“Our technology investments continue and in fact the largest one will go live in this month, is on track and the next year we will go live in quarter one of next year, sorry quarter four of this year. We will also be extending our sneaker studios, they have now got extended to almost 565 stores as well as our new product that I have been now talking about for several quarters, which is Floats, the casual, washable, molded footwear. Keeps on recording highest volumes, and has obviously done highest ever even this quarter.”

-Gunjan Shah, MD & CEO

Stock Data

| Ticker | BATAINDIA |

| Industry | Footwear |

| Exchange | NSE |

Share Price

| Last 5 Days | -2.2% |

| Last 1 Month | -3.4% |

| Last 5 Months | 19.6% |

Business Basics

Bata India Limited, a prominent name in the Indian footwear industry, operates with a rich heritage of quality craftsmanship, innovation, and a deep understanding of consumer preferences. The company’s business fundamentals revolve around delivering comfortable and stylish footwear and accessories to a diverse customer base across India.

At the core of Bata India’s business strategy is its extensive network of retail stores and a wide range of footwear brands. Bata, as a brand, is known for its durable and affordable footwear, catering to consumers of all ages and segments. Additionally, the company houses multiple sub-brands like Hush Puppies, Power, and Marie Claire, each designed to cater to specific fashion preferences and lifestyle needs. Innovation is a key driver of Bata India’s operations. The company continually invests in research and development to create comfortable, ergonomic designs and incorporate the latest trends in its product offerings. By staying attuned to changing consumer tastes and emerging fashion trends, Bata India maintains its position as a leader in the Indian footwear market.

Bata India’s customer-centric approach is evident in its store layouts, which are designed to provide a convenient and engaging shopping experience. The company also offers a wide range of sizes and fittings, ensuring that customers can find the perfect fit for their feet. Additionally, Bata’s e-commerce platform provides an avenue for consumers to shop conveniently online. Financially, Bata India demonstrates prudent financial management by balancing profitability and growth. The company’s strategies include efficient cost management, expansion into tier II and III cities, and continual product innovation to meet evolving consumer needs.

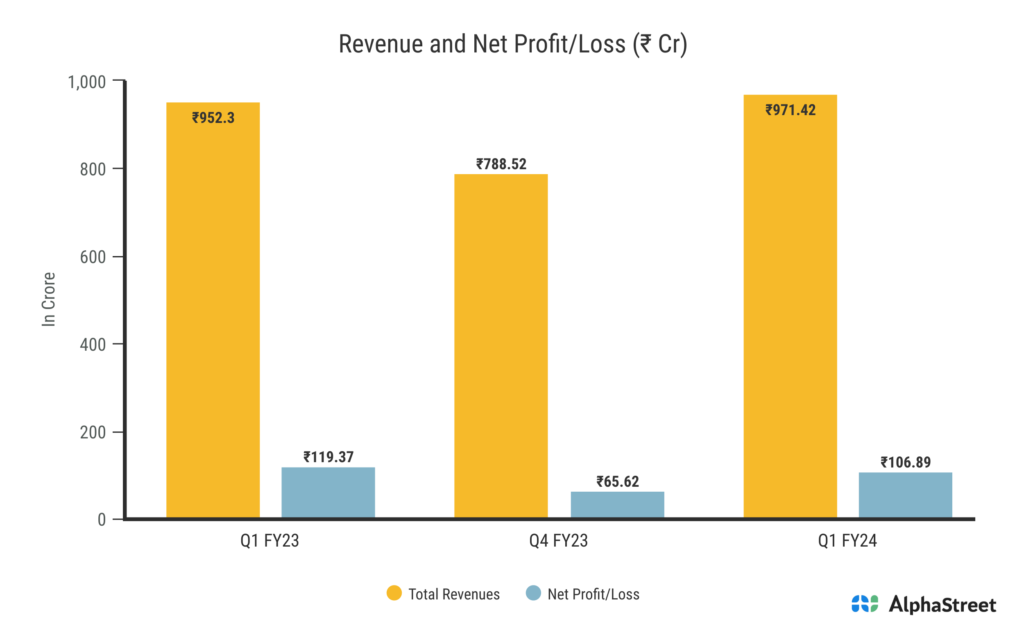

Q1 FY24 Financial Performance

Bata India Ltd reported Revenues for Q1FY24 of ₹958.00 Crores up from ₹943.00 Crore year on year, a rise of 1.59%. Consolidated Net Profit of ₹107.00 Crores down 10.08% from ₹119.00 Crores in the same quarter of the previous year. The Earnings per Share is ₹8.32, down 10.44% from ₹9.29 in the same quarter of the previous year.

To read more about company’s Financials:

Bata’s Retail and Franchise Strategy

Bata has been actively renovating their stores, with nearly 40 stores being revamped this quarter alone. This effort is part of their ongoing backlog refresh plan, which was initiated in response to the challenges posed by the COVID-19 pandemic. Over the past 18 months, and with approximately six more months to go, Bata will continue with store refreshes before returning to regular maintenance. The expansion of franchise stores remains a top priority for Bata, as they added an impressive 29 new stores this quarter, with growth expected to persist. The franchise business channel continues to receive an overwhelmingly positive response.

Despite a slowdown in the mass market segment, Bata remains committed to investing in the expansion of their distribution business, as per the management. Bata is taking significant steps to enhance control over its retail channel. This includes the implementation of productivity tools for field and sales forces, as well as key account management for the top 2,000 Multi-Brand Outlets (MBOs) they collaborate with.

Updates on Digital Business Growth

Bata’s digital business has been experiencing remarkable growth over the past three years. This growth has been consistently strong, encompassing all three channels of their operations. Notably, Bata has witnessed significant business expansion in both marketplaces and their dotcom channel. The number of online visits has surged dramatically, and their Omni-channel approach is now available not only in Cocoa, Bata, and Hush Puppies but also in franchise outlets. Bata has ensured that its products are accessible on various platforms, and they are actively exploring partnerships with platforms like ONDC. Additionally, Bata has recently introduced a new collection called “Power” with a unique feature known as “Step and Go,” which is now available in their stores.

Foot Wear Industry in India

The footwear industry in India has witnessed significant growth over the years, evolving from a traditional and unorganized sector to a thriving and organized industry. This transformation has been driven by factors such as increasing disposable income, changing fashion preferences, urbanization, and a growing awareness of global footwear trends. The market encompasses a wide range of products, including formal shoes, casual shoes, sports footwear, and traditional footwear like sandals and slippers. The footwear market in India was estimated to be worth over $15 billion. It was characterized by a mix of domestic and international brands catering to diverse consumer segments.

The total revenue is expected to grow at a CAGR of 12.83% through 2023 to 2029, reaching nearly $35.43 Billion. The growth of e-commerce platforms has made it easier for consumers in even remote areas to access a wide range of footwear options. This trend is likely to continue, further expanding the market.