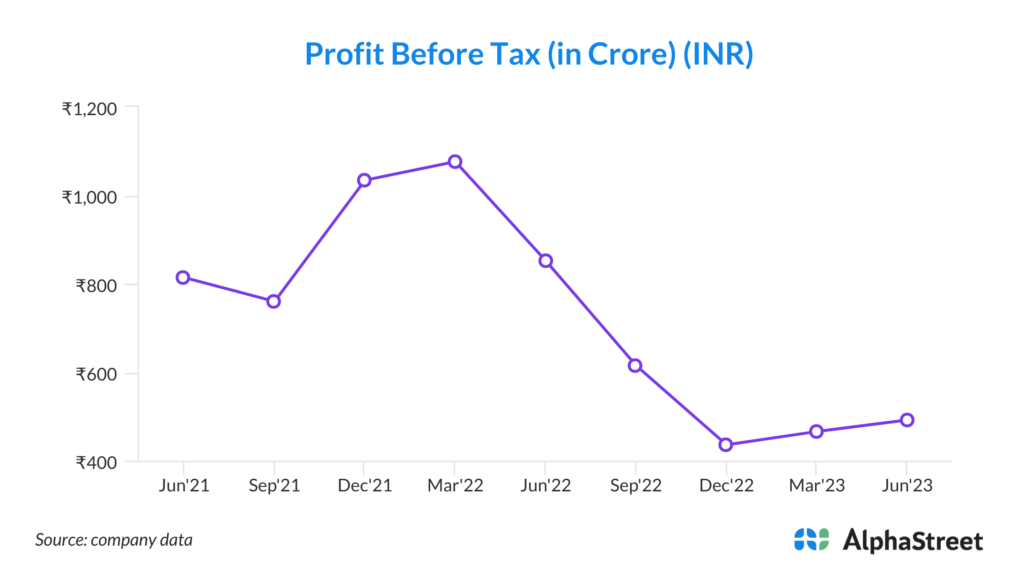

8. Financial Stability: Divi’s Laboratories’ robust financial performance is evident in their strong cash position, reasonable receivables, and inventories. Their ability to sustain uninterrupted customer shipments throughout the quarter and generate consistent profits reflects financial stability. This strength provides them with the financial resilience to weather economic uncertainties and seize growth opportunities.

Key Challenges:

1. Market Dependency on US and European Markets: Divi’s Laboratories acknowledges potential price pressures in the US and European markets. A significant portion of their exports goes to these regions (about 67%). Any adverse changes in regulations or pricing in these markets could negatively impact revenue and profitability.

2. Market and Product Concentration: While Divi’s is diversifying its product portfolio, they still have a substantial concentration in specific product segments, such as Contrast Media and Sartans. Relying heavily on a few product categories exposes the company to the risk of market fluctuations or changes in demand for these specific products.

3. Dependency on Patented Products: The anticipation of growth from soon-to-expire patented products carries inherent risks. If these products face competition from generic alternatives or encounter regulatory hurdles, it could affect the expected revenue growth.

4. Execution and Timelines of Expansion Projects: The success of Divi’s Unit-3 construction project is essential for their growth strategy. Delays, cost overruns, or operational issues in executing this project could hamper their ability to diversify and meet market demands effectively.

5. Price Volatility in Raw Materials: While Divi’s benefits from lower raw material prices in the generic portfolio, raw material prices can be unpredictable. A significant increase beyond expectations or supply chain disruptions could impact their profit margins.

6. Currency Exchange Risk: Divi’s Laboratories mentions a Forex gain of Rs. 3 crores in one quarter but also experienced a gain of Rs. 56 crores in the corresponding quarter of the previous year. Currency exchange rates can fluctuate significantly, affecting their financial performance, especially with a substantial portion of revenue coming from exports.

7. Competition and Margin Pressure: In the generic pharmaceutical industry, competition can be fierce. If competitors offer similar products at lower prices or if market dynamics change, Divi’s may face pressure on its margins, impacting profitability.

8. Regulatory and Compliance Risks: The pharmaceutical industry is heavily regulated, and changes in regulations can have a profound impact on operations. Any compliance issues, product recalls, or regulatory hurdles could result in financial penalties, reputational damage, and disruptions in production.