Cosmo First Ltd. (NSE: COSMOFIRST) reported mixed financial results for Q2 FY2023 (ended September 30, 2022). Revenues improved but profits faltered.

After posting lower profits, the stock is trading in the red, which indicates investors’ disappointment.

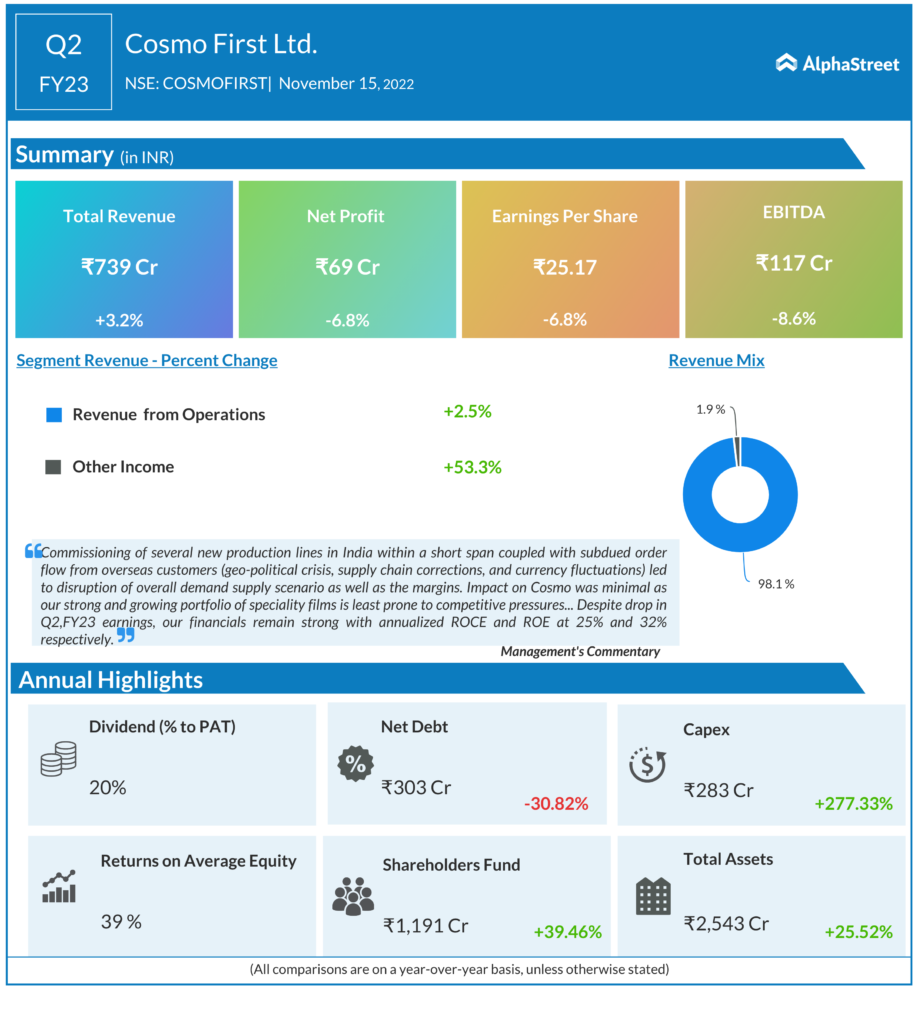

Revenues Up 3.2% YoY, Profit Drops

On a standalone basis, Cosmo First recorded total sales of Rs 739 crore, up 3.2% YoY riding on decent growth in packaging films. Revenues from operations grew 2.5% YoY to Rs 725 crore.

Net profit stood at Rs 69 crore, down 6.8% on a YoY basis. Results were impacted by lower profits in packaging films. Earnings per share (EPS) were Rs 25.17, down 6.8% from the prior-year quarter.

EBITDA came in at Rs 117 crore, down 8.6% YoY.

Packaging Films recorded revenues of Rs 775 crore, up 2.1% YoY. However, EBIT came in at Rs 118 crore, down 18.6% YoY.

Margin & Expenses

Total expenses stood at Rs 646 crore, up 5.7% YoY. EBITDA margins were 16%, down from 18% in Q2 FY2022.

Balance Sheet Position

On a standalone basis, as of September 30, 2022, total assets stood at Rs 2,781 crore compared to Rs 2,543 crore as of March 31, 2022. Cash and cash equivalents were Rs 11.85 crore, down 47.9% from the March quarter. Annualized ROE and ROCE stood at 32% and 25%, respectively.

Management Comments

Commenting on the quarterly results, management commented, “Commissioning of several new production lines in India within a short span coupled with subdued order flow from overseas customers (geo-political crisis, supply chain corrections, and currency fluctuations) led to disruption of overall demand supply scenario as well as the margins. Impact on Cosmo was minimal as our strong and growing portfolio of speciality films is least prone to competitive pressures. Margins were also under pressure in the overseas subsidiaries due to increase in raw material costs, weakening of foreign currencies against US dollar particularly in Japan and Korea. The near-term outlook for non-specialty films could be challenging however the Company will continue to expand on specialty films growth. BOPET line was commissioned two days before the end of Q2. Our focus shall be to rapidly develop value add and speciality products.”

Long-Term Targets

Cosmo First targets over 80% volume from Speciality & Semi Speciality segment by 2024. Total Capex over the next few years is expected at Rs 590 crores.

For Speciality Chemicals, the company expects 10% -15% revenue growth with over 25% ROCE in about 5 years.

Our Viewpoint

In the fast-evolving world, Cosmo First has turned triumphant in the Indian packaging industry. Though the company’s recent earnings report reflects the impact of macroeconomic challenges, the company’s diversified business model stands it out in the industry. Additionally, to cater to the rising demand in the sector, Cosmo First is on the path of expanding its services and products. Therefore, investors with buying the dips strategy can build a position in the stock as it is hovering near its 52-week low.