Assets Under Management increased 49.9% YoY and 11.4% QoQ to touch INR 86,525 million. The share of retail loans improved to 79.1% from 74.4% in Q2 FY23. The share of construction finance segment where growth was stronger in H1 FY23 due to a strong sanctions and disbursal pipeline, softened 200bps QoQ to 19.4%, below our threshold of 20% at consolidated level. This is in line with our previous commentary that construction finance momentum shall be softer in H2 FY23. Disbursals touched INR 18,105 million, growing 43.1% YoY and 21.7% QoQ. Disbursals for 9M FY23 stood at INR 43,917 million and were up 57.9% YoY. The share of retail disbursals comprising MSME, Affordable Housing, and Gold Loans was 75.5% in Q3 FY23 compared to 47.7% and 35% in Q2 FY23 and Q1 FY23 respectively. – Mr. Rajesh Sharma Founder & Managing Director, Capri Global Capital Ltd

Stock Data:

| Ticker | NSE: CGCL & BSE: 531595 |

| Exchange | NSE & BSE |

| Industry | BANKING AND FINANCE |

Price Performance:

| Last 5 Days | +4.63% |

| YTD | -14.14% |

| Last 12 Months | -12.49% |

Company Description:

Capri Global Capital Limited (CGCL) is a non-banking financial company (NBFC) that provides financial services such as home and entrepreneurship loans to the unbanked and underserved masses of North and West India. It has an asset under management (AUM) of Rs. 6633 crore and a strong presence across high growth segments like MSME, Construction Finance, Affordable Housing and Indirect Retail Lending segments. CGCL is listed on NSE, BSE, and registered with RBI, with over 123 offices spread across 12 states & Union Territories and a workforce of over 4100 employees in the country. The company positions itself as a leader among India’s most widely extended Non-Deposit Taking, Systematically Important Non-Banking Financial Companies.

Critical Success Factors:

- CGCL’s SME & Retail Lending vertical offers MSME business loans, working capital term loans, term loans against property rentals, and term loans for purchasing property, tailored to meet the requirements of customers through tech-enabled processes and smart analytics. Its Construction Finance vertical provides credit solutions for real estate developers, including project funding and structured debt financing. Additionally, its subsidiary, Capri Global Housing Finance Limited, provides home loans to underserved and deserving lower and middle-income families in the affordable housing finance space.

- Capri Global Capital Limited (CGCL) has shown impressive strength in its Gold Loan business, which continued to rapidly scale up since its launch in August 2022. CGCL has expanded its network to 449 exclusive branches in Q3 FY23 from 182 branches across 7 states and UTs in Q2 FY23. The branches are state-of-the-art and spacious, with an average area of 600-800 square feet, and secured by AI-driven security systems. The gold jewellery is secured in vaults with SRD doors. In Q3 FY23, the disbursals in the Gold Loan business increased to Rs7,741mn, constituting 42.8% of total disbursals, and achieved a closing AUM of Rs7,152mn, constituting 8.3% of total AUM compared to a 1.8% share in Q2 FY23. The average disbursal yield was 15.22%, and the LTV at disbursal was 74.2%. The assessed value of gold in custody was Rs9,530mn based on the average spot rate for 22K gold.

- CGCL’s growth strategy includes expanding its urban retail network deeper and in contiguous geographies, adding 15 urban retail branches across Rajasthan, Uttar Pradesh, and opening its maiden branch in Bihar in the state capital Patna. The non-gold loan branch network stood at 160, up from 145 in Q2 FY23, and the total branch network stood at 609, up from 327 in Q2 FY23. The Gold Loan business has contributed significantly to CGCL’s disbursals and AUM growth, indicating its strength and potential in this segment.

- Capri Global Capital Limited has a strong presence in car loan distribution, generating a net fee income of INR 333 million in Q3 FY23 and INR 800 million in 9M FY23. The company distributes new car loan products of Union Bank of India, Bank of Baroda, HDFC Bank, IOB, Yes Bank, and Bank of India through an asset-light model, with branch presence in eight locations and feet-on-street presence in 322 locations. The car loan distribution business had a presence in 29 states and union territories and originated loans worth INR 16,920 million in Q3 FY23, up 3.1x YoY and 24% QoQ basis. Total origination in 9M FY23 stood at INR 39,975 million, over 2.3x FY22 originations.

- Capri Global Capital Limited operates through its feet-on-street sales force and six exclusive branches. The income from the co-lending portfolio constituted INR 200 million and INR 385 million or 8% or 6% net income in Q3 FY23 or in 9M FY23, respectively. The company is not targeting any mix of spread and non-spread income and both non-interest income streams are doing well and have a strong growth runway given the scope of intermediation and bank partnerships. Capri Global Capital Limited’s car loan distribution business is expected to have a strong growth trajectory and has contributed significantly to the company’s earnings performance.

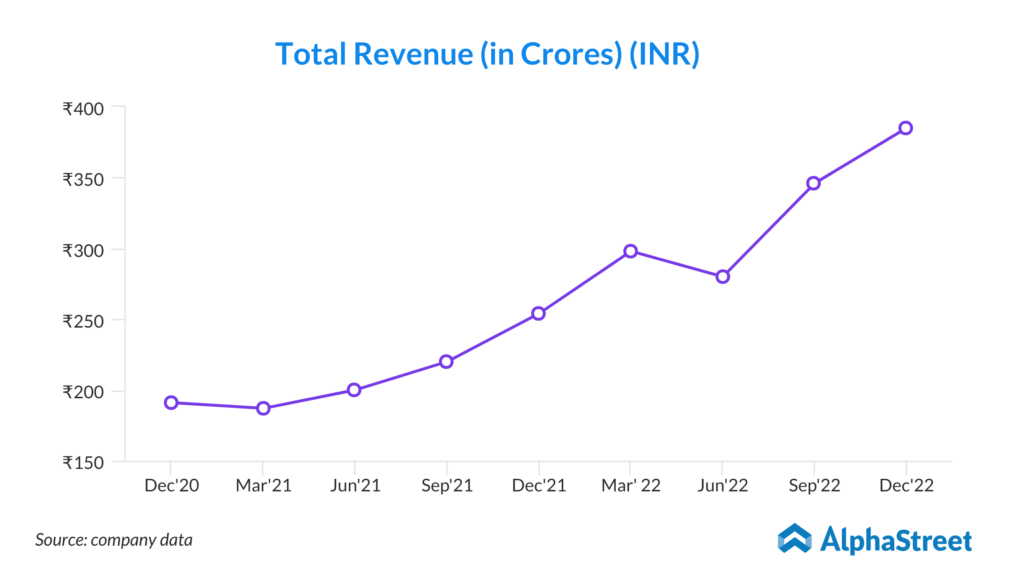

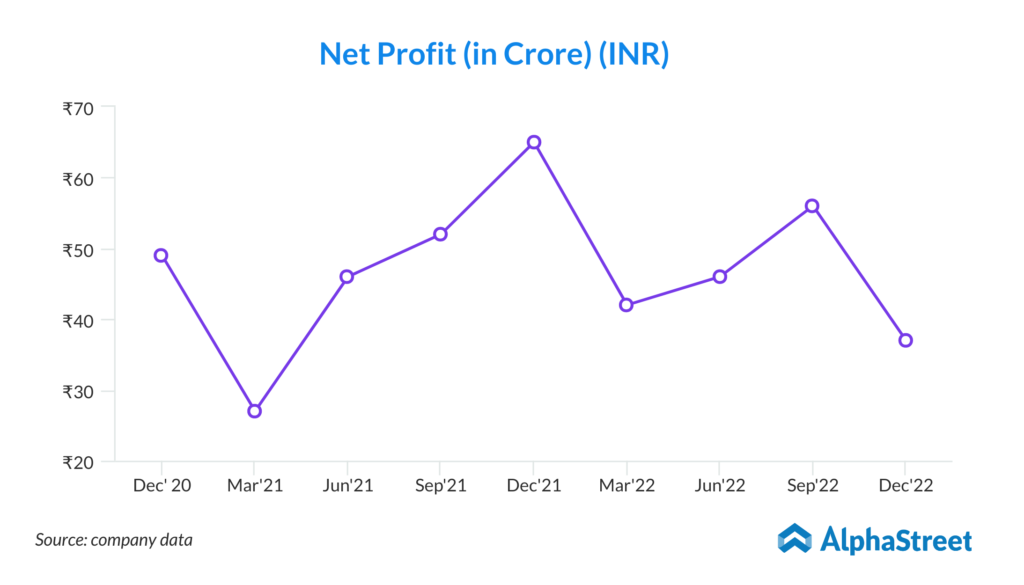

- Capri Global Capital Limited (CGCL) has performed well in terms of earnings, as seen in their Q3 FY23 and 9M FY23 results. The net interest income (NII) has increased by 17.5% YoY and 5.3% QoQ to reach INR 1,610 million, despite near-term pressure on net interest margins (NIM) due to lagged repricing of loans compared to borrowings. However, the NIM is expected to stabilize with incremental loan mix changes and the repricing of the existing loan book. CGCL’s non-interest income has become an important earnings driver, accounting for 26% of net income in H1 FY23 and rising to 32.4% in Q3 FY23.

- Capri Global Capital Limited has demonstrated strength in its collection efficiency, with consistently healthy resolution rates overall. Although the collection efficiency in the retail segment is marginally lower than the overall collection efficiency, the wholesale segments of Indirect Lending and Construction Finance have shown collection efficiency close to or higher than the overall collection efficiency.

- Capri Global Capital Limited (CGCL) has a comfortable liquidity position as it has active borrowing relationships with 21 financial institutions across different sectors, including PSU, private sector banks, foreign banks, mutual funds, life insurance companies, and public sector financial institutions. This indicates the company’s ability to access funding from a diverse range of sources, providing stability and flexibility to its operations. A comfortable liquidity position also allows the company to meet its financial obligations, including debt repayment and interest payments, and fund its growth initiatives.

Key Challenges:

- One potential risk for Capri Global Capital Limited is the impact of economic downturns on the credit quality of their loan portfolio. If there is a widespread economic slowdown or recession, borrowers may be more likely to default on their loans, which could lead to higher levels of non-performing assets for the company. Additionally, if there is a significant drop in property prices or a decline in demand for certain types of loans, it could also impact the credit quality of the loan portfolio.

- Another risk for the company is the possibility of regulatory changes that could impact their operations. For example, changes in lending regulations or policies could impact the types of loans that Capri Global Capital Limited is able to offer, or lead to increased compliance costs. In addition, the company may be subject to changes in tax laws or other regulations that could impact their financial performance.

- Finally, competition in the financial services industry is always a concern. As the company expands and enters new markets, they may face increased competition from other financial institutions offering similar products and services. This could lead to pressure on margins and potentially impact the company’s ability to attract and retain customers.