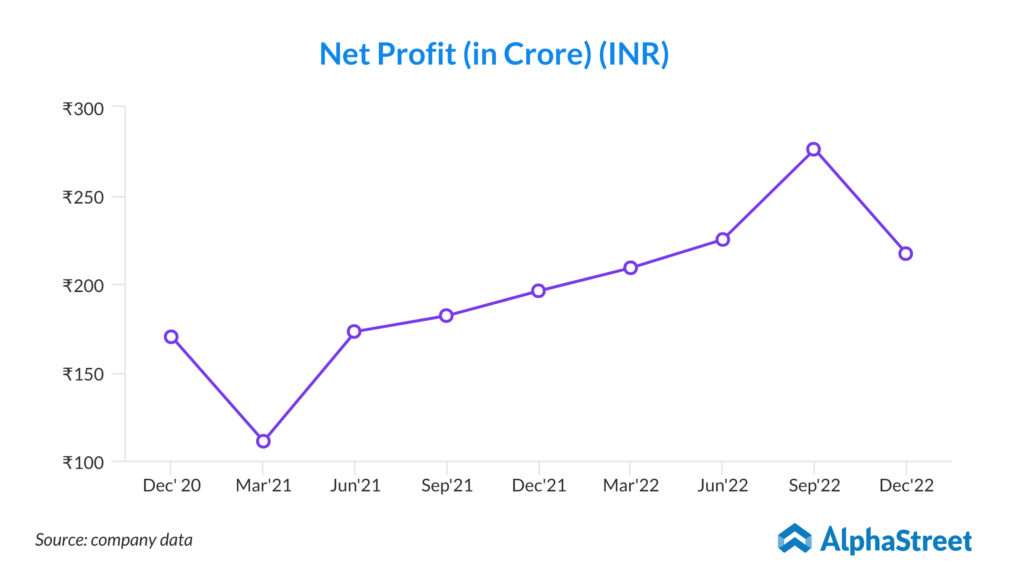

The net interest margin will stay around the current levels. ROA also to stay around the current level that is 1.5% for the financial year. The cost to income ratio also should stay around 40% as we have seen in the past, maybe 40% to 42% in the absence of higher treasury income. So we hope like say the things should be particularly on the general economy front take a better shape going forward and we hope to see like say better and better results as we move forward. – N. V. Kamakodi — Managing Director & Chief Executive Officer

Stock Data:

| Ticker | NSE: CUB & BSE: 532210 |

| Exchange | NSE & BSE |

| Industry | BANKING |

Price Performance:

| Last 5 Days | +1.25% |

| YTD | -29.58% |

| Last 12 Months | -11.18% |

Company Description:

City Union Bank is a private sector bank that has been operating since 1904, making it one of the oldest banks in India. The bank primarily focuses on lending to MSME (Micro, Small and Medium Enterprises) and agricultural sectors, which make up a significant portion of their overall lending portfolio. In fact, 63% of the bank’s advances are allocated to these sectors, highlighting the bank’s commitment to supporting the growth of small businesses and agriculture in the country.

Critical Success Factors:

- The bank has a strong presence in South India, with 669 out of their 752 branches located in this region. This regional focus allows the bank to better understand the needs of the local community and tailor their services accordingly. The bank’s branches are equipped with modern technology and trained staff to provide customers with efficient and high-quality banking services. Furthermore, the bank has a robust risk management framework in place, with 99% of its loans secured by collateral. This means that the bank requires borrowers to provide some form of asset as collateral against the loan, which helps to minimize the bank’s credit risk. This focus on risk management ensures that the bank is able to maintain a strong financial position and remain profitable over the long term.

- City Union Bank’s asset quality and its expected improvement going forward. The impact of RBI divergence on Q3FY23 performance has been reflected, and the management expects slippages to decrease due to lower incremental stress formation. However, slippages are expected to remain elevated between 2.5-2.8% for FY23 before tapering to 2-2.5% for FY24 onwards. The bank’s restructured pool has experienced lower slippages than expected, and the bank aims to increase its PCR to 50% by FY24. While improving asset quality is expected to improve credit cost, the management expects an additional impact of Rs 200 Cr on credit costs in case of implementation of the ECL provisions. The bank aims to keep credit costs steady at around 1.4% (+/-10bps) over FY24-25E.

- While CUB had earlier anticipated a credit growth of 15-18% as it exits FY23, the management has a conservative outlook on growth, expecting credit growth to be slightly lower in FY23 before picking up in FY24E onwards. The bank continues to carry excess liquidity of Rs 2500-3000 Cr to push credit growth but does not intend to widen the credit-deposit growth gap. The bank is expected to achieve a credit growth of around 15% CAGR over the period of FY23-25E.

- The bank has revised its loan growth guidance for FY23 due to delays in the investment cycle, and now aims to achieve double-digit loan growth in FY24. The bank has an excess liquidity of Rs30bn, which will support loan growth for the next few quarters, and can temporarily stretch its Loan-Deposit Ratio (LDR) to 90% before moving back towards 85%. The bank’s Net Interest Income (NII) was impacted by Rs320mn due to a procedural lapse in the recognition of interest subvention on KCC loans backed by gold, which is expected to be sorted out by Q4 with RBI inspection. As a result of these developments, the credit compound annual growth rate (CAGR) has been trimmed from 15% to 12.4% for FY22-25.

Key Challenges:

- City Union Bank’s asset quality was impacted in the quarter due to higher slippages, with the Gross Non-Performing Asset (GNPA) miss mainly due to this reason, at Rs4.4bn against a PLe of Rs3.6bn. The bank expects slippage ratio to be between 2.5-2.8% for FY23, which would then normalize to 2.0-2.5% in FY24. The bank aims to increase its Provision Coverage Ratio (PCR) to 50% by the end of FY24, from the current level of 43%. Therefore, provision costs for FY24/25E have been raised from an average of 105bps to 127bps. The bank’s exposure to SpiceJet is performing well, as 35% of the Rs1bn exposure has been repaid. The OTR pool, with a default rate of around 4%, is also performing better than expected with a lower slippage rate over the last year, at only 7%, compared to the bank’s guidance of 15-20%.

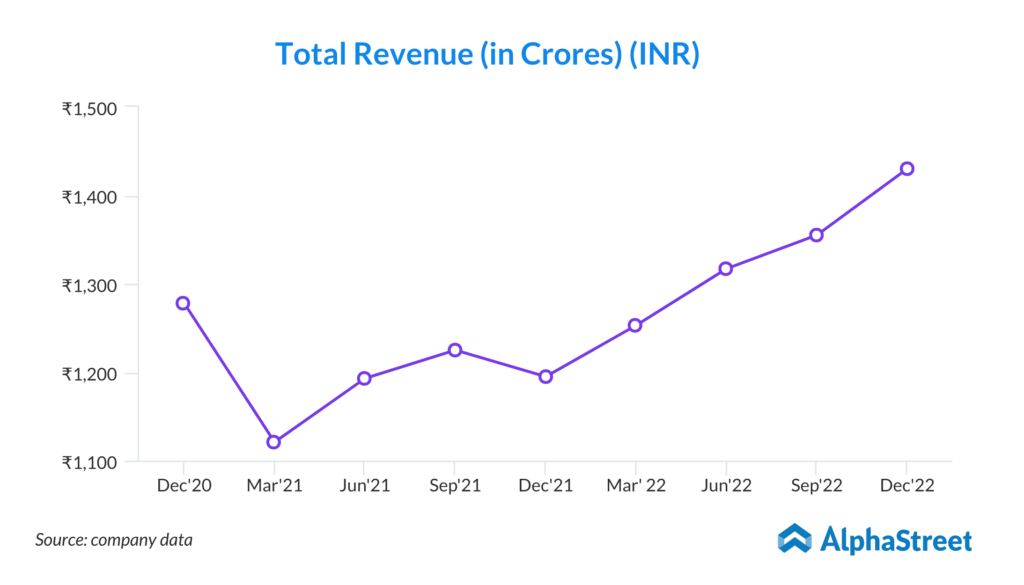

- City Union Bank’s business witnessed muted growth in Q3FY23, with total business growing by just 9% YoY and remaining flat sequentially. Deposits grew by 7% YoY and remained flat sequentially, while advances grew 12% YoY and 1% QoQ. The bank refrained from aggressive loan disbursement due to the lag in deposit growth, despite having excess liquidity of around Rs.3,000cr. Management expects credit growth to be slower in FY23 than the previously guided 15-18%. The bank’s gold loan disbursement portfolio grew by 31% YoY and constituted 25% of the total loan book. The CASA ratio declined to 29.2% compared to 31.3% QoQ as funds moved to fixed deposits due to increased interest rates. The bank’s Capital Adequacy Ratio stands strong at 20.5%. Moderate growth of 11% in advances and 10% in deposits is expected over FY23-25E.